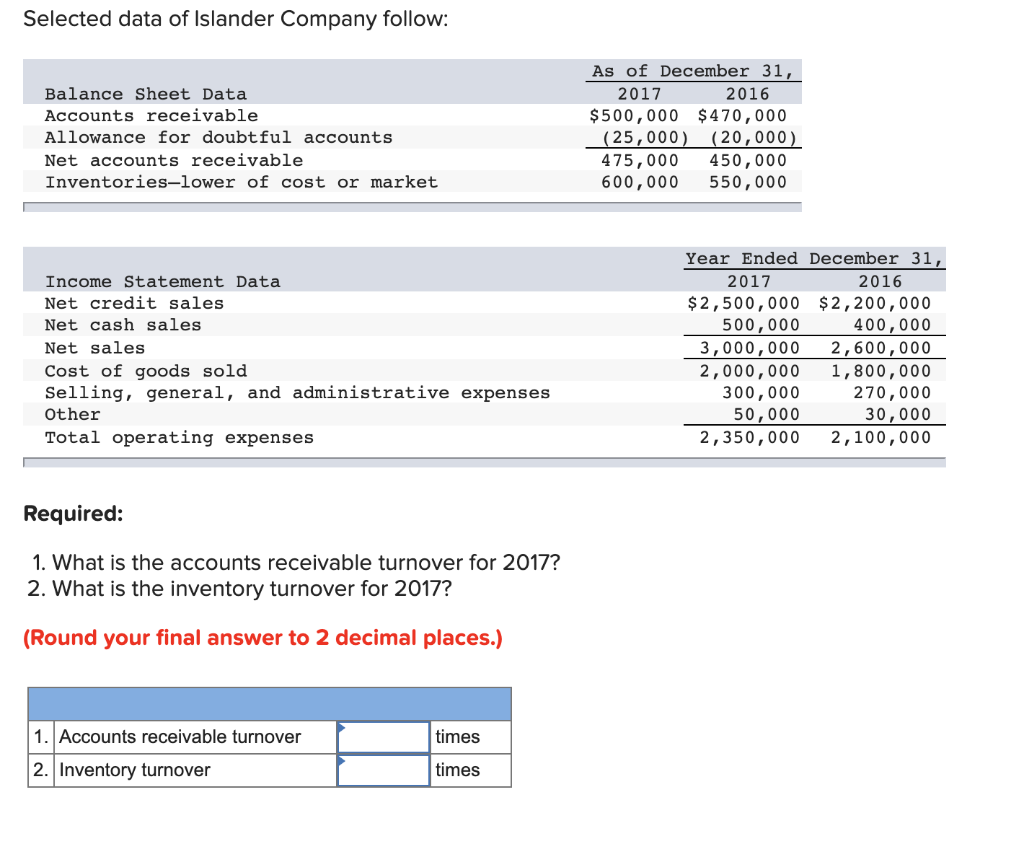

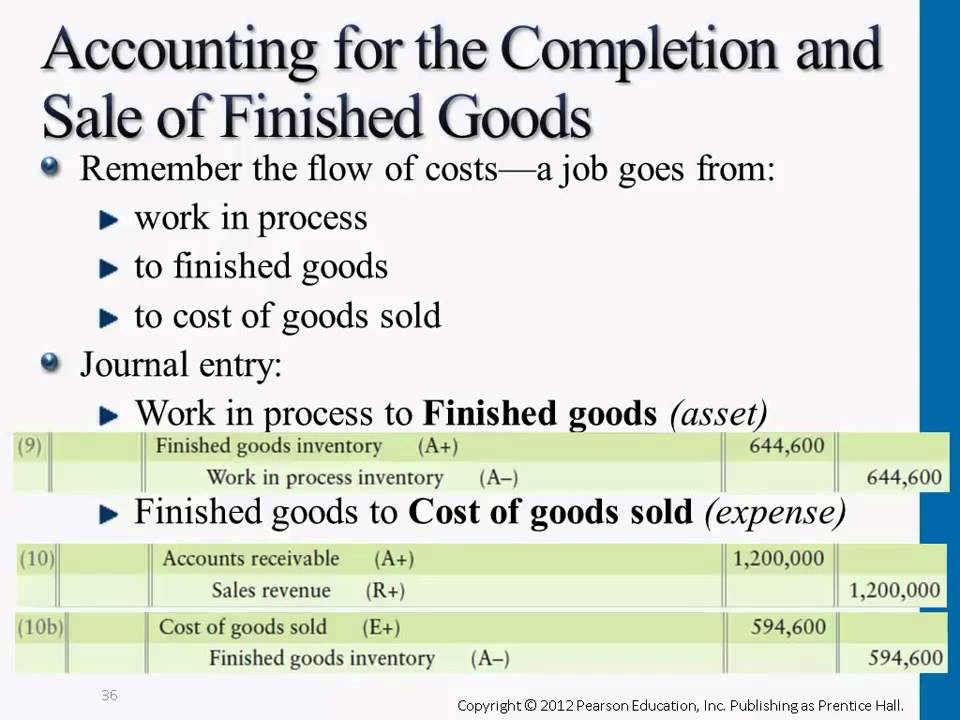

Journal Entry For Cost Of Goods Sold - Z) depending on your specific business and chart of accounts, the specific amounts and account names may differ. Web cost of goods sold on an income statement. Web journal entries to move finished goods into cost of goods sold. Web introduction to cost of goods sold. A corresponding entry is also made to. To record the cost of goods sold, we need to find its value before we process a journal entry. Identify the cost of goods sold. Sales revenue minus cost of goods sold is a business’s gross profit. This formula can be used to calculate how much it costs to produce a saleable product. When the sale has occurred, the goods are transferred to the buyer.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Web journal entries to move finished goods into cost of goods sold. Under cogs, record, any sold inventory. The journal entry for cost of goods.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

Web journal entries to move finished goods into cost of goods sold. What we have now learned is that using the periodic inventory system the.

Cash Sales Journal Entry Example

Introduction to inventory and cost of goods sold, inventory is reported at cost, periodic vs perpetual inventory systems. Inventory is the difference between your cogs.

Recording a Cost of Goods Sold Journal Entry

Web compute the cost of goods sold under a periodic system and create journal entries. Sales revenue minus cost of goods sold is a business’s.

Recording a Cost of Goods Sold Journal Entry

What we have now learned is that using the periodic inventory system the cost of goods sold (cogs) is computed as follows: On most income.

Completion of Sale & Finished Goods Journal Entries YouTube

Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate.

Journal Entry for Goods Sold on Credit YouTube

