Asc 842 Lessor Accounting Journal Entries - Web asc 842 articulates the guidance for sale leaseback with asc 606, revenue from contracts with customers. Under asc 842, lessees must calculate the present value of future lease payments to determine the lease liability balance. Richard stuart, partner, national professional standards group, rsm us llp [email protected], +1 203 905 5027 october 2022 the fasb material is copyrighted by the financial accounting foundation, 801 main avenue, norwalk, ct 06851, and is used with permission. An executive overview of the lease accounting standard from a lessor’s perspective. Details on the example lease agreement. We often just need a quick journal entry example to understand the concept or refresh our memory. Web asc 842 lease accounting standard is a new lease accounting standard that requires lessees to recognize lease assets and lease liabilities on their balance sheets. Determine the lease term under asc 840. The white paper to lessor accounting includes guidance and examples to: Web operating lease accounting example and journal entries.

Leases 101 New Accounting Standard Asc 842 Part 2 Finacco

To remedy this, in january and. Determine whether a contract is or includes a lease that meets the definition of a lease in asc 842..

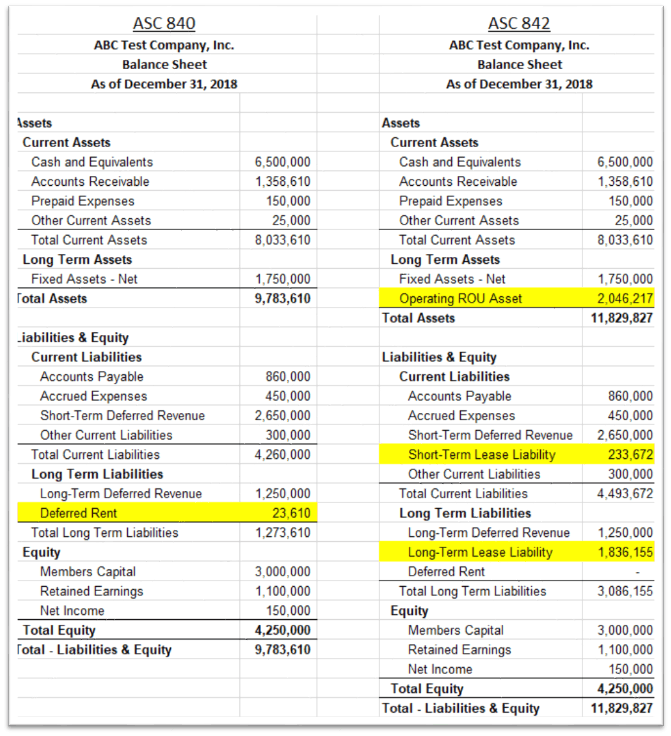

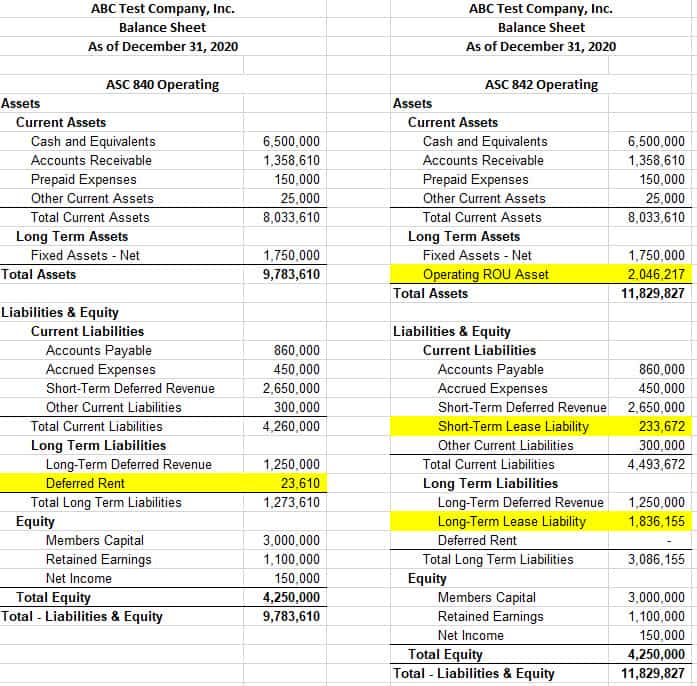

ASC 842 Summary of Balance Sheet Changes for 2020

To remedy this, in january and. Lessor accounting under asc 842. Determine whether a contract is or includes a lease that meets the definition of.

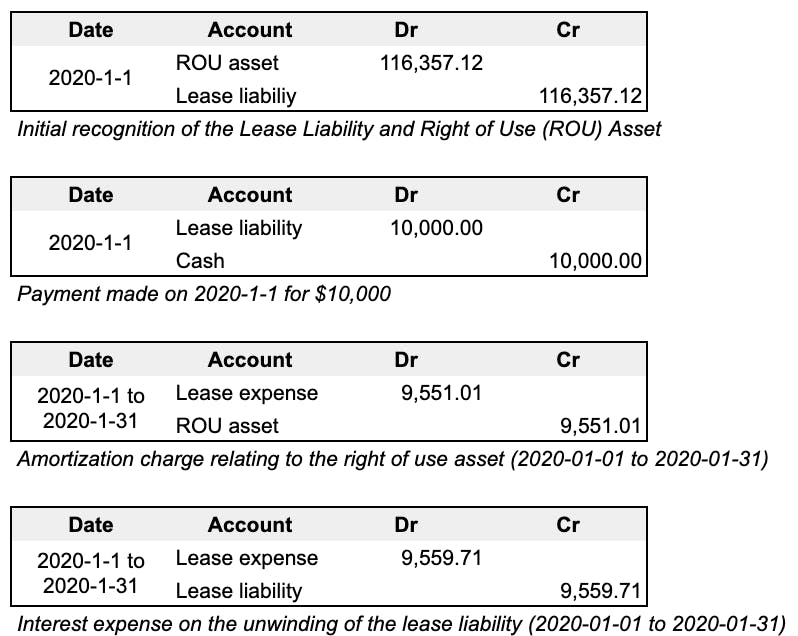

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Therefore, if the sale meets the criteria in asc 606 to be recognized as revenue to the seller, the buyer lessor will account for the.

ASC 842 Guide

Determine whether a contract is or includes a lease that meets the definition of a lease in asc 842. Web asc 842 can be overwhelming;.

Asc 842 Operating Lease Excel Template

Web the board issued proposed accounting standards update, leases (topic 842): Web the impact on lessors is not expected to be as significant. For companies.

First Class Asc 842 Balance Sheet Presentation How Should A Look

Web asc 842 can be overwhelming; Web asc 842 articulates the guidance for sale leaseback with asc 606, revenue from contracts with customers. $10,000 idc.

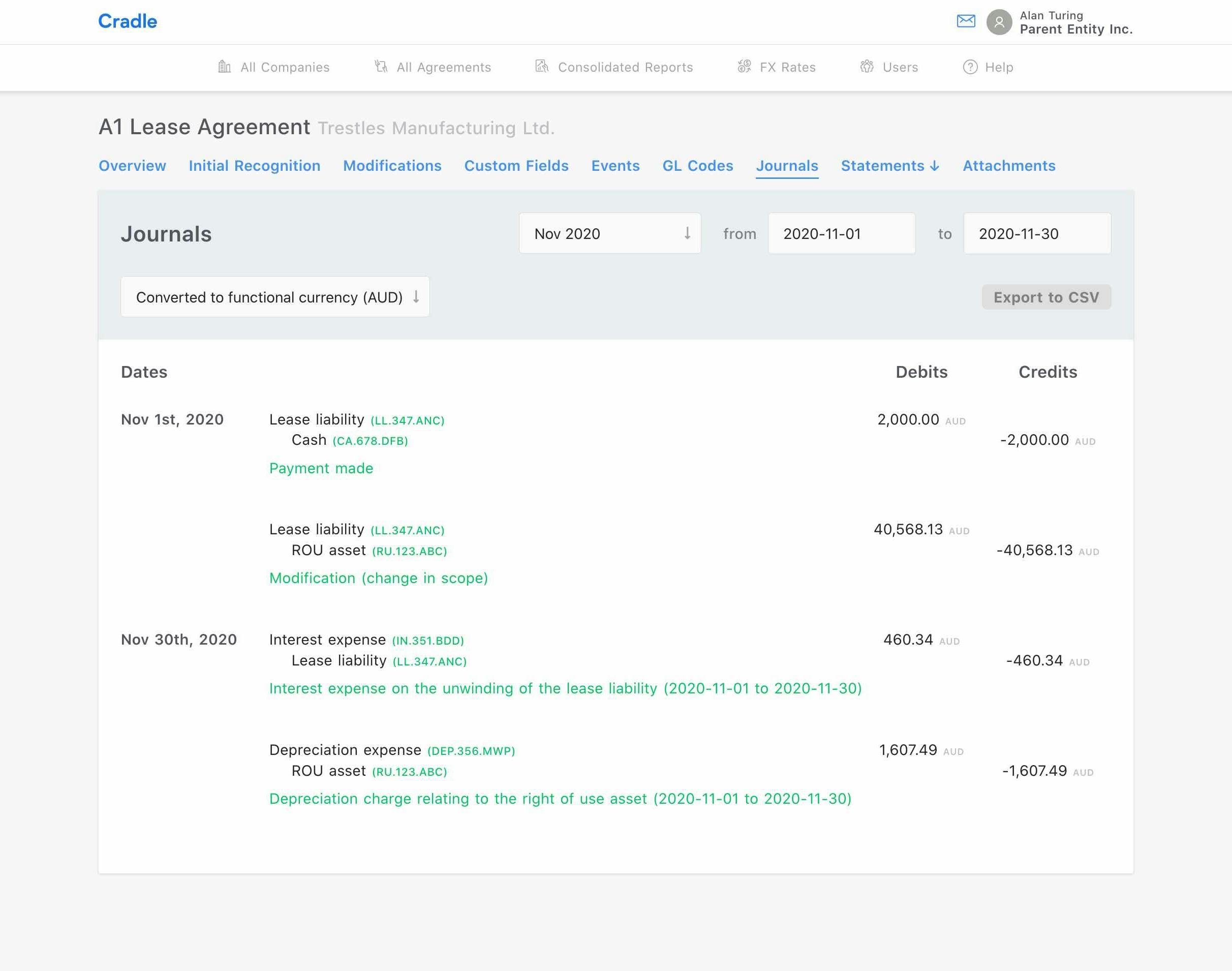

ASC 842 Software

The board considered respondents’ comments in reaching the conclusions in this update, as discussed further below. Determine whether a contract is within the scope of.

Asc 842 Lease Accounting Excel Template

Web handbooks | june 2023. Dive into the lessor's perspective for clarity on profit and interest income. On the asc 842 effective date,. Web lease.

Lease Liabilities in Journal Entries & Calculating ROU Visual Lease

The board considered respondents’ comments in reaching the conclusions in this update, as discussed further below. Determine whether a contract is or includes a lease.

Web Lease Accounting Has Often Been Criticized For Being Too Reliant On Bright Lines And Subjective Judgments, As Lessees Were Not Required To Disclose Assets And Liabilities Arising From Operating Leases Directly On The Balance Sheet, Thereby Improving The Appearance Of The Financial Condition To Investors.

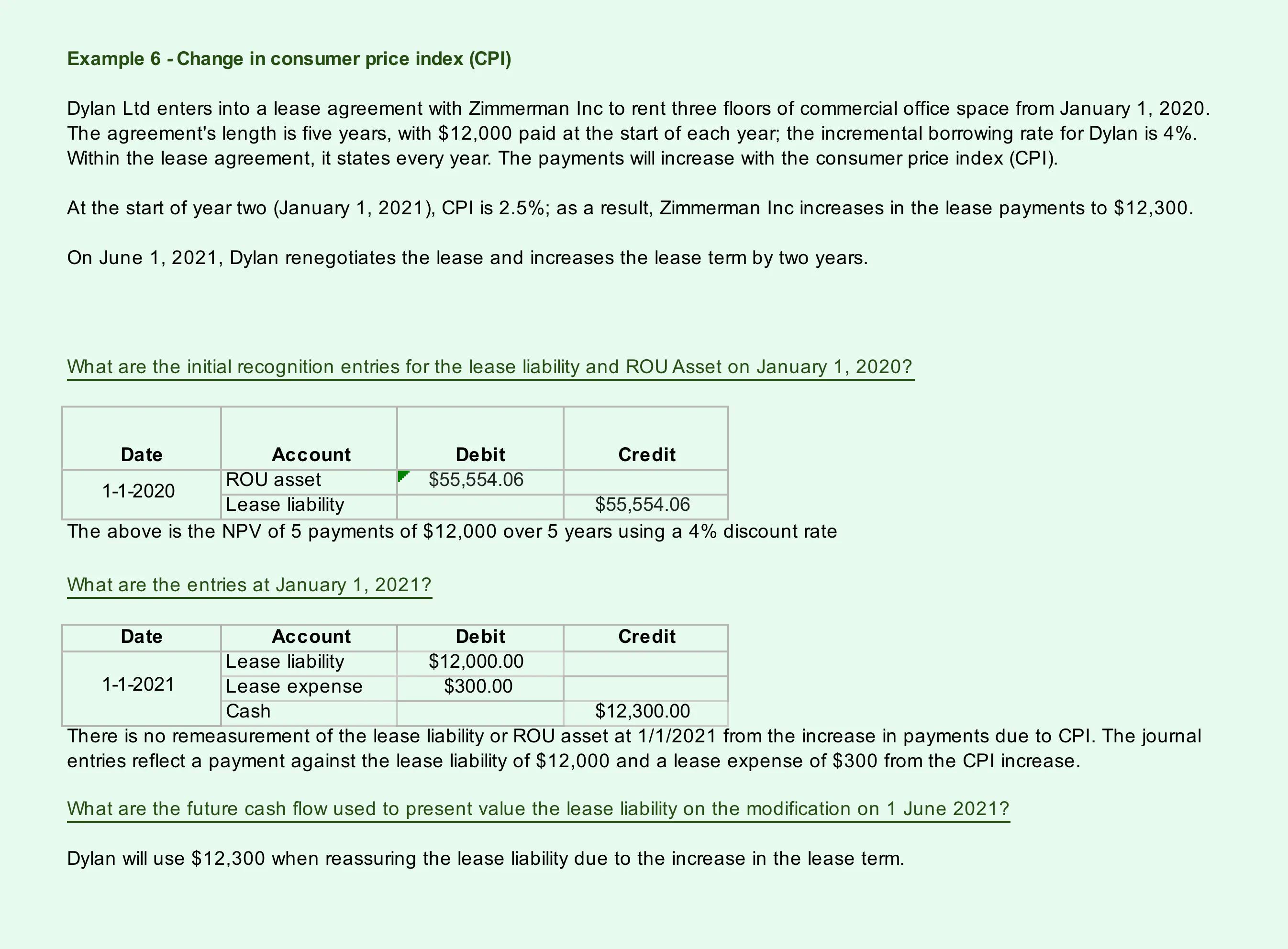

Under asc 842, lessees must calculate the present value of future lease payments to determine the lease liability balance. The white paper to lessor accounting includes guidance and examples to: $10,000 idc divided by 10 years. Here, we’ll break down operating lease journal entries simply and straightforwardly, including both the lessee and lessor sides.

Web Discover Asc 842 Journal Entries With Leasecrunch's Guide.

Determine whether a contract is or includes a lease that meets the definition of a lease in asc 842. Web deferred rent journal entries for year 1. Web asc 842 can be overwhelming; Web asc 842 lease accounting standard is a new lease accounting standard that requires lessees to recognize lease assets and lease liabilities on their balance sheets.

For Companies That Have Not Yet Adopted The New Standard, We Highlight Key Accounting Changes And Organizational Impacts For Lessors Applying Asc 842.

We provide detailed q&as, examples and observations, as well as comparisons to legacy us gaap. Lessor accounting remains largely unchanged from asc 840 to 842. Web asc 842 articulates the guidance for sale leaseback with asc 606, revenue from contracts with customers. Determine whether a contract is within the scope of asc 842.

An Executive Overview Of The Lease Accounting Standard From A Lessor’s Perspective.

On the asc 842 effective date,. Web handbooks | june 2023. The board considered respondents’ comments in reaching the conclusions in this update, as discussed further below. Richard stuart, partner, national professional standards group, rsm us llp [email protected], +1 203 905 5027 july 2022 the fasb material is copyrighted by the financial accounting foundation, 401 merritt 7, norwalk, ct 06856, and is used with permission.