Journal Entry For Payroll Deductions - Increase the salary expense account with a debit, increase any deduction payable accounts with a credit and decrease the cash account with a credit. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Identify payroll expenses and liabilities. An accountant typically includes these entries in the company's general ledger. Web payroll journal entries fall under the payroll account and are part of your general ledger. Web what are payroll accounting journal entries? Small business payroll accounting uses three basic types of journal entries: Web payroll journal entries | financial accounting. You’ll need to collect a few. Each payroll journal entry is paired with.

Payroll

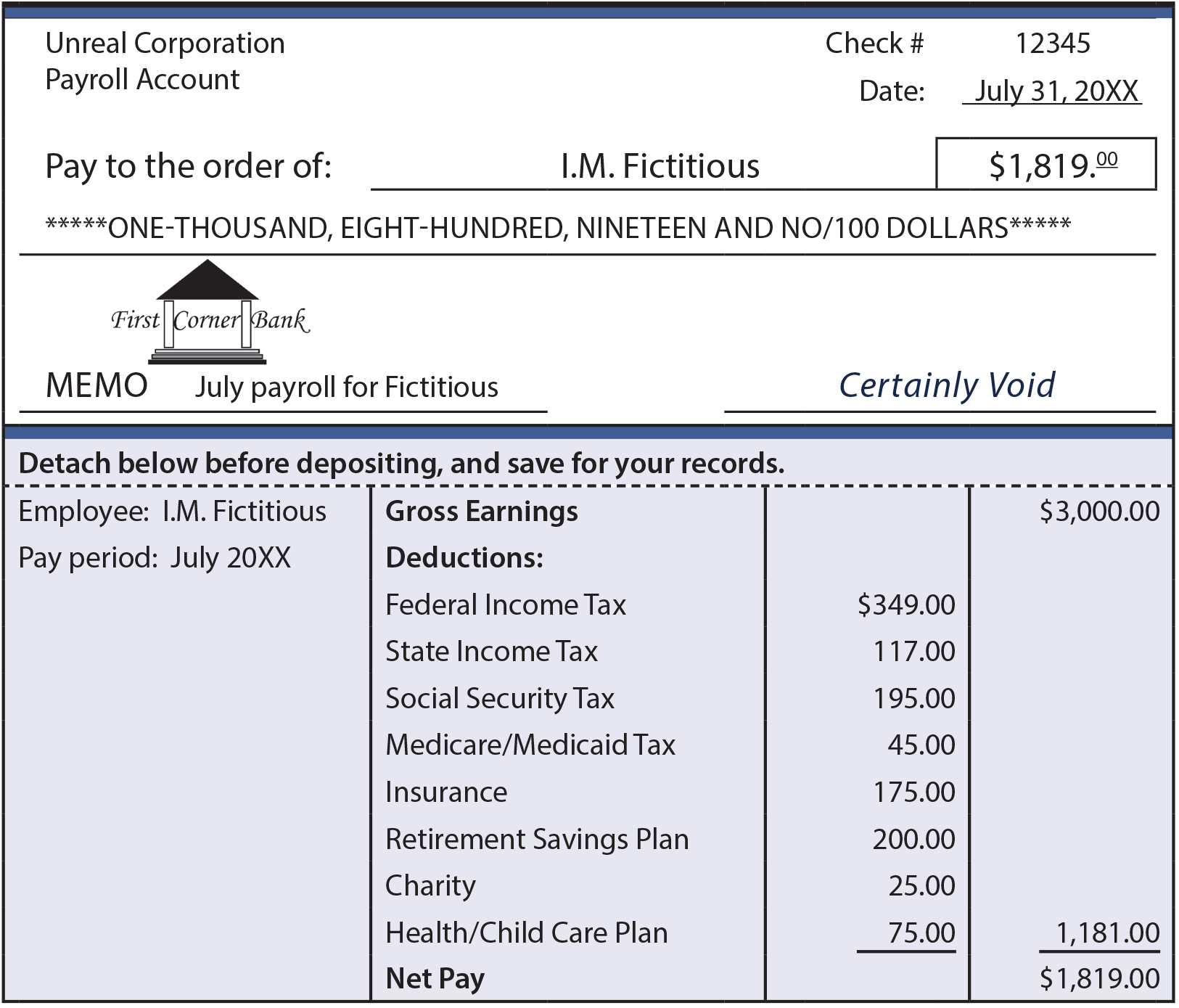

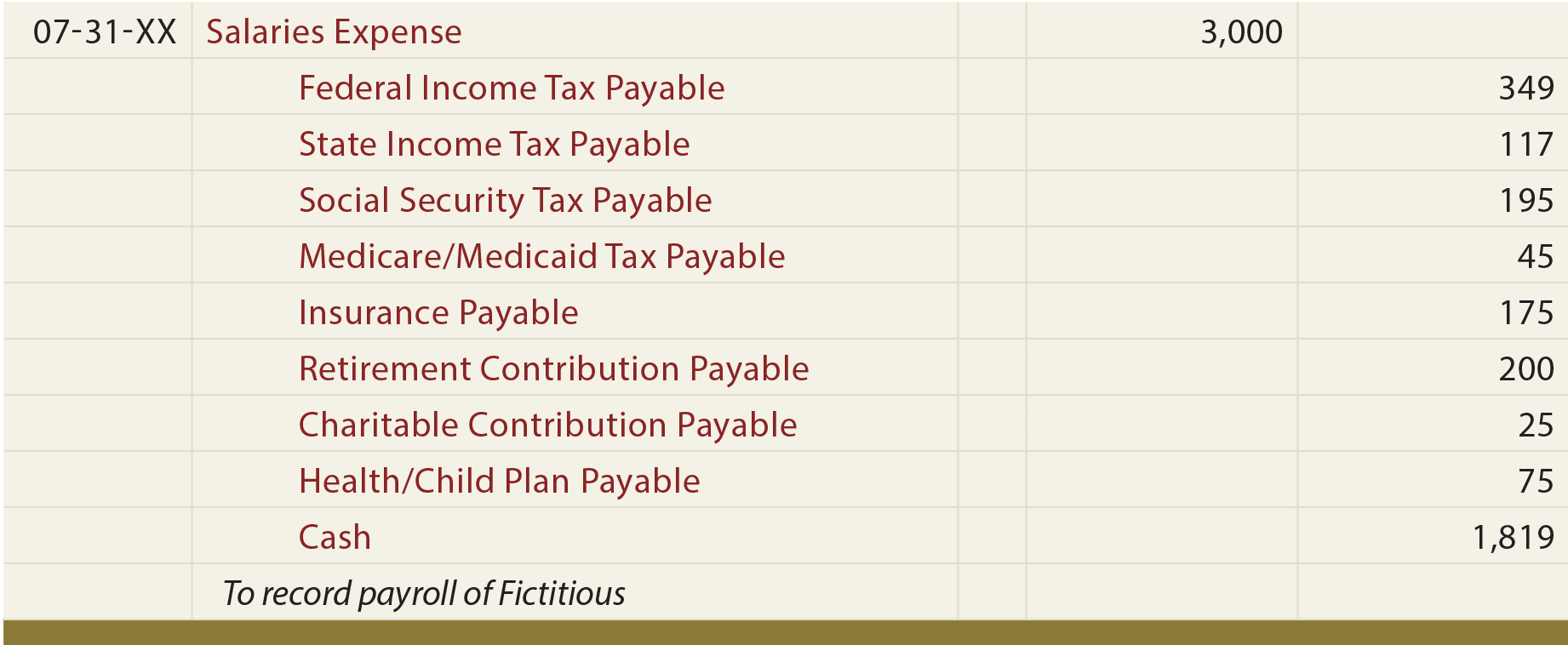

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Record the following.

Payroll Journal Entry Example Explanation My Accounting Course

Study examples of payroll journal entries and. Web payroll journal entries | financial accounting. Web what are payroll accounting journal entries? Identify payroll expenses and.

Accounting Journal Entries For Dummies

Initial recordings, accrued wages and manual payments. Web payroll journal entries fall under the payroll account and are part of your general ledger. Payroll liabilities.

PPT CHAPTER 8 PowerPoint Presentation, free download ID1794722

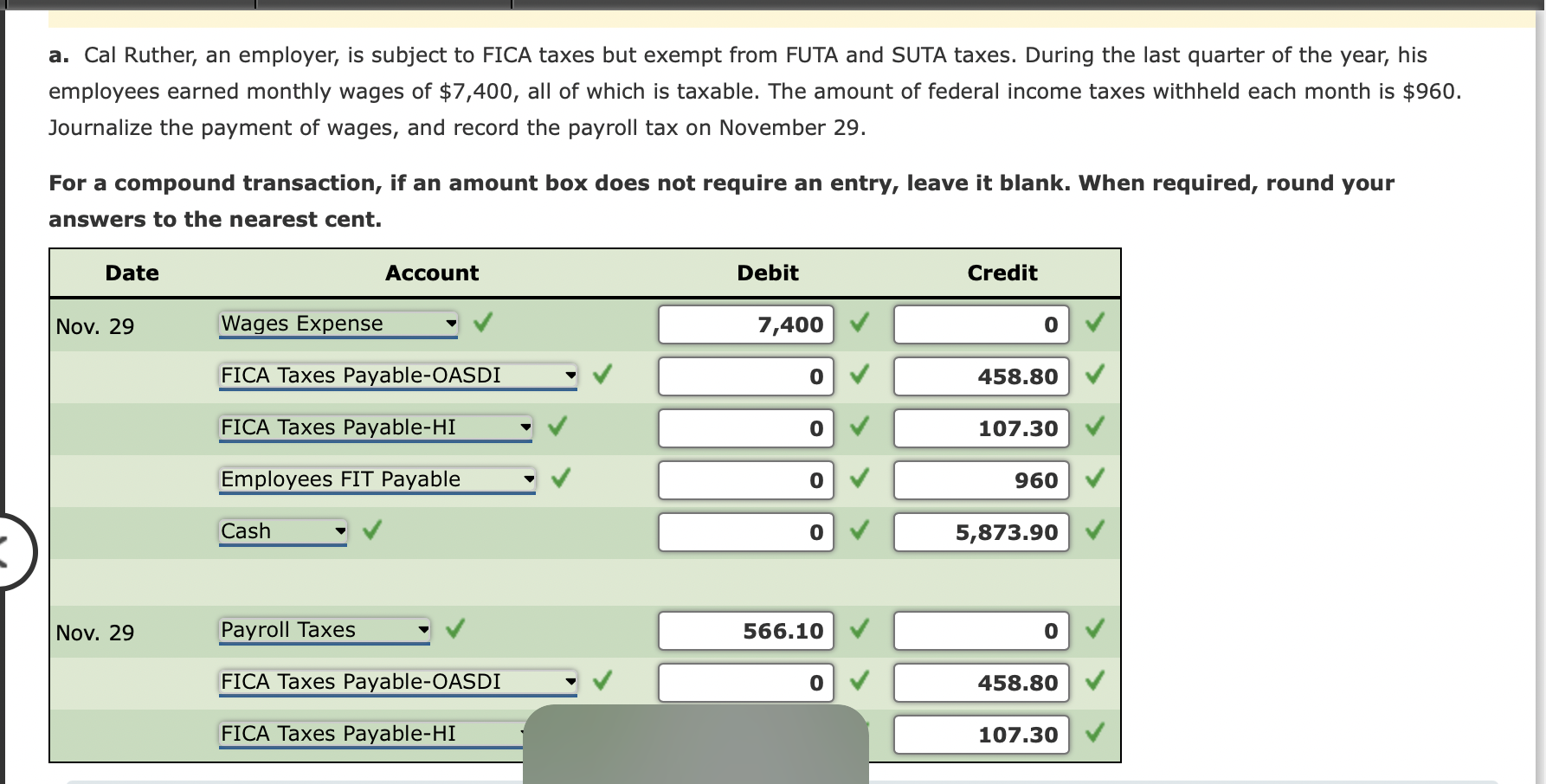

Payroll journal entries are what an accountant (or in many cases the small business owner) uses to record business. Web please make a journal entry.

Solved Example 65 The journal entry to record the payroll

Payroll journal entries are what an accountant (or in many cases the small business owner) uses to record business. This entry usually includes debits for.

Gross Pay Journal Entry Alvy Salary

Small business payroll accounting uses three basic types of journal entries: Identify payroll expenses and liabilities. Web what are payroll accounting journal entries? Each payroll.

Sample Payroll Journal Entry

Initial recordings, accrued wages and manual payments. Web payroll journal entries are the numbers you record in your small business’s general ledger to track employees’.

10 Payroll Journal Entry Template Template Guru

Also known as an initial recording, this first entry is very important. In the following examples we assume that the employee’s tax rate for social.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

This entry records the gross pay earned by employees during a pay period. Web a payroll journal entry is a record of employee earnings for.

An Accountant Typically Includes These Entries In The Company's General Ledger.

What is a payroll journal entry? Web payroll journal entries are the numbers you record in your small business’s general ledger to track employees’ wages. This entry records the gross pay earned by employees during a pay period. Web examples of payroll journal entries for wages.

Initial Recordings, Accrued Wages And Manual Payments.

Small business payroll accounting uses three basic types of journal entries: Each payroll journal entry is paired with. Also known as an initial recording, this first entry is very important. The company needs to pay a salary amount $ 50,000 but it has to deduct some amount for the relevant party.

Web Marshall Hargrave, N.

Web generally speaking, there are three types of payroll accounting entries: You’ll need to collect a few. This entry usually includes debits for the direct labor expense, salaries,. Web what are payroll accounting journal entries?

Web Payroll Journal Entries | Financial Accounting.

Web a payroll journal entry is a record of employee earnings for an accounting period. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Payroll accounting is simply recording.