Journal Entry To Record Purchase Of Business - In accounting, a business combination is a transaction that gives your company control of one or more businesses. If you buy the assets, inc. The entries in this journal are made based on the invoice. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. The initial entry, adjusting entry, and correcting entry. A sales journal entry is a bookkeeping record of any sale made to a. Find out how to calculate goodwill, capital profit, interest to vendors,. Let’s review what you need to know about making a sales journal entry. Web learn how to record the purchase of a business by a company in its books, with examples and illustrations. Web an inventory purchase journal entry records the acquisition of goods that a business intends to sell.

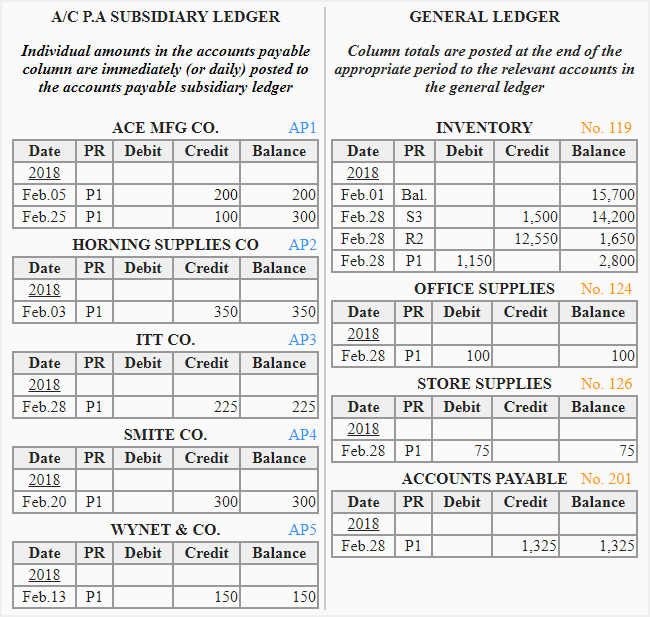

How to Pass Journal Entries for Purchases Accounting Education

Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. If you buy the assets, inc..

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

You probably depend on equipment to run your business. This entry typically involves debiting the inventory account to increase the. Are you buying the company.

Purchases journal explanation, format, example Accounting For

It allows you to accurately track and document the acquisition of new assets,. Web learn how to record the purchase of an existing business in.

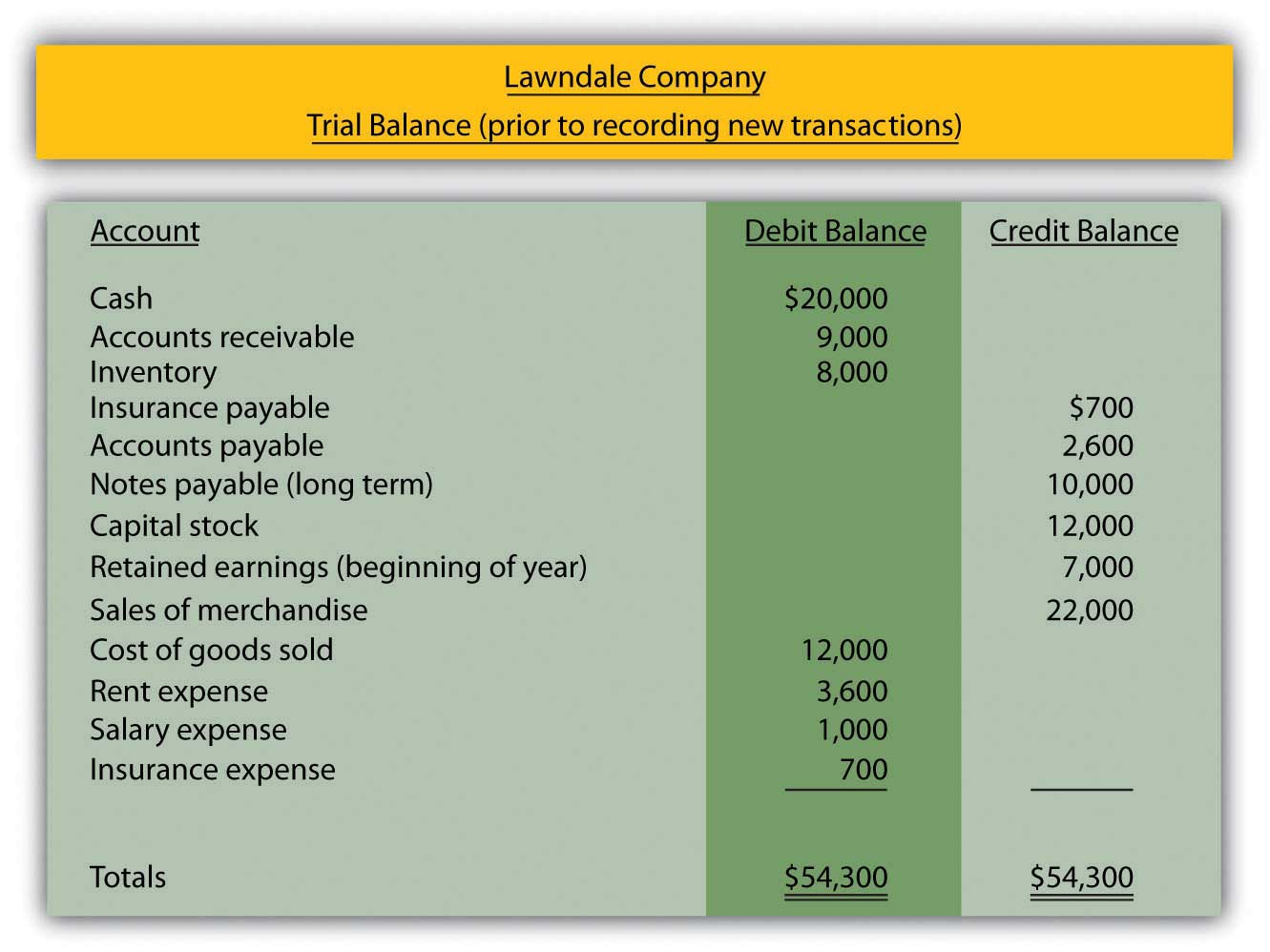

Accounting Journal Entries For Dummies

Let’s review what you need to know about making a sales journal entry. Web a purchases journal is a special journal used to record any.

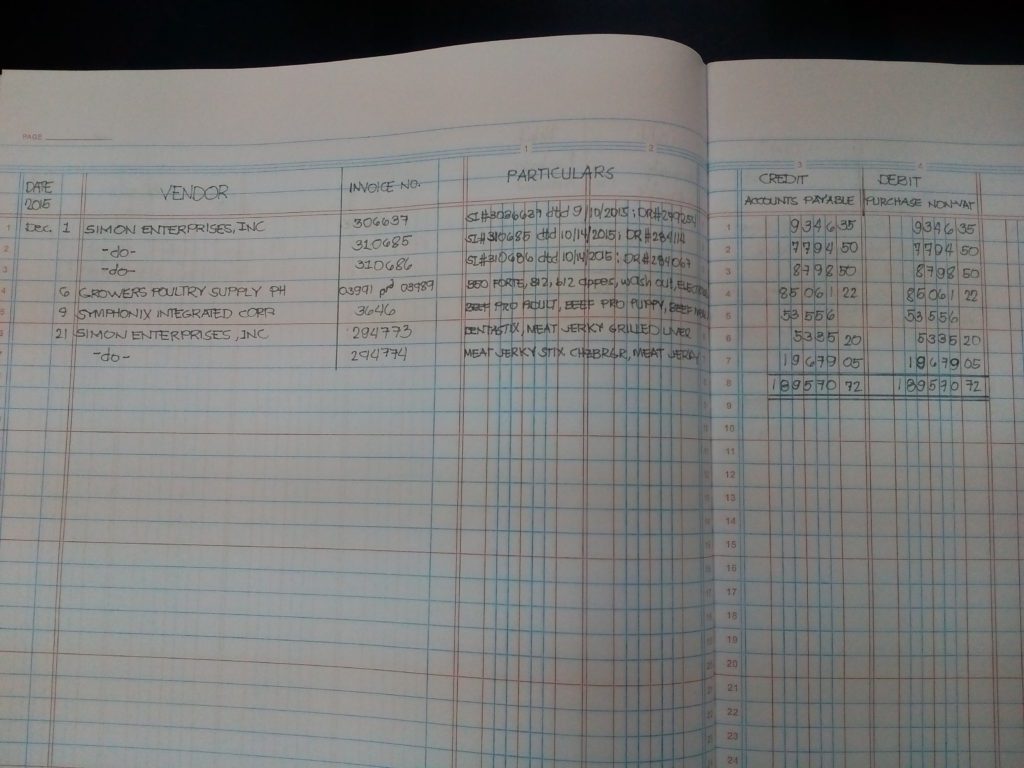

Purchase Journal What is it and How to Write Manually?

In accounting, a business combination is a transaction that gives your company control of one or more businesses. Web learn how to record the purchase.

Pt 5 Journal Entries for Merchandising Business Purchases, Purchase

Then, add the inventory items. Web you can record the purchase of assets using the check or expense feature. The entries in this journal are.

How to use Excel for accounting and bookkeeping QuickBooks

Let’s review what you need to know about making a sales journal entry. 3 purchased $500 worth of inventory on credit with terms 2/10, n/30,.

Bookkeeping Example of Business Transaction, Journal, Ledger, Report

Let’s review what you need to know about making a sales journal entry. Then, add the inventory items. Web you can record the purchase of.

Purchases Journal (Purchase Day Book) Double Entry Bookkeeping

Web you can record the purchase of assets using the check or expense feature. Web the journal entry to record the purchase of the equipment.

You Probably Depend On Equipment To Run Your Business.

If you buy the assets, inc. Web using the proper journal entry to record the purchase of a business requires defining precisely what's happening: Journal entries are recorded in the journal, also known as books of original entry. Every entry contains an equal debit and credit along with the.

Make Sure To Set Up The Accounts In The Chart Of Accounts.

Web when a company acquires more than 50% of another company, us gaap requires the acquirer to consolidate the acquired company under the consolidation method. Web the journal entry to record the purchase of the equipment paying $50,000 cash and by signing a note for the balance would be: Find out how to calculate goodwill, capital profit, interest to vendors,. Web a purchases journal is a special journal used to record any merchandise purchased on account.

The Entries In This Journal Are Made Based On The Invoice.

Web date january 01 general journal debit credit record entry clear entry view general journal > required information [the following information applies to the questions. Web you can record the purchase of assets using the check or expense feature. What is a sales journal entry? Then, add the inventory items.

Web An Accounting Journal Entry Is The Written Record Of A Business Transaction In A Double Entry Accounting System.

In accounting, a business combination is a transaction that gives your company control of one or more businesses. The initial entry, adjusting entry, and correcting entry. This entry typically involves debiting the inventory account to increase the. 3 purchased $500 worth of inventory on credit with terms 2/10, n/30, and invoice dated.