Journal Entry For Dividend Declaration - Web the cash dividend is: Web thus, a journal entry for dividend declared on december 20, 2018,looks like: And as with debiting the retained earnings account, you’ll credit the total declared dividend. In january, when the payment is made, the journal entry would be:. Upon the declaration of dividends by the board of directors, the company must make an entry in its journal to reflect the creation of a. Web initial declaration entry. The journal entry to record the declaration of the cash dividends involves a decrease. Web on december 14, 2020, when the company declares the cash dividend. On january 8, 2021, when the company pay the cash dividend. Web the dividend is owed to shareholders on record on 21 july and paid on 30 july.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Retained earnings retained earnings retained earnings are defined as the. Web what are journal entry examples of dividends payable? Web journal entry for payment of.

Stock Dividends Journal Entry To Record Stock Dividend Issued YouTube

The journal entry to record the declaration of the cash dividends involves a decrease. A formal procedure would recognize the. As the company has declared.

Calculating Dividends, Recording Journal Entries YouTube

Record the first journal entry as follows: Web a company may issue a stock dividend rather than cash if it doesn’t want to deplete its.

How To Record And Report Dividend Payments In Accounting Records And

Web what are journal entry examples of dividends payable? Likewise, the common stock dividend distributable is $50,000 (500,000 x 10% x $1) as the common..

Recording Payment Of Dividend Journal Entry

Web journal entries for dividend payments. On january 8, 2021, when the company pay the cash dividend. Web record the declaration and payment of the.

Dividends Payable Accounting Journal Entry

In january, when the payment is made, the journal entry would be:. The journal entry to record the declaration of the cash dividends involves a.

How to Record Dividends in a Journal Entry Accounting Education

Record the first journal entry as follows: Web on december 14, 2020, when the company declares the cash dividend. Likewise, the common stock dividend distributable.

Answered Required information Journal entry… bartleby

Web accounting practices are not uniform concerning the actual sequence of entries made to record stock dividends. Suppose a corporation currently has 100,000 common shares.

Journal Entry for Dividends YouTube

Web on december 14, 2020, when the company declares the cash dividend. Hence, the company needs to account for dividends by making journal entries. As.

Web Journal Entry For Payment Of A Dividend.

Web thus, a journal entry for dividend declared on december 20, 2018,looks like: 9,200shares × $0.50 = $4,600 9,200 shares × $0.50 = $4,600. Web hence, the value of stock dividend is $250,000 (500,000 x 10% x $5). Hence, the company needs to account for dividends by making journal entries.

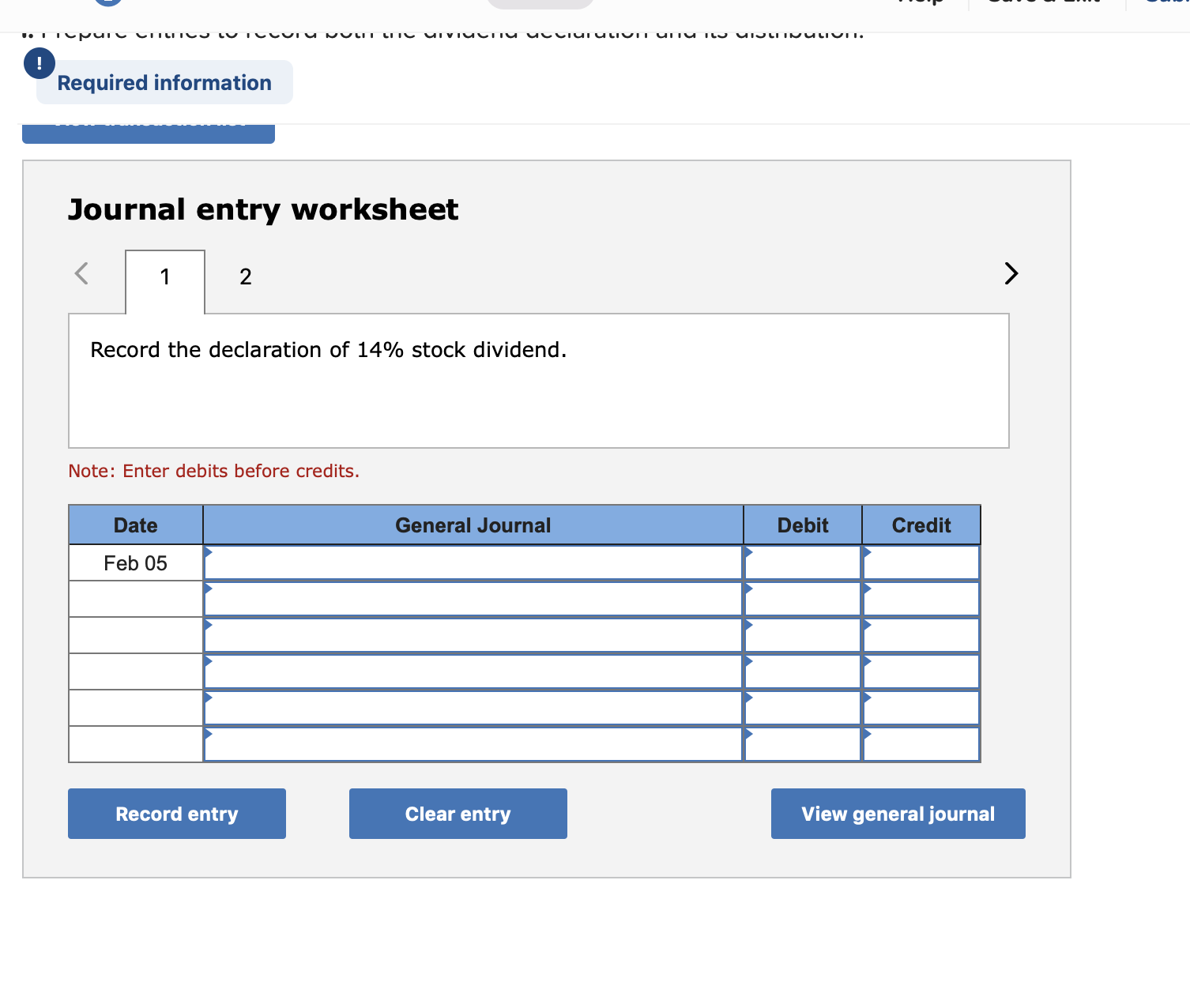

Web Record The Declaration And Payment Of The Stock Dividend Using Journal Entries.

Web the declaration of dividends is journalized as follows: Dividend is usually declared by the board of directors before it is paid out. Web initial declaration entry. In january, when the payment is made, the journal entry would be:.

The Common Stock Dividend Distributable Is $50,000 —.

Web on december 14, 2020, when the company declares the cash dividend. Web accounting practices are not uniform concerning the actual sequence of entries made to record stock dividends. Upon the declaration of dividends by the board of directors, the company must make an entry in its journal to reflect the creation of a. Web on the date of declaration, credit the dividend payable account.

Web The Journal Entries.

As the company has declared a 10% stock dividend, it would be. Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings for the market value of the shares to be distributed: When a company decides to distribute dividends, the accounting process begins with the declaration of the. Record the first journal entry as follows: