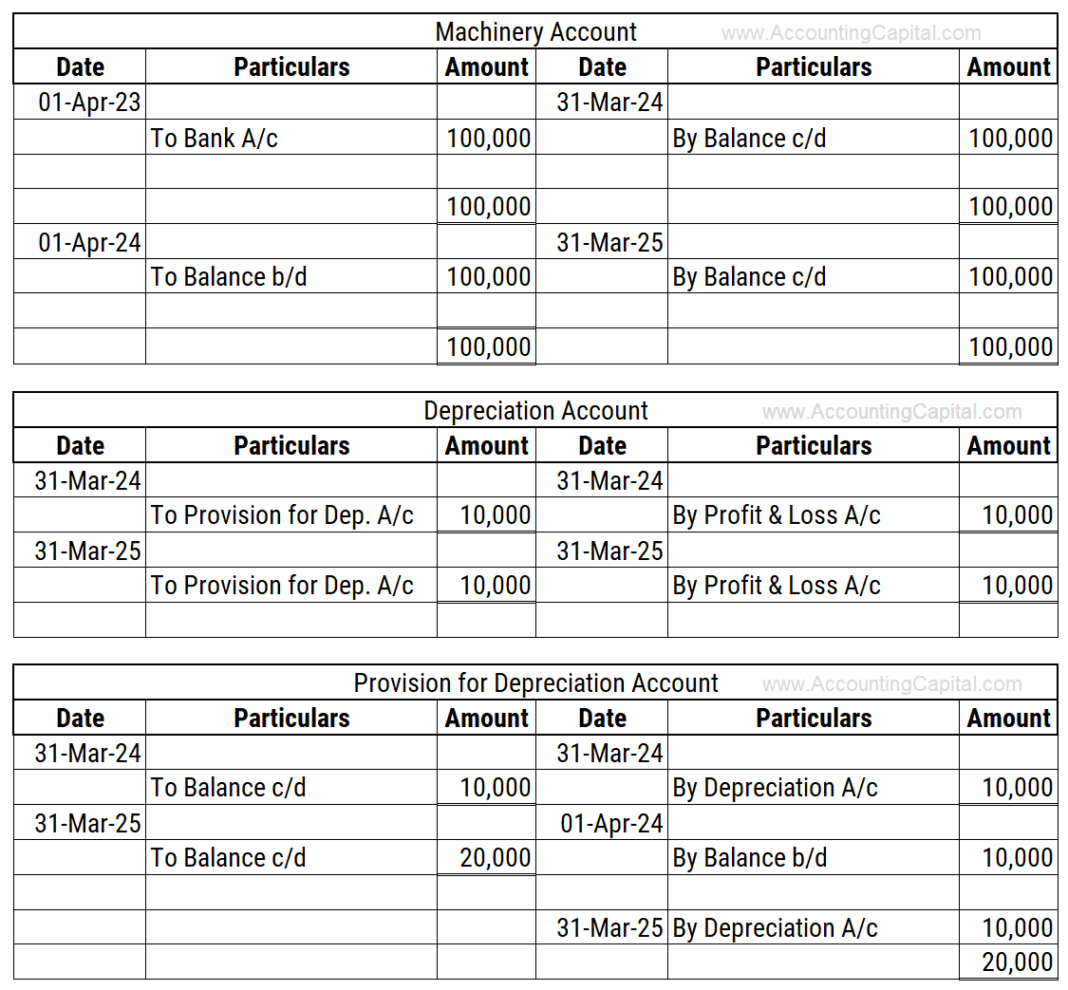

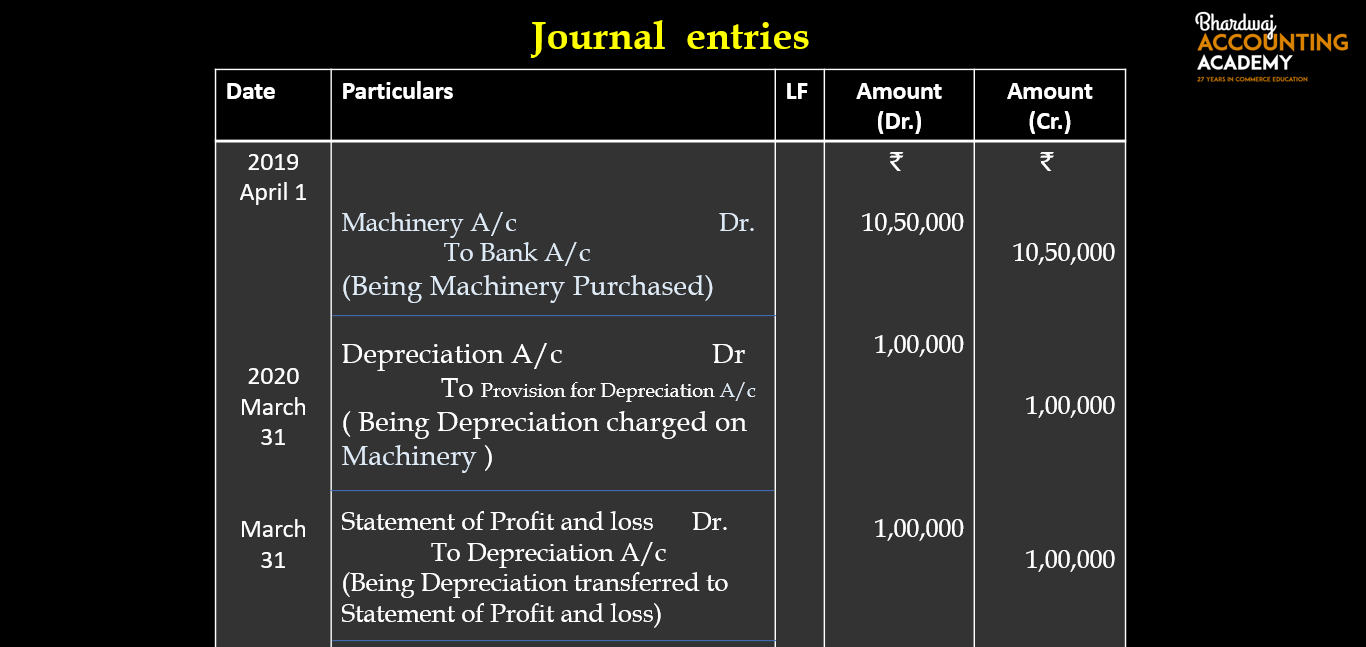

Journal Entry Example Depreciation - $1,950 ÷ 12 = $162.50. Depreciation expense can be recorded using the following journal entry: Expenses that have a useful life of multiple years are written off via an accounting method called depreciation. Web the journal entry for depreciation is: In year 2, the total. Debit to the income statement account depreciation expense. Web the journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal entry to the accumulated. A lorry costs $4,000 and will have a scrap value of $500 after continuous use of 10. Let’s assume that a piece of machinery worth 100,000 was purchased on april 1st 2023, with a scrap value of nil and a. Debit to depreciation expense, which flows through to the income statement.

Journal Entry for Depreciation Example Quiz More..

The following facts are available: The following three are most common: Web here are four easy steps that’ll teach you how to record a depreciation.

What is the journal entry for depreciation? Leia aqui What is

The meaning and measurement of place. Credit to the balance sheet account accumulated depreciation. By debiting the depreciation expense and crediting accumulated depreciation, the book.

Depreciation and Disposal of Fixed Assets Finance Strategists

Credit to the balance sheet account accumulated depreciation. Let’s assume that a piece of machinery worth 100,000 was purchased on april 1st 2023, with a.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

What if the delivery van has an estimated residual value of $10,000 after 5 years? Web the journal entry to record depreciation is fairly standard..

13.4 Journal entries for depreciation

At the yearend like 30, dec we will record the following. Debit to depreciation expense, which flows through to the income statement. By debiting the.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Depreciation is calculated using any of a number of depreciation methods. Web the journal entry for depreciation refers to a debit entry to the depreciation.

Journal Entry for Depreciation Example Quiz More..

Web here are four easy steps that’ll teach you how to record a depreciation journal entry. The journal entry for year 2 is as follow:.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Recording depreciation expenses accurately is essential for a clear picture of the asset's worth over time and for informed decision. The credit is always made.

16.7 Journal entries for depreciation YouTube

To clarify the concept of depreciation, let's consider an example. In year 2, the depreciation is the same as in year 1. On january 1,.

Web Let Us Take The Example Of A Company To Calculate The Depreciation Expense During The Year And Illustrate The Journal Entry Of The Depreciation Expense In The Financial Statements.

Web to calculate depreciation by month: Depreciation expense can be recorded using the following journal entry: What if the delivery van has an estimated residual value of $10,000 after 5 years? Credit to accumulated depreciation, which is reported on the balance.

Matt Randolph (Phd Candidate In.

Depreciation is calculated using any of a number of depreciation methods. The meaning and measurement of place. Web the journal entry for depreciation is: To clarify the concept of depreciation, let's consider an example.

Accounting Entries To Record Depreciation:

Recording depreciation expenses accurately is essential for a clear picture of the asset's worth over time and for informed decision. The above entries should be recorded in the following manner. Journal entry for year 2. By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset decreases on the balance sheet.

On January 1, 2018, The Company Bought A Piece Of.

Let’s assume that a piece of machinery worth 100,000 was purchased on april 1st 2023, with a scrap value of nil and a. Web in year 1, the journal entry is as follow: Web the journal entry to record depreciation is fairly standard. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation.