Journal Entry For Amortization Of Patent - This gives the owner the exclusive right to make, use, and sell their invention. An intangible asset with an indefinite life is not. In accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset. Related articleaccounting for credit and cash purchase. Web how to amortize a patent. Assume mech tech purchased the patent for. Assuming the patent will last 40 years with no residual value and the ½ year rule applies, amortization expense will be. Web in such cases, amortization expense of $10,000 is recorded by debiting amortization expense for $10,000 and crediting the patent for $10,000. Web the firm would amortize the cost of a purchased patent over its finite life which reasonably would not exceed its legal life. Intangible assets with an indefinite life.

[Solved] I need help preparing journal entries for patent amortization

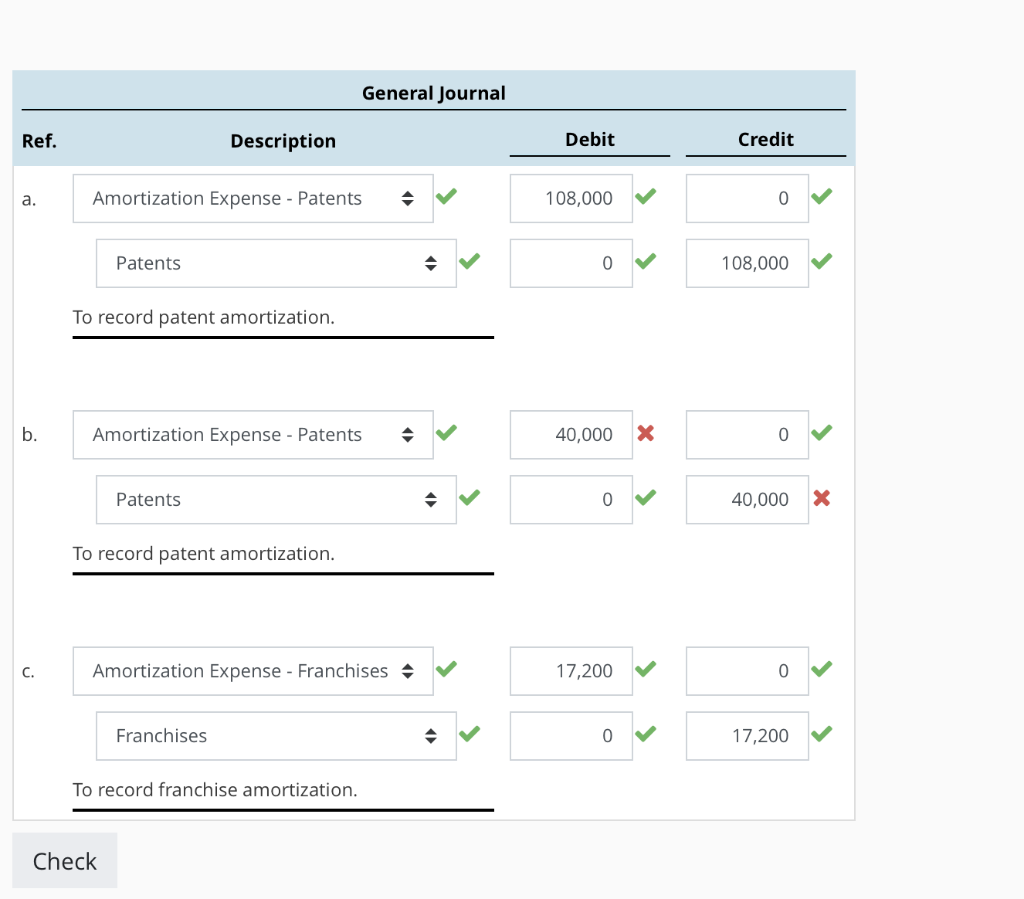

In accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset..

Chapter 10, Problem 25E Bookmark Show all steps O ON Problem Handling

Web like copyrights, patents are amortized over their useful life, which can be shorter than twenty years due to changing technology. Assume mech tech purchased.

