Payroll Expense Journal Entry - On the due date, company. This entry usually includes debits for the direct labor expense, salaries, and the company's. Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web in addition the employer payroll tax liability needs to be recorded with the following payroll journal entry: In addition to the salaries recorded. Michael cohen's invoice dated feb. Web journal entries record the entire spectrum of monetary transactions performed by a business, including the buying and selling of goods and services, expenses, company. Web what is a payroll journal entry? The first entry is the expense charged to the income statement, and the. Web payroll can be one of the largest expenses and potential liabilities for a business.

Accrued expenses journal entry and examples Financial

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web recording the.

Accounting Journal Entries For Dummies

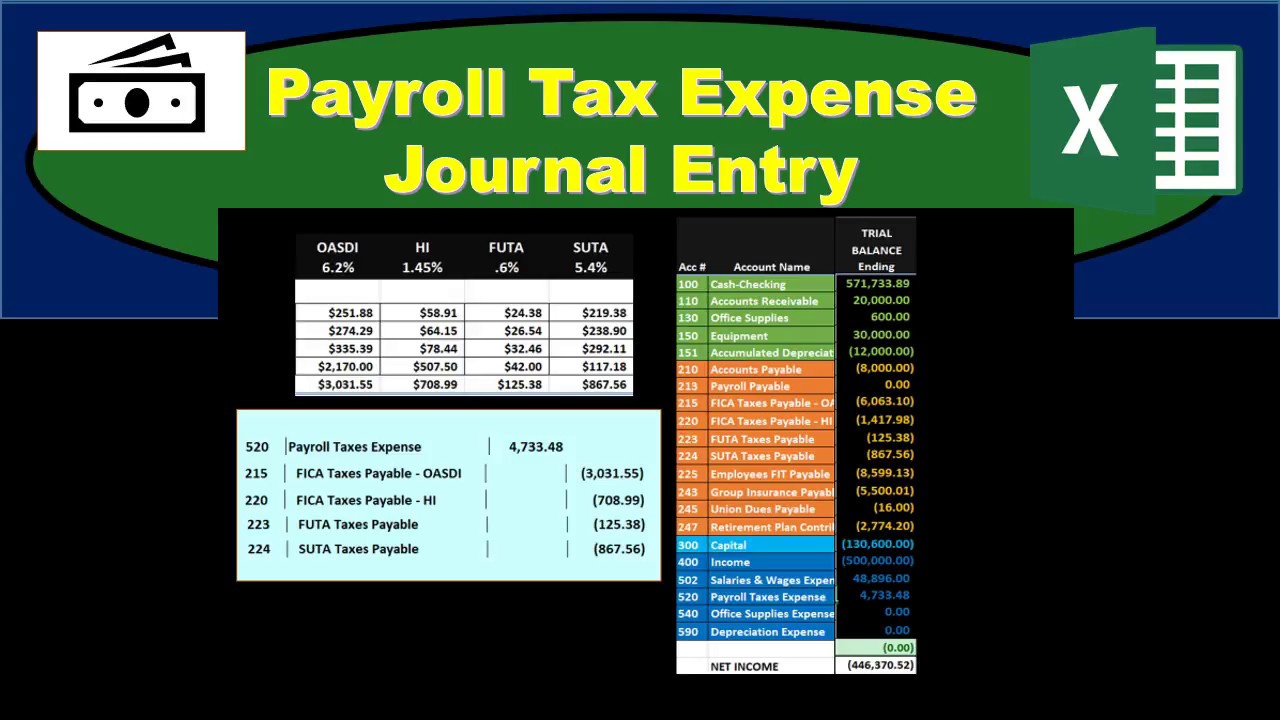

Web in addition the employer payroll tax liability needs to be recorded with the following payroll journal entry: Accruing payroll liabilities, transferring cash, and making.

