Journal Entry For Notes Payable With Interest - Web the journal entry for this looks like the following: The result of this entry is to record an interest expense of $1,800 and to reduce the carrying value of the notes payable to $10,555, as shown in the following t accounts: Notes payable is a promissory note offered by the lender to the borrower wherein the latter is bound to pay a certain amount to the lender within a stipulated period along with interest. They both are based on installment payments. Web journal entries for notes payable. Interest payable [debit] cash/bank [credit] interest payable on balance sheet. Suppose the amount is more significant than the average amount. Suppose for example, a business issues a note payable for 15,000 due in 3 months at 8% simple interest in order to obtain a loan, then the total interest due at the end of the 3 months is. In that case, it shows that a corporation is defaulting on its debt commitments, and this amount may be a critical aspect of financial statement analysis. This journal entry will eliminate the $3,000 of interest payable that the company has.

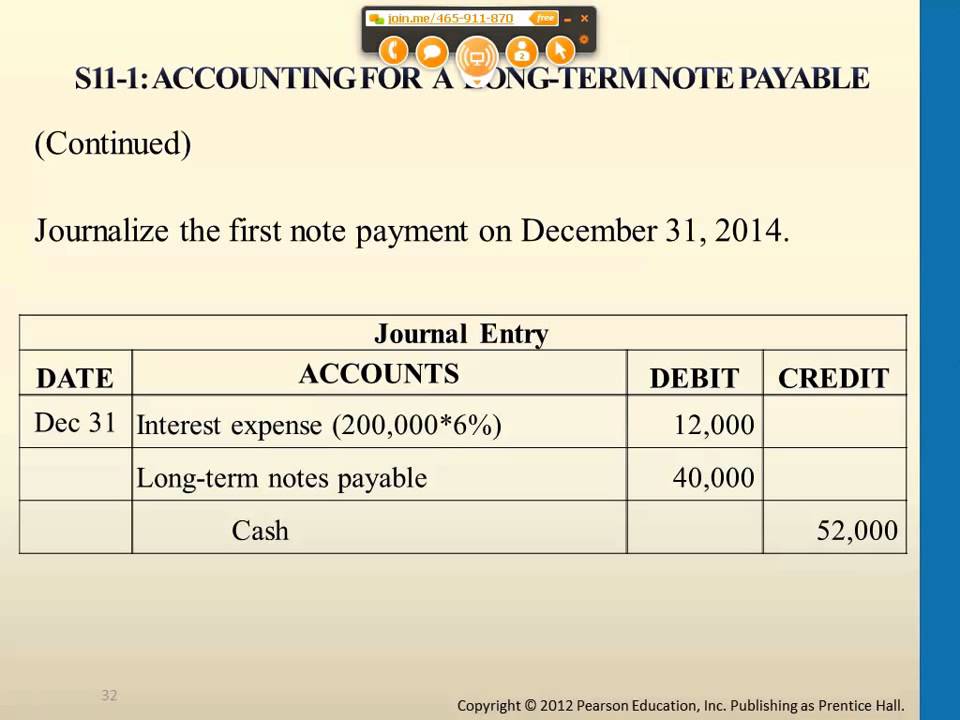

Accounting for a Long Term Note Payable YouTube

In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period. Web in.

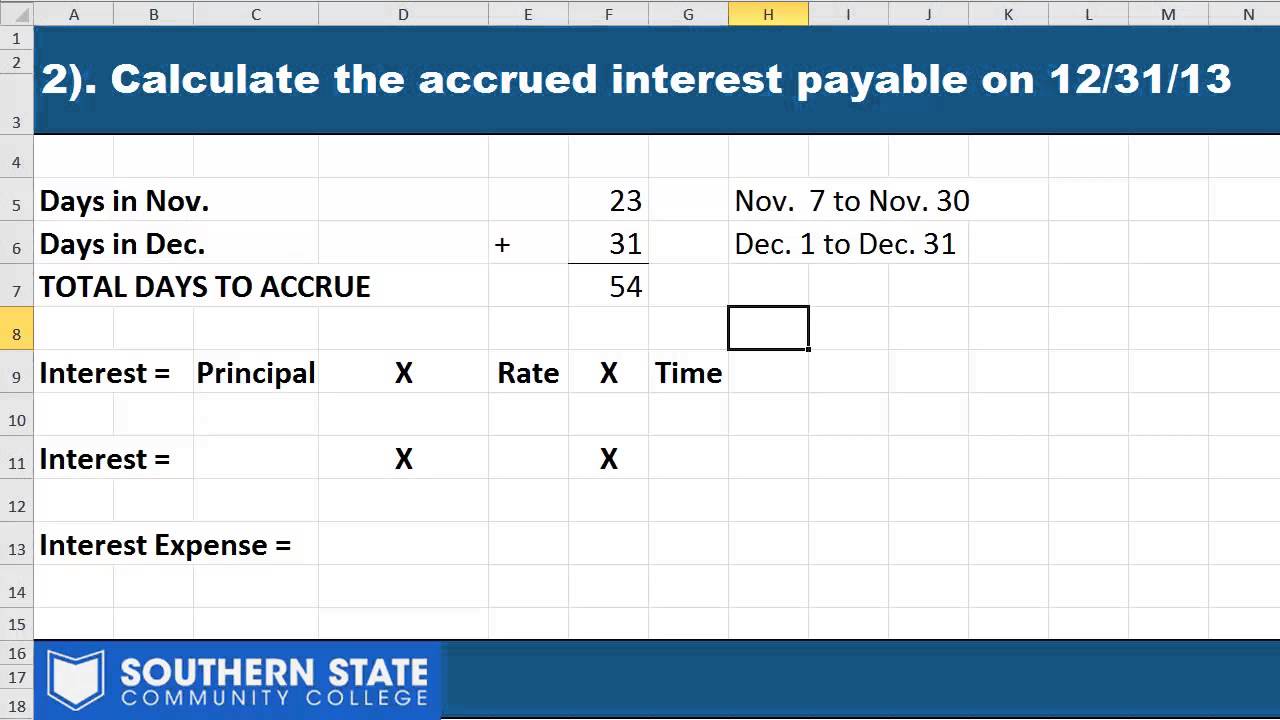

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

Suppose the amount is more significant than the average amount. This journal entry will eliminate the $3,000 of interest payable that the company has. What.

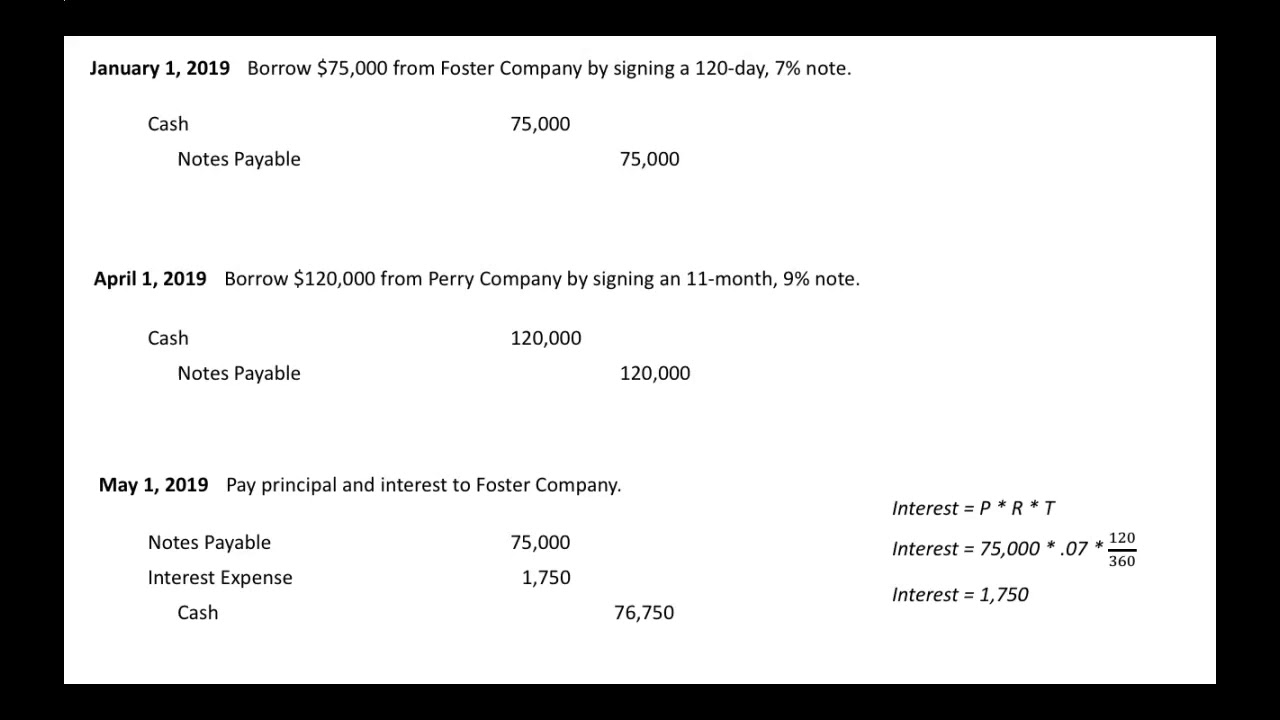

Notes Payable Journal Entries YouTube

Web on jan 1, 2021. Web this journal entry is made to eliminate the interest payable that we have recorded above. In that case, it.

Accounting for a Note Payable YouTube

Later, on january 1, 2022, when we make the payment to honor the promissory note that we have issued, we can make the journal entry.

Notes Receivable Journal Entries, with Interest YouTube

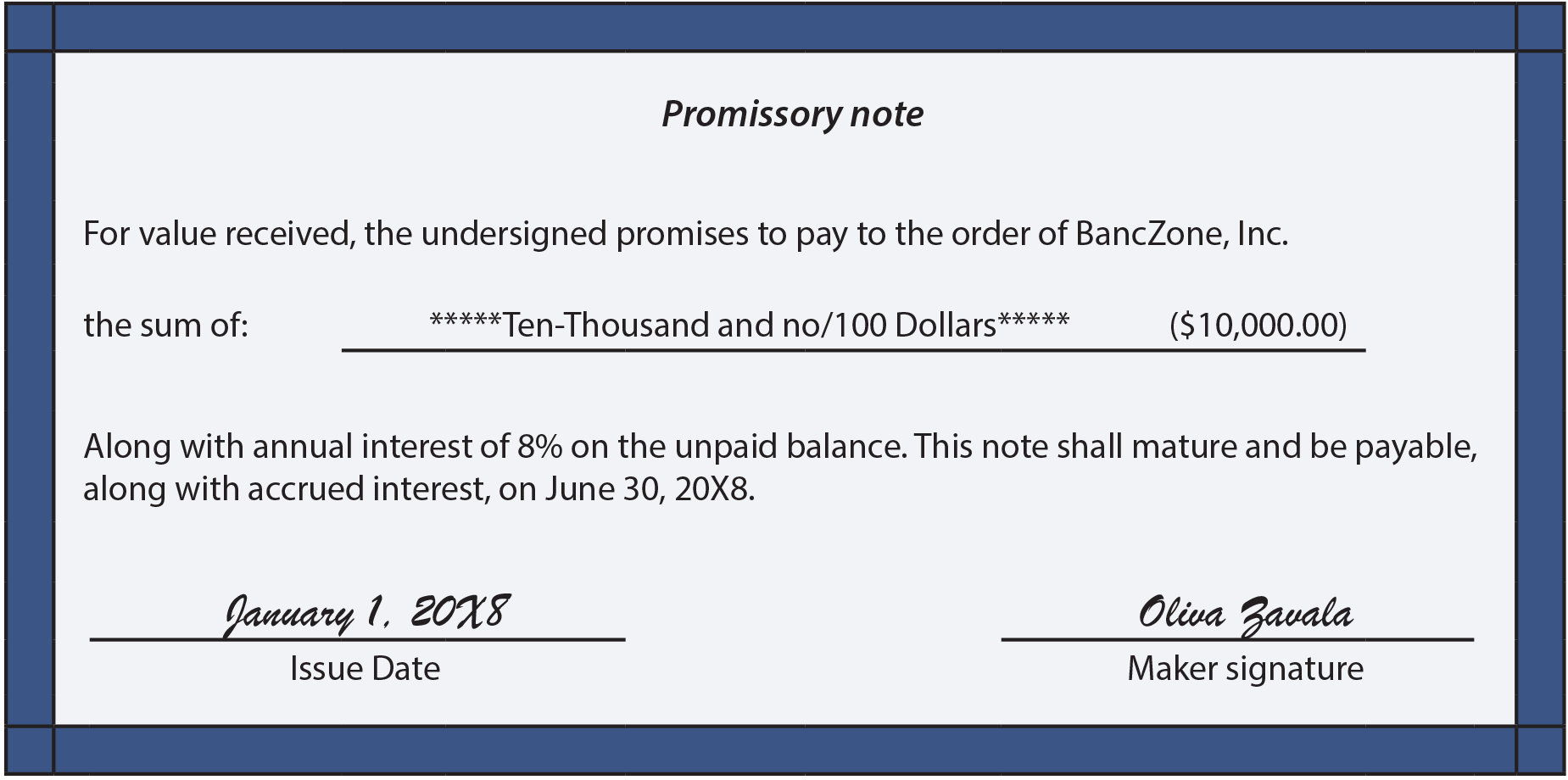

Web notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. The result.

Notes Payable (Journal Entries) YouTube

Web in notes payable accounting there are a number of journal entries needed to record the note payable itself, accrued interest, and finally the repayment..

Notes Payable

The terms require the borrower to make equal installment payments over the term of the loan. Web journal entries for notes payable. Web interest payable.

Bill of Exchange Note Payable Accountancy Knowledge

Web instead of doing a quarterly journal entry, you would create a journal entry for your annual interest expense, which is $1,500. In this journal.

Notes Payable

Issued notes payable for cash. Web interest payable is the amount of interest owed to lenders by a corporation as of the balance sheet date..

Web The Journal Entry For The Interest Payable Should Include The Amount Of Interest That Is Owed And The Period In Which It Was Incurred.

Suppose the amount is more significant than the average amount. The entries in the following years would be made in the same manner. Web notes payable journal entries. The terms require the borrower to make equal installment payments over the term of the loan.

The Journal Entry Would Look Like This:

Web interest payable is a liability account that reports the amount of interest the company owes as of the balance sheet date. Yourco borrows $100,000 from the bank on december 1 of 20x1 at 12% interest (compounded monthly) with principal and interest due monthly so that the loan is completely amortized by december 1 of 20x9. They both are based on installment payments. Web notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g.

Let’s Discuss The Various Instances Of Notes Payable With Examples In Each Of The Following Circumstances:

Accountants realize that if a company has a balance in notes payable, the company should be reporting some amount in. The interest would be $ 30,000 * 3/12 * 8% = $600. When the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting the cash account. In that case, it shows that a corporation is defaulting on its debt commitments, and this amount may be a critical aspect of financial statement analysis.

Monthly Payments Will Be $1,625.28.

The relevant journal entry would be. When the company abc makes the payment on jan 1, 2021, it can make the journal entry for interest payment as below: Web the journal entry to record the payment for the first year is: Web journal entries for notes payable.