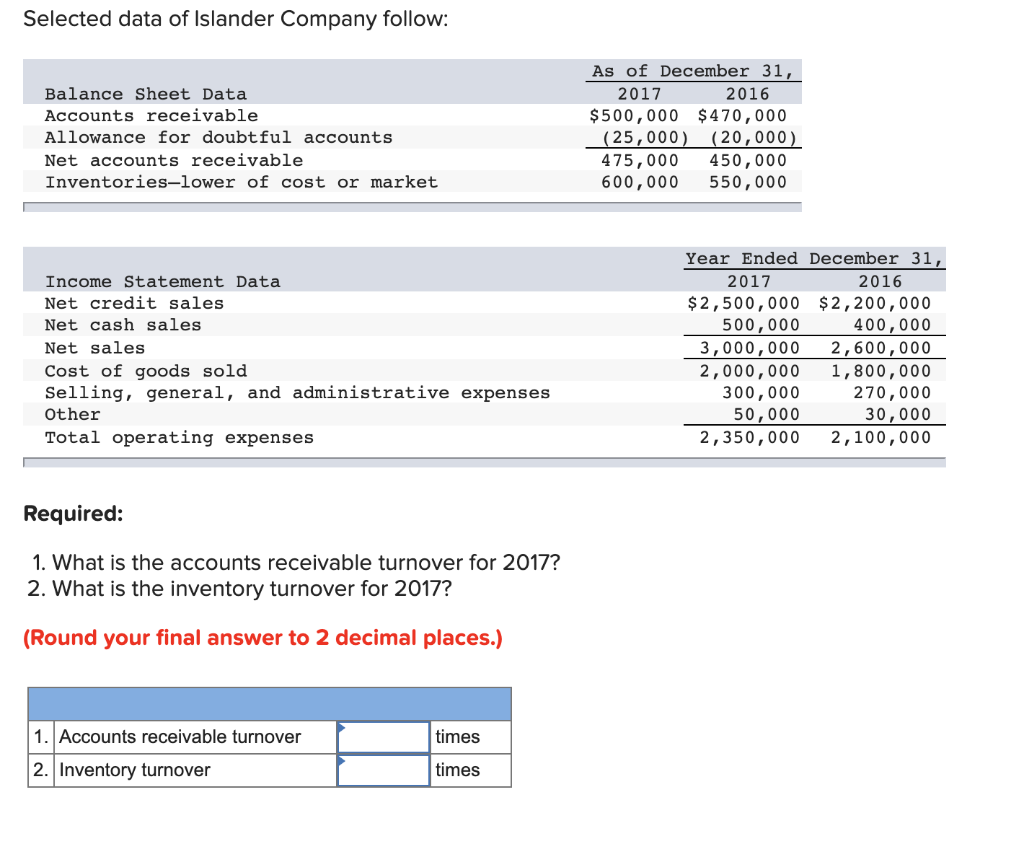

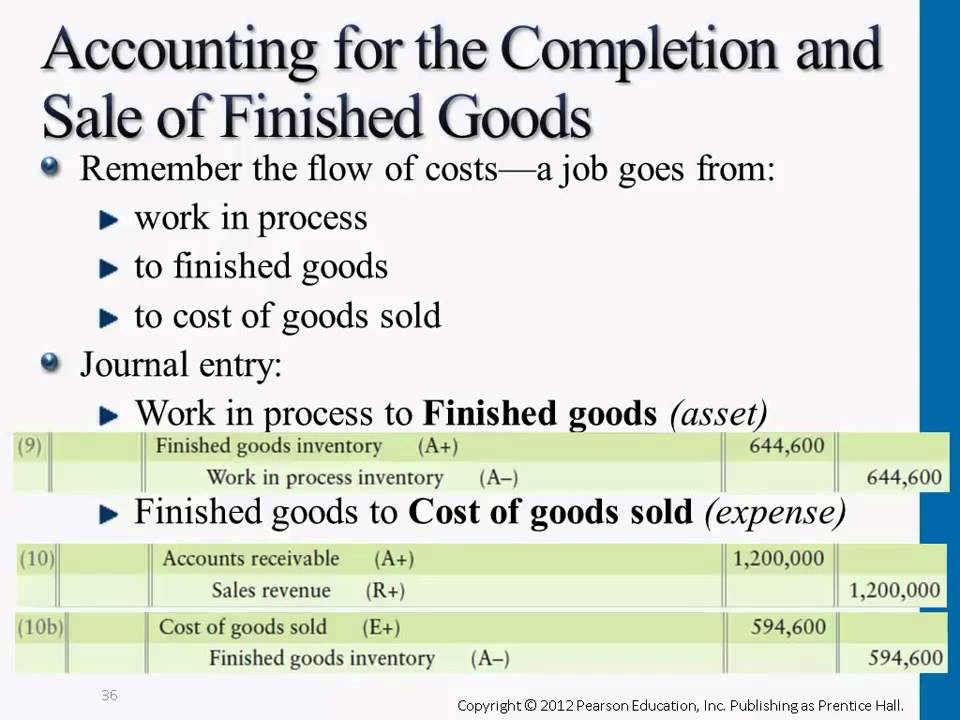

Cost Of Goods Sold Inventory Journal Entry - A second journal entry reduces the account inventory and increases the account cost of goods sold. The components of cost of goods sold can be broken down into four key parts: If your business has inventory, it’s integral to understand the cost of goods sold. Web additionally, the journal entry for the cost of goods sold with the reduction of the inventory is to reflect the actual balance of the inventory at the time of goods sold under the perpetual inventory system. The total value of goods a company has at the beginning of an accounting. The cost of goods sold entry records the total of all direct costs. You should record the cost of goods sold as a debit in your accounting journal. Web the cost of goods sold journal entry is: However, before passing a journal entry, this is necessary to find the value. It includes direct costs like raw materials and labor costs directly associated with the production of goods.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

But to calculate your profits and expenses properly, you need to understand how money flows through your business. Web the cost of goods sold journal.

Perpetual Inventory Systems

Web simply put, cogs accounting is recording journal entries for cost of goods sold in your books. This is a simple, effective way to stay.

How to Record a Cost of Goods Sold Journal Entry insurance1health

Web the journal entry is debiting inventory $ 20,000 and credit cost of goods sold $ 20,000. A second journal entry reduces the account inventory.

Recording a Cost of Goods Sold Journal Entry

The cost of goods sold entry records the total of all direct costs. Web cost of goods sold journal entry is a financial term that.

Calculate Cost of Goods Sold StepbyStep Guide MintLife Blog

This is a simple, effective way to stay on top of your numbers and maintain predictable, sustainable profit margins. But to calculate your profits and.

Completion of Sale & Finished Goods Journal Entries YouTube

In this post, we’ll discuss how to record a cost of goods sold journal entry in quickbooks online (qbo). Journal entry for goods sold for.

[Solved] Develop journal entries and find out the cost of goods sold