Identify the cost of goods sold. Opening inventory plus purchases and production costs minus closing inventory. The journal entry for cost of goods sold is.

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Web when recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct.

Cost of Goods Sold Journal Entry How to Record & Examples

Z) depending on your specific business and chart of accounts, the specific amounts and account names may differ. Web introduction to cost of goods sold..

When The Sale Has Occurred, The Goods Are Transferred To The Buyer.

Web the cost of goods sold formula is: Based on your company’s accounting system, enter the. (being fittings sold for 10,000 to mr. Under cogs, record, any sold inventory.

Sales Revenue Minus Cost Of Goods Sold Is A Business’s Gross Profit.

When compared with revenue, the cost of goods sold. Z) depending on your specific business and chart of accounts, the specific amounts and account names may differ. To record the cost of goods sold, we need to find its value before we process a journal entry. Web accounting for costs of goods sold in financial statements:

What We Have Now Learned Is That Using The Periodic Inventory System The Cost Of Goods Sold (Cogs) Is Computed As Follows:

Web the cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. As the first part of this step, ensure you have all raw materials inventory, your related expenses, and information about additional inventory. Web the journal entry for the above transaction will be: Web let’s take a look at an example of a journal entry for cash sales.

See Examples Of Simple And Advanced Journal Entries And Why They Are Important For Profit Analysis.

Identify the cost of goods sold. Web journal entries to move finished goods into cost of goods sold. The cost of goods sold is considered an expense in accounting. Web when recording journal entries for the cost of goods sold, accountants work in tandem with manufacturing or operations to ensure they’re booking the correct costs.