The Journal Entries For A Bank Reconciliation - • other items on the bank statement must be compared to the other items in the company’s cash account. Compare every amount on the bank statement (or in the bank’s online information) with every amount in the company’s general ledger cash account and note any. For purposes of this lesson, we’ll prepare. Web the bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account as reflected by the. Web in any case, those items that reconcile the general ledger (book balance) to the adjusted bank balance (the target) have to be recorded. B) may include a debit to office expense for bank service charges. Find out how to deal with bank charges, interest, nsf checks, and more. Web when an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal entry must be made. Journal entries are how you record all your transactions (sometimes called debits and credits). Begin by reviewing the bank statement and comparing it with the.

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

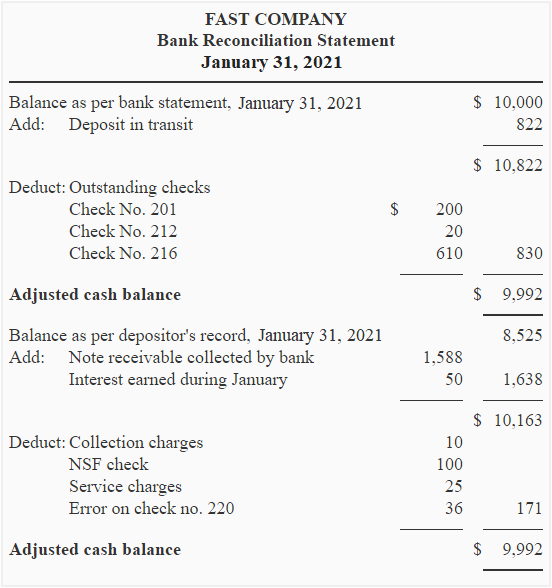

Deposit in transit dated 9/30 for $6,700. Web the purpose of the bank reconciliation is to be certain that the company’s general ledger cash account.

Bank reconciliation statement definition, explanation, example and

Web the bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account.

Bank Reconciliation Journal Entries Templates at

On the bank side of the reconciliation, you do not need to do anything else except contact the bank if you notice. May include a.

Solved Bank Reconciliation? Journal Entries Prepare the

Web in any case, those items that reconcile the general ledger (book balance) to the adjusted bank balance (the target) have to be recorded. Web.

The correct bank reconciliation statement is provided

After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the. Compare every amount on.

How To Do A Bank Reconciliation Step By Step Guide

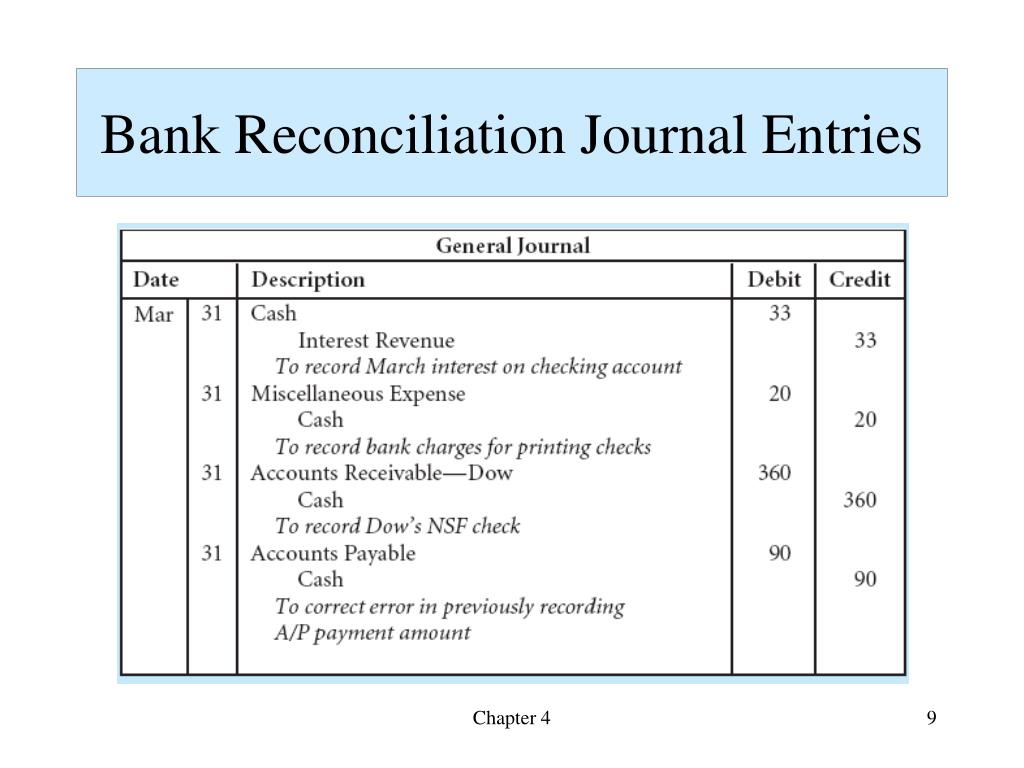

Web the journal entries for a bank reconciliation a. Web part of the adjustments listed on the bank reconciliation. Bank service charges which are often.

Journal Entries For Bank Reconciliation PDF Cheque Deposit Account

Compare every amount on the bank statement (or in the bank’s online information) with every amount in the company’s general ledger cash account and note.

Solved PB52 Preparing A Bank Reconciliation And Journal

All your journal entries are gathered. Web the bank reconciliation is the internal financial report that explains and documents any differences that may exist between.

Journal Entries from Bank Reconciliation

Are taken from the balance per bank section only. Web in any case, those items that reconcile the general ledger (book balance) to the adjusted.

Are Taken From The Balance Per Bank Section Only.

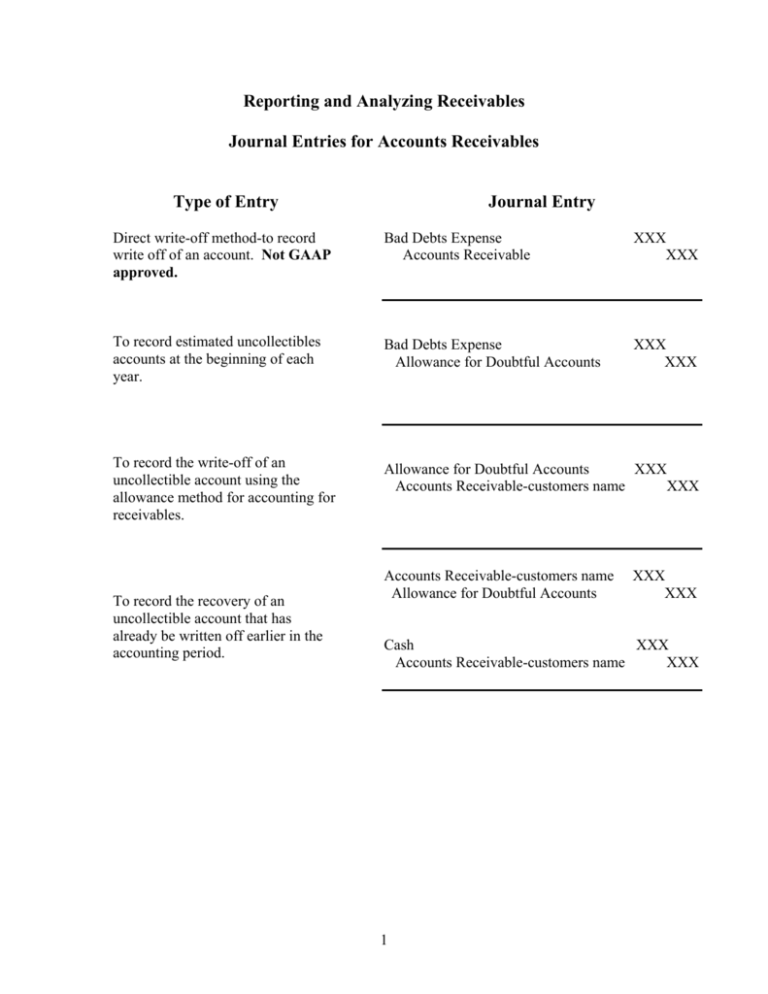

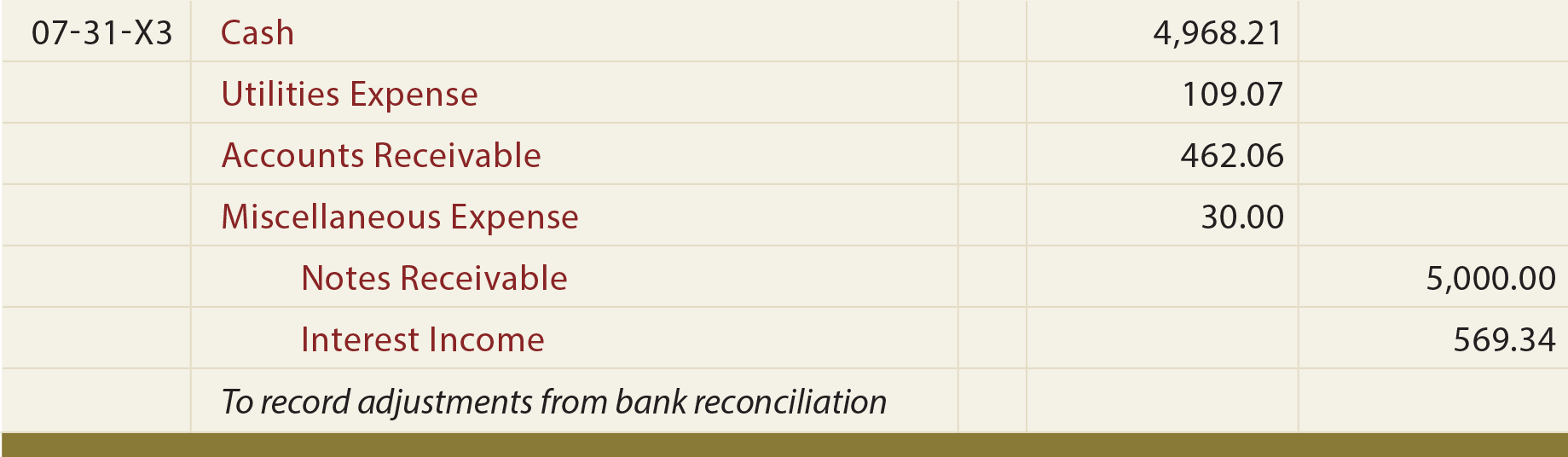

All your journal entries are gathered. Web journal entries are required in a bank reconciliation when there are adjustments to the balance per books. For purposes of this lesson, we’ll prepare. Web making the necessary bank reconciliation journal entries helps to eliminate any discrepancies between the bank statement figures and the figures on the company’s.

Web The Purpose Of The Bank Reconciliation Is To Be Certain That The Company’s General Ledger Cash Account Is Complete And Accurate.

Web a bank reconciliation statement summarizes banking and business activity, comparing the bank's account balance with internal financial records. Web after comparing the bank statement and records of my company, you should have identified the following reconciling items: Web when an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal entry must be made. Web how does it do this?

May Include A Debit To Office Expense For Bank Service Charges.

Web in any case, those items that reconcile the general ledger (book balance) to the adjusted bank balance (the target) have to be recorded. Web the bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account as reflected by the. Web the journal entries for a bank reconciliation a. On the bank side of the reconciliation, you do not need to do anything else except contact the bank if you notice.

• Other Items On The Bank Statement Must Be Compared To The Other Items In The Company’s Cash Account.

These adjustments result from items appearing on the bank. Web part of the adjustments listed on the bank reconciliation. After recording the journal entries for the company’s book adjustments, a bank reconciliation statement should be produced to reflect all the. Begin by reviewing the bank statement and comparing it with the.