Journal Entry For Prepaid Insurance Expired - Web the journal entries for prepaid rent are as follows: How to book prepaid expense amortization journal entry. In this journal entry, the supplies account is a prepaid expense that will be recognized as an expense when it is used. Adjusting journal entry as the prepaid. When companies initially pay for the total. Initial journal entry for prepaid rent: Web to utilize the journal entry feature inside the program, you'll want to go to the +new button and choose journal entry. Web on 31 december 2016, the following adjusting entry will convert the expired portion of prepaid insurance (1,800 × 3/12 = $450) into an expense: On the other hand, the balance of prepaid insurance on the balance sheet will decrease by the same amount. Web accounting questions and answers.

What is Prepaid expense Example Journal Entry Tutor's Tips

Therefore on march 31st, 2023, the journal entry to release the prepaid expense is: Web on 31 december 2016, the following adjusting entry will convert.

Insurance Expired During the Year Adjusting Entry

Thus, we should make the following adjusting entry: Learn how to account for them and create a prepaid expenses journal entry! At the end of.

Prepaid expense journal entry important 2022

Web in this journal entry, the total expenses on the income statement will increase as a result of insurance expiration. Here, the prepaid insurance account.

Journal Entry for Prepaid Insurance YouTube

Web to utilize the journal entry feature inside the program, you'll want to go to the +new button and choose journal entry. Adjusting journal entry.

The Adjusting Process And Related Entries laacib

Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a.

Journal Entry for Prepaid Insurance Online Accounting

In accounting, we usually amortize the prepaid insurance that we have paid in advance in order spread the insurance cost over the period that it.

Adjusting Journal Entries Jojonomic Officeless Operating System, No

Web the journal entry would be. A guide to prepaid expense accounting. Web in this journal entry, the total expenses on the income statement will.

Journal Entry of Prepaid/Advance Expenses & Prepaid Expired

Using the expense method will record the whole amount of $1,800 as an expense by making the following journal entry on 1 october 2016: On.

Prepaid Insurance Journal Entry Financial

Choose an account from the account field on the initial line. Web on 31 december 2016, the following adjusting entry will convert the expired portion.

A Prepaid Expense Is A Payment Made In Advance For Goods Or Services That Will Be Received In The Future.

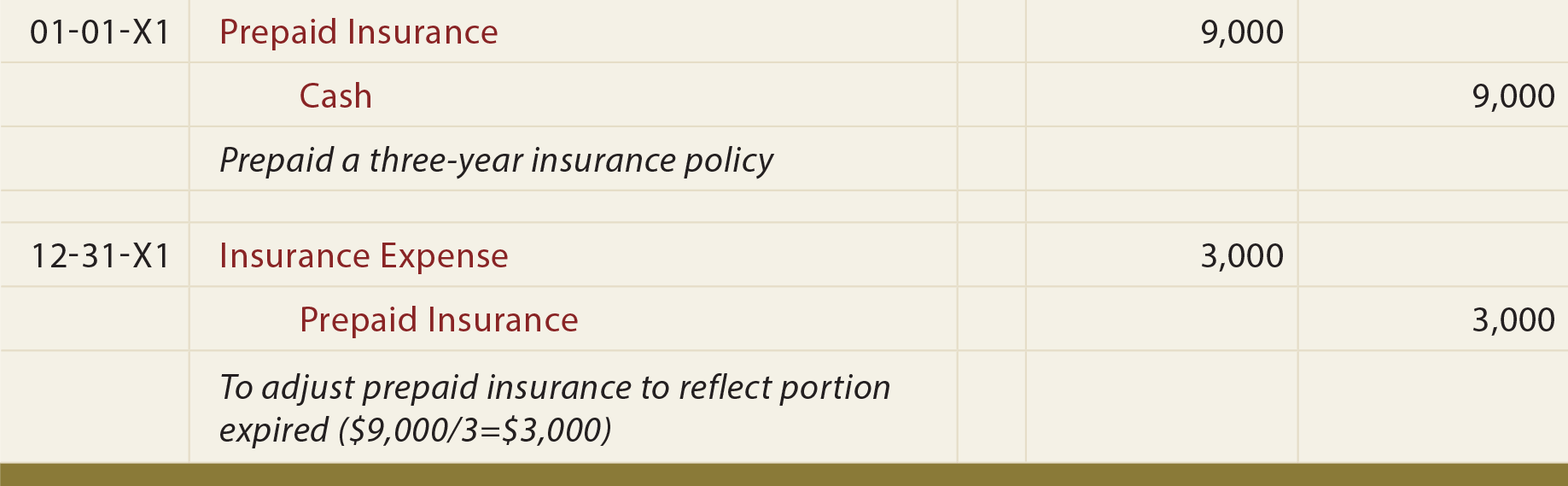

Web as prepaid insurance is an asset that will expire through the passage of time, the cost of expiration will need to be recognized as an expense during the period. Here, the prepaid insurance account is debited as it increases and there is a counter decrease in cash or bank account. Adjusting entries for prepaid insurancethe prepaid insurance account had a balance of $11,700 at the beginning of the year. Therefore on march 31st, 2023, the journal entry to release the prepaid expense is:

Learn How To Account For Them And Create A Prepaid Expenses Journal Entry!

Prepaid expenses are recorded as assets. The damage/exp is offset with the insurance check which is fine. Note that the ending balance in the asset prepaid insurance is now $600—the correct amount of insurance that has been paid in advance. If the company would still like to be covered by insurance, it will have to purchase more.

Web The Journal Entries For Prepaid Rent Are As Follows:

Web in this journal entry, the total expenses on the income statement will increase as a result of insurance expiration. Example of insurance premium paid. Web our journal entry to record the prepaid rent expense is: This is accomplished with a debit of $1,000 to insurance expense.

In This Journal Entry, The Supplies Account Is A Prepaid Expense That Will Be Recognized As An Expense When It Is Used.

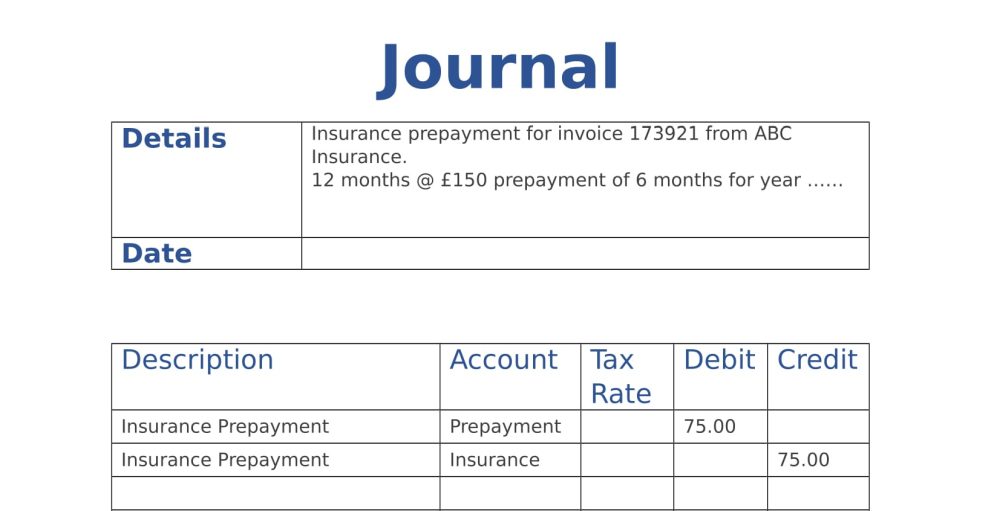

Web journal entry for prepaid expenses. In accounting, we usually amortize the prepaid insurance that we have paid in advance in order spread the insurance cost over the period that it covers. A guide to prepaid expense accounting. If companies use the coverage within a year after purchase, prepaid insurance is a current asset.