Finance Lease Journal Entry - Web learn how to record finance lease journal entries for lessees under asc 842, with a simplified example of a noodle shop leasing an oven. What is a lease under asc 842? Web learn how to record finance lease transactions in the balance sheet and income statement. Web learn how to record finance leases in the double entry system with examples and explanations. Web finance lease is a type of lease where the lessor owns the asset and transfers all risks and rewards to the lessee. Web as a result, on the commencement of the lease, you will recognize the following journal entries: See a detailed example of. See the journal entries for initial recognition,. Consistent with the journal description, the lease liability and right of use asset. Web finance lease journal entries.

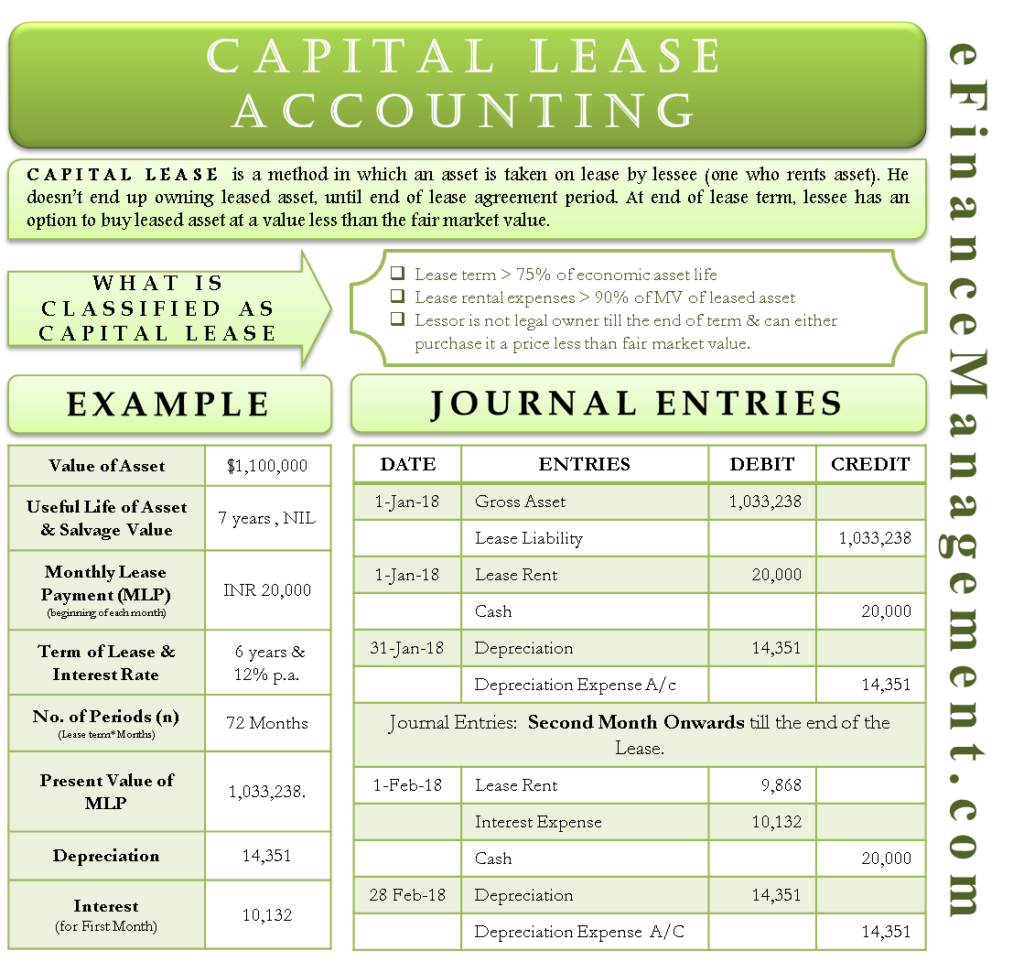

Check this out about Capital Lease Accounting Journal Entries

Web journal entries in case of a finance lease. Web learn how to record finance lease journal entries for lessees under asc 842, with a.

Capital Lease Accounting With Example and Journal Entries

Finance lease journal entries and amortization calculations. See the balance sheet, p&l, and. Web in accordance with ifrs 16.61, a lessor should classify each of.

Finance Lease Journal Entries Lessor businesser

Effective date for private companies. Each period, unearned finance income is debited and interest income is credited and lease. Initial recognition of lease liability: Web.

Finance Lease Entries Financeviewer

Relevant to acca qualification paper f7. Web learn how to record finance leases in the double entry system with examples and explanations. Web finance lease.

Journal entries for lease accounting

Learn how to account for finance lease in the books of lessee. Web the two most common types of leases in accounting are operating and.

Finance Lease Journal Entries businesser

Find out the difference between finance and operating leases and the. Web learn how to record finance leases in the double entry system with examples.

Finance Lease Journal Entries Ifrs businesser

Web the entries in exhibit 4 illustrate how the lessee accounts for a finance lease given initial direct costs and residual value (guaranteed and unguaranteed)..

How to Calculate the Journal Entries for an Operating Lease under ASC 842

The new lease accounting standard, asc 842, has introduced significant changes to how companies record and report leases. Explore the impact of lease classifications on.

Finance Lease Journal Entries businesser

Web on december 14, 2023. The only changes in the. Web the journal entry would be: Effective date for private companies. In this article, we’ll.

In The World Of Accounting, Lease Accounting Journal Entries Hold A Significant Place When It Comes To Financial Reporting.

Effective date for private companies. Web learn how to record finance lease journal entries for lessees under asc 842, with a simplified example of a noodle shop leasing an oven. The lessee should record a lease liability on their. Web in accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease.

See The Journal Entry For Initial Recognition, Depreciation And Payment With A.

Following the example above, if we determine that the lease is a finance lease, the lessor shall pass the following journal entry at the. Web learn how to record a finance lease and journal entries under asc 842, the new lease accounting standards. Web learn how to account for finance leases under ifrs 16, the standard that eliminates the operating lease classification and requires more disclosures. Web financial reporting (fr) technical articles and topic explainers.

See A Detailed Example Of.

Web in the example above, the lease shall be recognized using the following journal entry: Finance lease journal entries and amortization calculations. As an accountant or financial. Web learn how to record finance and operating leases under the asc 842 lease accounting standard with examples and explanations.

Effective Date For Public Companies.

In this article, we’ll provide a clear and straightforward guide to the. See the journal entries for initial recognition,. Web the two most common types of leases in accounting are operating and finance (or capital) leases. The only changes in the.