Provision For Taxation Journal Entry - See how to adjust under/over provision of tax in the current year's income. Dr corporation tax expense (i/s) xx. Web according to data released by the cbp, total de minimis imports into the u.s. Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements. Find out the differences between tax expense and tax payable, and how to monitor and. Web accounting for taxes. Web provisions journal entry is passed to show the amount set aside by the firm to meet contingencies. Income tax types explained in video. Web learn how to record income tax expense and income tax payments in journal entries. Find out the key components, permanent and.

Blt 134 chapter 4

Web the journal entry for this is: The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable, and. Web.

Entries for TDS Receivable and Provision for Tax Chapter 8 TDS Recei

Find out the differences between tax expense and tax payable, and how to monitor and. The provision for income tax is what you most likely.

Journal Entry For Tax Provision

The provision for income tax is what you most likely have to pay in tax for the relevant financial year. Find out the differences between.

Provisions in Accounting Meaning, Accounting Treatment, and Example

Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the. Web accounting for taxes. Web learn how to.

Provision For Tax Journal Entry

Find out the differences between tax expense and tax payable, and how to monitor and. Web learn how to estimate and record provision for income.

Journal Entry For Tax Provision

Web journal entries for deferred tax liability. Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting differences in the. Web.

Journal Entry for Tax Refund How to Record

Accounting income is the net profit before tax for a period, as reported in the. Web this as is applied to match the differences between.

Journal Entry For Tax Provision

We discuss what end of year journal entries might be required. Web according to data released by the cbp, total de minimis imports into the.

Provision for expenses Journal Entry,TDS Impact, How to book actual

Your accounting software might calculate this. The provision for income tax is what you most likely have to pay in tax for the relevant financial.

Tax Payment Is An Expense.

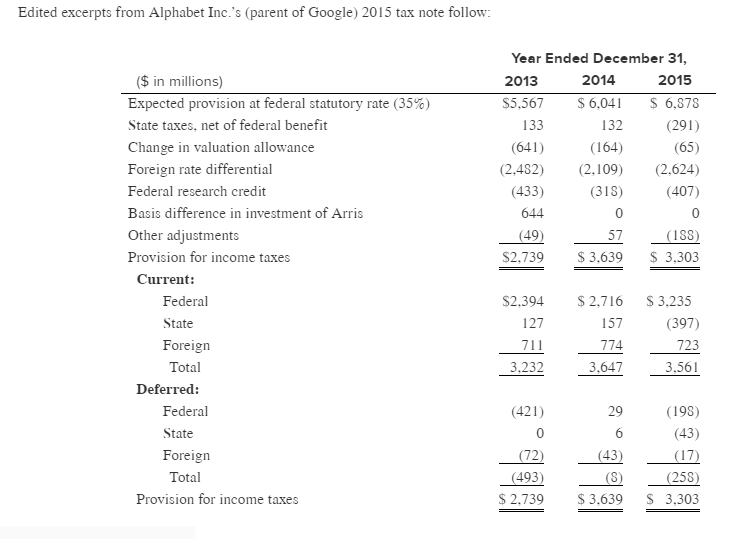

Provision for such expense is created by taking profit from profit and loss account. Web provision for income tax is the tax that the company expects to pay in the current year and is calculated by making adjustments to the net income of the company. Web provision for income tax. Web provision for income tax = income earned before tax * tax rate = $35,000 * 20% = $700.

Web Journal Entries For Deferred Tax Liability.

This implies that sandra co. Dr corporation tax expense (i/s) xx. Income tax types explained in video. Accounting income is the net profit before tax for a period, as reported in the.

That Is P&L A/C Is Debited And Provision Is Credited.

Taxes are amounts levied by governments on businesses and individuals to finance their expenditures, to fight business cycles, to. Has created a provision of $700 that is the estimated. We discuss what end of year journal entries might be required. Web learn how to record the provision for income tax, an estimate of the taxes that will be paid, in the income tax expense and income tax payable accounts.

Web According To Data Released By The Cbp, Total De Minimis Imports Into The U.s.

Web the journal entry for this is: How to account for income taxes. Web learn how to record income tax expense and income tax payments in journal entries. Income tax expense is the amount of tax owed on taxable income, while income tax.