Journal Entry For Revenue Accrual - Accrued revenue is the revenue that the company has already earned but has not received the payment from the customers yet. The journal entry needed to account for accrued income is: Deferred revenue is when the revenue is spread over time. Accounting for business revenue might seem straightforward: Web with the journal entry, the asset (accrued revenue) is increased by 4,000 representing an amount owed by the customer for services provided during the month. Last updated january 29, 2024. What accrued revenue is and how to handle it. Last updated march 27, 2023. At the point of sales being made: You need to document how much money is coming in, what you’re selling in exchange for it, and when this exchange.

Lasicamping Blog

You need to document how much money is coming in, what you’re selling in exchange for it, and when this exchange. Written by true tamplin,.

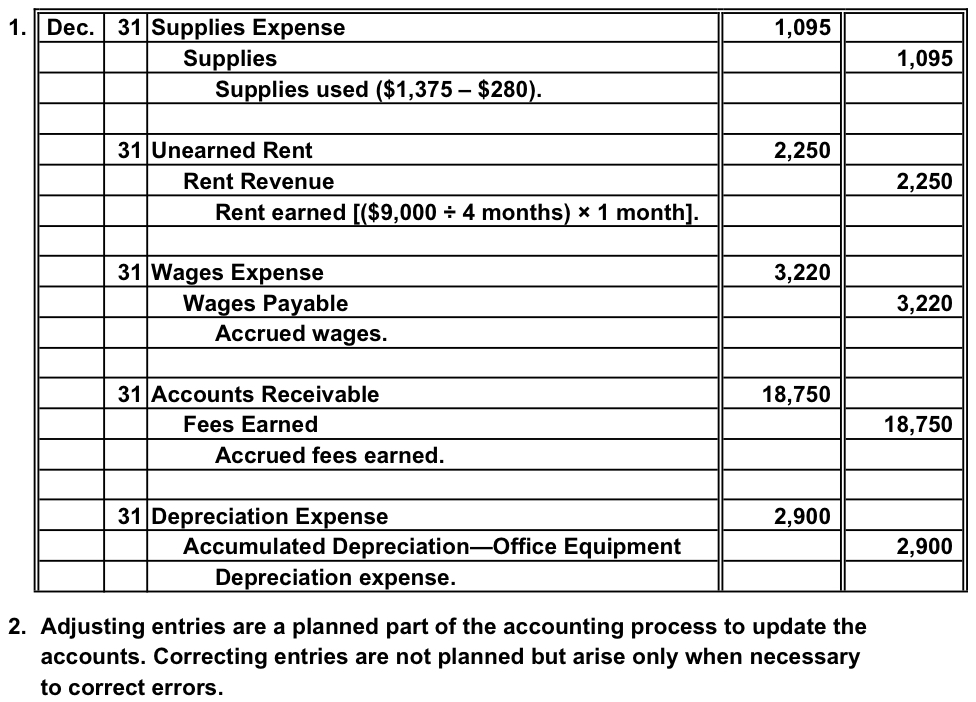

Adjusting Journal Entries Defined Accounting Play

Web the journal entry to record accounts receivable balance and the associated accrued revenues for the customer is as follows. Deferred revenue is when the.

Accrued revenue how to record it in 2023 QuickBooks

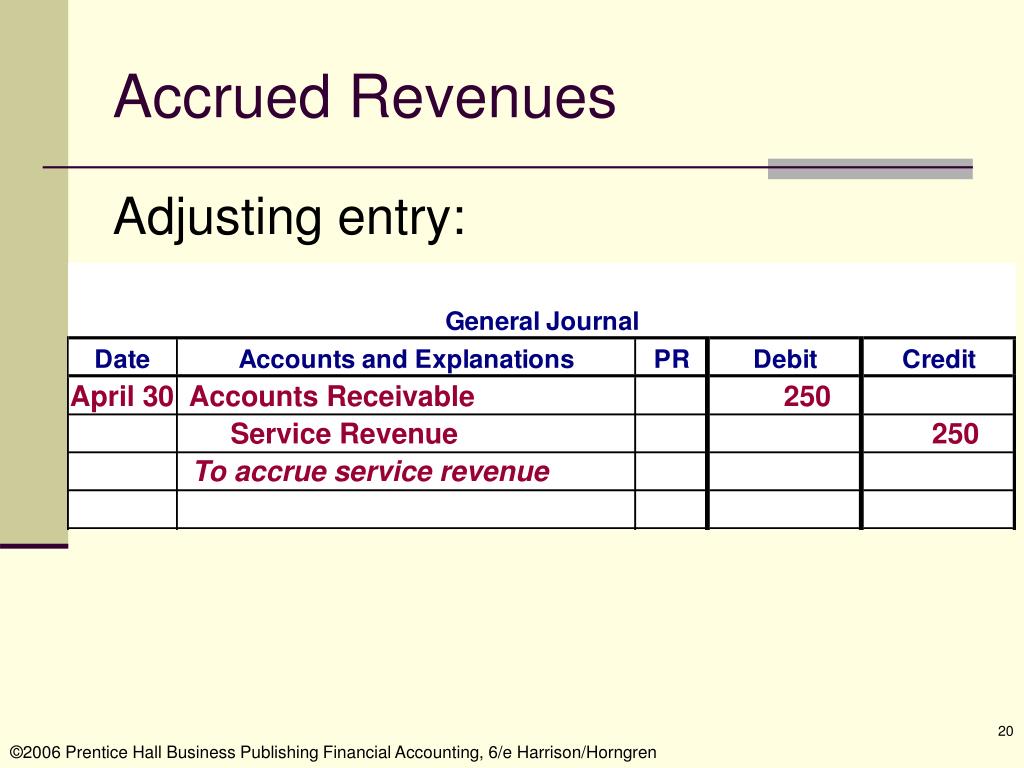

Web how is accrued revenue recorded in journal entries? The amount will be collected after 1 year. Accrued revenue is the revenue that has been.

What is Unearned Revenue? QuickBooks Canada Blog

In contrast on the other side of the equation, the additional revenue increases the net income and retained earnings of the business resulting in an.

Journal Entries Accounting

Web in order to record accrued revenue, you should create a journal entry that debits the accrued billings account (an asset) and credits a revenue.

Accruals and Prepayments Journal Entries HeathldDunn

Recording adjustments for accrued revenue. Interest is earned through the passage of time. Explanation example journal entries to record accrued expenses accrued expenses. The journal.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

It is classified as current assets on the balance sheet, whereas on the. At the end of december, no entry was entered in the journal.

What Is The Journal Entry For Payment Of Salaries Info Loans

Interest is earned through the passage of time. Accounting for business revenue might seem straightforward: Web as per the example, the journal entry for accrued.

PPT Accrual Accounting and the Financial Statements Chapter 3

Accrued revenue vs deferred revenue. At the end of december, no entry was entered in the journal to take up the interest income. Accrual of.

An Adjusting Journal Entry Is Usually Made At The End Of An Accounting Period To Recognize An Income Or Expense In The Period That It Is Incurred.

Web the entry of accrued revenue entry happens for all the revenue at once. It is recorded when there is a mismatch between the time of the payment and delivery of goods and services. Accrued income reported on the balance sheet. Adjusting entries at the end of the each accounting period to debit accrued accounts receivable and credit revenue.

Deferred Revenue Is Unearned Revenue And Hence Is Treated As A Liability.

Web accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. It is also called unbilled revenue. Web the journal entries to be passed are: Web accrual accounting is an accounting method that records revenues and expenses when they are earned or incurred, regardless of when the cash transactions occur.

Accounting For Business Revenue Might Seem Straightforward:

At the time of receipt of cash: Adjusting journal entries are a feature of accrual accounting as a result of. The journal entry needed to account for accrued income is: Web journal entries accounting for accrual of revenues involves the following journal entries:

This Results In Revenue Being Recognized In The Current Period.

Web accrued revenue journal entry overview. The accrual accounting method provides a more accurate picture of a company's financial position and performance over a specific period. It is classified as current assets on the balance sheet, whereas on the. At the end of december, no entry was entered in the journal to take up the interest income.