Quickbooks Adjusting Journal Entries - Access the adjusting journal entries feature. This time sillycat50 asks about adjusting journal entries in quickbooks online.if you are looking for. In the future months the amounts will be different. 335k views 4 years ago accounting topics tutorials | quickbooks. Web join lynda & matthew for another qb community question. Web you can create adjusting journal entries for a variety of reasons: Generally, this permission is given to users with administrative access, such as the business owners or accountants. In accrual accounting, revenues and the corresponding costs should be reported in the same accounting period. We will walk you through the steps of determining the need for adjustment, creating a journal entry, and entering the correct accounts and amounts, followed by. Web learn how to create and review adjusting journal entries.

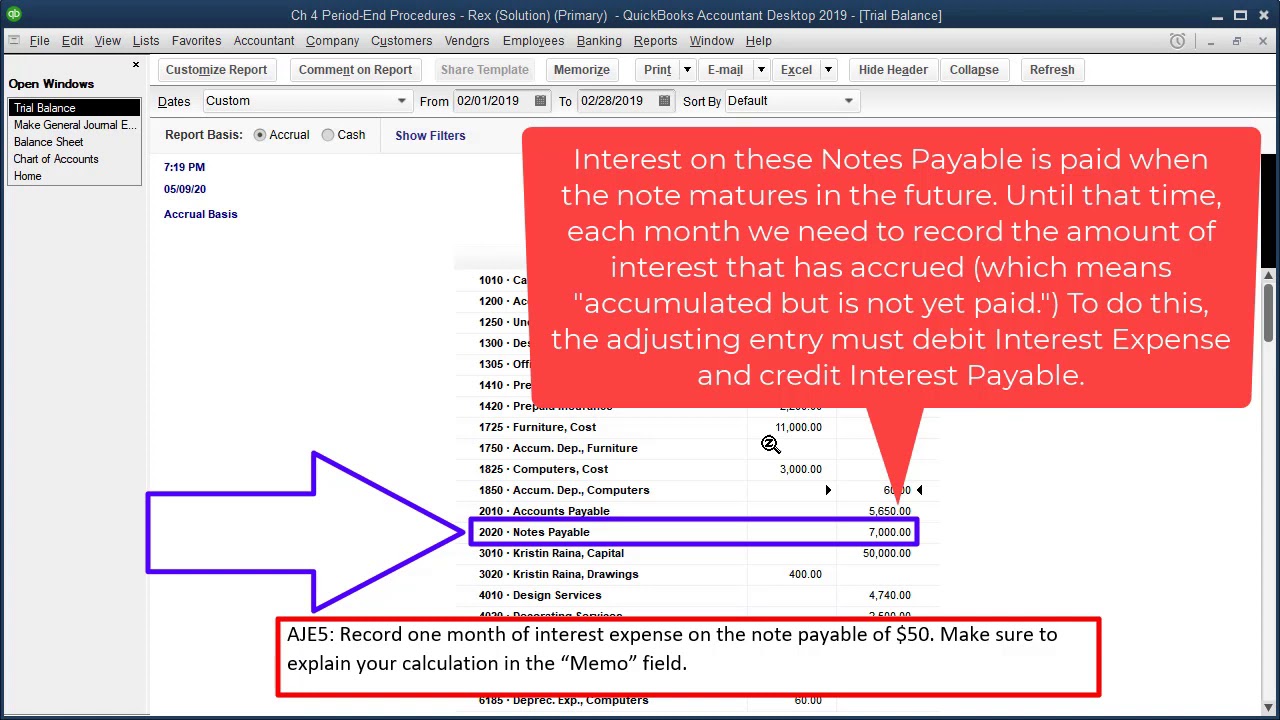

QuickBooks Adjusting Journal Entry 5 Interest Expense YouTube

An adjusting journal entry is a type of journal entry that adjusts an account's total balance. Web the adjusting journal entry for interest payable is:.

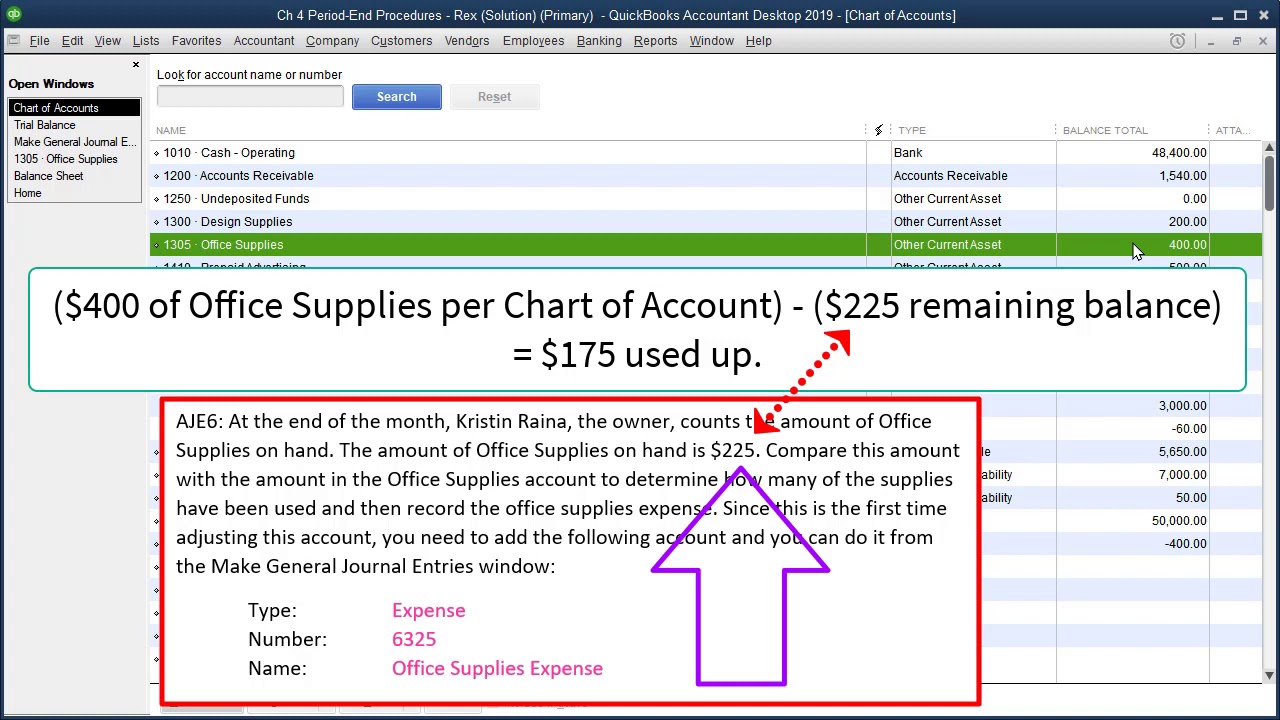

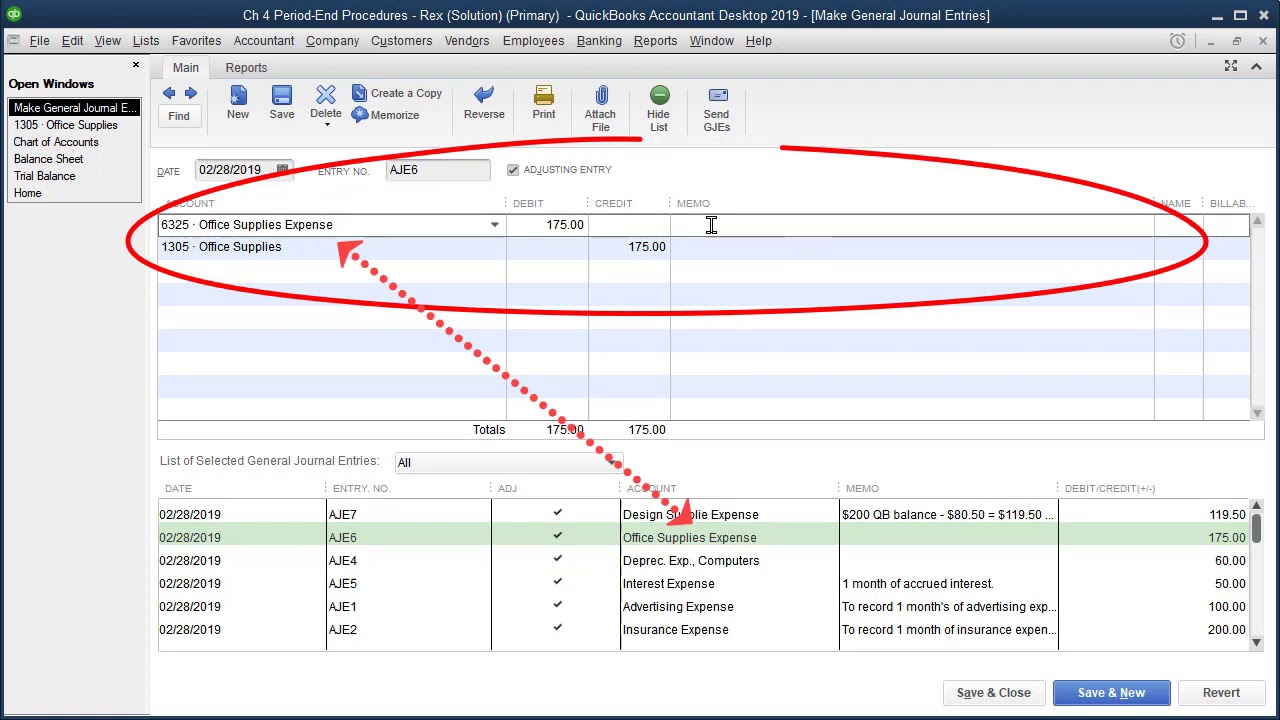

QuickBooks Adjusting Journal Entry 6 Office Supplies YouTube

Accountants usually use adjusting journal Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features.

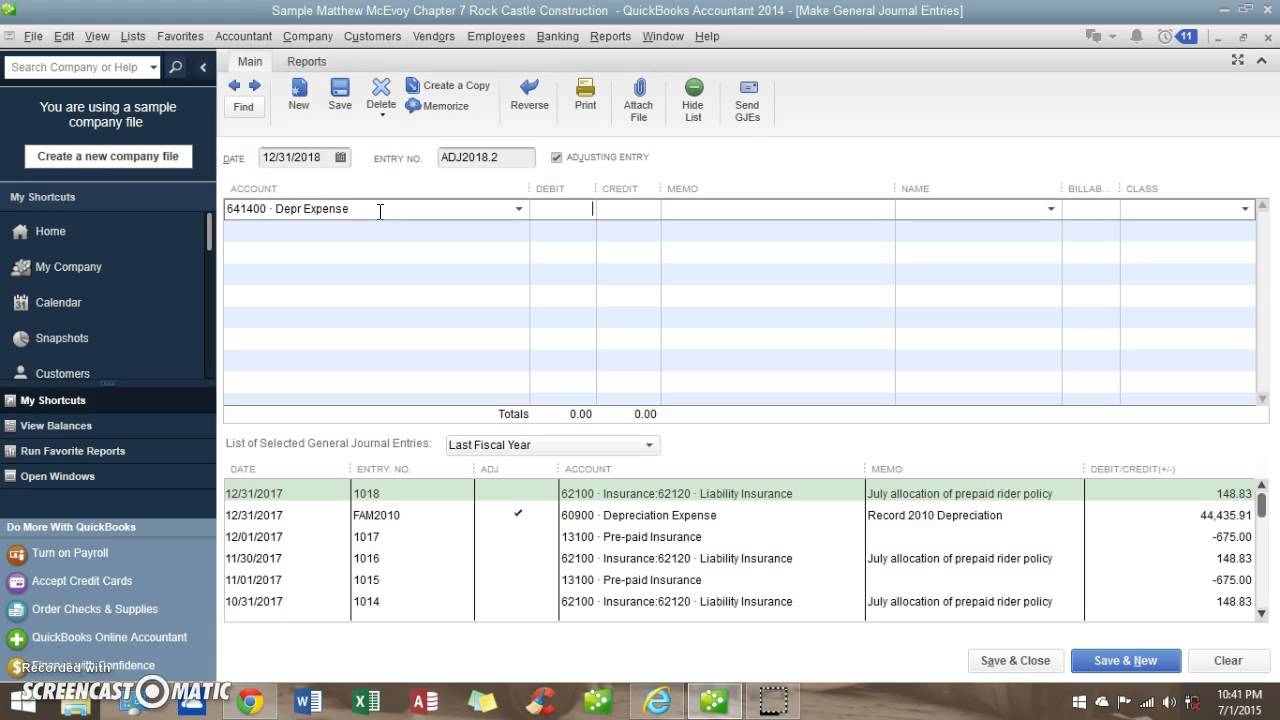

How To Use QuickBooks How to do Adjusting Entries YouTube

Web first, we will explore the process of adjusting accounts receivable in quickbooks using journal entries. In accrual accounting, revenues and the corresponding costs should.

How to enter adjusting journal entries in QuickBooks Desktop Scribe

Accounting professionals can correct some errors or document any uncategorized transactions by using. Reallocating accruals and reversing accruals of prepaid income or expenses; Once on.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

Interest expense will be closed automatically at the end of each accounting year and will. Web the adjusting journal entry for interest payable is: Web.

Adjusting Journal Entries Defined Accounting Play

Web join lynda & matthew for another qb community question. Web you can create adjusting journal entries for a variety of reasons: In the future.

How To Make Adjusting Journal Entries In Quickbooks Online Putnam Chasity

Once on the journal entries page, users can see a detailed list of transactions, including the date, description, debit, and. An adjusting journal entry is.

How to Print General/Adjusting Journal Entries in QuickBooks?

An adjusting journal entry is a type of journal entry that adjusts an account's total balance. Web the splitting of a journal entry into an.

Correcting a QuickBooks Adjusting Journal Entry YouTube

Get personalized help adding journal entries with quickbooks live:. Web learn how to create and review adjusting journal entries. In the future months the amounts.

Web The Splitting Of A Journal Entry Into An Adjusting Journal Entry In The Quickbooks Software Enables Users To Change The Total Balance Of An Account.

Web first, we will explore the process of adjusting accounts receivable in quickbooks using journal entries. Web to create a journal entry in quickbooks online, you must complete the journal entry form. It typically relates to the balance sheet. Web this page can be accessed by clicking on the ‘reports’ tab in the main menu, then selecting ‘accountant & taxes’ and choosing ‘journal’.

Web About Press Copyright Contact Us Creators Advertise Developers Terms Privacy Policy & Safety How Youtube Works Test New Features Nfl Sunday Ticket Press Copyright.

An adjusting journal entry is a type of journal entry that adjusts an account's total balance. This involves selecting the date of the transaction or adjustment, selecting the accounts that are impacted, inputting debit and credit amounts, and including additional information,. Web first look at whether you need to make adjustments to transactions, whether there should be adjustments to any lists, next, any adjustments to source transactions or balances, and then, finally, see whether you should be adjusting using journal entries. Accountants usually use adjusting journal

335K Views 4 Years Ago Accounting Topics Tutorials | Quickbooks.

In the future months the amounts will be different. Adjusting tax payable for interest, discounts, or penalties; This time sillycat50 asks about adjusting journal entries in quickbooks online.if you are looking for. Web you can create adjusting journal entries for a variety of reasons:

Interest Expense Will Be Closed Automatically At The End Of Each Accounting Year And Will.

Once on the journal entries page, users can see a detailed list of transactions, including the date, description, debit, and. Web the three most common types of adjusting journal entries are accruals, deferrals and estimates. We will walk you through the steps of determining the need for adjustment, creating a journal entry, and entering the correct accounts and amounts, followed by. Access the adjusting journal entries feature.