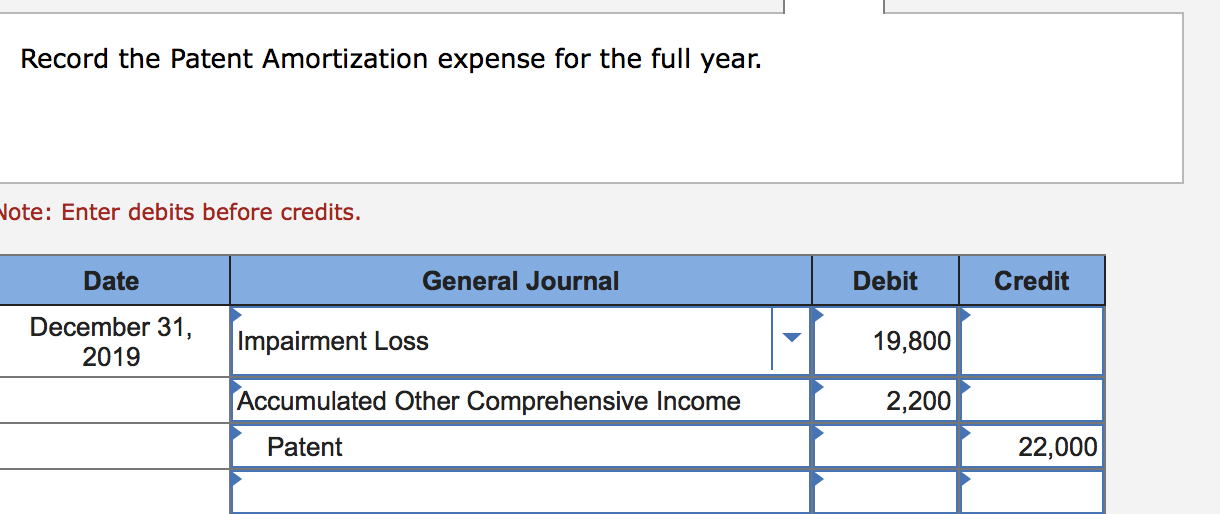

[Solved] . Impaired Goodwill and Amortization of Patent On April 1, a

To record an amortization journal entry, find: No one can copy or use the invention without the patent owner’s permission. You must record all amortization.

Journal Entry for Amortization with Examples & More

For example, $50,000 of amortization on a patent would be recorded: To record an amortization journal entry, find: It is recorded as an intangible asset.

Solved Amortization Expense For Each Of The Following Unr...

You must record all amortization expenses in your accounting books. Web the journal entry for amortization credits the asset directly. There is usually not a.

Intangibles

Web example & journal entries. For example, $50,000 of amortization on a patent would be recorded: Web how to amortize a patent. See if you.

Breathtaking Amortization Of Patent Cash Flow Statement Financing

To record an amortization journal entry, find: Intangible assets with an indefinite life. Patents need to be amortized regularly over the course of their life..

Solved The following transactions and adjusting entries were

A patent is a legal right provided by the government to the inventor or the owner of an invention (if a patent is sold). Patents.

Cómo calcular la amortización de una patente 10 pasos

Web amortization is the process of gradually writing off an asset's initial cost, and it only applies to intangible assets. No one can copy or.

Web The Journal Entry For The Patent Amortization Will Increase The Total Amortization Expenses On The Income Statement While Decreasing The Total Assets On The Balance Sheet By The.

There is usually not a separate accumulated. In accounting, amortization is the allocation of the cost of the intangible asset over the periods that the company receives the benefits from the asset. It’s calculated by taking the difference between the asset's cost and. Web the journal entry for amortization credits the asset directly.

Web Amortization Journal Entry.

Report the preliminary patent price on the corporate ledger as an. Web debit the amortization expense to the amortization expense account in a new journal entry at the end of each accounting period of the patent’s useful life. Web the firm would amortize the cost of a purchased patent over its finite life which reasonably would not exceed its legal life. Web the amortization is recorded with the following bookkeeping journal entry.

Patents Need To Be Amortized Regularly Over The Course Of Their Life.

It is recorded as an intangible asset on. See if you can determine the amortization. Web amortization is the process of gradually writing off an asset's initial cost, and it only applies to intangible assets. Web in such cases, amortization expense of $10,000 is recorded by debiting amortization expense for $10,000 and crediting the patent for $10,000.

If A Patent Cost $40,000 And Has A Useful Life Of 10 Years,.

Web the appropriate entries are: Unlike pp&e, notice that the preceding annual amortization entry credits the asset account directly. Web when recording the cost of a patent in the accounting books, an amortization expense must be debited and an accumulated amortization credit must be recorded in the. For example, $50,000 of amortization on a patent would be recorded: