Journal Entry For Share Repurchase - The nominal value of 5% of its share capital. Web share buyback rationale and impact on share price. The common shares are again eliminated at their new average cost: The cost method ignores the par value of the shares and the amount received from investors when the shares were originally issued. An entity cannot own part of. Out of capital in accordance with chapter 5, (ie sections 709 to 723) and. Usually, it involves the cost and constructive retirement method. The journal entry would be: Based on the approach used, the journal entries will also differ. The rationale for share repurchases is often that management has determined its share price is currently undervalued.

View 27 Treasury Stock Journal Entry greatsomethingstock

When a reporting entity reissues treasury stock at an amount greater (less) than it paid to repurchase the shares (based on its policy such as.

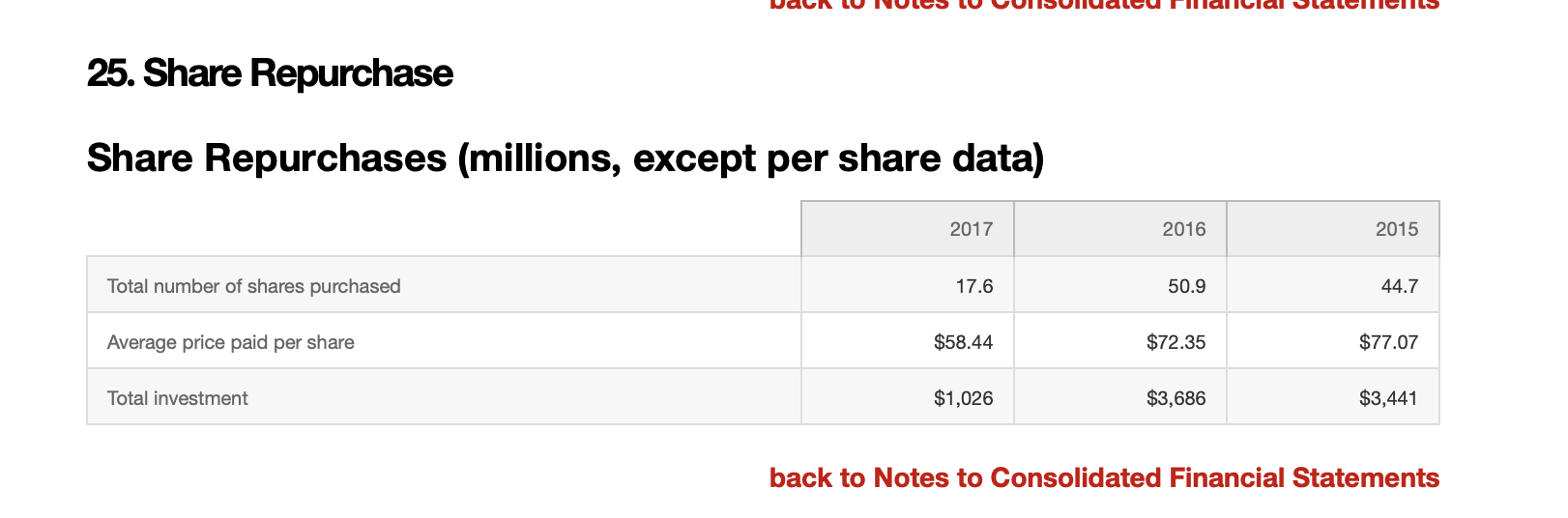

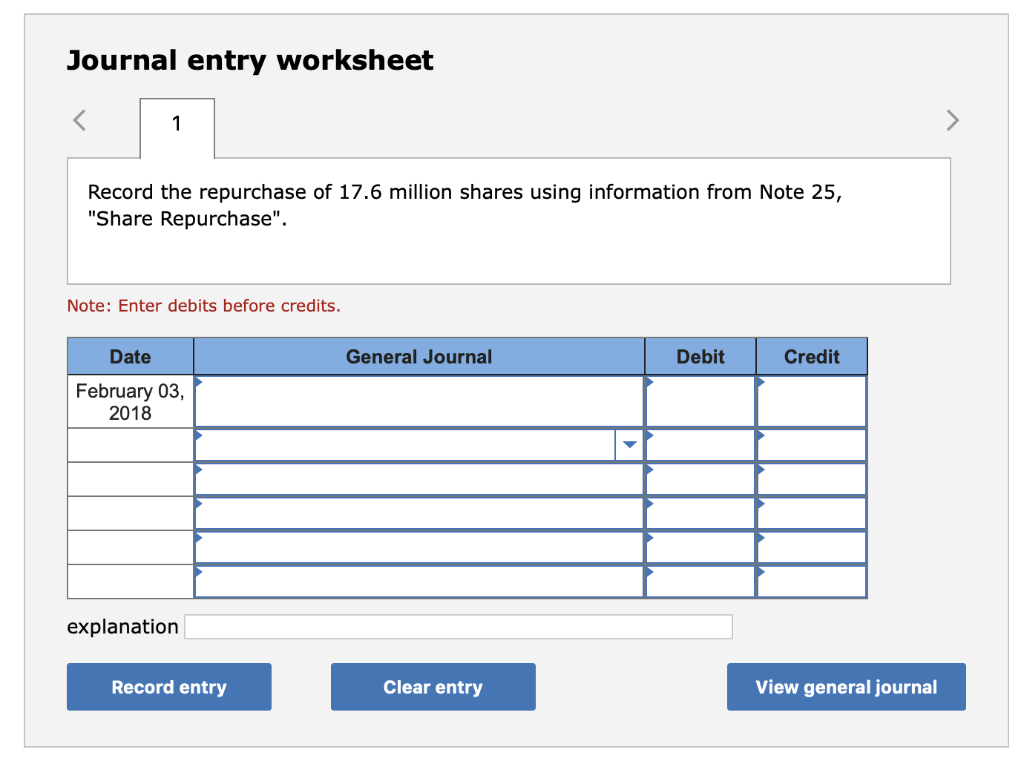

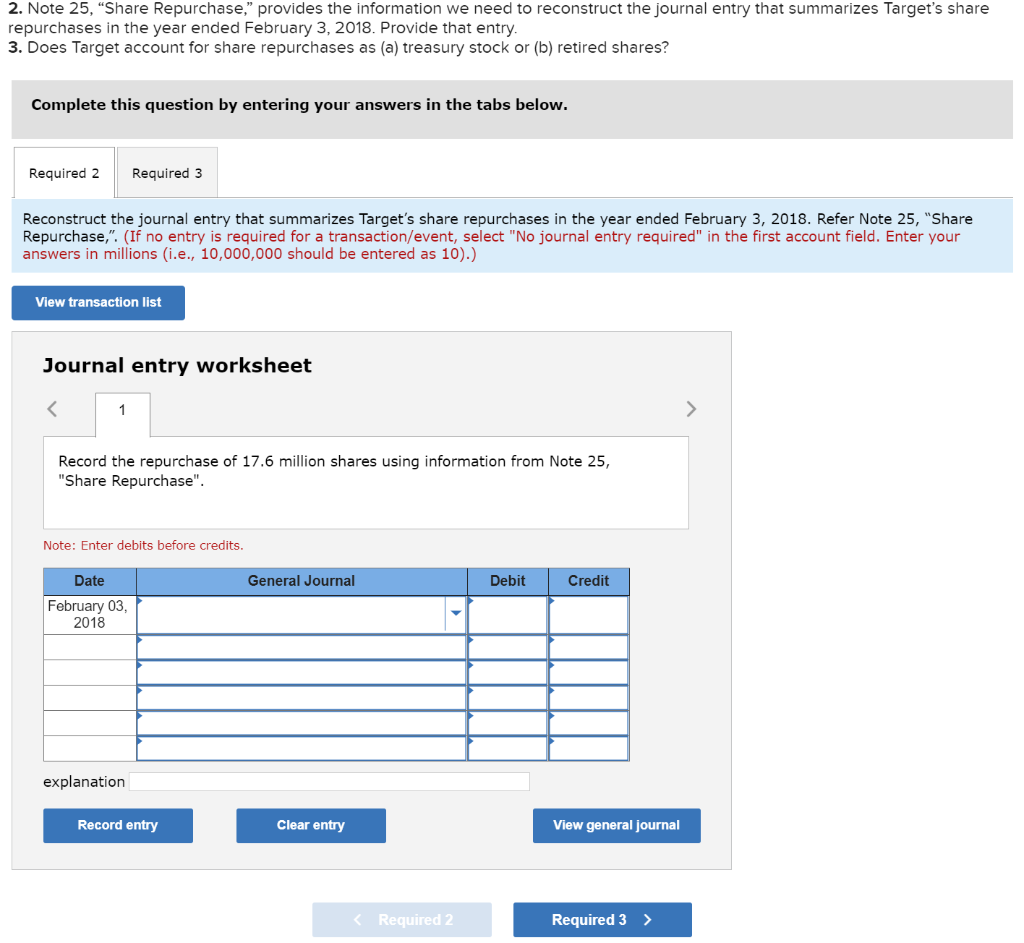

Solved Journal entry worksheet Record the repurchase of 17.6

When a reporting entity reissues treasury stock at an amount greater (less) than it paid to repurchase the shares (based on its policy such as.

Changes to Accounting for Repurchase Agreements The CPA Journal

Out of capital in accordance with chapter 5, (ie sections 709 to 723) and. A company may elect to buy back its own , which.

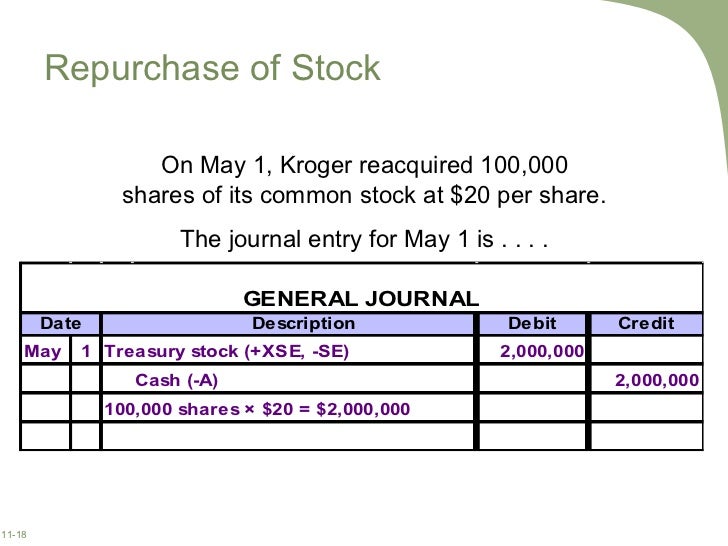

Chap011

The treasury stock account will be debited and the cash account credited for the full repurchase. Web to retire shares under the cost method, two.

2 Buy Back of Shares Journal Entries / CMA / CA INTER By

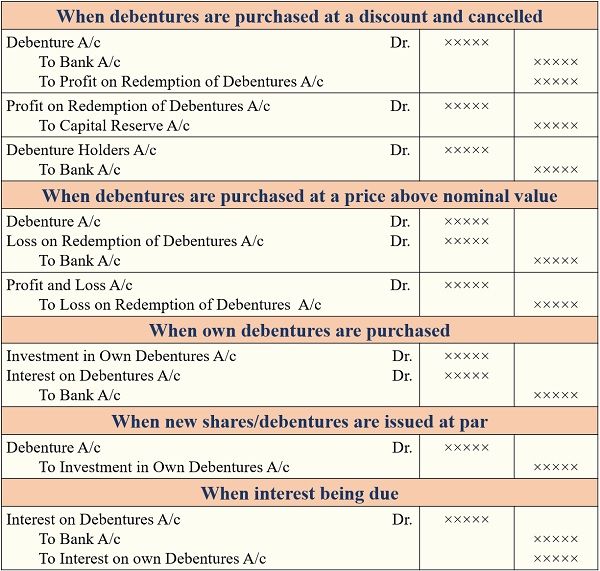

The first party agrees to repurchase the financial asset on a specific date and at a set price. Web the following journal entry is recorded.

Changes to Accounting for Repurchase Agreements The CPA Journal

However, all buybacks must comply with these considerations: A forward repurchase contract that, by its terms, must be physically settled by delivering cash in exchange.

Solved Journal entry worksheet Record the repurchase of 17.6

There are many reasons for the repurchase of stock, which include the following: Web share buyback rationale and impact on share price. Web a private.

Solved Journal entry worksheet

An entity cannot own part of. The nominal value of 5% of its share capital. A share repurchase or buyback is when a publicly traded.

Solved 2. Note 25, “Share Repurchase," provides the

The cost method ignores the par value of the shares and the amount received from investors when the shares were originally issued. However, all buybacks.

Accounting For The Repurchase Of Shares:

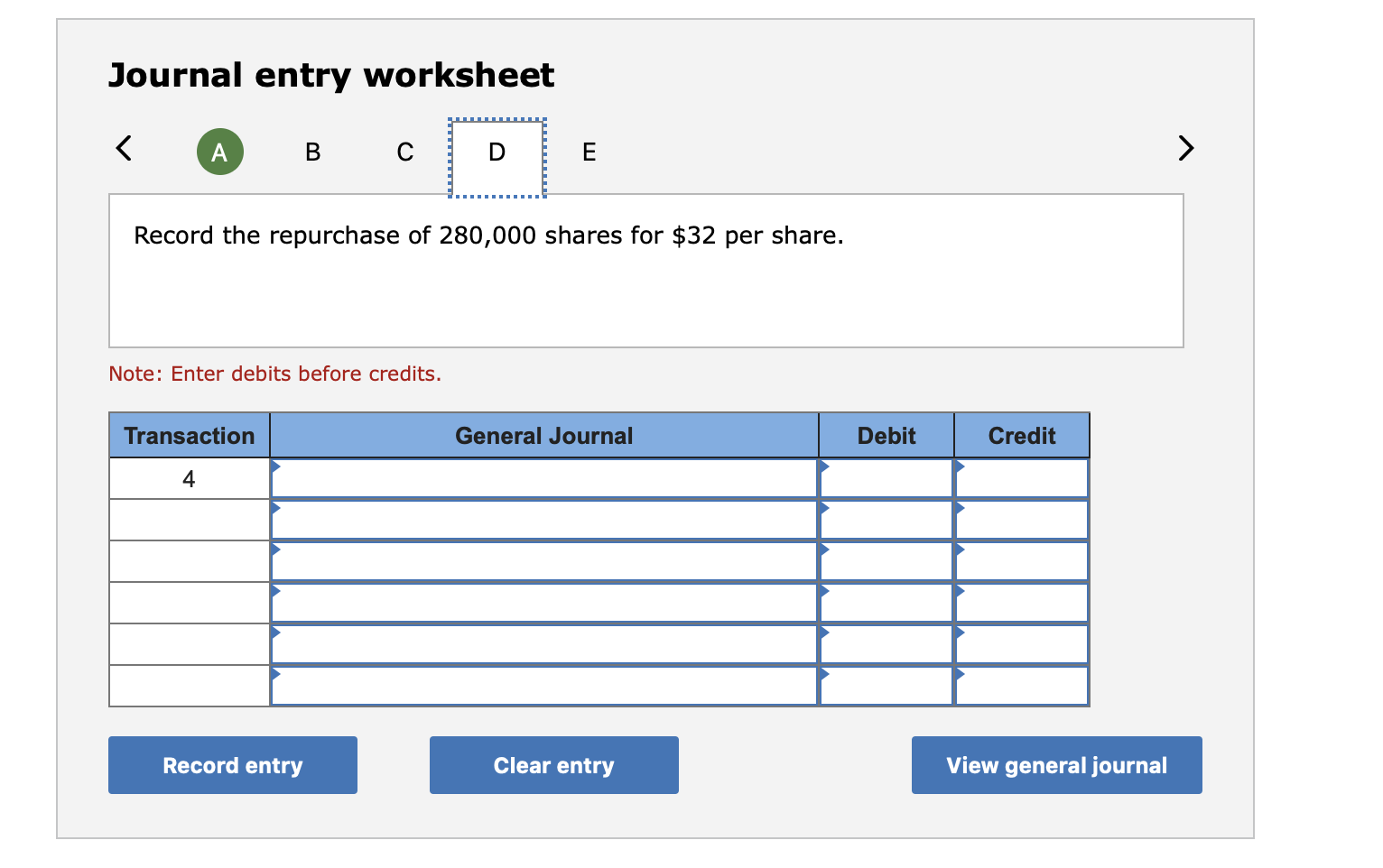

A stock buyback program that is intended to reduce the overall number of shares and thereby increase the earnings per share. Web recording transaction in journal entry. This chapter discusses the accounting for several share repurchase alternatives. Learn how to account for the cost and impact of repurchasing and retiring common stock on the balance sheet.

The Cost Method Ignores The Par Value Of The Shares And The Amount Received From Investors When The Shares Were Originally Issued.

Therefore, it is crucial to study them individually. Prepare the journal entry to record the transaction. Web share buyback rationale and impact on share price. A share repurchase or buyback is when a publicly traded company purchases its own shares in the.

Record The Entire Amount Of The Purchase In The Treasury Stock Account.

The previous contributed surplus is fully utilized, with an additional excess amount being charged to retained earnings. Web the procedure for repurchase of shares is pretty much the same whichever method is chosen; Purchase must not be prohibited by the companyʼs articles. Retained earnings = $500,000 ($5 premium per share * 100,000 shares) credit:

Usually, It Involves The Cost And Constructive Retirement Method.

When a reporting entity reissues treasury stock at an amount greater (less) than it paid to repurchase the shares (based on its policy such as average cost, fifo, lifo, or specific identification), it realizes a gain (loss) on the reissuance of the shares. Web the journal entry to record this sale of the treasury shares at cost is: A company may elect to buy back its own , which are then called. However, all buybacks must comply with these considerations: