Purchase Supplies On Account Journal Entry - Purchase office supplies on account journal entry. When a business engages in a transaction to acquire supplies on credit, an account payable entry is recorded in the journal. Only later on february 26, 2021, did it makes the $800 cash payment to settle this account. The business has received consumable supplies (paper towels, cleaning products, etc.) and holds these as a current asset as supplies on hand. The company purchased supplies, which are assets to the business until used. Purchase supplies on account journal entry: Supplies are incidental items that are expected to be consumed in the near future. Web purchase supplies on account journal entry. The accounting records will show the following purchased supplies on account journal entry: We can make the journal entry for purchasing goods on credit by debiting the purchases account and crediting the accounts payable in the periodic inventory system.

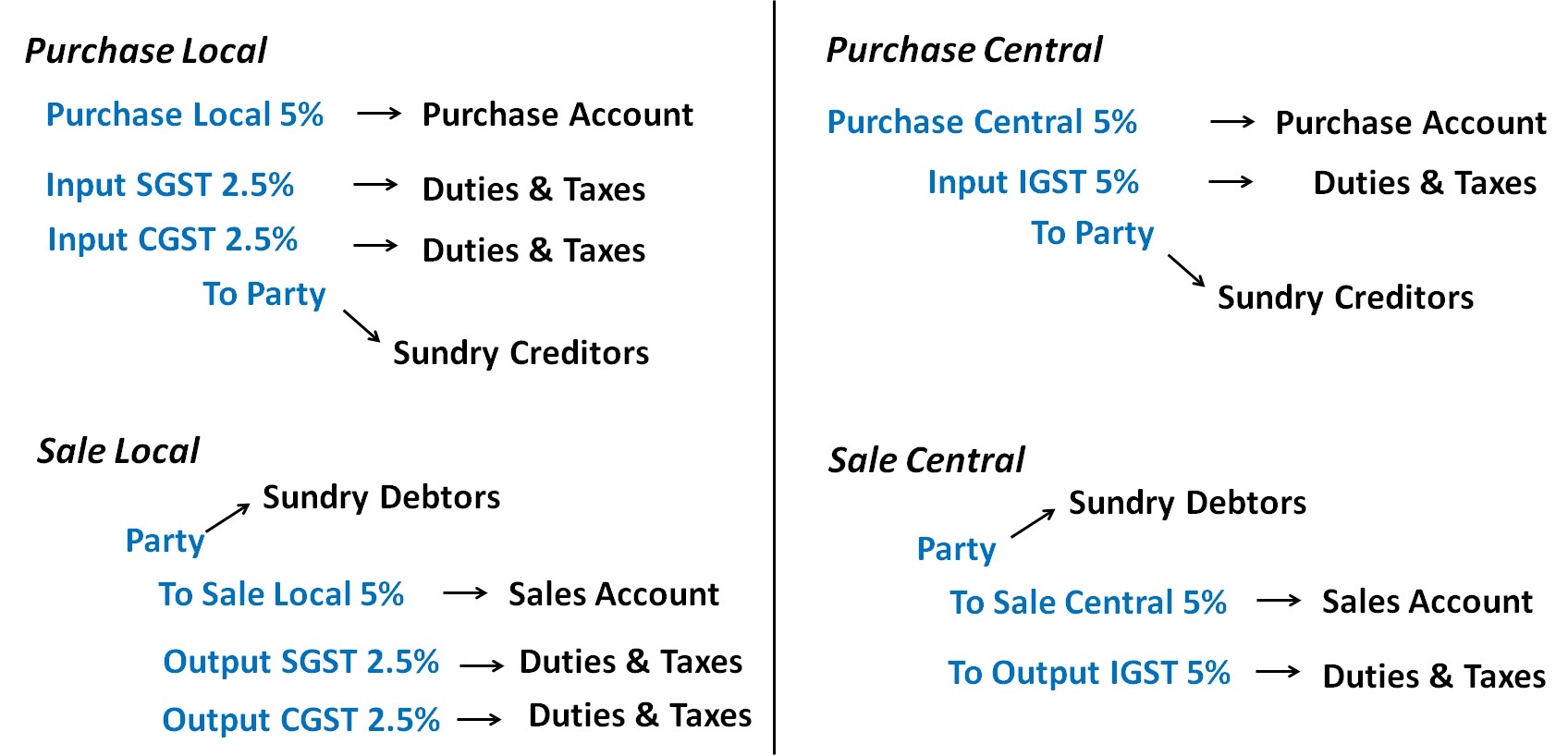

Entries for Sales and Purchase in GST Accounting Entries in GST

Supplies are incidental items that are expected to be consumed in the near future. Web for example, suppose a business purchases pens, stationery and other.

Purchased Supplies On Account Journal Entry / Property Plant And

The accounting records will show the following purchased supplies on account journal entry: Only later on february 26, 2021, did it makes the $800 cash.

purchased supplies on account journal entry patchplacementoncub

This entry is recorded as a debit to the supplies account and a credit to the accounts payable account. The business has received consumable supplies.

Journal Entry Examples

For example, on january 28, 2021, the company abc bought supplies of $800 on credit from one of its suppliers. Purchase supplies on account journal.

Perpetual Inventory System Journal Entry

Supplies are incidental items that are expected to be consumed in the near future. In each case the purchase transaction entries show the debit and.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Purchase supplies on account journal entry: The business has received consumable supplies (paper towels, cleaning products, etc.) and holds these as a current asset as.

Journal Entry Problems and Solutions Format Examples MCQs

On january 30, 2019, purchases supplies on account for $500, payment due within three months. The debit is made to the supplies expense account, which.

Purchases journal explanation, format, example Accounting For

For a fuller explanation of journal. In each case the purchase transaction entries show the debit and credit account together with a brief narrative. We.

[Solved] Record following purchases transactions in JOURNAL ENTRY I

In each case the purchase transaction entries show the debit and credit account together with a brief narrative. Supplies is an asset that is increasing.

Web When You Make A Purchase Of Supplies On Account, You Must Prepare A Journal Entry That Contains One Debit And One Credit.

What is the journal entry for the supplies bought on credit on january 28, 2021? Web the purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of purchase transactions. This entry is recorded as a debit to the supplies account and a credit to the accounts payable account. Supplies is an asset that is increasing on the debit side.

We Can Make The Journal Entry For Purchasing Goods On Credit By Debiting The Purchases Account And Crediting The Accounts Payable In The Periodic Inventory System.

For example, on january 28, 2021, the company abc bought supplies of $800 on credit from one of its suppliers. Purchase office supplies on account journal entry. Supplies is increasing, because the company has more supplies than it did before. Only later on february 26, 2021, did it makes the $800 cash payment to settle this account.

Web The Purchase Of Supplies For Cash Is Recorded In The Accounting Records With The Following Bookkeeping Journal Entry:

The debit is made to the supplies expense account, which is a temporary. In each case the purchase transaction entries show the debit and credit account together with a brief narrative. On january 30, 2019, purchases supplies on account for $500, payment due within three months. Web journal entry for purchasing goods on credit.

Web For Example, Suppose A Business Purchases Pens, Stationery And Other Office Consumables For 250, And Is Given Credit Terms From The Supplier.

The business has received consumable supplies (paper towels, cleaning products, etc.) and holds these as a current asset as supplies on hand. For a fuller explanation of journal. The company purchased supplies, which are assets to the business until used. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry.