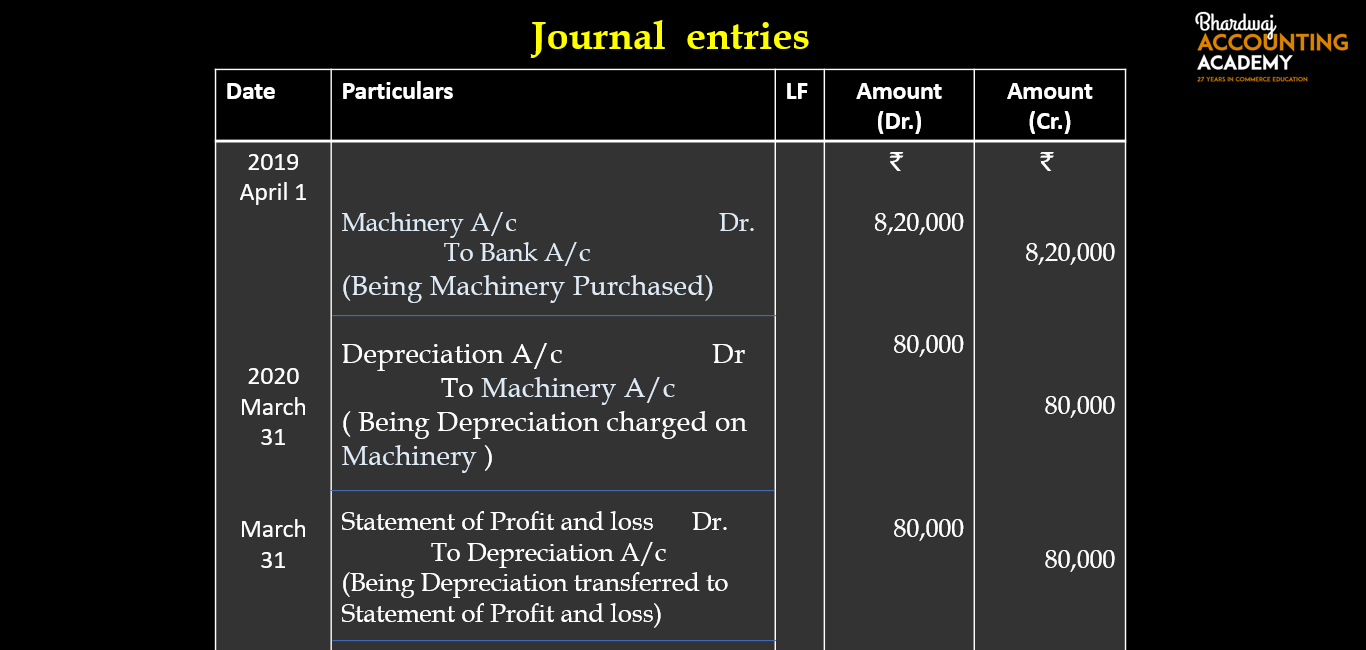

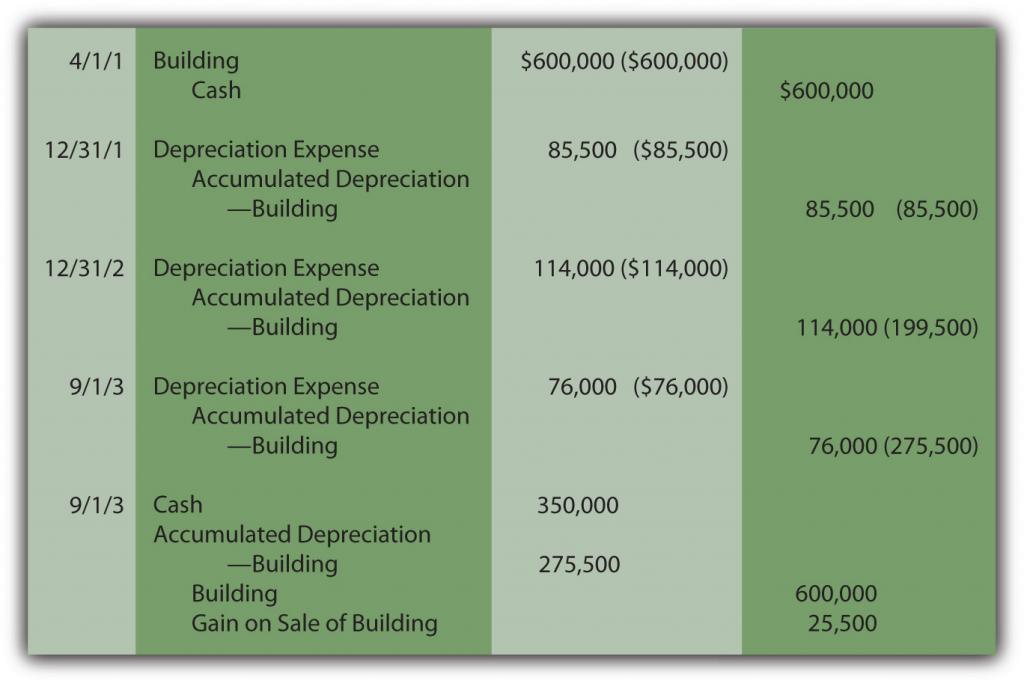

How To Record Depreciation Journal Entry - The straight line method depreciates the asset at a constant rate over its useful life. Web adjusting entries include accruals for revenue and expenses, deferrals for prepayments, estimates for depreciation and provisions for doubtful accounts. Web to record depreciation, a journal entry is made at the end of each accounting period, debiting the depreciation expense account and crediting the accumulated depreciation account. Web straight line method. The journal entry for year 2 is as follow: We simply record the depreciation on debit and accumulated depreciation on credit. Journal entry for year 2. We'll work through a straight l. Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting system. Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the respective fixed asset account will be credited.

What is the journal entry for depreciation? Leia aqui What is

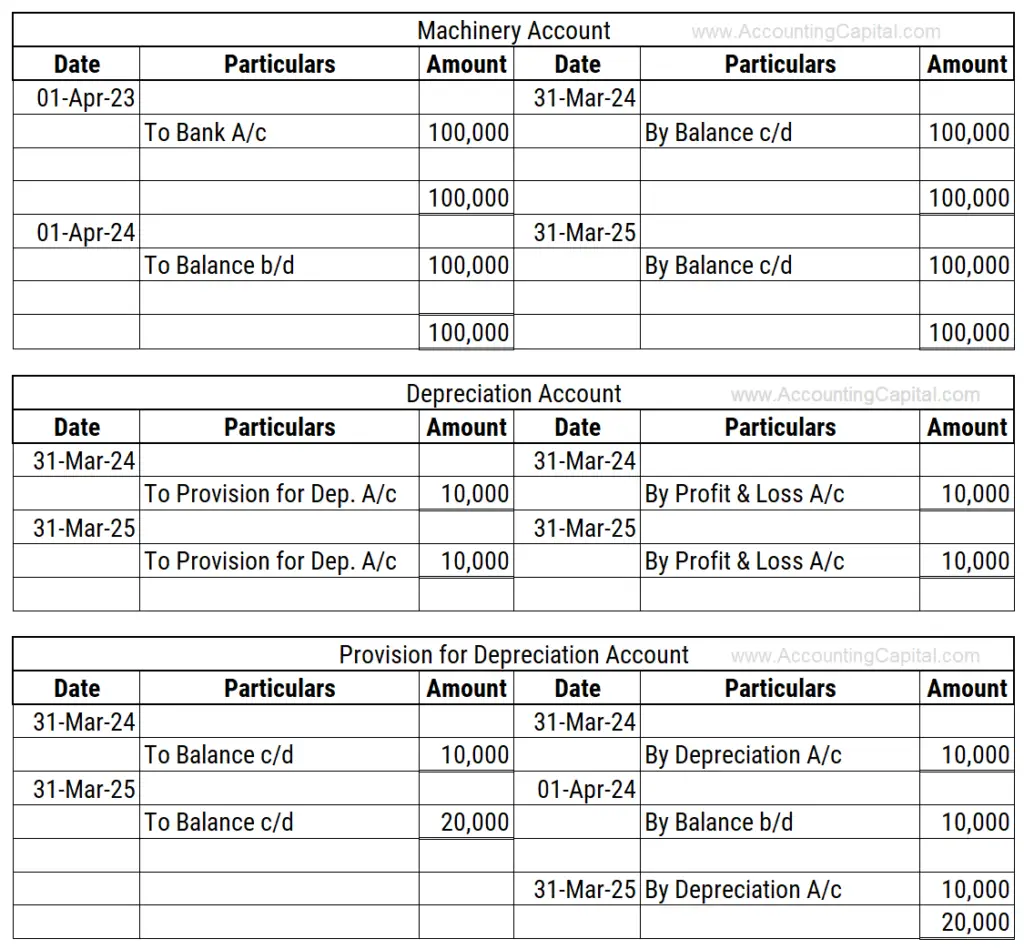

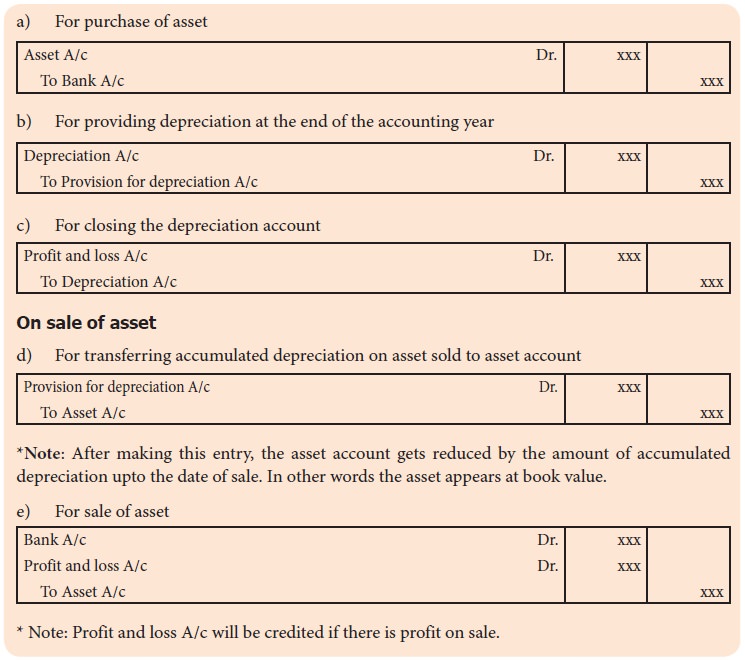

One is where the depreciation account is debited and accumulated depreciation account is credited. For example, manufacturing equipment is a fixed asset class. The depreciation.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Further details on using the method can be found in our straight line depreciation tutorial. The income statement account depreciation expense is a temporary account..

Journal Entry for Depreciation Example Quiz More..

Depreciation is a measure of how much of an asset's value has been depleted over the depreciation schedule or period. One is where the depreciation.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

One is where the depreciation account is debited and accumulated depreciation account is credited. Web adjusting entries include accruals for revenue and expenses, deferrals for.

Depreciation Journal Entry With Example Howto Diy Today

The journal entry for year 2 is as follow: Web © 2024 google llc. Web the journal entry for depreciation is: Depreciation expense will impact.

Depreciation journal Entry Important 2021

Web recording journal entry of accumulated depreciation. Web how to record depreciation expense. Web the company can make depreciation expense journal entry by debiting the.

Journal Entry for Depreciation Example Quiz More..

These entries align financial statements with actual economic activity, ensuring accurate and transparent reporting.there are six types of adjusting entries. We'll work through a straight.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

Web a depreciation journal entry is used at the end of each period to record the fixed asset or plant asset depreciation in the accounting.

Depreciation Recapture Definition ⋆ Accounting Services

Web straight line method. Bookkeeping for assets ensures financial statements accurately reflect the company’s value. These entries align financial statements with actual economic activity, ensuring.

Record The Initial Purchase On The Date Of Purchase, Which Places The Asset On The Balance Sheet (As Property, Plant, And Equipment) At Cost, And Record The Amount As Notes Payable, Accounts Payable, Or An Outflow Of Cash.

One is where the depreciation account is debited and accumulated depreciation account is credited. Web how to record depreciation expense. Web depreciation journal entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear, normal usage or technological changes, etc., where the depreciation account will be debited, and the respective fixed asset account will be credited. Journal entry for year 2.

Get The Close Checklist For Client Accounting Services Firms.

Web the journal entry to record the purchase of the laptop is as follows: Web the journal entry to record this expense is straightforward. It is a balance sheet item which its normal balance is on the credit side. The straight line method depreciates the asset at a constant rate over its useful life.

Depreciation Expense Will Impact The Income Statement And Deduct Company Profit.

Before you record depreciation, you must first select the depreciation method—and the depreciation method must be uniform for all classes of assets. At the end of every year, fixed assets of the company are depreciated by charging the depreciation expenses. In year 1, the journal entry is as follow: Web adjusting entries include accruals for revenue and expenses, deferrals for prepayments, estimates for depreciation and provisions for doubtful accounts.

Web To Reflect The Decrease In The Value Of An Asset, Businesses Use Depreciation To Record Journal Entries Accurately.

Consequently the depreciation charge will be the same for each accounting period. The depreciation journal entry records the passage of time and the use of an asset. Web the journal entry to record depreciation is fairly standard. This depreciation expense adds the balance of the accumulated depreciation account.