Journal Entry T Account Example - In the journal entry, cash has a debit of $20,000. If barnes & noble inc. Debits and credits in different account types. Here are the events that take place. Web the corresponding journal entry for the above t account expenses example would look like this. What is a t account? The journal entry should increase the company's cash, and increase (establish) the capital account of mr. We are following paul around for the first year as he starts his guitar store called paul’s guitar shop, inc. Each general journal entry lists the date, the account title(s) to be debited and the corresponding amount(s) followed by the account title(s) to be credited and the corresponding amount(s). Web posting journal entries example.

T Account Template

The journal entry should increase the company's cash, and increase (establish) the capital account of mr. How are t accounts used in accounting? Understanding the.

T Account in Accounting Definition Example Template

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: This is posted.

4.4 Preparing Journal Entries Financial Accounting

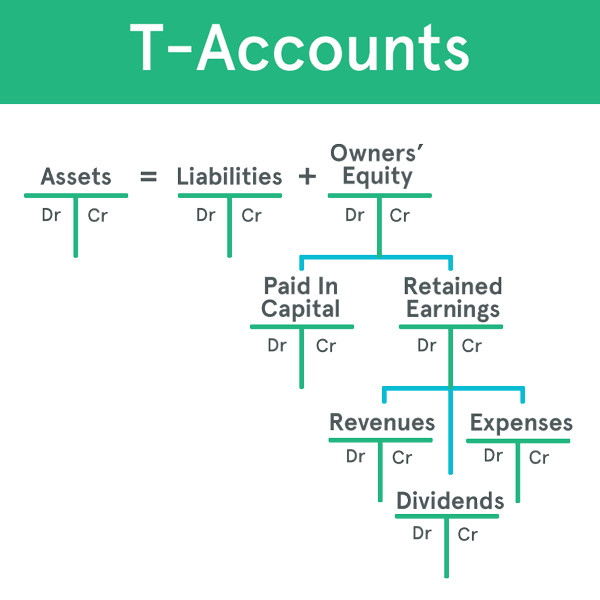

Every transaction your business makes requires journal entries. Sample entries with debits and credits for common scenarios. Another way to visualize business transactions is to.

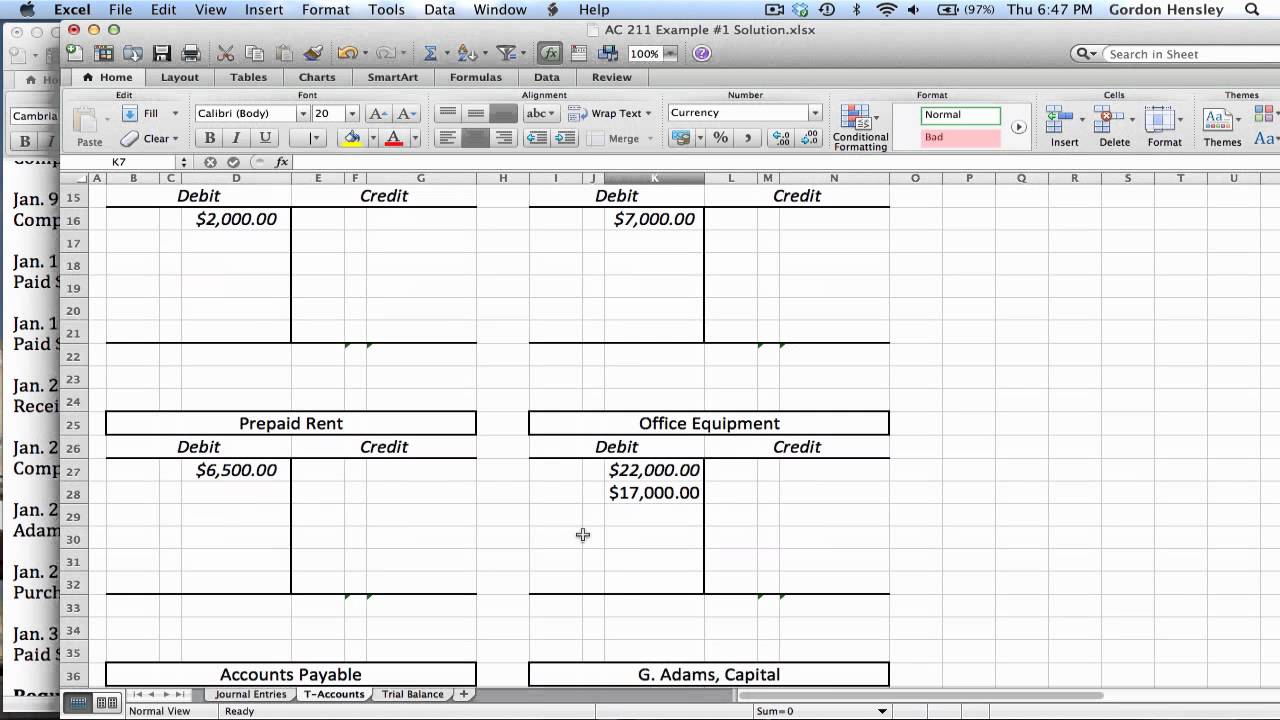

Intermediate Journal Entries, TAccounts, and Trial Balance

Web read along to learn about: Web here is an example of a t account entry: Use this template to visualize the accounting perspective of.

TAccounts and 3 columns. r/Accounting

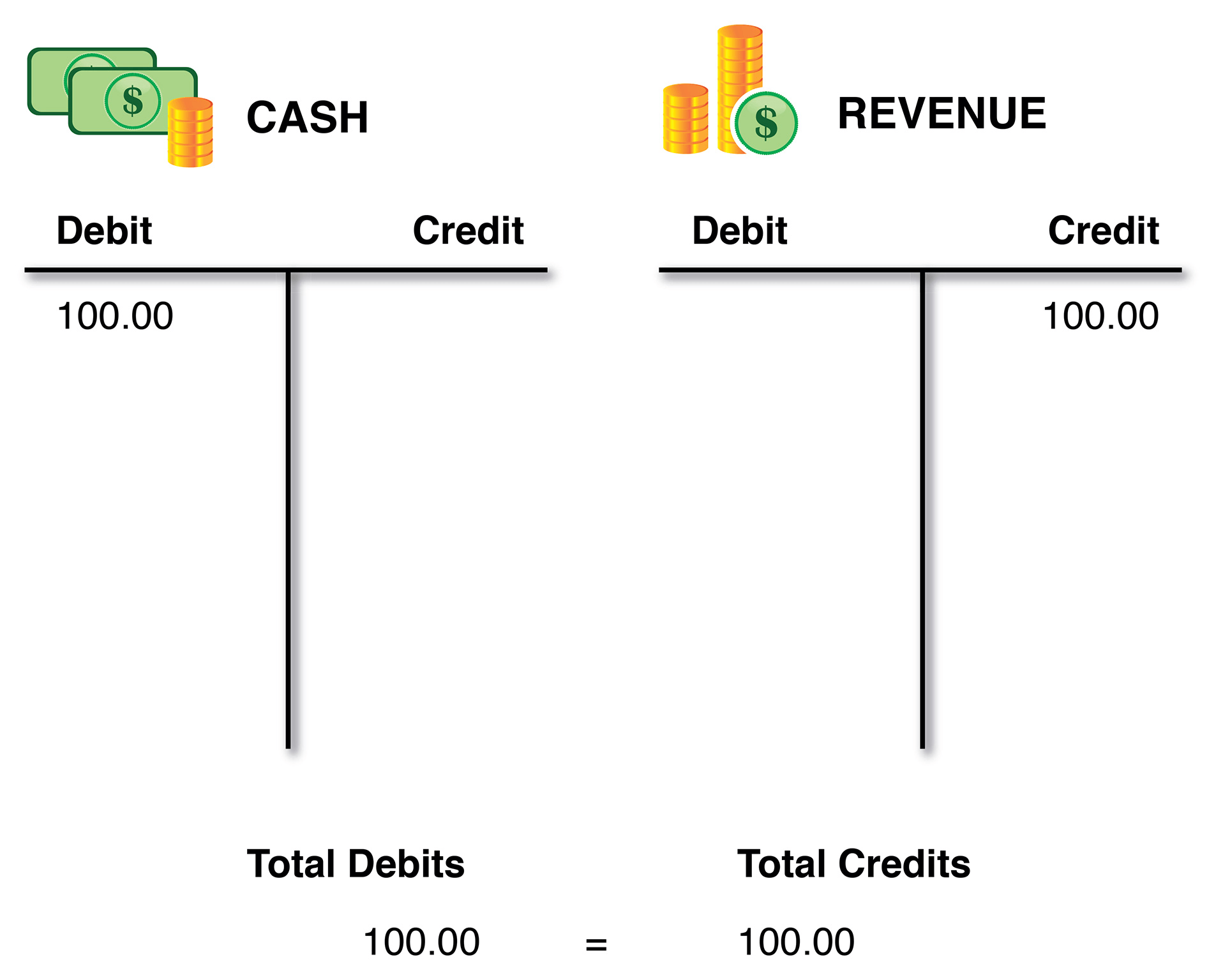

Debits and credits can mean either increasing or decreasing for different accounts, but their t account representations look the same in terms of left and.

Journal Entries, TAccounts, Trail Balance Demonstration Part 4 YouTube

The accounts to be credited are indented. Entry #2 — paul finds a nice retail storefront in the local mall and signs a lease for.

Journal Entries Examples Format How to Use Explanation

Web table of content. Web read along to learn about: This asset entry shows that j corp has sold a product valued at $10.000. Web.

Accounting Debits And Credits Chart

Debits and credits can mean either increasing or decreasing for different accounts, but their t account representations look the same in terms of left and.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

This system allows accountants and bookkeepers to easily track account balances and spot errors in journal entries. Automate your debit and credit accounting with vencru..

Learn More In Cfi’s Free Accounting Courses.

The following are the journal entries recorded earlier for printing plus. If barnes & noble inc. Understanding the difference between credit and debit is essential for this process. Web table of content.

This Means The Debit Account Is Seeing A $10,000 Increase In Cash, While The Value Of Its Inventory (Under “Credits”) Has Been Reduced By That Same Amount.

This asset entry shows that j corp has sold a product valued at $10.000. This t format graphically depicts the debits on the left side of the t and the credits on the right side. Each general journal entry lists the date, the account title(s) to be debited and the corresponding amount(s) followed by the account title(s) to be credited and the corresponding amount(s). How are t accounts used in accounting?

Here Are The Events That Take Place.

Every transaction your business makes requires journal entries. Entry #1 — paul forms the corporation by purchasing 10,000 shares of $1 par stock. A t account (or general ledger account) is a graphical representation of a general ledger account. The top is the name of the account.

This System Allows Accountants And Bookkeepers To Easily Track Account Balances And Spot Errors In Journal Entries.

Web these entries are recorded as journal entries in the company’s books. Normal balances, revenues & gains are usually credited, expenses & losses are usually debited, permanent & temporary accounts. Last modified december 2nd, 2019 by michael brown. Web posting journal entries example.

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)