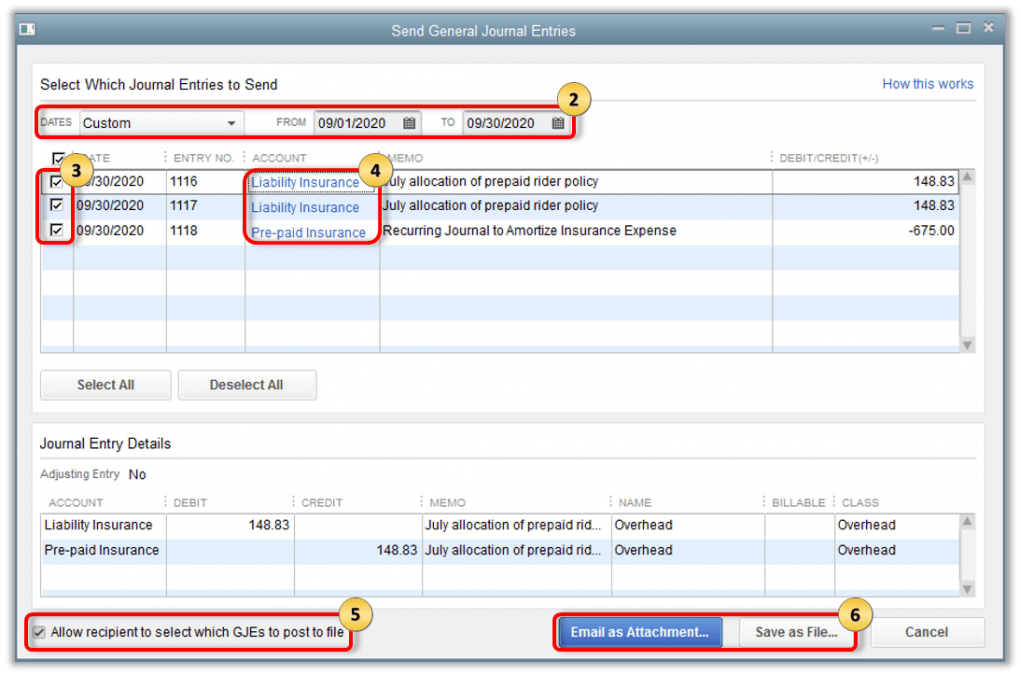

Journal Entry For Payroll In Quickbooks - Which method you choose will depend on how much detail you. The key is knowing which is which and what goes on inside qbo when you create journal entries to make corrections. Web what is a quickbooks journal entry? Set up a journal entry in qbo as a recurring transaction: In other words, this is an entry that helps you determine exactly how much you are paying out in payroll in a given period. Enter the current date and assign a journal entry number. The journals created affect your liability balances. This involves selecting the date of the transaction or adjustment, selecting the accounts that are impacted, inputting debit and credit amounts, and including additional information, like description, class, and location if needed. Web go to the company menu and select make general journal entries. Salaries & wages is an expense account, the accounts for the employee deductions are current liabilities:

Record payroll transactions manually QuickBooks Community

Web the most common way to enter payroll into quickbooks is via a general journal entry. Rippling is the best payroll solution overall. Fill out.

Payroll Journal Entries Demonstration YouTube

Web the payroll journal entry. Web how to do payroll in quickbooks in 6 steps. A journal entry to a payroll clearing account is a.

QuickBooks How to find the Payroll Journal Pento UK

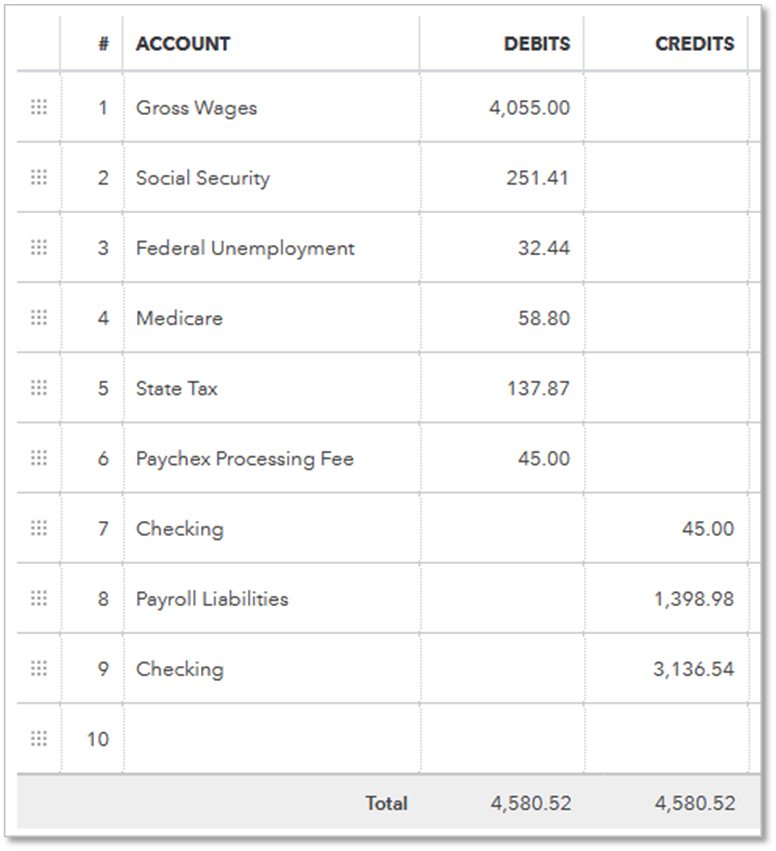

Web record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll expense or liability.

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

Onpay is best for small businesses. Web some payroll services let you import paycheck data directly into quickbooks. Let’s get into that right now. If.

How to Record a Journal Entry in QuickBooks Online?

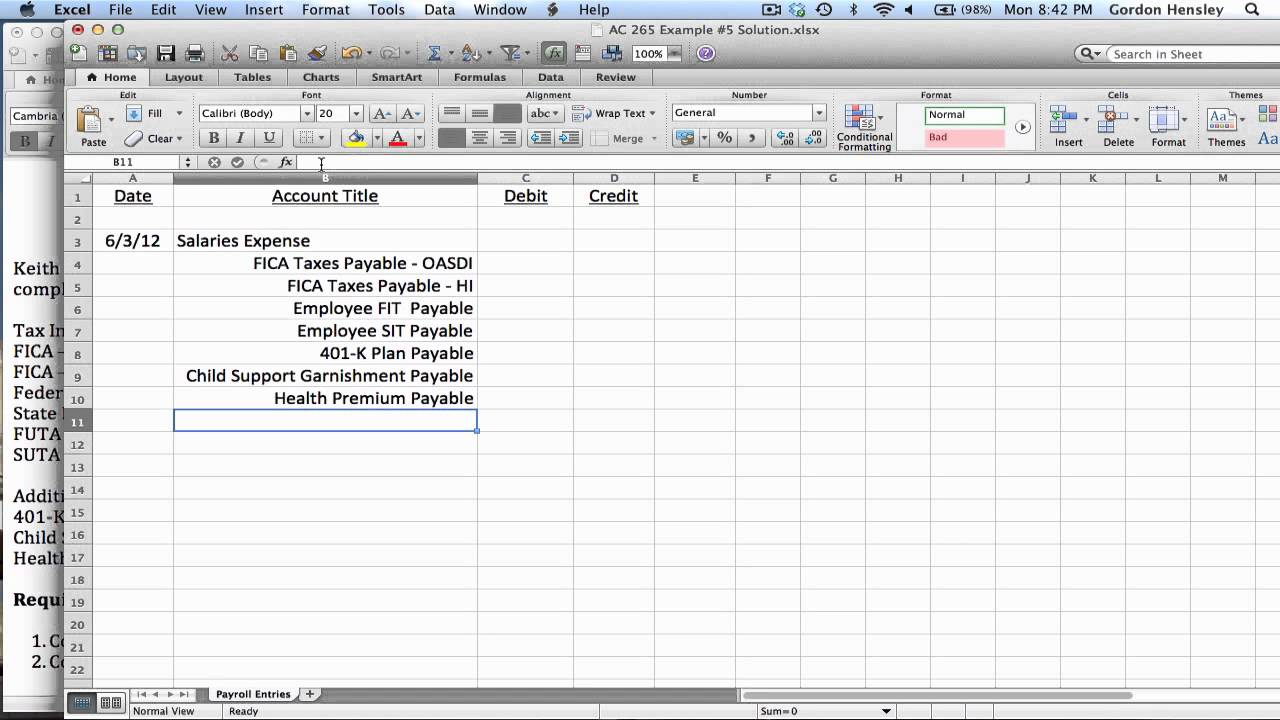

Salaries & wages is an expense account, the accounts for the employee deductions are current liabilities: In this article, we cover one of the basic.

Journal Entries In Quickbooks Online Farmer Lextre

You’ll need to collect a few forms from your employees before you can run payroll: Enter the current date and assign a journal entry number..

Payroll Journal Entry Example Explanation My Accounting Course

Credit the payroll liability account for the amount of the reduction. What is a payroll journal entry? Web journal entries are a good way to.

How to use journal entries in QuickBooks Online YouTube

Journal entry as a recurring transaction. Salaries & wages is an expense account, the accounts for the employee deductions are current liabilities: Set up a.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web what is a payroll journal entry? Journal entry as a recurring transaction. First, let’s clarify exactly what a quickbooks journal entry is. One method.

Enter The Amount As A Debit.

Web what is a quickbooks journal entry? The journals created affect your liability balances. Let’s get into that right now. Web journal entries are a good way to record the accounting information for your payroll in quickbooks online if you are not using our payroll service.

Journal Entry As A Recurring Transaction.

Web record your gross wages, taxes, and employee taxes by creating a journal entry that offsets your bank account and your payroll expense or liability account. Proceed to the account column and record them using them using these entries: Web there are two ways to manually enter payroll in quickbooks online if your payroll software product doesn't integrate with it. Which method you choose will depend on how much detail you.

Web How To Do Payroll In Quickbooks In 6 Steps.

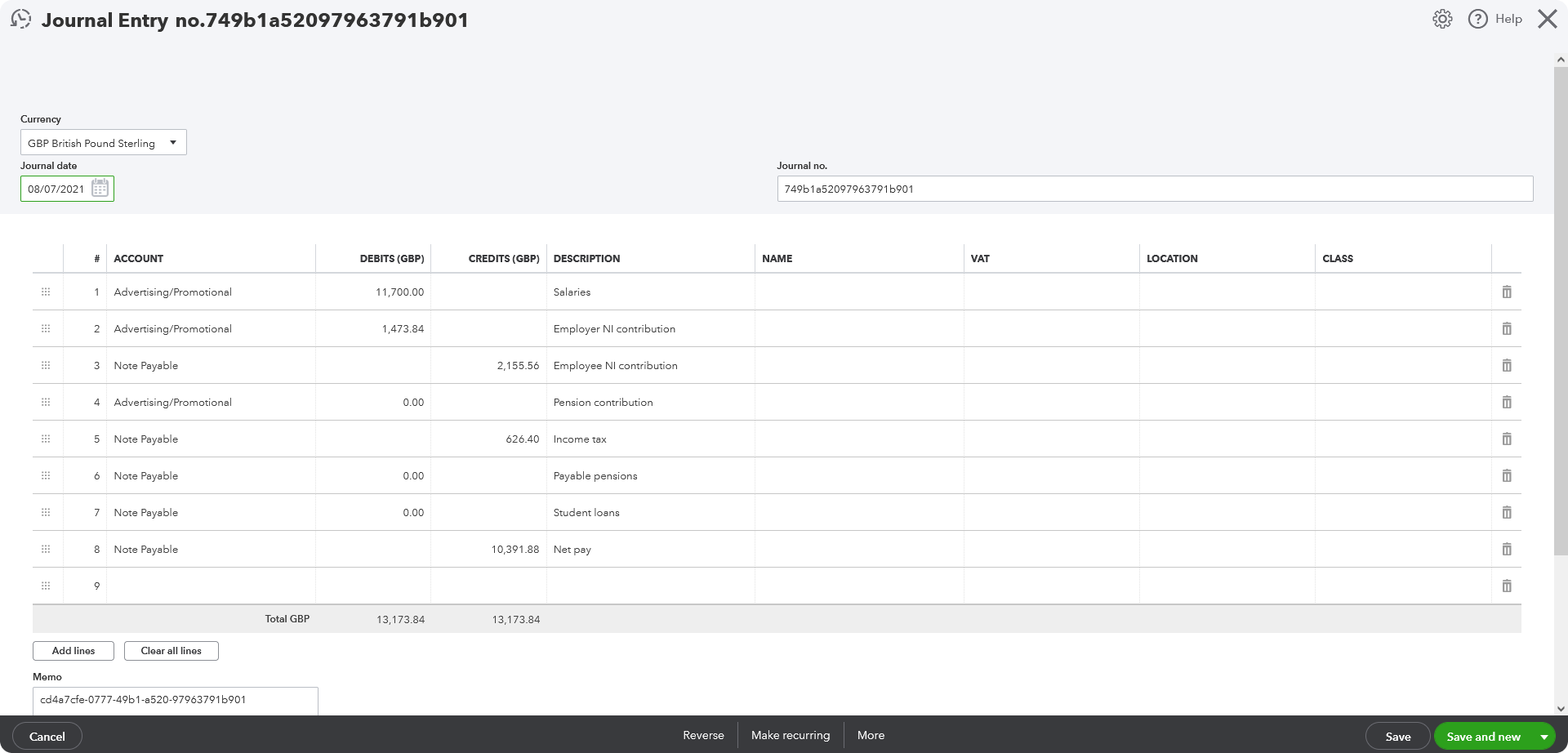

For your payments, you can create an expense or a check using the payroll expense. Fill out the fields to create your journal entry. Web when you run payroll in quickbooks online standard payroll, journal entries are created for each employee and the liabilities which you have to pay to hmrc. In this article, we cover one of the basic steps of payroll accounting —the payroll journal entry.

To Help Streamline This Process;

This involves selecting the date of the transaction or adjustment, selecting the accounts that are impacted, inputting debit and credit amounts, and including additional information, like description, class, and location if needed. Web as an accounting professional, you may have been trained to use journal entries liberally (i know i was), but in qbo there are some situations where journal entries help, and some where they can really mess up the books! Web we will discuss the intricacies of making a payroll journal entry in quickbooks, including determining the type of entry, entering the journal entry, and recording it in quickbooks. The key is knowing which is which and what goes on inside qbo when you create journal entries to make corrections.