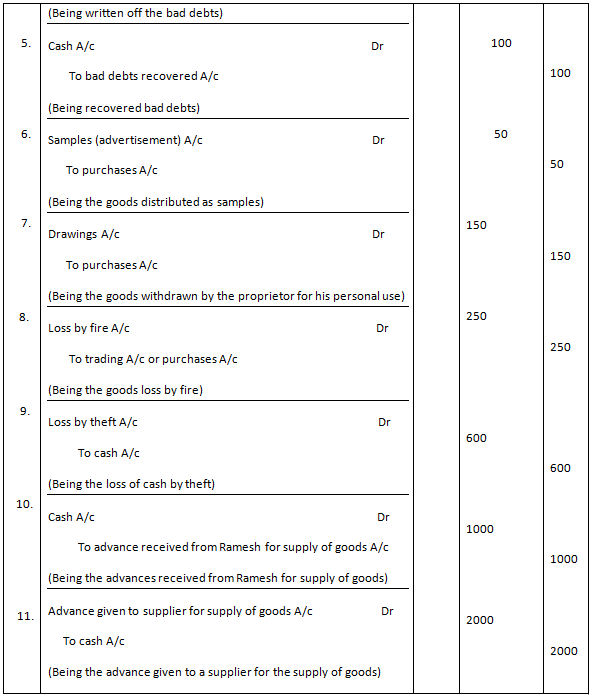

Journal Entry For Write Off - This will be a credit to the asset account. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. The inventory write off journal entry is as follows: Allowance for doubtful accounts x. Allowance for doubtful debts is. Web following journal entry shall be recognized to account for the cancellation of liability: Debit bad debts expense (reports the loss on the firm’s income statement) credit accounts receivable (eliminates the amount that can not be collected) journal entry for allowance method: One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt expense in the income statement of the business. Irreparable damage to inventory (e.g., flood, hurricane) spoilage of perishable inventory. If you're making a write off entry in sap, the your software.

Recovering Writtenoff Accounts Wize University Introduction to

$9,000 shall be reported as an operating expense in his income statement for the year ended 2019 and accounts receivable on his balance sheet shall.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Debit bad debts expense (reports the loss on the firm’s income statement) credit accounts receivable (eliminates the amount that can not be collected) journal entry.

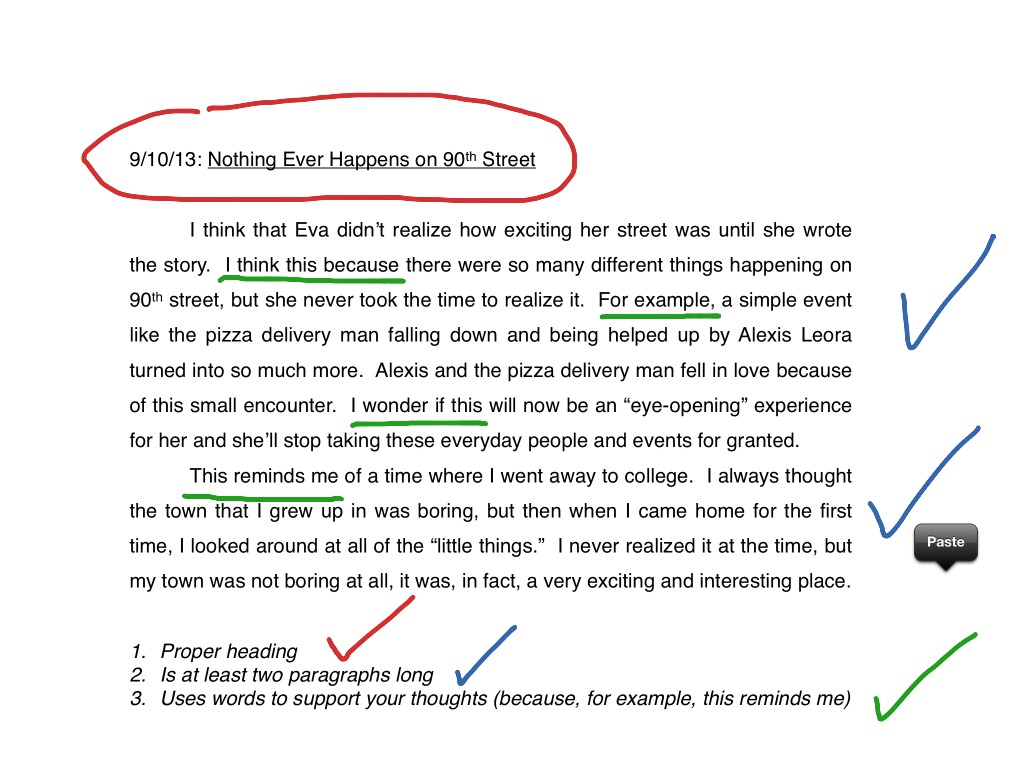

How To Write a Journal Entry english, Writing, Reading ShowMe

As the name suggests, this method will directly remove accounts receivable to bad debt expenses. The journal entry is a debit to the bad debt.

