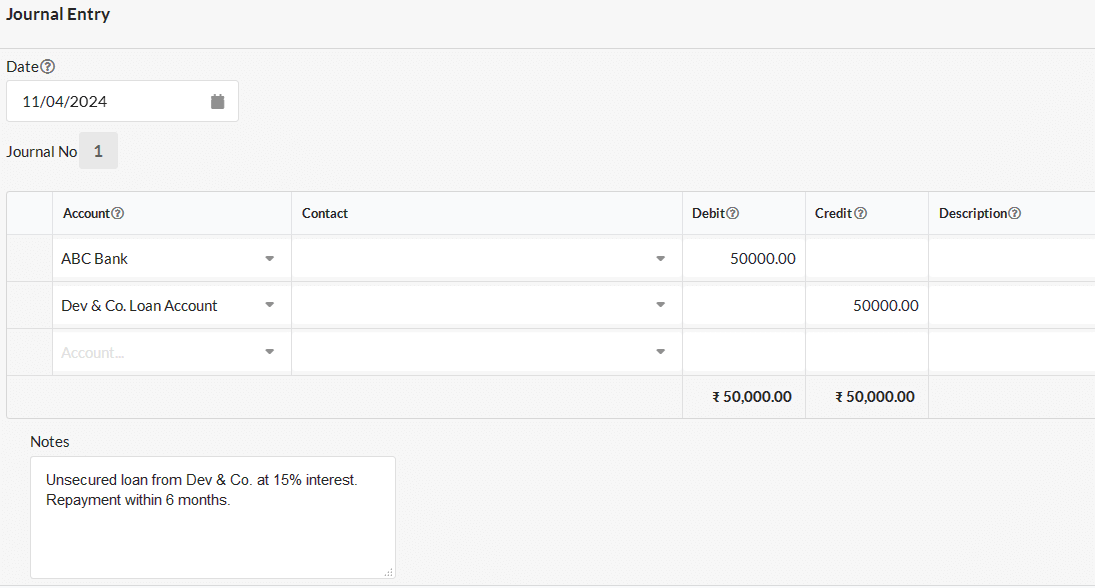

Journal Entry For Loan Receivable - The company abc can make the journal entry for the loan given to employee on jan 1, 2021, as below: Web what is accounts receivable? Web the journal entry is debiting cash and credit loan receivable. Web following is the journal entry for loan taken from a bank; Web on jan 1, 2020. Unlike usual trading balances and credits, notes receivable balances come. The journal entry to record such credit sales of goods and. When you hear your banker say, “i’ll credit your. As per this system, all entries need to have a. Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the total payment of $1,000.

Journal entry for Loan Payable Output Books

Web the assignment of accounts receivable journal entries are based on the following information: They may be accounted for. Web banks and other businesses in.

The Basics Of Loan Receivable What You Need To Know PT. BBU

Like most businesses, a bank would use what is called a “double entry” system of accounting for all its transactions, including loan receivables. Web the.

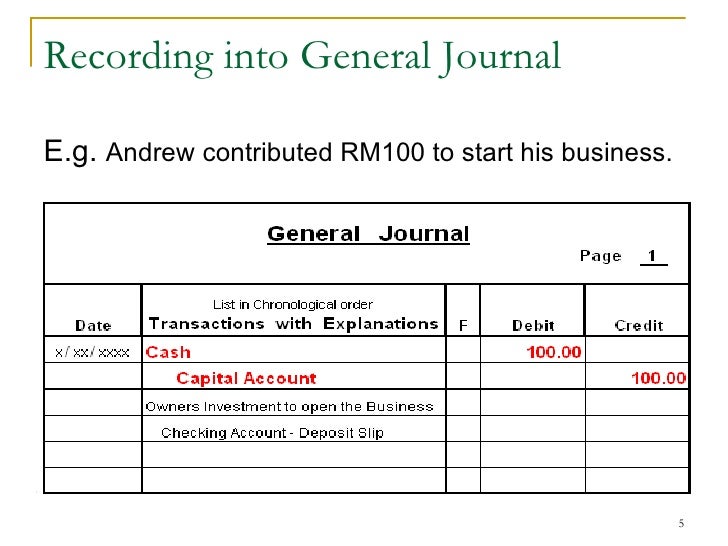

journal entry format accounting accounting journal entry template

On december 31, 2022, the interest accrued on the loan must be. Web the journal entry is debiting cash and credit loan receivable. As per.

What Is The Journal Entry For A Loan Payment

Web on jan 1, 2020. Journal entries are rightly called the backbone of the modern accounting system as they are the first. Web the journal.

Journal Entry Examples

A double entry system requires a much more detailed bookkeeping process, where every entry has an additional corresponding entry to a different account. Web the.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

At the end of the first year. Web the accounts receivable journal entries below act as a quick reference, and set out the most commonly.

Journal Entries of Loan Accounting Education

You've done the work, sent the bill, but your customer hasn't paid you yet. Web banks and other businesses in india employ the double entry.

Loan Journal Entry Examples for 15 Different Loan Transactions

Web journal entries for interest receivable. After 3 months, the business partner. Bank's debits & credits, bank's balance sheet, recap. Web the accounts receivable journal.

Accounting for Loan Receivable (Part 1) YouTube

Web journal entries for interest receivable. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you.

On December 31, 2022, The Interest Accrued On The Loan Must Be.

They may be accounted for. Web the amount you can borrow through accounts receivable financing is based on the value of your outstanding invoices, typically providing a percentage of their value minus fees. Web banks and other businesses in india employ the double entry accounting system for all transactions, such as loans receivable. Web what is accounts receivable?

Web Following Is The Journal Entry For Loan Taken From A Bank;

Web loan receivables are loans given by company to borrowers in exchange for repayment. After 3 months, the business partner. At the end of the first year. Web journal entries for interest receivable.

Web Below Is A Compound Journal Entry For Loan Payment Made Including Both Principal And Interest Component;

As per this system, all entries need to have a. Bank's debits & credits, bank's balance sheet, recap. Web the accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double. Web the journal entry to recognize the receipt of the loan funds is as such:

The Journal Entry To Record Such Credit Sales Of Goods And.

You've done the work, sent the bill, but your customer hasn't paid you yet. Accounts receivable 50,000 on 45 days terms. A double entry system requires a much more detailed bookkeeping process, where every entry has an additional corresponding entry to a different account. The company abc can make.