Bond Premium Amortization Journal Entry - Web this entry reduces the value of the intangible asset on the balance sheet by 2,000 and recognizes the expense on the profit & loss account. 3.8k views 10 years ago. Web by obaidullah jan, aca, cfa and last modified on oct 31, 2020. In this example the premium amortization will be $5,250 discount amount / 6 interest payment (3 years x 2 interest payments each year). Below are the 12 monthly entries for the amortization plus the june 30 and december 31 payments of semiannual interest during the year 2023: The investment in bonds account is debited for four months of discount amortization. Issuing of bonds at a premium. Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal entries. Bond discount amortization is the process through which bond discount is written off over the life of the bond. Web amortizing bond premium with the effective interest rate method.

Bond Discount or Premium Amortization Business Accounting

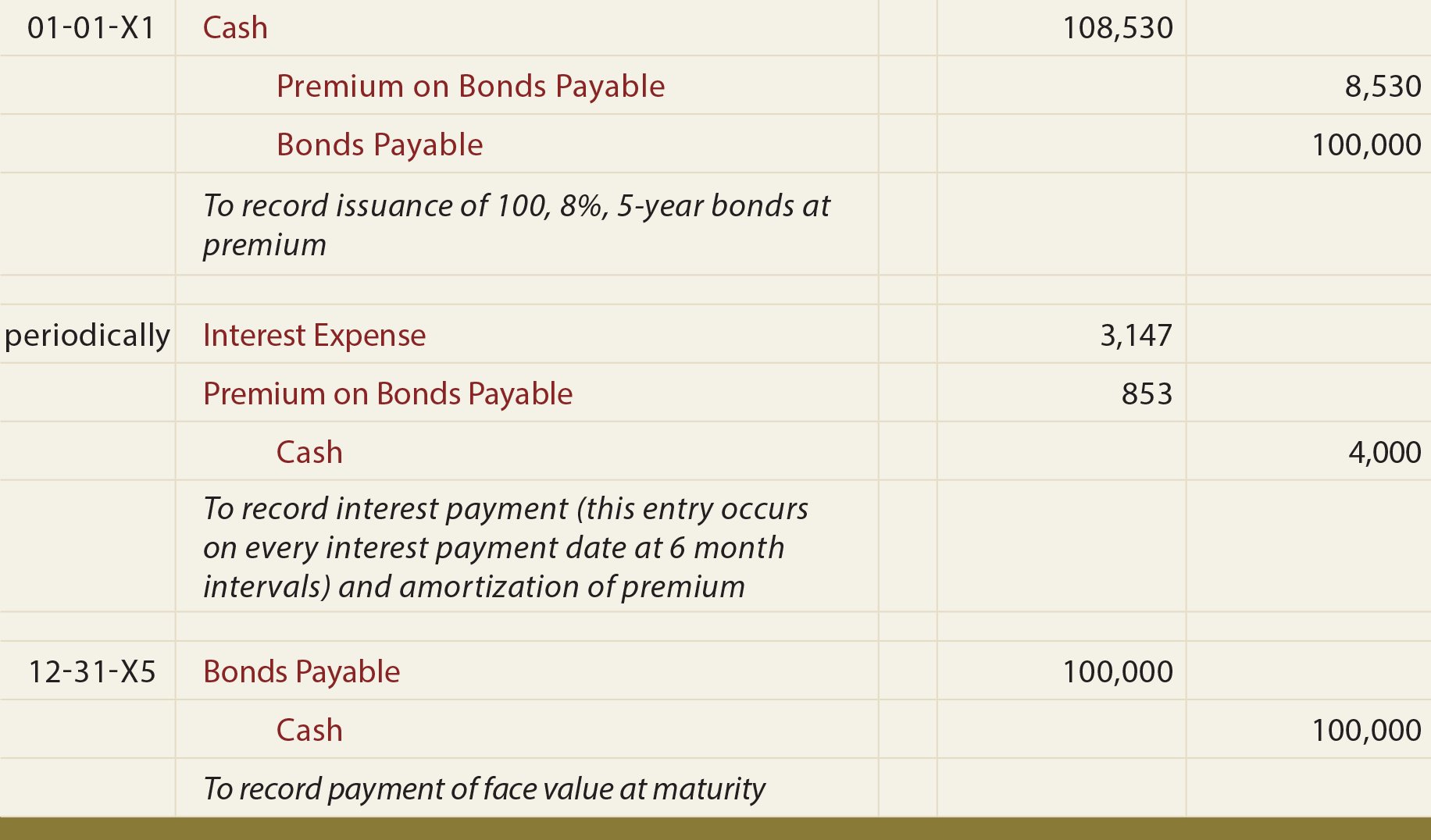

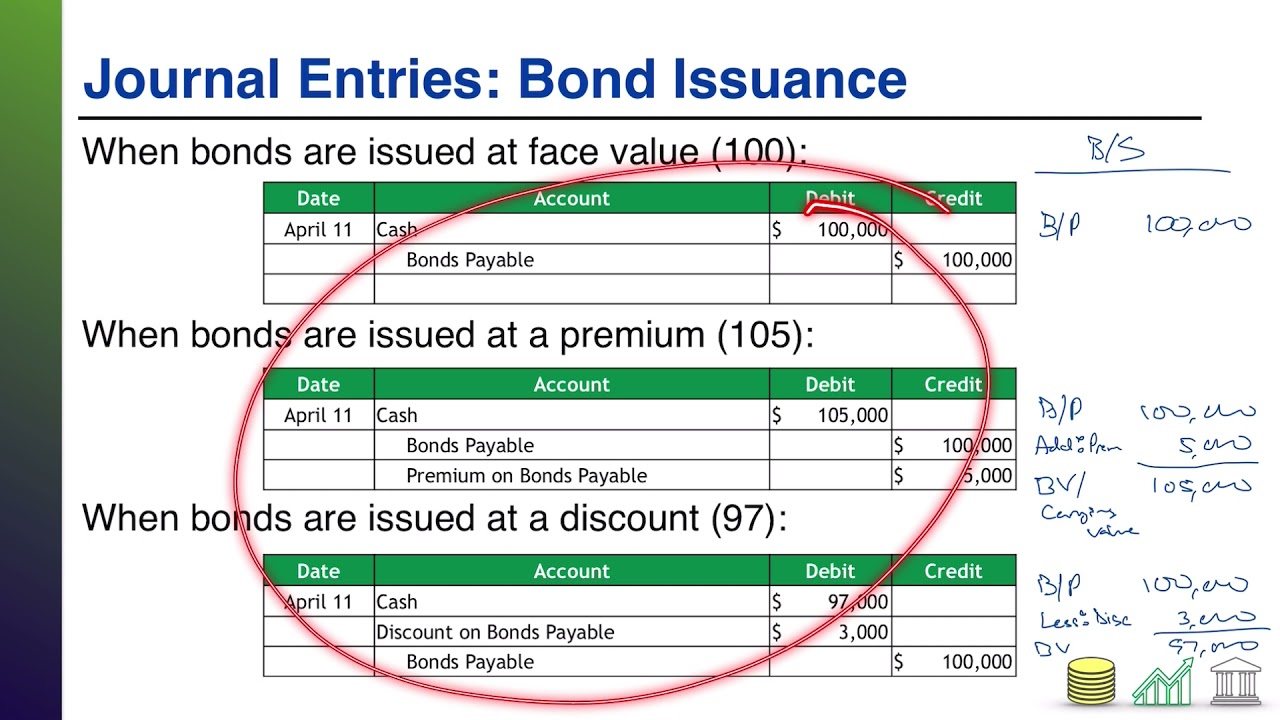

We can make the journal entry for issuing of bonds at a premium by debiting the $512,000 to. The baseline amount is the amount of.

Bond Amortization Calculator Double Entry Bookkeeping

Web this entry reduces the value of the intangible asset on the balance sheet by 2,000 and recognizes the expense on the profit & loss.

Bonds Issued at a Premium Explanation, Examples & Journal Entries

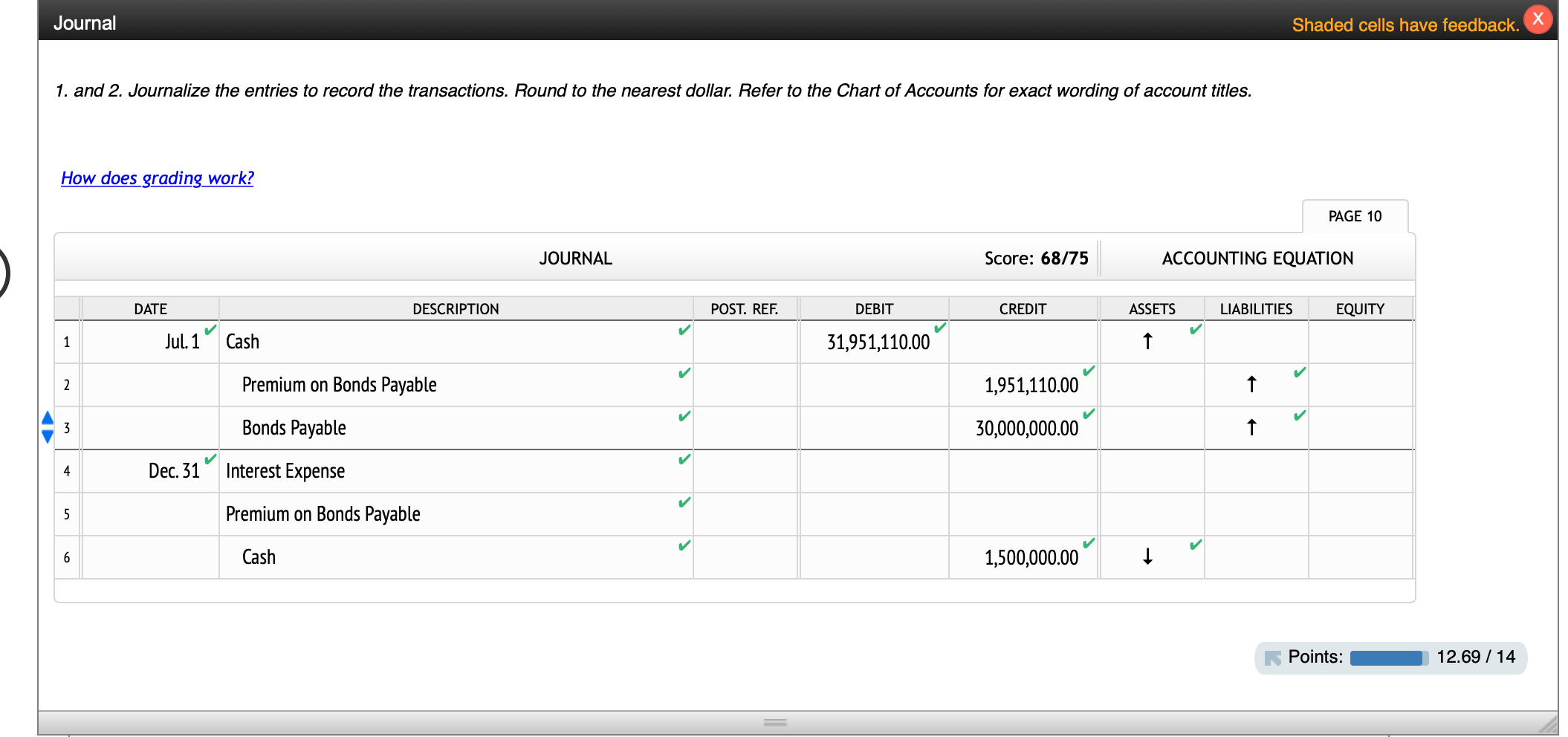

Web the bond interest payment and amortization journal entry would be: Web the entries for 2023, including the entry to record the bond issuance, are:.