Journal Entry Problems and Solutions Format Examples

Web inventory write off journal entry. The credit above reduces the amount down to zero. One method of recording the bad debts is referred to.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

Agreement may specify a term over which the creditor has to claim the outstanding amount at the expiry of which the debtor seizes to be.

A Beginner's Guide to Journal Entries A and M Education

Web steps to write off accounts receivable. Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account.

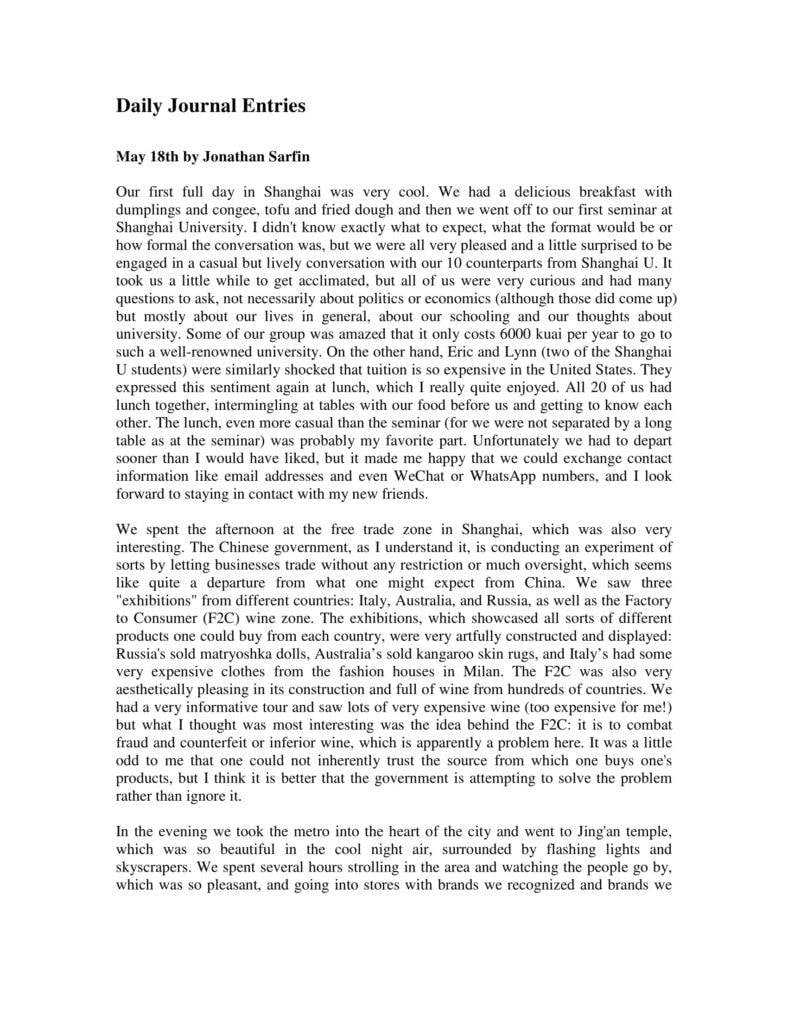

5+ Daily Journal Entry Templates PDF

Web direct write off method. Web create a journal entry to write off the appropriate amount of the asset. Web journal entry for writing off.

What is Journal Entry? Example of Journal Entry

Web the bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt.

Sample Journal Entries Writing Your Life

Web steps to write off accounts receivable. The accounting records will show the following bookkeeping entries for the bad debt write off. The inventory write.

The Inventory Write Off Journal Entry Is As Follows:

Web following journal entry shall be recognized to account for the cancellation of liability: Web nate should pass the following journal entry in his books to write off serena from his accounts receivable: Web journal entry for writing off uncollectible account. Web journal entry for the bad debt provision.

Web Create A Journal Entry To Write Off The Appropriate Amount Of The Asset.

The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense. The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. The amount owed by the customer 200 would have been sitting as a debit on accounts receivable. Allowance for doubtful accounts x.

Learn How To Write Off Accounts Receivable Under The Allowance Method And The Direct Write Off Method With Journal Entry Examples.

The accounting records will show the following bookkeeping entries for the bad debt write off. It’s important to note that the creation of allowance in the balance sheet requires recording expenses in the income statement. When it is determined that the receivable is no longer collectible, the company writes it off. Merits and demerits of direct write off technique.

This Will Be A Credit To The Asset Account.

The credit above reduces the amount down to zero. It can be to an expense account, if no reserve was ever set up against the asset in the past. Agreement may specify a term over which the creditor has to claim the outstanding amount at the expiry of which the debtor seizes to be liable for the amount due towards the payable. The journal entry is a debit to the bad debt expense account and a.