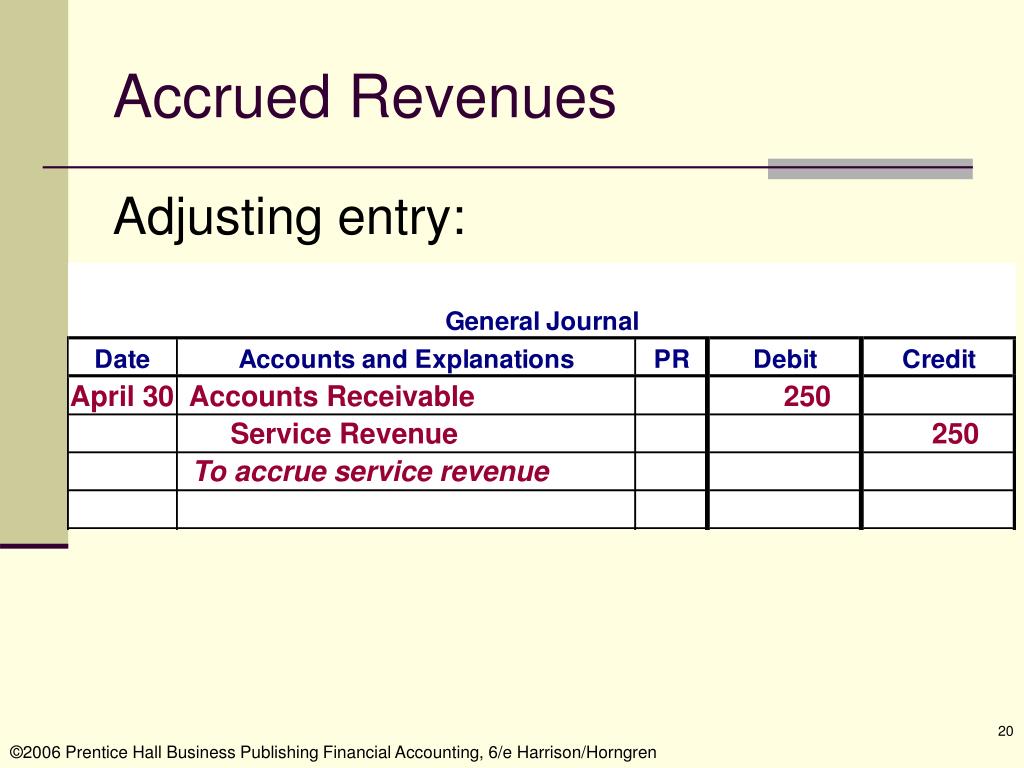

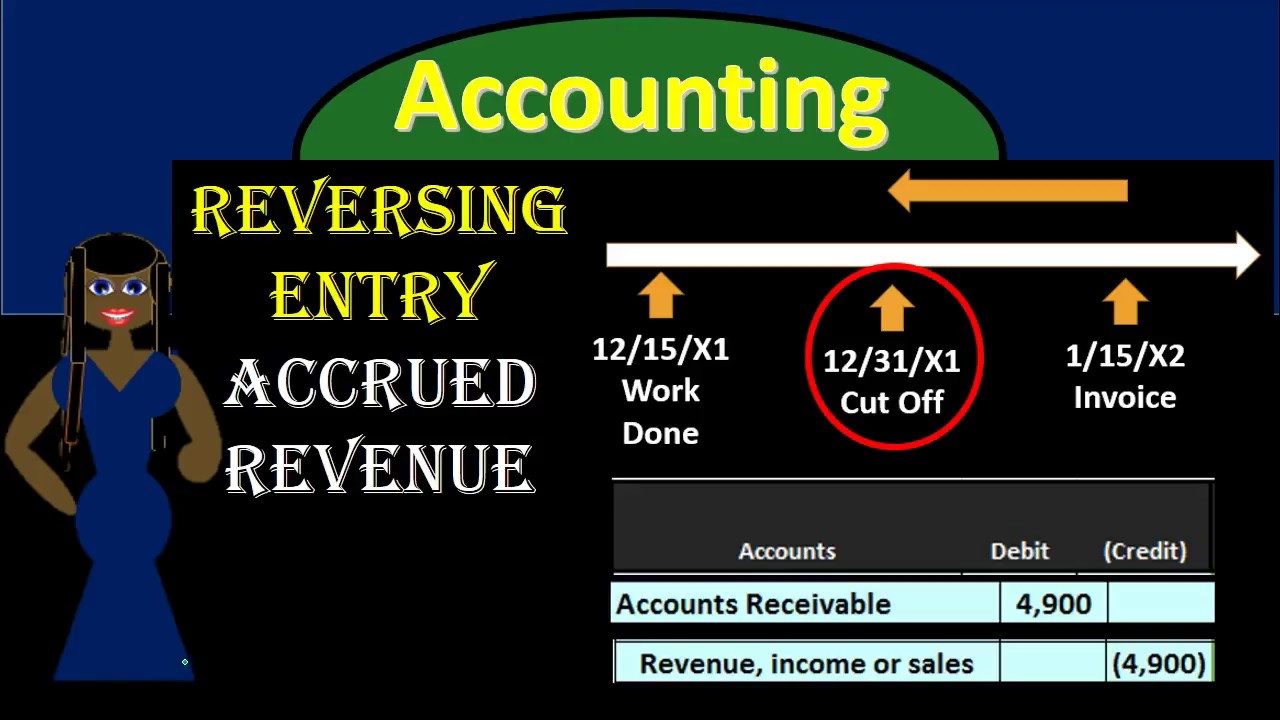

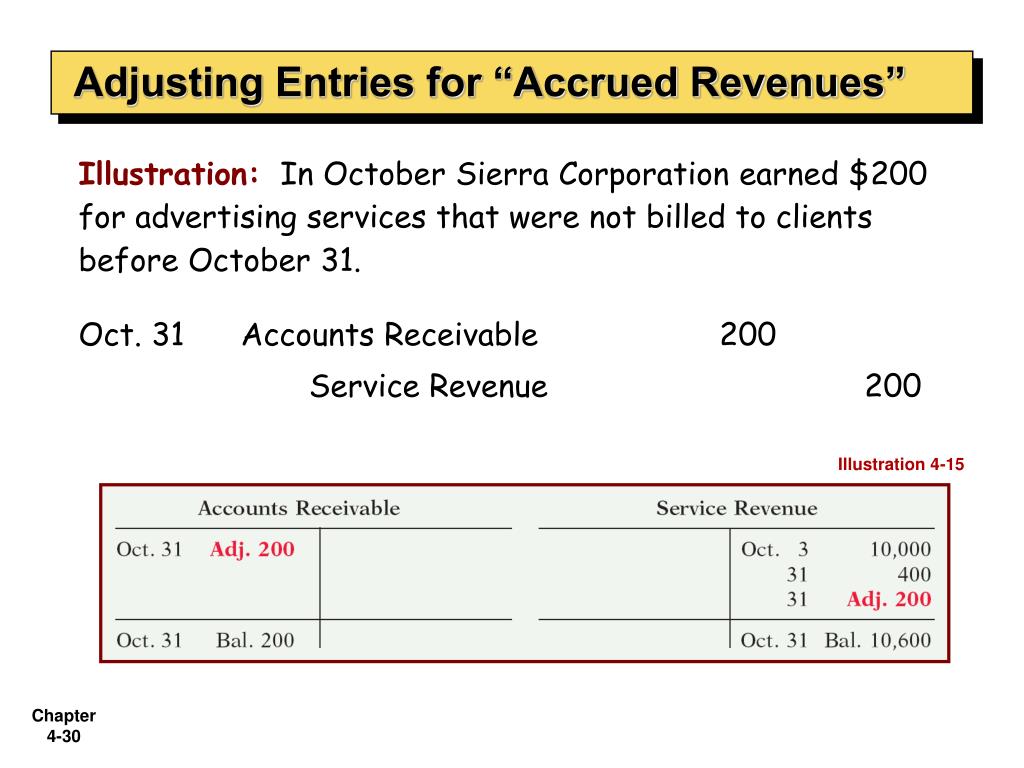

Journal Entry For Accrued Revenue - It is classified as current assets on the balance sheet, whereas on the. Accruals refer to the recording of revenues a company has earned but has yet to receive payment for, and expenses that have been incurred but the company has. See examples of accrued revenue for product sales, services and interest. Accrued revenue entry leads to cash receipts. Adjusting entries at the end of the each accounting period to debit accrued accounts. Web learn what accrued revenue is, how to record it and when to reverse it in accounting. Web the journal entry to record accounts receivable balance and the associated accrued revenues for the customer is as follows. Web journal entry for accrued income recognizes the accounting rule of “debit the increase in assets” (modern rules of accounting). Deferred revenue is when the revenue is spread over time. Web the adjusting entry to record an accrued revenue is:

Accruals and Prepayments Journal Entries HeathldDunn

Deferred revenue is when the revenue is spread over time. Accrued revenue or accrued income account (a newly opened account) cr.: Find out how to.

300 Reversing Journal Entries Accrued Revenue YouTube

Web accrued revenue is shown as adjusting journal entries under the current assets category in the balance sheet and as an earned revenue in the.

Accrued Expenses Journal Entry How to Record Accrued Expenses With

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it.

PPT Accrual Accounting Concepts PowerPoint Presentation, free

Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales transactions.

Journal Entries Accounting

Before recognizing the accrued revenue for a. An adjusting journal entry is usually made at the end of an accounting period to recognize an income.

Accrued revenue how to record it in 2023 QuickBooks

Web the adjusting entry to record an accrued revenue is: An adjusting journal entry is usually made at the end of an accounting period to.

Accrued Revenue Definition, Examples, and How To Record It

Web in order to record accrued revenue, you should create a journal entry that debits the accrued billings account (an asset) and credits a revenue.

PPT Accrual Accounting and the Financial Statements Chapter 3

It is classified as current assets on the balance sheet, whereas on the. Web the entry of accrued revenue entry happens for all the revenue.

How to use Excel for accounting and bookkeeping QuickBooks

Web how is accrued revenue recorded in journal entries? Deferred revenue is when the revenue is spread over time. Find out how to record. Web.

Adjusting Entries At The End Of The Each Accounting Period To Debit Accrued Accounts.

Web how is accrued revenue recorded in journal entries? Web learn what accrued revenue is, how to record it and when to reverse it in accounting. Web the entry of accrued revenue entry happens for all the revenue at once. Web accrued revenue is shown as adjusting journal entries under the current assets category in the balance sheet and as an earned revenue in the income statement of the company.

Deferred Revenue How To Calculate And Record Accrued (Unbilled) Revenue The Role Of Accrued Revenue In Financial Analysis.

Web learn how to record accrued revenue in the correct accounting period with journal entries. Web accrued revenue journal entries are passed and accounted under the amount receivables in the balance sheet of the company to reflect the value that their. Deferred revenue is when the revenue is spread over time. Web journal entry for accrued income recognizes the accounting rule of “debit the increase in assets” (modern rules of accounting).

Web As Per The Example, The Journal Entry For Accrued Revenue Shall Be As Follows:

Last updated january 29, 2024. Web accounting for accrual of revenues involves the following journal entries: Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales transactions that occurred during that accounting period but were not yet billed. Web learn the definition, principles, and examples of accrued revenue, a type of receivable that occurs when you provide a product or service before payment.

See Examples Of Accrued Revenue For Product Sales, Services And Interest.

Web the adjusting entry to record an accrued revenue is: Accrued revenue entry leads to cash receipts. Web the journal entry to record accounts receivable balance and the associated accrued revenues for the customer is as follows. See an example of accrued revenue for services performed and received in different.

:max_bytes(150000):strip_icc()/accrued-revenue-Final-ae2075d1acbb46d18adb27838b33751c.jpg)