Journal Entry For Unrealized Gain - Go to general ledger > journal entry. This gain must be included in the report to increase the investment account. Journal entry examples from youtube video linked below. Web remaining amount to be tested for recognition 70. Journal entry for unrealized gain or loss. No impact to income statement or cash flow statement. Web updated april 26, 2022. Web any unrealized gain or loss is reported under other comprehensive income. It is the price difference between the. The program generates this journal entry if you set.

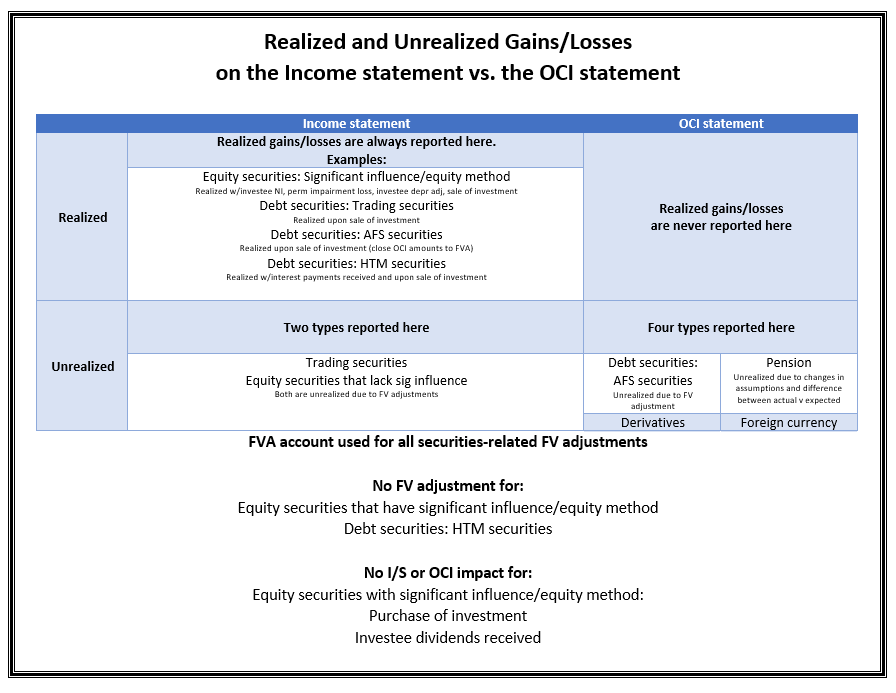

Realized and unrealized gains and losses on the statement vs OCI

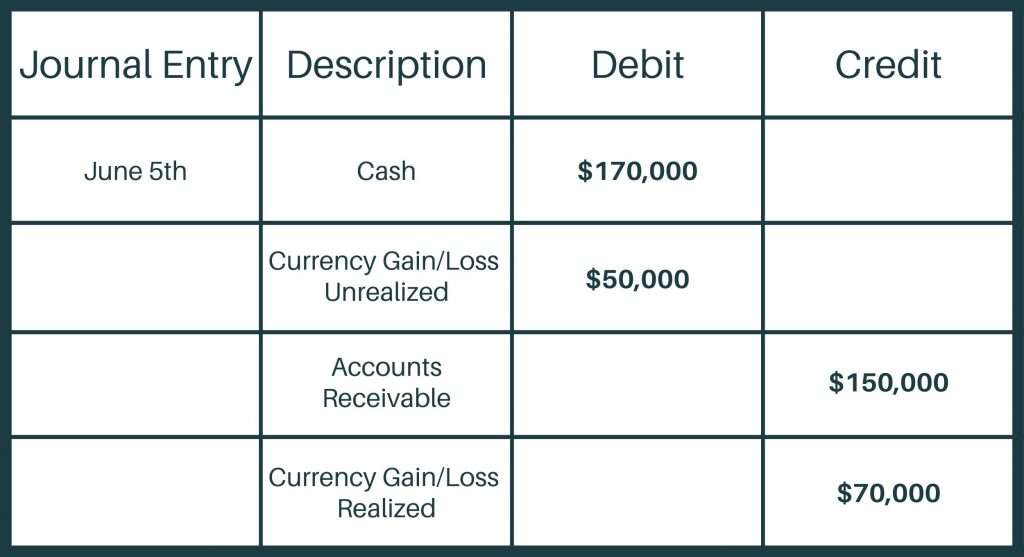

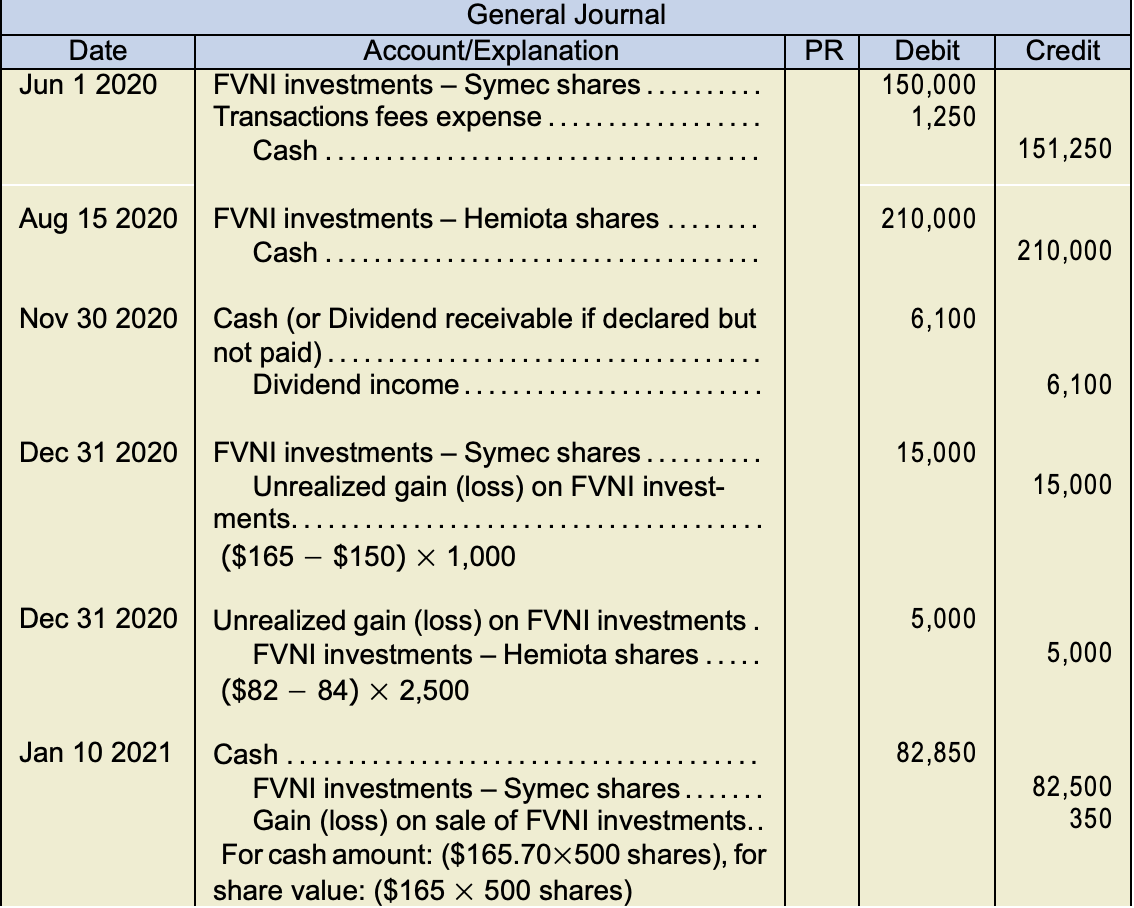

Journal entry for unrealized gain or loss. It is the price difference between the. Abc has a total unrealized gain of $ 50,000. The following.