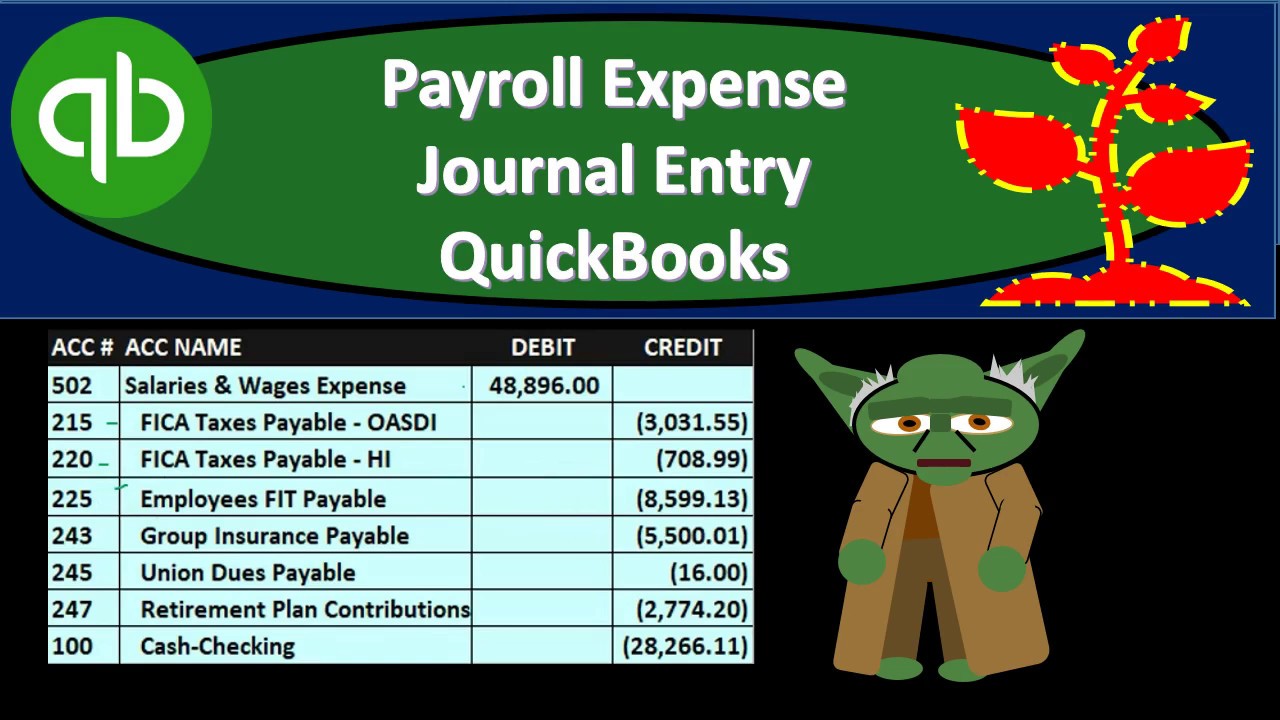

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

Accruing payroll liabilities, transferring cash, and making payments. Assume a company had a payroll of $35,000 for the month of april. You don’t make a.

Payroll Journal Entry Example Explanation My Accounting Course

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: A payroll journal.

Payroll Expense Journal EntryHow to record payroll expense and

Web payroll journal entries record your workers’ pay alongside overall business expenses. Web journal entries record the entire spectrum of monetary transactions performed by a.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web a payroll journal records each payroll transaction through entries like journal entry wages and payroll tax expense journal entries. Web journal entries for expenses.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web here are the primary types of payroll journal entries: Accruing payroll liabilities, transferring cash, and making payments. Web salaried payroll entry #1: Web for.

80 Payroll Tax Expense Journal Entry u YouTube

There are diverse types of payroll journal entries, including: Web the journal entry is debiting payroll expense $ 50,000 and credit salary tax payable $.

Wave Payroll All about the bookkeeping Help Center

On the due date, company. While the process may look different for every company, payroll ledgers can include. A payroll journal entry is a method.

Web Here Are The Primary Types Of Payroll Journal Entries:

In addition to the salaries recorded. In contrast, a payroll ledger. Web journal entries record the entire spectrum of monetary transactions performed by a business, including the buying and selling of goods and services, expenses, company. Web for the first kind of payroll journal entry, it is important to realize that you only do one entry for all employees.

While The Process May Look Different For Every Company, Payroll Ledgers Can Include.

A payroll journal entry is a method of accrual accounting, in which a business records its debit and credit payroll transactions pertaining to employee. Web hourly payroll entry #1: Web a payroll journal records each payroll transaction through entries like journal entry wages and payroll tax expense journal entries. Web the journal entry is debiting payroll expense $ 50,000 and credit salary tax payable $ 5,000, social security payable $ 8,000, cash $ 37,000.

Web The Payroll Expense Equals The Accrued Gross Salaries Plus Employer Payroll Taxes And The Amount Paid To Employees Is Net Of Any Employee Payroll Taxes.

They display gross employee pay, direct employee expenses,. Web salaried payroll entry #1: Web payroll journal entries fall under the payroll account and are part of your general ledger. Record the following expenses in your payroll account:

This Entry Records The Gross Pay.

Web payroll journal entries record the payroll expenses of the company. One method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer. Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. That way, you can look back and see details about employee.