Merchandise Returned Journal Entry - When this happens, the purchaser no longer has the merchandise. Basic analysis of sales transaction journal entries. Web journal entry for sales returns or return inwards. Web home > inventory > perpetual inventory system journal entries. Web return of merchandise sold for cash is entered in the cash payments journal or cash book. Web the journal entry for purchase of merchandise on account is the same as the journal entry for purchase of merchandise for cash, except that the accounts payable account is credited instead of the cash account. A return occurs when a buyer returns part or all of the merchandise they purchased back to the seller. Cash and credit purchase transaction journal entries; Thus, the purchase return journal entries are. A returned merchandise journal entry is a financial record that a company creates when a customer returns previously purchased goods.

Pt 5 Journal Entries for Merchandising Business Purchases, Purchase

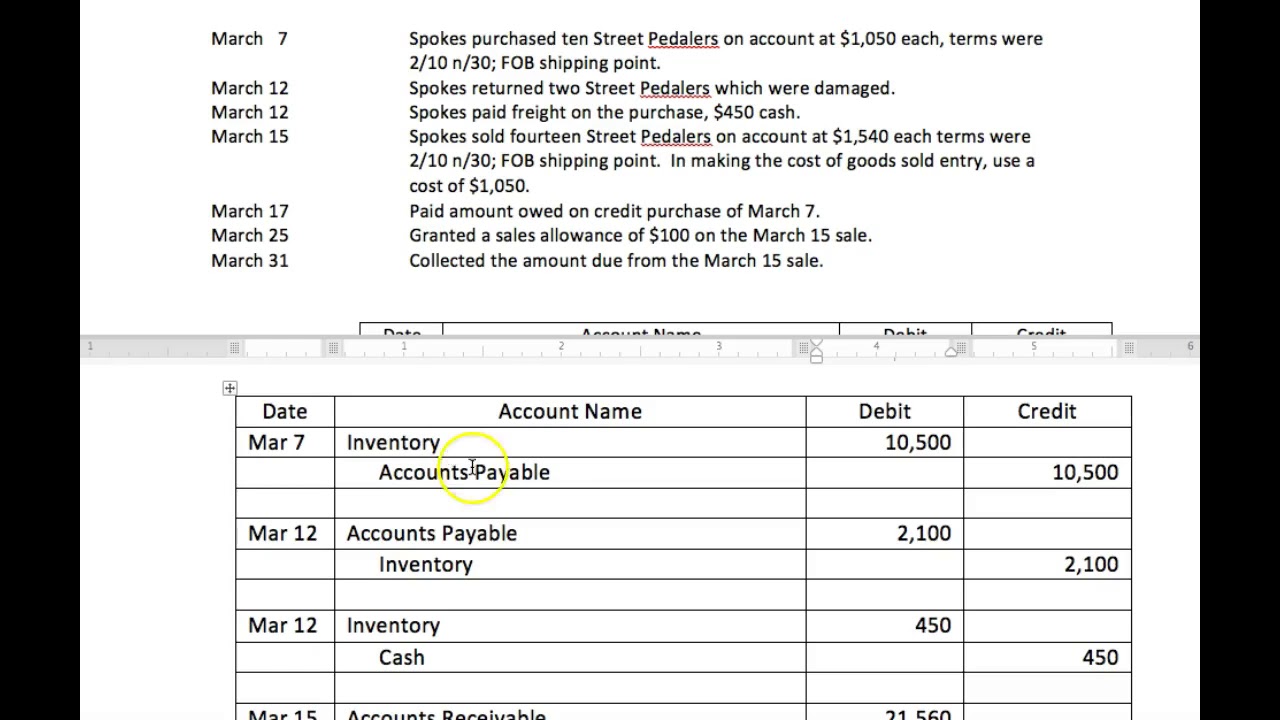

In merchandising business, purchasing merchandise is one of the main activities that the merchandising company operates in its business. Web when merchandise purchased for cash.

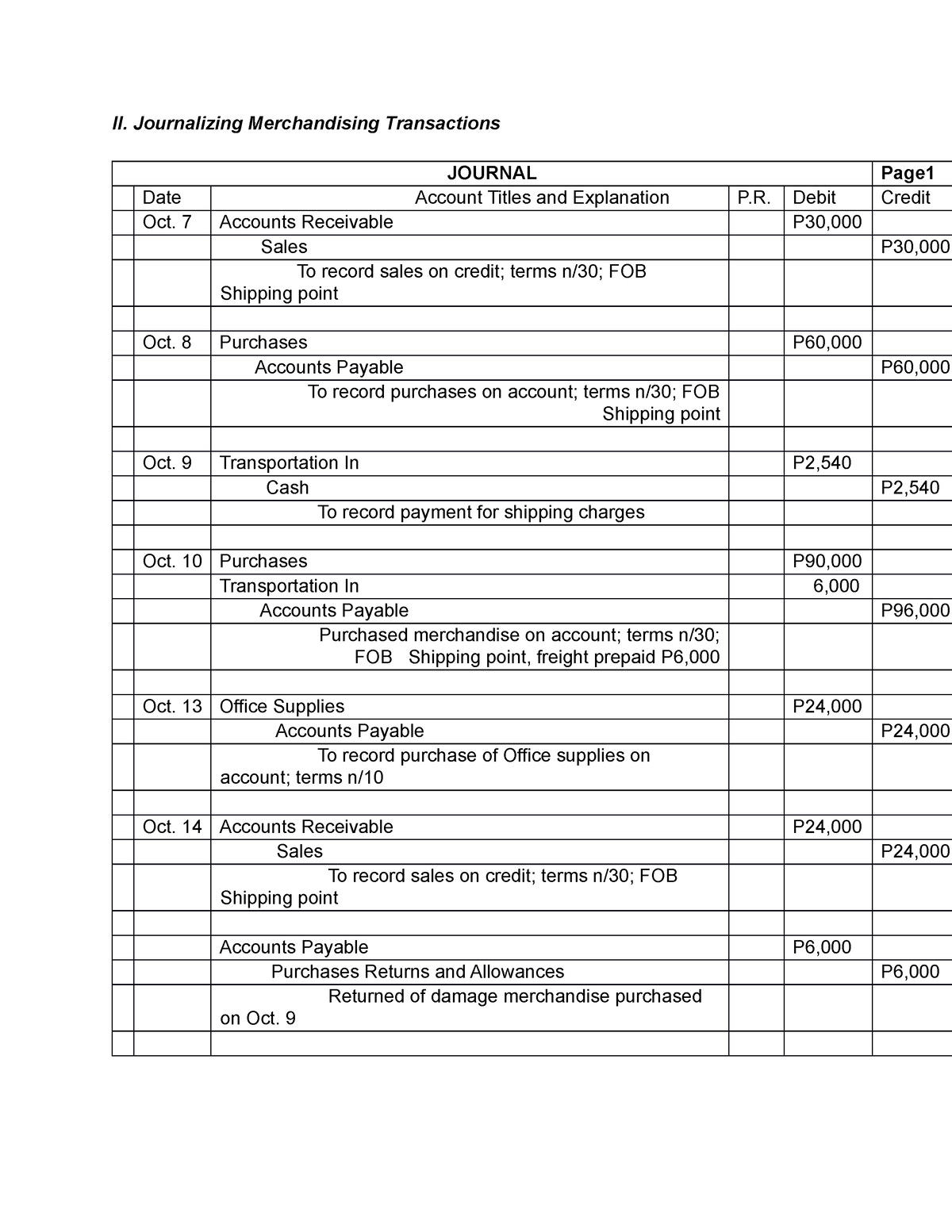

Merchandising business Example of a journal entry II. Journalizing

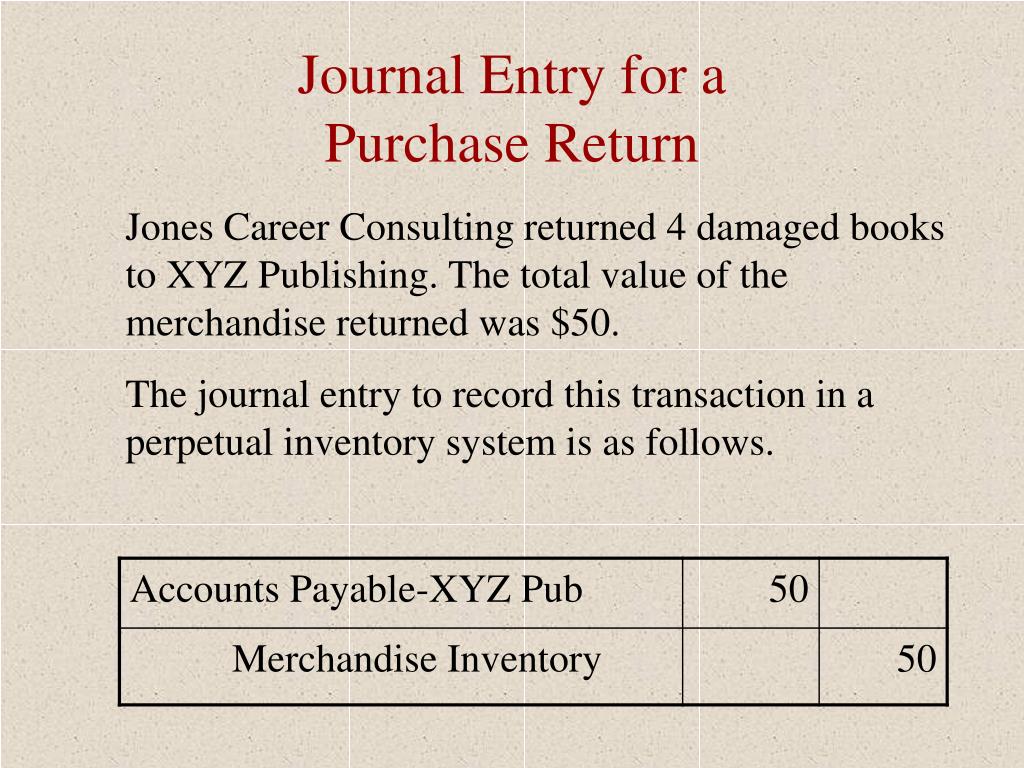

Hence, accounting for sales return is. The source document for a purchase return or allowance is the debit memorandum. Web journal entry for purchase returns.

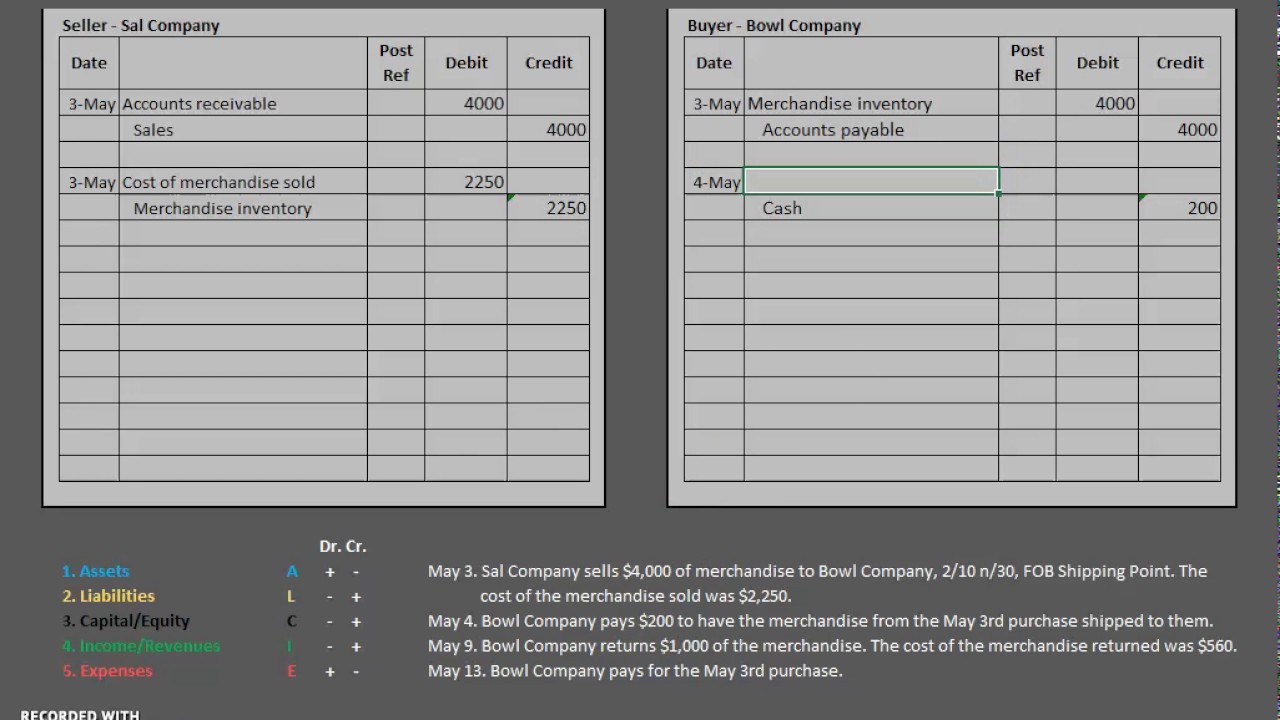

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Excessive use of return outwards can harm relationships with suppliers, leading to trust issues. Sometimes merchandise must be returned to the vendor or an adjustment.

Purchase Considerations For Merchandising Businesses

Web basic analysis of purchase transaction journal entries; When this happens, the purchaser no longer has the merchandise. In merchandising business, purchasing merchandise is one.

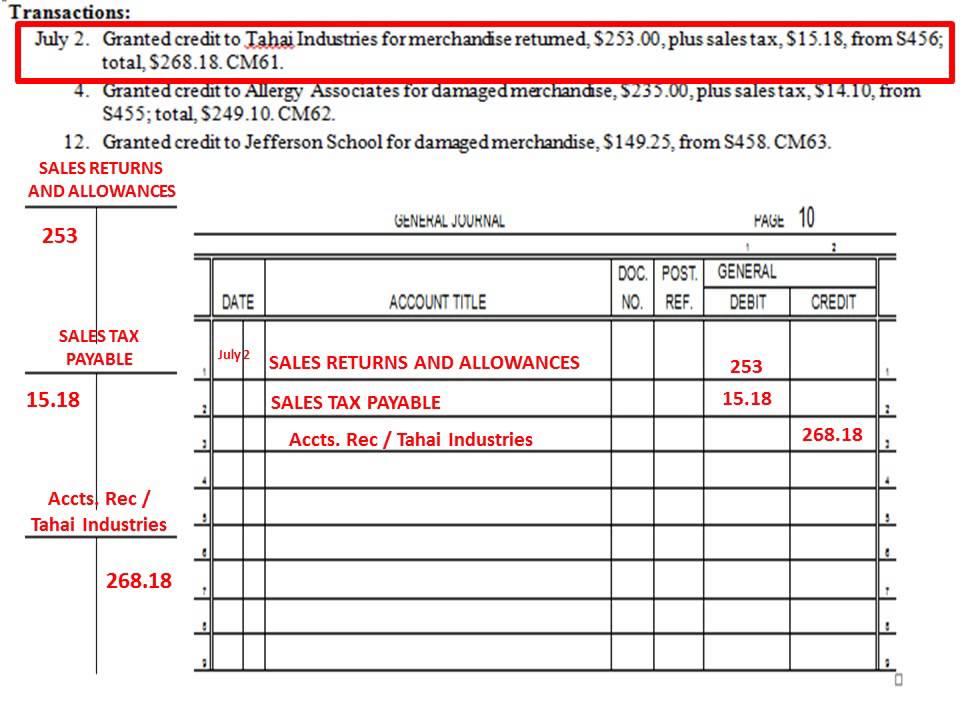

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General

The second entry debits the cash account and credits the accounts receivable account. Web a sales return is merchandise returned by a buyer. Sometimes merchandise.

Accounting for Sales Return Journal Entry Example Accountinguide

The second entry debits the cash account and credits the accounts receivable account. A return occurs when inventory is purchased and later returned to the.

Merchandising Buyer/Seller Journal Entries YouTube

Hence, accounting for sales return is. Web journal entry for sales returns or return inwards. The source document for a purchase return or allowance is.

Example of Merchandising Entries YouTube

In merchandising business, purchasing merchandise is one of the main activities that the merchandising company operates in its business. Web when merchandise purchased for cash.

PPT Accounting for Merchandising Companies Journal Entries

A returned merchandise journal entry is a financial record that a company creates when a customer returns previously purchased goods. This may happen due to.

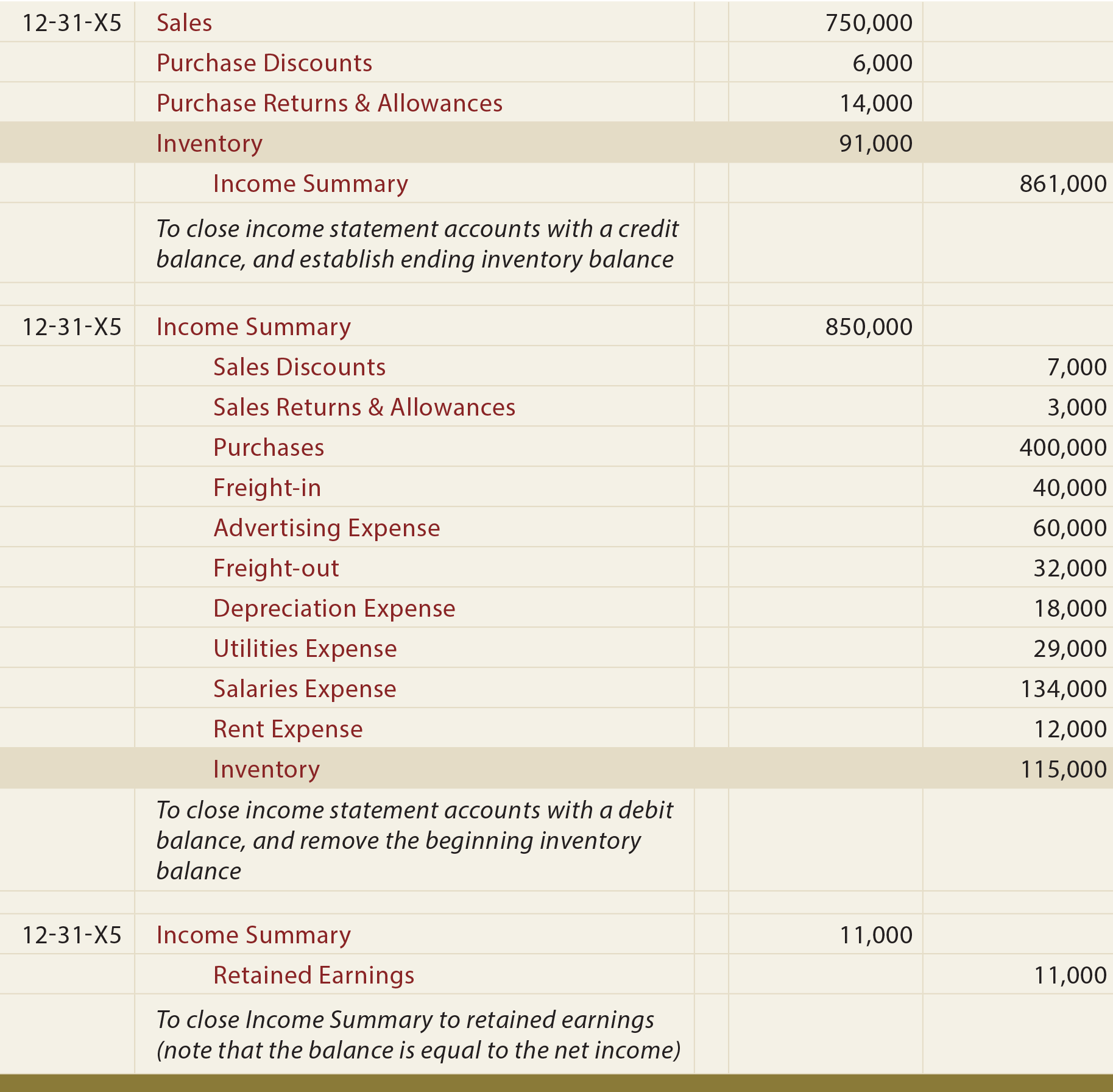

Analyze And Record Transactions For Merchandise Purchases And Sales Using The Periodic Inventory System.

Can make the journal entry for the purchase return on october 21, 2020, as below: In merchandising business, purchasing merchandise is one of the main activities that the merchandising company operates in its business. Web journal entries for purchase returns. Sales return is the transaction or event when customers return purchased goods back to the company due to various reasons, such as the wrong product, late delivery, or the goods are damaged or defective.

Under The Periodic Inventory System, Abc Ltd.

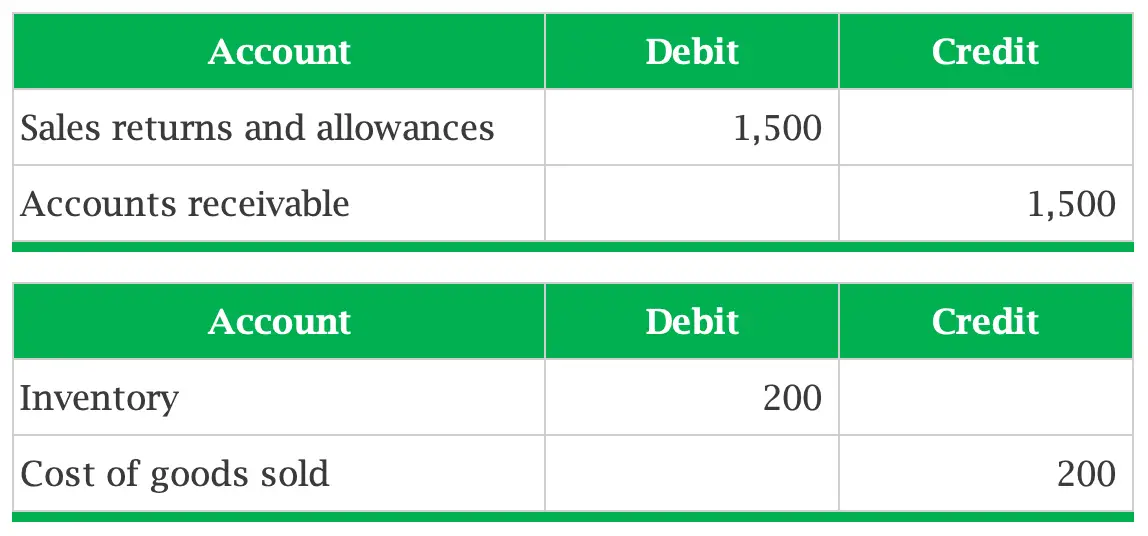

A return occurs when a buyer returns part or all of the merchandise they purchased back to the seller. Web the following entries show the purchase and subsequent return. A purchase return is when a buyer (either a business or an individual) returns goods that they bought to the seller for a refund or store credit, depending on the seller’s policy. Web the journal entry to record this transaction in a perpetual inventory system is as follows.

Web We Can Make The Journal Entry For The Return Of Damaged Goods To The Supplier By Debiting The Accounts Payable Or Cash Account And Crediting The Purchase Returns And Allowances Account If We Use The Periodic Inventory System.

This entry is crucial for accurately reflecting the impact of returns on the company’s financial statements. In this case, $1,500 will be offset with the amount of purchase during the period when the company calculates the cost of goods sold. The first entry debits the accounts receivable account and credits the purchase returns and allowances account. Web journal entry for sales returns or return inwards.

Excessive Use Of Return Outwards Can Harm Relationships With Suppliers, Leading To Trust Issues.

The perpetual inventory system journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting under a perpetual inventory system. A sales allowance is a deduction from the original invoiced sales price granted when the customer keeps the merchandise but is dissatisfied for any of a number of reasons, including inferior quality, damage, or deterioration in transit. The second entry debits the cash account and credits the accounts receivable account. Basic analysis of sales transaction journal entries.