Journal Entry Sale Of Equipment - Web what the journal entry to record a purchase of equipment? Journal entry for disposal of fixed assets at net book value. Web when it comes to recording an equipment sale in procurement through journal entries, there are specific steps to follow: (b) accumulated depreciation = $63,000. What is a sales journal entry? Web the equipment will be disposed of (discarded, sold, or traded in) on 4/1 in the fourth year, which is three months after the last annual adjusting entry was journalized. Journal entry for sale of asset. Journal entry for sale of. Let’s review what you need to know about making a sales journal entry. Web what is the entry in quickbooks for the sale of an asset?

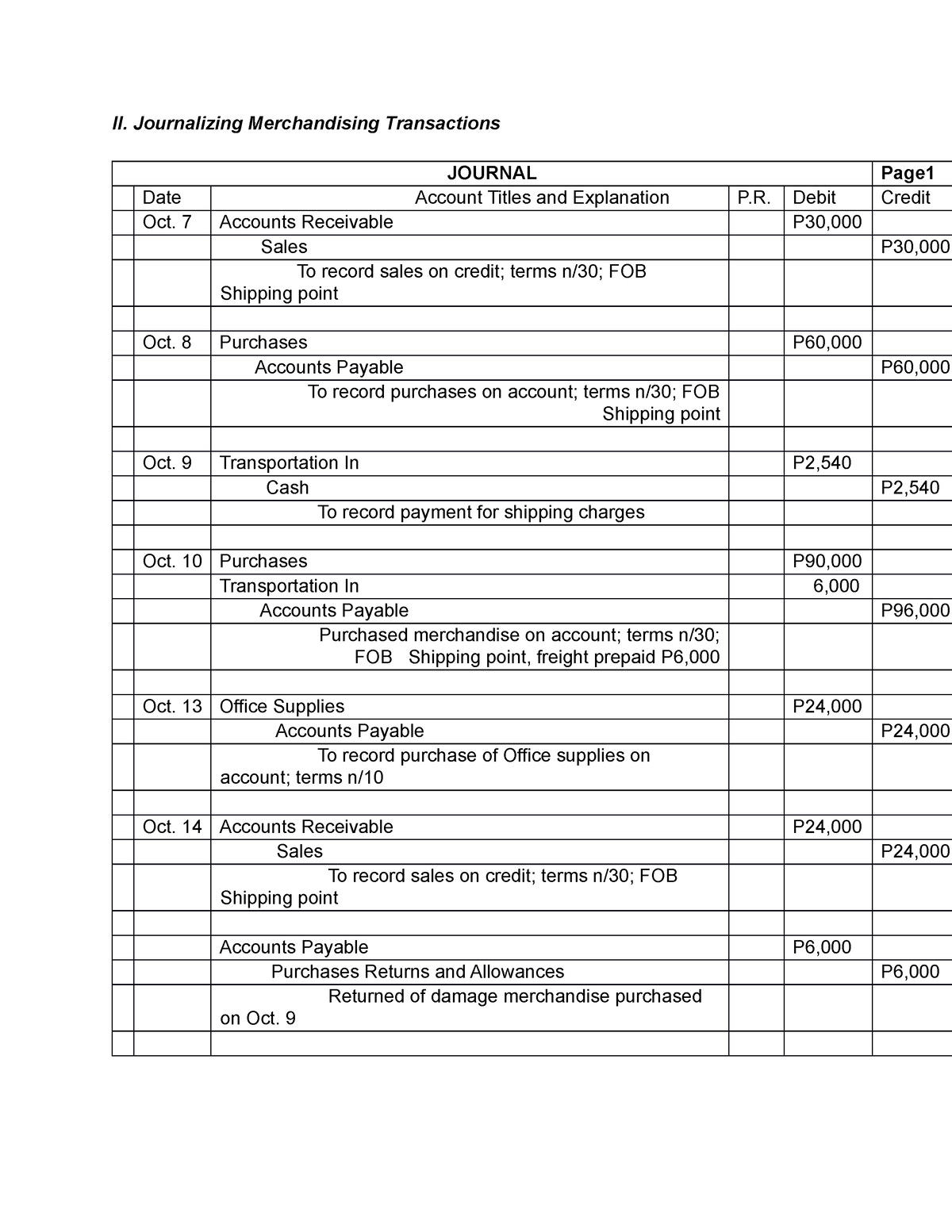

Merchandising business Example of a journal entry II. Journalizing

Journal entry for disposal of fixed assets at net book value. The fixed asset's depreciation expense. Let’s review what you need to know about making.

General Journal entry form June 1 . Purchased equipment in the amount

The fixed asset's depreciation expense. Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the loss. Web the journal entry.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the loss. Journal entry for sale of assets (land) example 4:.

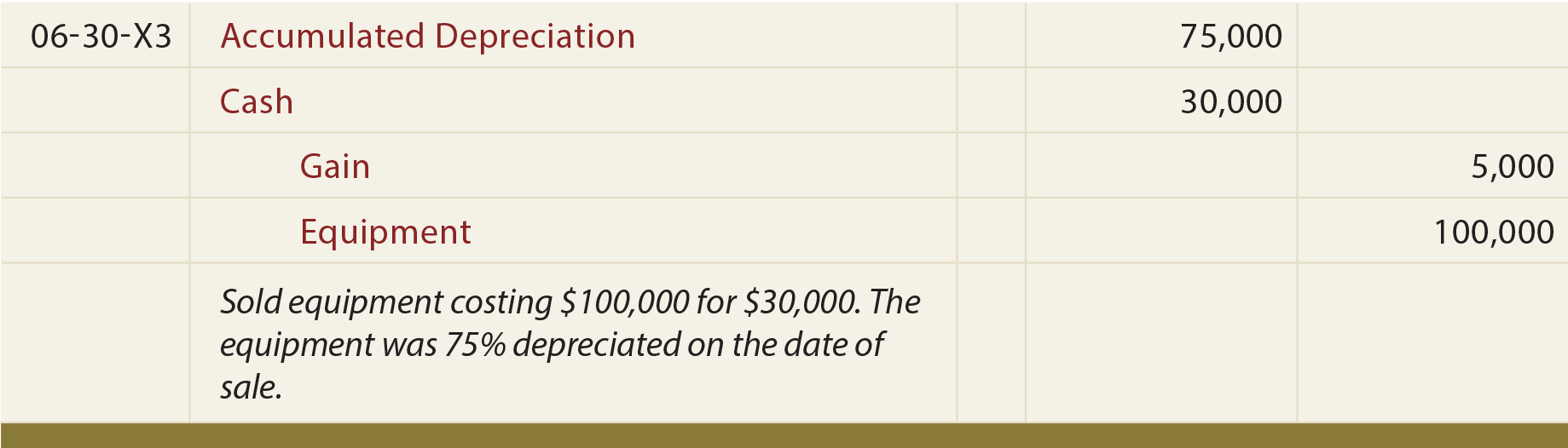

Gain on Sale journal entry examples Financial

When the fixed assets are sold at net. Web the journal entry will have four parts: You would debit the accumulated depreciation, credit the asset.

Perpetual Inventory System Journal Entry

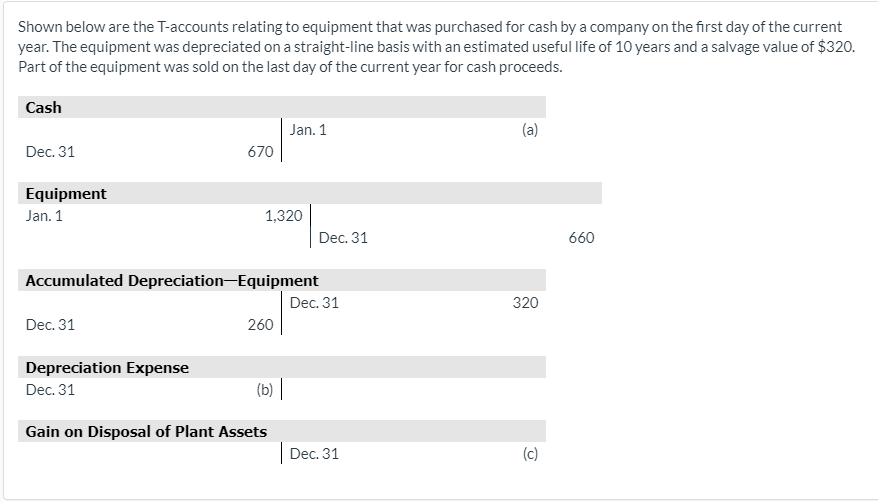

When equipment that is used in a business is disposed of (sold) for cash before it is fully depreciated, two steps must be taken: Web.

5.3 Analyze and Record Transactions for the Sale of Merchandise Using

Web the journal entry is debiting loss from sale of equipment, accumulated depreciation, and credit cost of equipment. Web when it comes to recording an.

Solved Prepare the journal entry to record sale of part of

The fixed asset trade in transaction is shown in the accounting records with the following bookkeeping entries: The fixed asset's depreciation expense. (a) cost of.

Accounting Journal Entries For Dummies

In the journal entry, equipment has a debit of $3,500. Journal entry for sale of asset. Web when it comes to recording an equipment sale.

Sales Journal Definition, Explanation, Format and Entry Examples

This includes recording the equipment in your books: When equipment that is used in a business is disposed of (sold) for cash before it is.

Web The Journal Entry For The Discard Of This Computer Equipment Is As Follow:

Web the equipment cost and the related accumulated depreciation are removed from balance sheet in the process of disposal and the gain is reported in income statement. October 15, 2018 06:21 pm. Web the equipment will be disposed of (discarded, sold, or traded in) on 4/1 in the fourth year, which is three months after the last annual adjusting entry was journalized. Web the journal entry is debiting loss from sale of equipment, accumulated depreciation, and credit cost of equipment.

Sale Of Fixed Assets Journal Entry.

In the journal entry, equipment has a debit of $3,500. What is a sales journal entry? Web fixed asset trade in journal entry. One is when the business sells, donates, or.

The Fixed Asset's Depreciation Expense.

Journal entry for disposal of fixed assets at net book value. Let’s review what you need to know about making a sales journal entry. (c) sale price of equipment = $8,500. This includes recording the equipment in your books:

Web 6.4 Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System;

The purchase of property, plant, or equipment results in a debit to the asset section of the balance sheet. Web what the journal entry to record a purchase of equipment? (a) cost of equipment = $70,000. Web entries to record a sale of equipment.