Bonds Payable at a Premium

Web the above journal entry reduces the carrying value of the bonds by $2,500 and increases the bond premium by the same amount, resulting in.

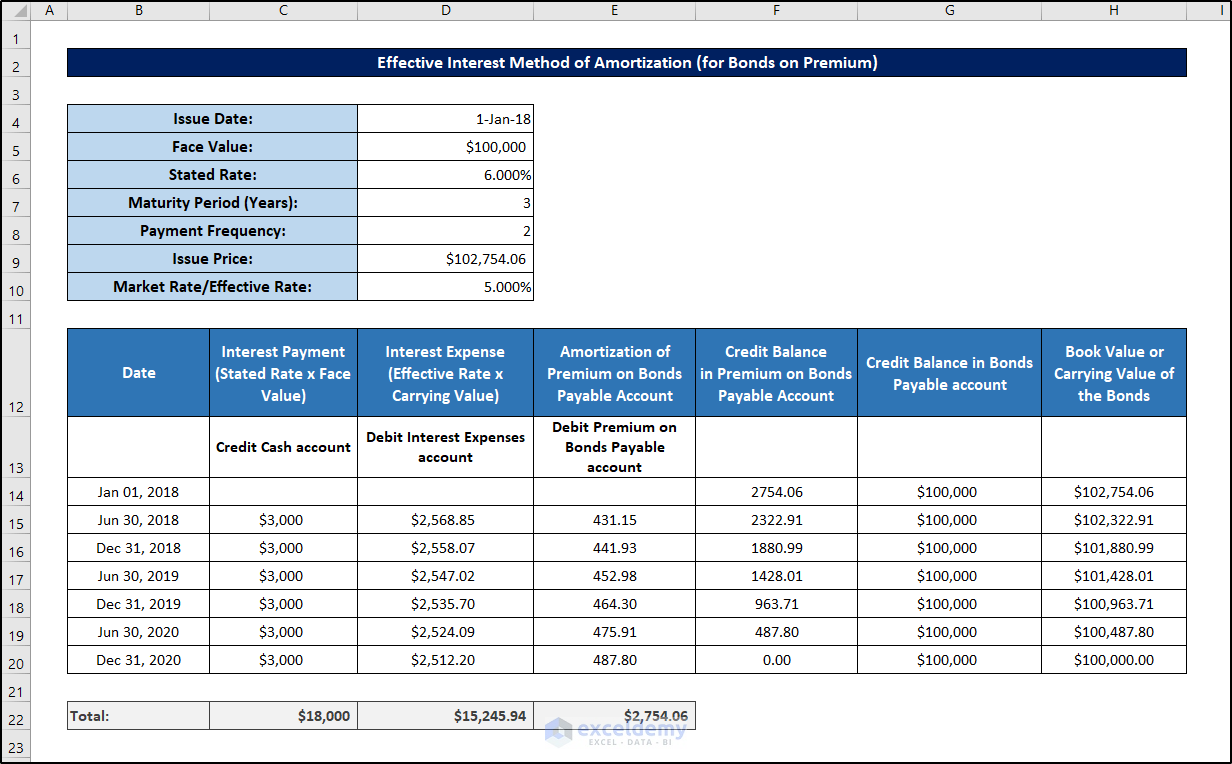

How to Create Effective Interest Method of Amortization in Excel

When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each period differs from bond interest payments. Web.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web the journal entry is debiting cash and credit interest income, investment in bonds. Web the following entry would be made to record the receipt.

Bond Issuance Journal Entries and Financial Statement Presentation

The journal entries for the year 2024 are: Web the entries for 2023, including the entry to record the bond issuance, are: In this entry,.

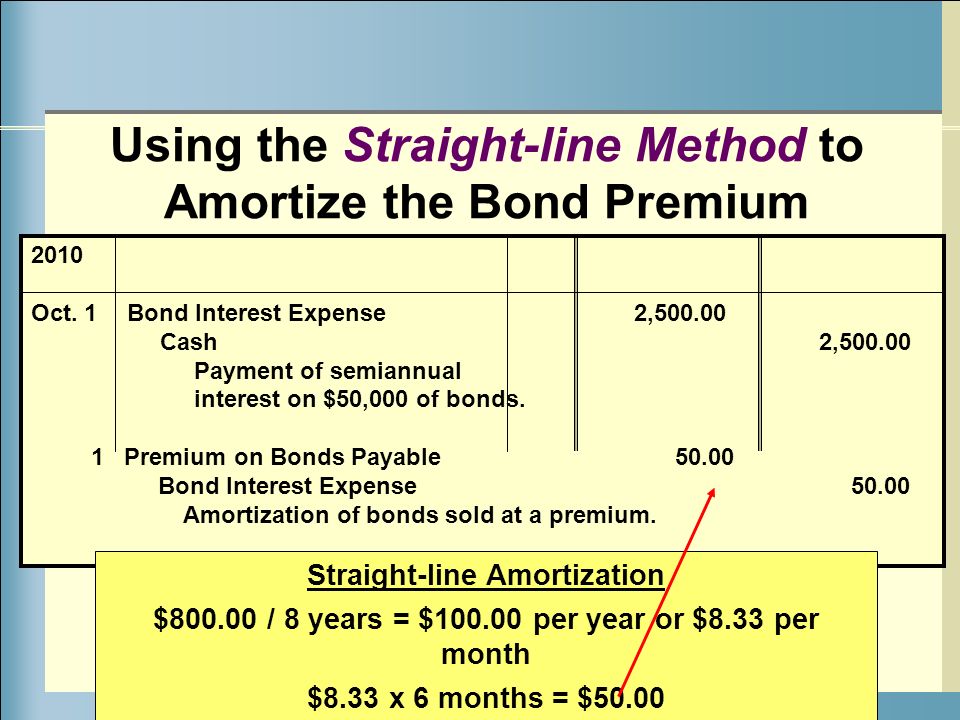

Bond Premium with StraightLine Amortization AccountingCoach

Web the premium will disappear over time as it is amortized, but it will decrease the interest expense, which we will see in subsequent journal.

Accounting Q and A PR 143B Bond premium, entries for bonds payable

The investment in bonds account is debited for four months of discount amortization. Web this entry reduces the value of the intangible asset on the.

The Bond Premium Rules Address Situations In Which A Bond Holder Has Purchased A Debt Instrument At A Price That Exceeds A Baseline Amount.

Web the entry to record the issue of the bond on january 1 would be: Thus, the amortization of bond premium for each period is $1,623 ($16,225.40/10). The investment in bonds account is debited for four months of discount amortization. The premium on bonds payable account has a credit balance of 2,204 which needs to be amortized to the interest expense account over the lifetime of the bond.

The Baseline Amount Is The Amount Of All Remaining Payments Other Than Qualified Stated Interest (Qsi).

With the issuance of $300,000 bonds at a premium price of $312,000, the company abc can make the journal entry as below: 3.8k views 10 years ago. Web the above journal entry reduces the carrying value of the bonds by $2,500 and increases the bond premium by the same amount, resulting in the correct carrying value of $1,047,500 and bond premium of $47,500. The bond pays interest every 6 months on june 30 and december 31.

Web Amortizing Bond Premium With The Effective Interest Rate Method.

The journal entries for the year 2024 are: The corporation must make an interest payment of $4,500 ($100,000 x 9% x 6/12) on each june 30 and december 31 that the bonds are outstanding. You would repeat this entry each year until the asset is fully amortized. Advantages and limitations the primary advantage of premium bond amortization is that it is a tax deduction in the current tax year.

The Premium On Bonds Payable Account Has A Credit Balance Of 9,075 Which Needs To Be Amortized To The Interest Expense Account Over The Lifetime Of The Bond.

The journal entries for 2025, 2026, and 2027 will also be taken from the schedule above. Web the bond interest payment and amortization journal entry would be: It is useful to create an amortization schedule in such a situation. Investment in bonds is equal to the amortizing of the difference between bonds’ purchase price and par value.