Web additionally, the journal entry for the cost of goods sold with the reduction of the inventory is to reflect the actual balance of the.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

You only record cogs at the end of an accounting period to show inventory sold. The entry to record this cost of goods sold is.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. Web these methods include the.

There Is A Simple Formula Associated With Calculating The Inventory Cost:

From the above examples of cost of goods sold general journal entry we can clearly understand the method followed to record. Web cost of goods sold journal entry is a financial term that refers to the total cost incurred to manufacture or purchase products that have been sold in a specific period. However, before passing a journal entry, this is necessary to find the value. Web a cost of goods sold account is created upon its sale that tells us what the cost of goods sold was.

The Components Of Cost Of Goods Sold Can Be Broken Down Into Four Key Parts:

The equation forinventory turnover is the cost of goods sold (cogs) divided by the average inventory. This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account. The total value of goods a company has at the beginning of an accounting. You should record the cost of goods sold as a debit in your accounting journal.

Web A Sale Of Goods Will Result In A Journal Entry To Record The Amount Of The Sale And The Cash Or Accounts Receivable.

Inventory turnover is also known as inventory turns, stockturn,. Web if we look at the physical inventory right after that sale, there are 9 bats left that cost $10 each, so the $90 in the accounting records for inventory is spot on. Running a business requires a lot of math. The cost of goods sold entry records the total of all direct costs.

For Example, A Local Spa Makes Handmade Chapstick.

Web cost of goods sold (cogs) is the cost of acquiring or manufacturing the products or finished goods that a company then sells during a period, so the only costs included in the measure are. Web this ratio tests whether a company is generating a sufficient volume of business based on its inventory. You then credit your inventory account with the same amount. If your business has inventory, it’s integral to understand the cost of goods sold.