Accounting Gift Cards Journal Entries - How should gift cards be recorded to be in compliance with gaap? Web understanding who buys gift cards, why, and when can be important in business planning. Properly accounting for gift cards is essential to comply with tax regulations and financial reporting standards. What accounting guidance applies to gift card accounting and any new accounting pronouncements that occurred since the last holiday season? The purchase of the voucher and the redemption of the voucher for goods or services. Web table of contents. Solved journal entry worksheet record the. When the company sells the gift card to customers, they will receive cash as well as the obligation to customer. Below is an example of a journal entry when you sell a $100 gift card in shopify (when shopify takes out your merchant fee prior to the payout) Web there are several points to consider when accounting for promotions and gift card sales:

Gift Card Software Seamless Gift Card Sales ROLLER

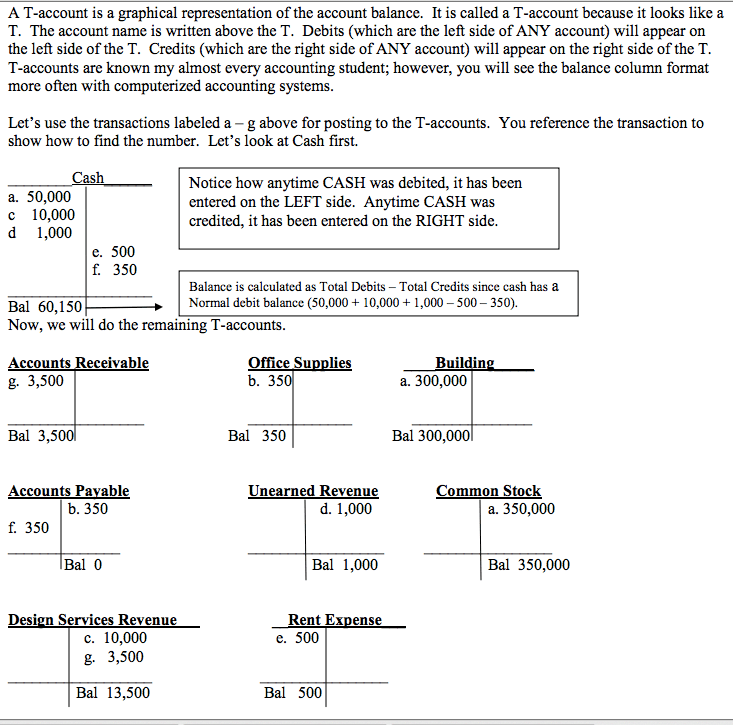

How should the sale of gift certificates be recorded in. Web the journal entry to record gift card breakage revenue is to debit deferred revenue.

gift card breakage revenue example YouTube

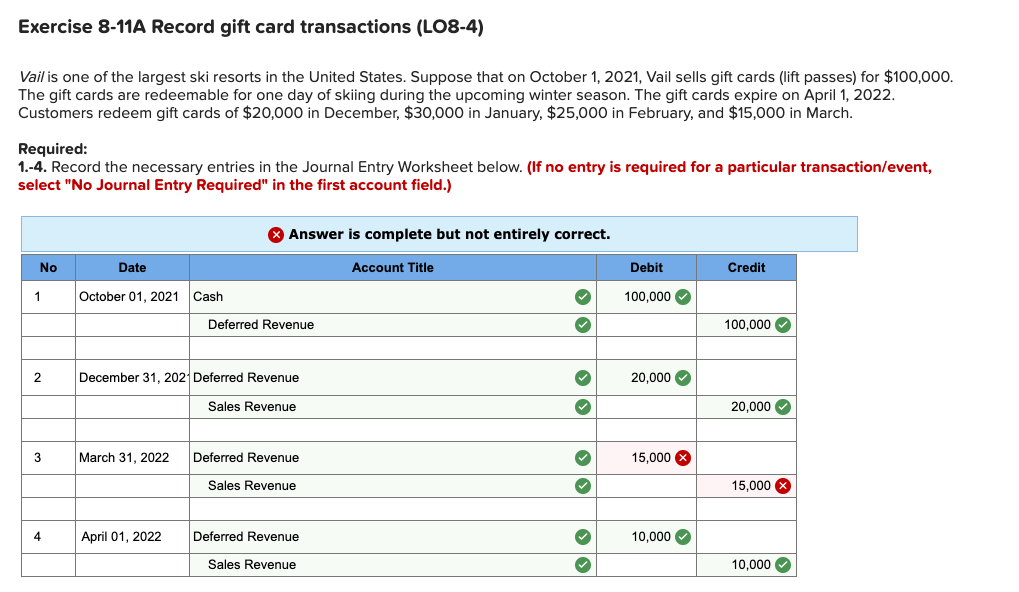

Properly accounting for gift cards is essential to comply with tax regulations and financial reporting standards. When should the redeemed gift card revenue be recognized?.

Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown

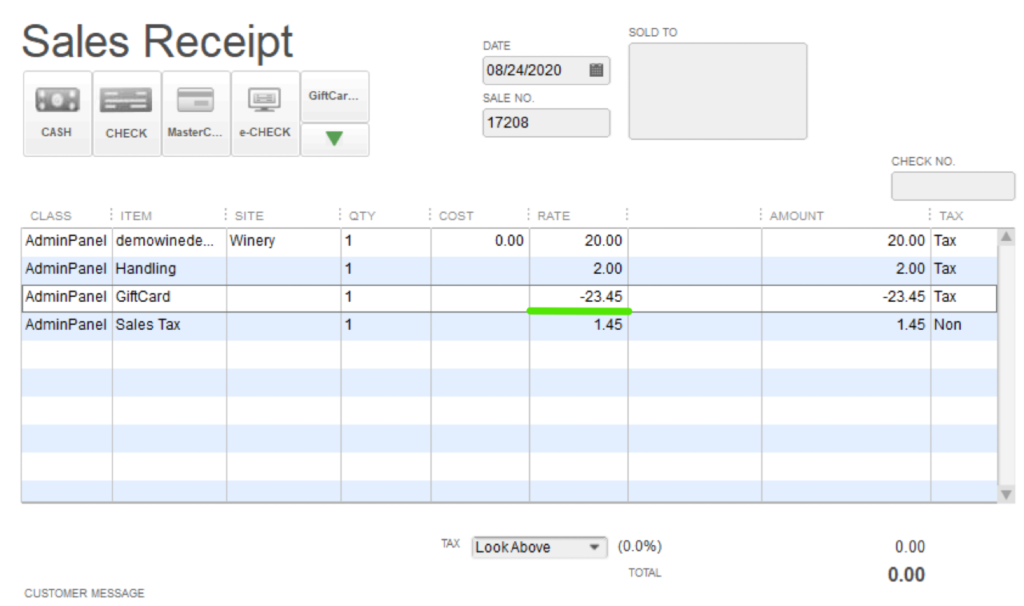

Web journal entry for gift cards. Below is an example of a journal entry when you sell a $100 gift card in shopify (when shopify.

How Do Gift Card Transactions Work? WGITS

When compared to ias 18 ‘revenue’, ifrs 15 ‘revenue from contracts with customers’ provides more significant guidance, that can be applied to various situations retailers.

journal entry format accounting accounting journal entry template

How to handle gift cards in your accounting. Web accounting for gift cards when giving them to employees as gifts. Web when you sell gift.

Think Twice about Gifting Gift Cards AccountingCoaching

It is not yet the revenue, the company records cash received and liability. Accounting for redeemed gift cards. Web journal entry for gift cards. How.

Gift Cards a Present to Bottom Line Gift Cards a Present to Bottom

How should the sale of gift certificates be recorded in. Web the sale of a gift certificate should be recorded with a debit to cash.

Solved Exercise 811A Record gift card transactions (LO84)

Definition of gift cards in accounting. When the company sells the gift card to customers, they will receive cash as well as the obligation to.

Accounting For Gift Cards Double Entry Bookkeeping

It is not yet the revenue, the company records cash received and liability. Rather, the retailer is recording its obligation/liability to provide merchandise or services.

Web Unresolved Issues Stemming From The Reporting Treatment Of Gift Card Sales And “Breakage” (Gift Cards That Consumers Fail To Redeem) Potentially Encroach Upon Several Accounting Regulations, Including Standards For Revenue Recognition And.

Gift card sales increase the company’s gift card liability (credit) and increase cash (debit) on the balance sheet. Below is an example of a journal entry when you sell a $100 gift card in shopify (when shopify takes out your merchant fee prior to the payout) How to handle gift cards in your accounting. Web the sale of a gift certificate should be recorded with a debit to cash and a credit to a liability account such as gift certificates outstanding.

Solved Journal Entry Worksheet Record The.

Journal entry for credit purchase and cash purchase. Web while great for customers and support teams, this can create a massive challenge for accounting teams. Learn to automate the gift card accounting process with an integration. Accounting for redeemed gift cards.

Rather, The Retailer Is Recording Its Obligation/Liability To Provide Merchandise Or Services For The Amount Of The Certificate Sold.

How should gift cards be recorded to be in compliance with gaap? The purchase of the voucher and the redemption of the voucher for goods or services. When compared to ias 18 ‘revenue’, ifrs 15 ‘revenue from contracts with customers’ provides more significant guidance, that can be applied to various situations retailers need to face, such as the treatment of gift cards (vouchers). When a gift card is redeemed by a customer, the business satisfies its obligation to supply the goods and the liability is extinguished.

Web Accounting For Gift Cards When Giving Them To Employees As Gifts.

How are gift cards recorded in an account? The journal entry for the sale of gift voucher: As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. How do we properly track unredeemed.

/illustrations/giftcard report.png?width=2100&height=2100&name=giftcard report.png)

![Solved Exercise 139 (Algo) Gift Cards (LO133] CircuitTown](https://media.cheggcdn.com/media/aff/aff5bad8-dca3-484d-a0de-9b22e029607c/phpYJQRRt)