Accounting Journal Entries For Dummies

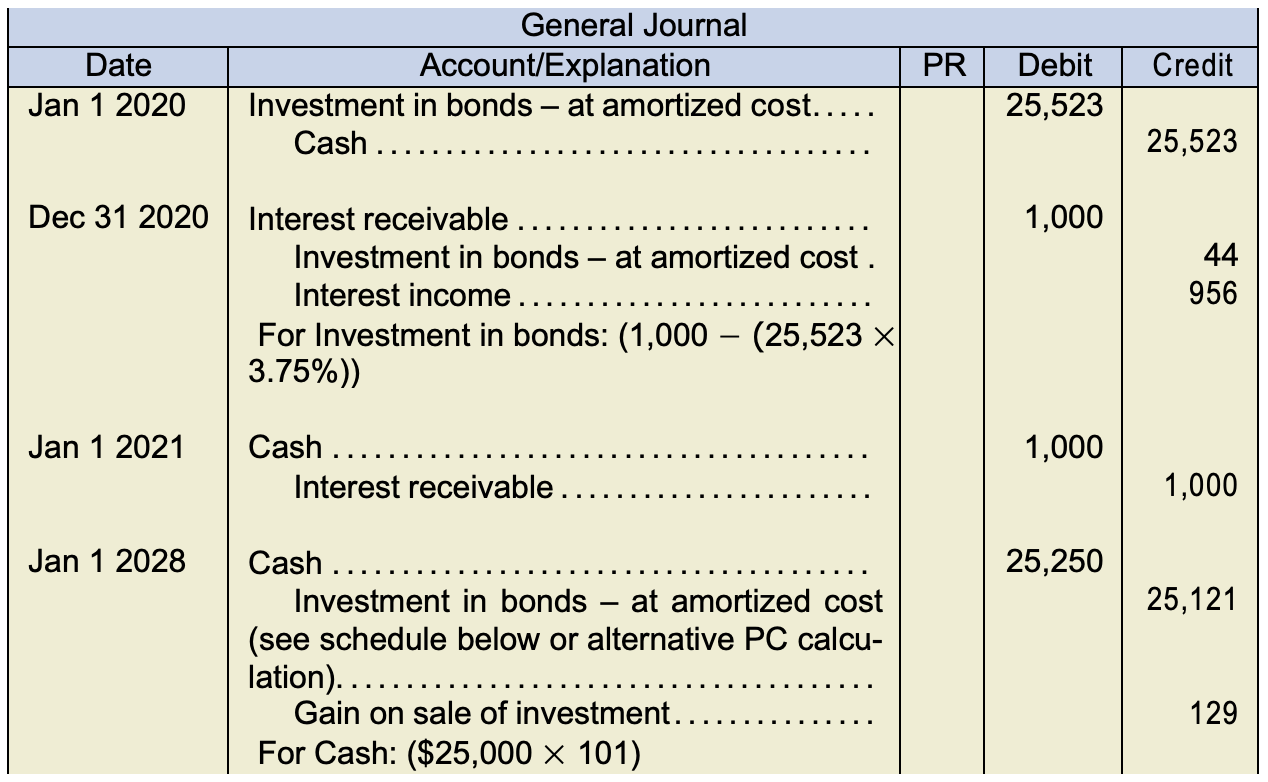

This gain must be included in the report to increase the investment account. The following shows a journal entry for the sample report. The journal.

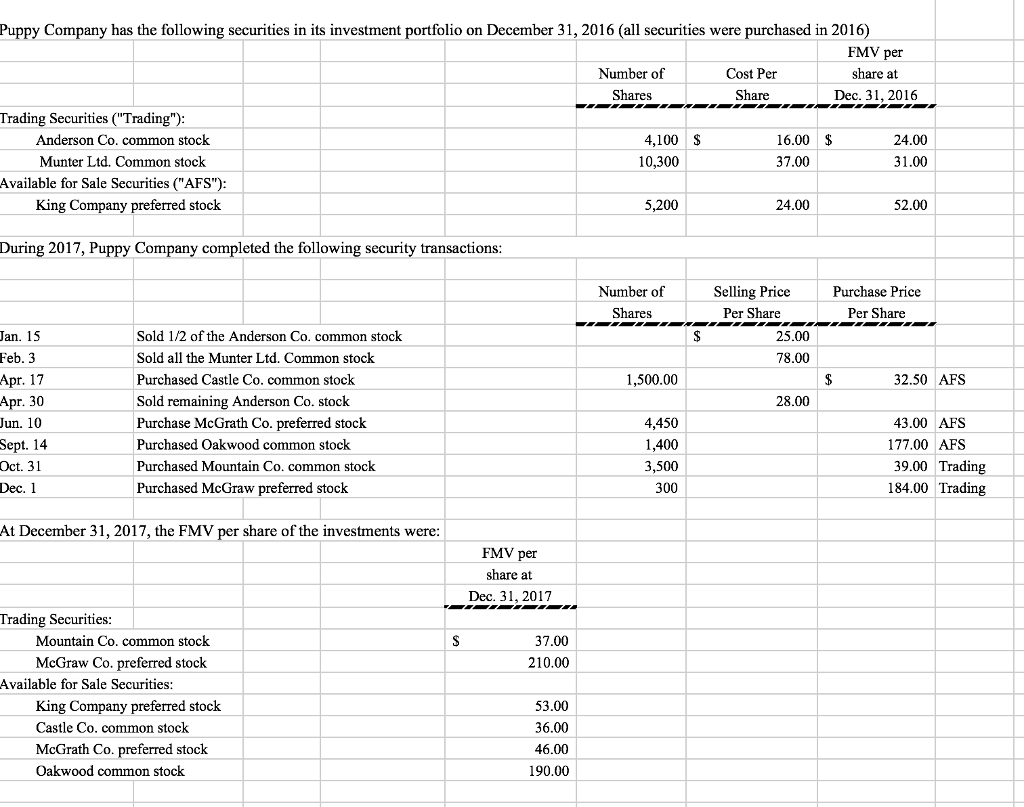

Solved I need details not only the answers. Required

Web in this journal entry, the $50,000 unrealized loss on investments account will be presented on the balance sheet under the equity section. Click on.

Unrealized Gains (Losses) on Balance Sheeet Examples Journal

Web using the example above, let’s walk through a sample journal entry. They are a critical component of an entity’s financial. No impact to income.

Accounting Q and A EX 1521 Fair value journal entries, availablefor

Web you'll learn key definitions, how to record journal entries, tax guidelines from the irs, and impacts across different asset classes. Web set up income/expense.

Foreign Currency Revaluation Definition, Process, and Examples

Web gain or loss on investment is the profit or loss that investors receive from their investment such as shares, bonds, and other investments. It.

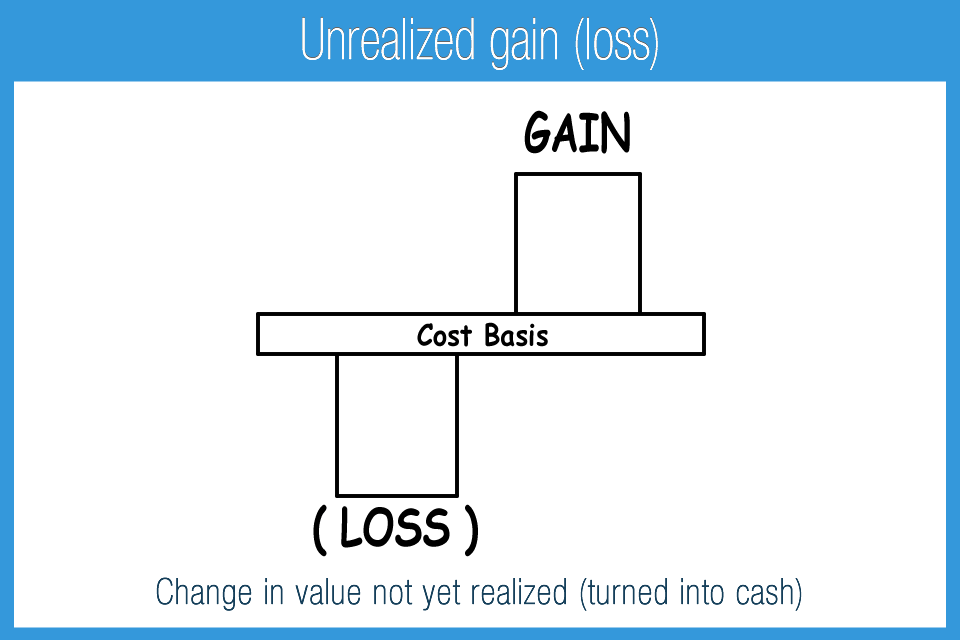

Unrealized gain (loss) Accounting Play

Web an unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open.

8.2 NonStrategic Investments Intermediate Financial Accounting 1

Web gain or loss on investment is the profit or loss that investors receive from their investment such as shares, bonds, and other investments. Web.

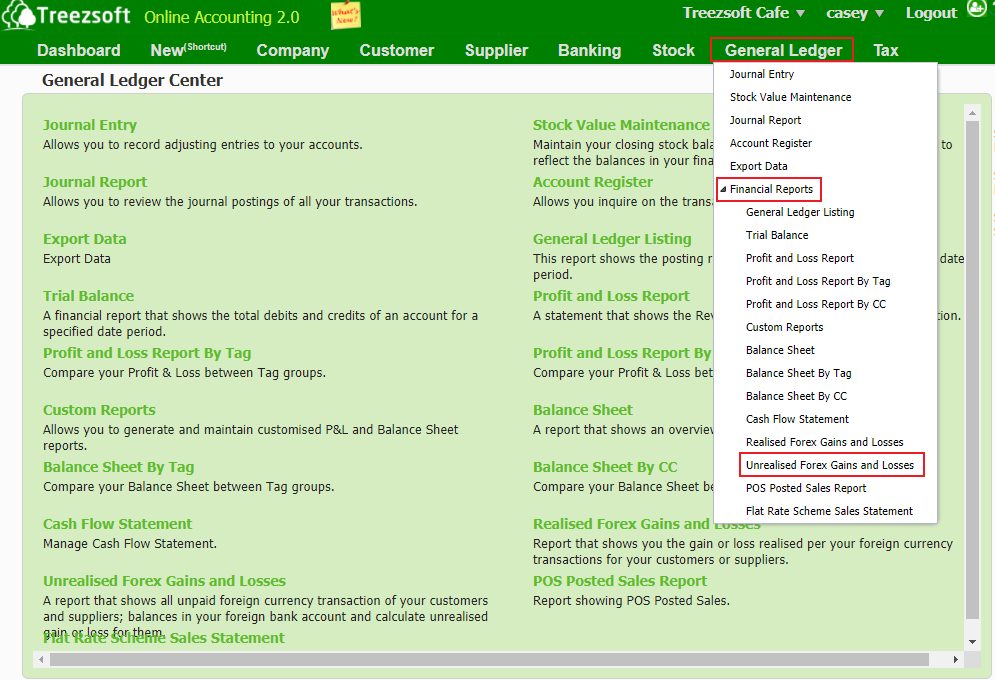

Unrealized Gain Loss AutoCount Resource Center

This gain must be included in the report to increase the investment account. Web set up income/expense accounts for all the things you want to.

Web Updated April 26, 2022.

Web any unrealized gain or loss is reported under other comprehensive income. No impact to income statement or cash flow statement. A realized gain results from selling an asset at a price. Temporary change in fair value) are recorded to other.

After Setting Up The Dedicated Account, The Next Step Involves Creating A Journal Entry In Quickbooks To Record The Unrealized Gains Or.

Web on june 30, 20x9, an interim financial statement is published, the first financial statement published since the purchase of the above securities. Web you'll learn key definitions, how to record journal entries, tax guidelines from the irs, and impacts across different asset classes. Journal entry examples from youtube video linked below. Go to general ledger > journal entry.

Web Impacts Balance Sheet.

Any unrealized gain or loss is reported under income statement. It is the price difference between the. The gain is not guaranteed; Unrealized gains represent potential financial benefits that have yet to be converted into cash.

Web Unrealized Gain Or Loss.

Web in this journal entry, the $50,000 unrealized loss on investments account will be presented on the balance sheet under the equity section. Web published jan 12, 2024. This is the same as the method. Web set up income/expense accounts for all the things you want to track and in investments just have 3 subaccounts for cash, securities, unrealized gains/losses.