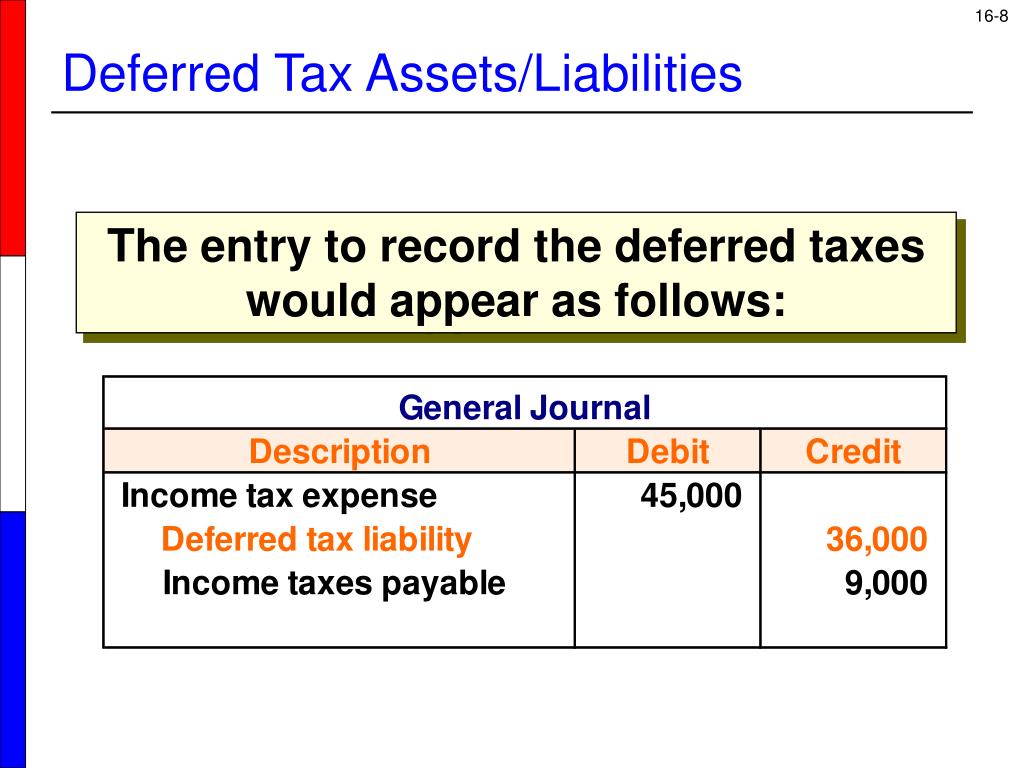

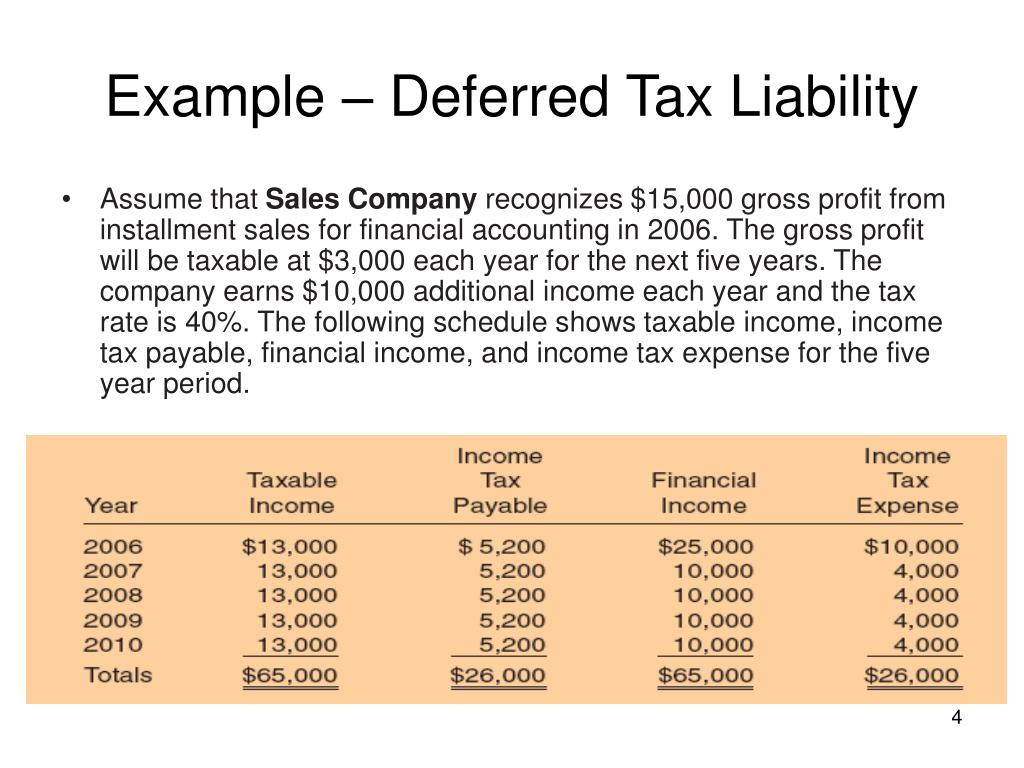

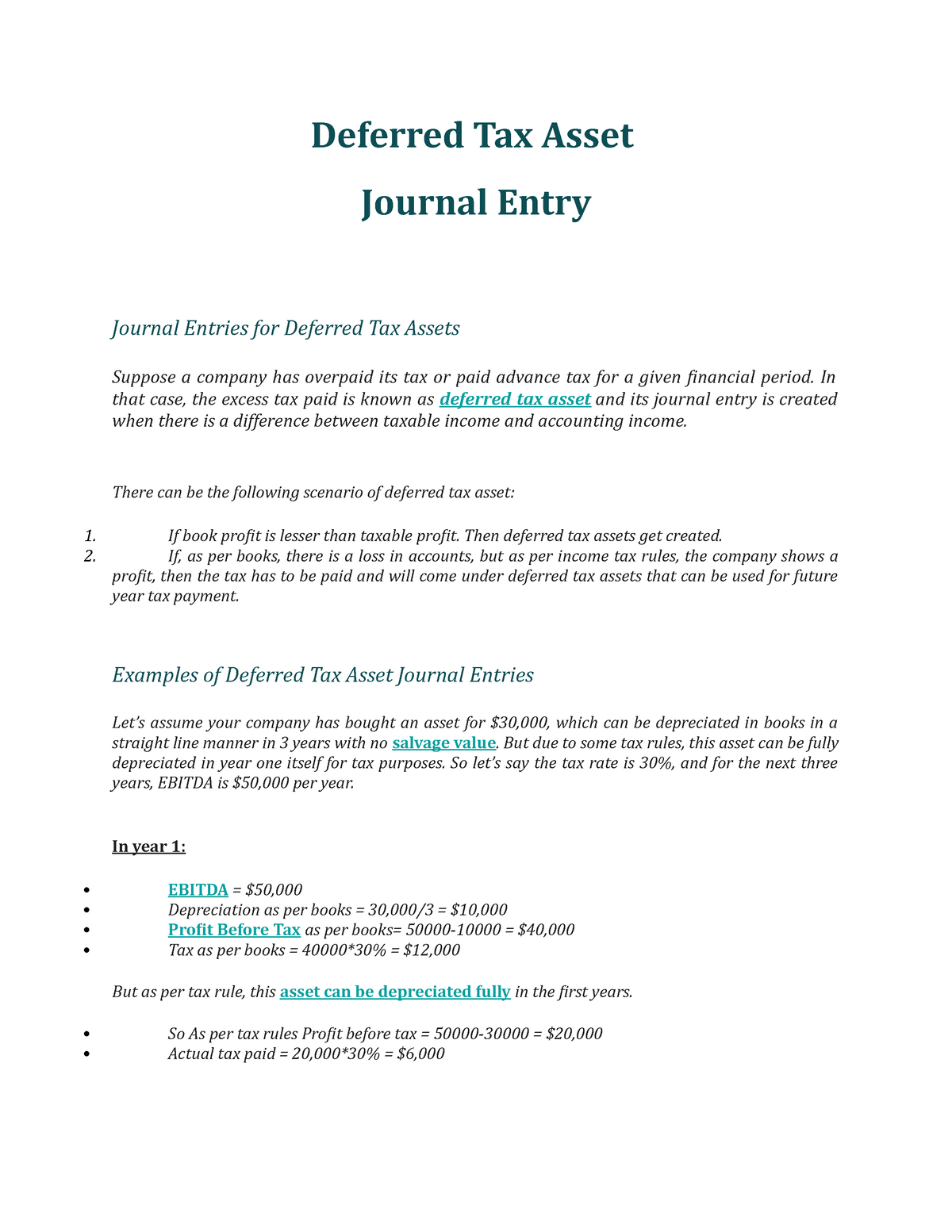

Deferred Tax Liability Journal Entry - Web learn how to account for deferred tax liability, a liability to future income tax, caused by temporary timing differences between taxable income and accounting income. Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. Web learn what deferred tax liability is, how it is created and calculated, and why it is recorded on the balance sheet. See examples of deferred tax liability in different situations, such. Suppose a company has overpaid its tax or paid advance tax for a given financial period. Compute the future income tax disbenefit ($900 = $300 + $600). Deferred taxes are the postponement of income taxes to future periods due to differences in accounting and tax accounting. Web the deferred tax liability or deferred tax asset is derived from the comparison of profit & loss a/c of balance sheet and computation of total income for income tax purpose. See examples of deferred tax entries,. Web learn how to record deferred tax liability when income tax expense is higher than income tax payable.

PPT Accounting for Taxes PowerPoint Presentation, free

Web the deferred tax liability or deferred tax asset is derived from the comparison of profit & loss a/c of balance sheet and computation of.

Deferred Tax Liabilities Meaning, Example, Causes and More

Web journal entries for deferred tax assets. Web learn how deferred tax liabilities and assets are created by temporary differences between book and tax accounting.

Deferred Tax Liability Accounting Double Entry Bookkeeping

10.4.2 expected manner of recovery or settlement. 10k views 3 years ago company accounts hindi. Web learn how to account for deferred tax liability, a.

Deferred Tax Liabilities Explained With Reallife

In that case, the excess tax paid is known as. Web learn what deferred tax liability is, how it is created and calculated, and why.

PPT Deferred Tax Examples PowerPoint Presentation, free download ID

Web learn how to account for deferred tax liability, a liability to future income tax, caused by temporary timing differences between taxable income and accounting.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Web preparing the journal entry to record the recognition or discharge of deferred income taxes consists of three steps: Deferred tax asset is an asset..

Deferred Tax Asset Journal Entry Example Balance Sheet Verkanarobtowner

10k views 3 years ago company accounts hindi. A deferred tax liability is a future tax payment that a company records when its taxable income.

Solved 1. Prepare Journal Entry to record tax

10k views 3 years ago company accounts hindi. Web learn how deferred tax liabilities and assets are created by temporary differences between book and tax.

Deferred Tax Asset Deferred Tax Asset Journal Entry Journal Entries

Web learn the basics of deferred tax accounting, how it measures the net earnings of an enterprise, and why it is important for financial reporting..

Web Learn How To Record Deferred Tax Liabilities And Assets In Journal Entries With Examples.

In this video, journal entries for deferred tax assets and liabilities have been explained. Web learn how deferred tax liabilities and assets are created by temporary differences between book and tax accounting rules. The carrying amount of an asset exceeds its tax. Web learn how to account for deferred tax liability, a liability to future income tax, caused by temporary timing differences between taxable income and accounting income.

10K Views 3 Years Ago Company Accounts Hindi.

See examples of deferred tax liabilities arising from taxable temporary differences and how to. A deferred tax liability is a future tax payment that a company records when its taxable income and. See an example of how tax rules and accounting rules differ and affect taxable income and tax payable. 10.4.2 expected manner of recovery or settlement.

See The Formula, The Journal Entry, And An Example With.

See examples of deferred tax liability in different situations, such. Web learn the basics of deferred tax accounting, how it measures the net earnings of an enterprise, and why it is important for financial reporting. Suppose a company has overpaid its tax or paid advance tax for a given financial period. See examples of deferred tax entries,.

Web Learn How To Record Deferred Tax Liability In The Journal Entry When The Tax Authority And The Business Have Different Treatments Of Income, Expenses, Assets And Liabilities.

Web learn how to account for deferred tax in accordance with ias 12, income taxes. See the journal entry for current income tax. Web this whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities (dtls), which form the basis for the. Web learn how to record a deferred tax liability, which occurs when financial income is greater than taxable income, with a visual example.