Journal Entry Service Revenue - In the journal entry, accounts receivable has a debit of $5,500. Web the entry will be “credit: Most simple financial transactions involve a customer requesting goods or a service and paying for them immediately. Web an unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry when you supply the service or product to your client. A business received revenue in advance of 4,000 from a customer for services yet to be provided. *appropriate receivable such as accounts receivable, rent receivable, interest receivable, etc. The entry must have at least 2 accounts with 1 debit amount and at least 1 credit amount. The service revenue will be recorded on the income statement. Web in this journal entry, the company recognizes the revenue during the period as well as eliminates the liability that it has recorded when it received the advance payment from the customers. The accounts receivable will record as current assets on the balance sheet, it happens when the company sells on credit.

Basic Everyday Journal Entries Debits And Credits Business Vrogue

Web when a business transaction requires a journal entry, we must follow these rules: In the journal entry, accounts receivable has a debit of $5,500..

Accruals and Prepayments Journal Entries HeathldDunn

Company abc is the consulting service provider. Under the accrual basis of accounting, revenues should be recognized when they are earned regardless of. Web the.

Closing entries explanation, process and example Accounting for

*appropriate receivable such as accounts receivable, rent receivable, interest receivable, etc. Web a sales revenue journal entry is an accounting entry recorded in the financial.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web at the end every accounting period, unearned revenues must be checked and adjusted if necessary. The double entry bookkeeping journal entry to show the.

Unearned Revenue Journal Entry LizethkruwSmith

The double entry bookkeeping journal entry to show the revenue received in advance is as follows: The debits are listed first and then the credits..

9.1 Explain the Revenue Recognition Principle and How It Relates to

On december 31, 2021, gray electronic repair services rendered $300 worth of services to a client. This is an easy accounting process when recording the.

PPT Accrual Accounting and the Financial Statements Chapter 3

Service revenue $1,000.” thus, this journal entry accurately records the increase in accounts receivable or cash along with the recognition of the revenue. All about.

How to use Excel for accounting and bookkeeping QuickBooks

Web customer revenue received in advance. A business received revenue in advance of 4,000 from a customer for services yet to be provided. Web the.

Unearned Revenue Journal Entry Double Entry Bookkeeping

Service revenue $1,000.” thus, this journal entry accurately records the increase in accounts receivable or cash along with the recognition of the revenue. Web when.

This Event Triggers The Entry For Service Revenue In Your Accounting Records.

Cost of services journal entry: The primary objective behind these adjustments is to transition from cash transactions to the accrual. Service revenue has a credit balance of $5,500. Web in this journal entry, the company recognizes the revenue during the period as well as eliminates the liability that it has recorded when it received the advance payment from the customers.

Recognize When A Service Has Been Provided, Even If The Payment Has Not Yet Been Received.

The entry must have at least 2 accounts with 1 debit amount and at least 1 credit amount. Web an unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment, then another double entry when you supply the service or product to your client. The accounts receivable will record as current assets on the balance sheet, it happens when the company sells on credit. The service revenue will be recorded on the income statement.

The Adjusting Entry For Unearned Revenue Depends Upon The Journal Entry Made When It Was Initially Recorded.

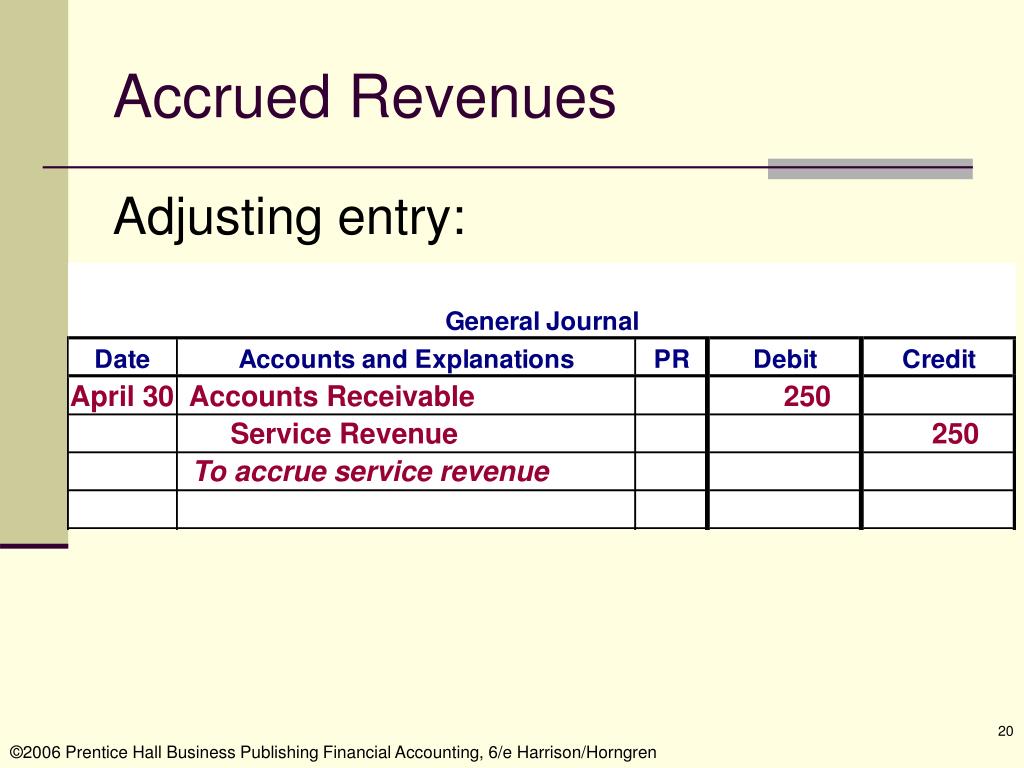

There are two ways of recording unearned revenue: Web the entry will be “credit: Web the adjusting entry to record an accrued revenue is: Company abc is the consulting service provider.

Web At The End Every Accounting Period, Unearned Revenues Must Be Checked And Adjusted If Necessary.

Web the journal entry is made for accrued revenue as an asset and income statement revenue before billing and receiving cash from customers for proper revenue recognition in accounting. Unearned revenue refers to the compensation or payment received by an individual or an organization for products or services that are yet to be delivered or produced. The debit amounts will always equal the credit amounts. This is an easy accounting process when recording the transaction as revenue.