Journal Entry For A Sale - It does not only record the cost of purchase, the sales journal entry also notes the date, time, sales tax, and so much more in the sales journal. Web a sales journal entry is a journal entry in the sales journal to record the sale of inventory on credit. Web accounting for a sales return involves reversing (a) the revenue recorded at the time of original sale, and (b) the related cost of goods sold. A sales journal entry records the generated by the sale of goods or services. For a business using the periodic inventory system, we only have one journal. Web a sales journal is a type of journal used to record credit sale transactions of the company and is used for maintenance and tracking the account receivable and inventory account. When you credit one account, you debit another. Web the following journal entry is required. Web a sales revenue journal entry records the income earned from selling goods or services, debiting either cash or accounts receivable and crediting the sales revenue account. Some accounts are increased by debits and decreased by credits.

How to Pass Journal Entries for Purchases Accounting Education

I have sold my business and have a. Web credit and debit journal entry. The journal entry for a cash sale actually involves two possibilities..

6.4 Analyze and Record Transactions for the Sale of Merchandise Using

Web here are a few different types of journal entries you may make for a sale or a return depending on how your customer paid..

journal entry format accounting accounting journal entry template

Web a sales revenue journal entry records the income earned from selling goods or services, debiting either cash or accounts receivable and crediting the sales.

SALES JOURNAL Accountaholic

When you credit the revenue account, it means that your total. This means every transaction has a plus and. In this case, the debtor’s account.

Sales Journal Entry How to Make Cash and Credit Entries

It is the principal book of credit sale transactions, and the. Every entry contains an equal debit and credit along with the names of the.

Bir Cash Receipts Journal Sample Master of Documents

Some accounts are increased by debits and decreased by credits. The journal entry for a cash sale actually involves two possibilities. It is the principal.

Sales Tax Payable Journal Entries YouTube

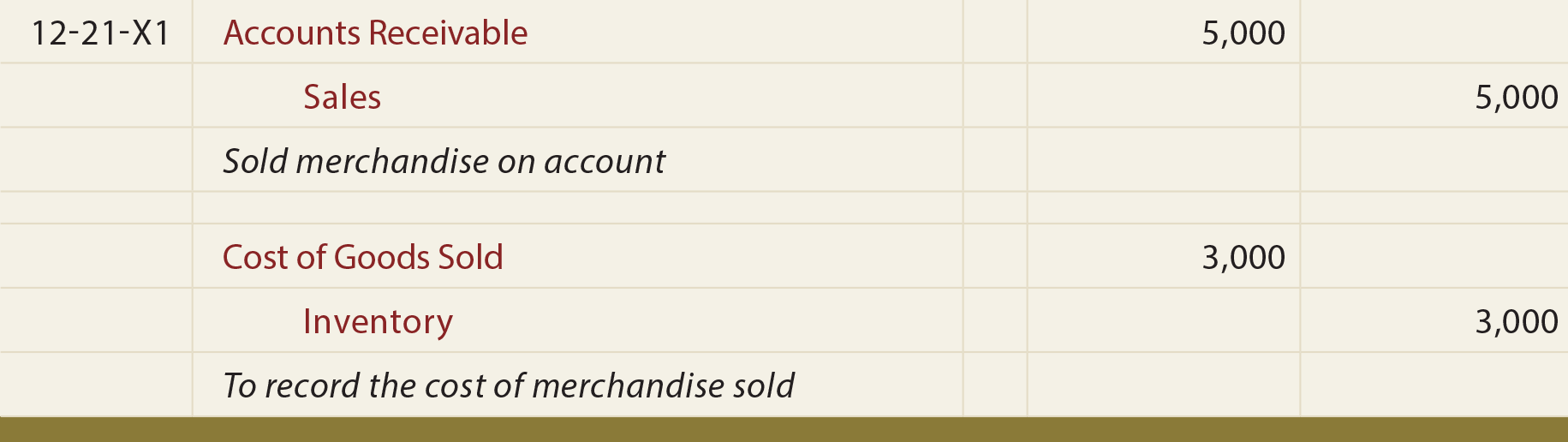

The accounting records will show the following bookkeeping entries for the sale of inventory on account: Web a daily entrance fee or a deauville annual.

Journal Entry Examples

How do you record a cash sale in a journal entry? For a business using the periodic inventory system, we only have one journal. The.

Perpetual Inventory

Web what is the sales journal entry? How do you record a cash sale in a journal entry? These entries also reflect any changes to.

Web A Sales Journal Entry Is A Sale Entry Made In The Sales Journal When A Customer Purchases A Product.

It is the principal book of credit sale transactions, and the. Web an accounting journal entry is the written record of a business transaction in a double entry accounting system. Web a sales revenue journal entry records the income earned from selling goods or services, debiting either cash or accounts receivable and crediting the sales revenue account. The exact double entries we do depends on which inventory system the business uses.

Web Sales Credit Journal Entry Refers To The Journal Entry Recorded By The Company In Its Sales Journal When The Company Makes Any Sale Of The Inventory To A Third Party On Credit.

What are the correct journal entries for the sale of a business per the closing statement and associated closing entries for capital assets? Web journal entry for sales example & guide | accountant town. Businesses make their money by selling goods or services. Web credit and debit journal entry.

For A Business Using The Periodic Inventory System, We Only Have One Journal.

In recording a journal entry for sales, you’ll need to pass entry for sales—that is, move the information to all of the different accounts where it needs to be recorded. To create a journal entry in your general ledger or for a sale, take the following steps. Web the following journal entry is required. When you credit the revenue account, it means that your total.

This Would Be Journalized As.

The credit sale of inventory affects accounts receivable, revenue accounts, inventory, and the cost of goods sold account. Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. Web if for example, sales are made on credit to customer a for 200 and customer b for 400 the first entry would be to the sales day book to record the sales. Debit the cash account for the total amount that the customer.