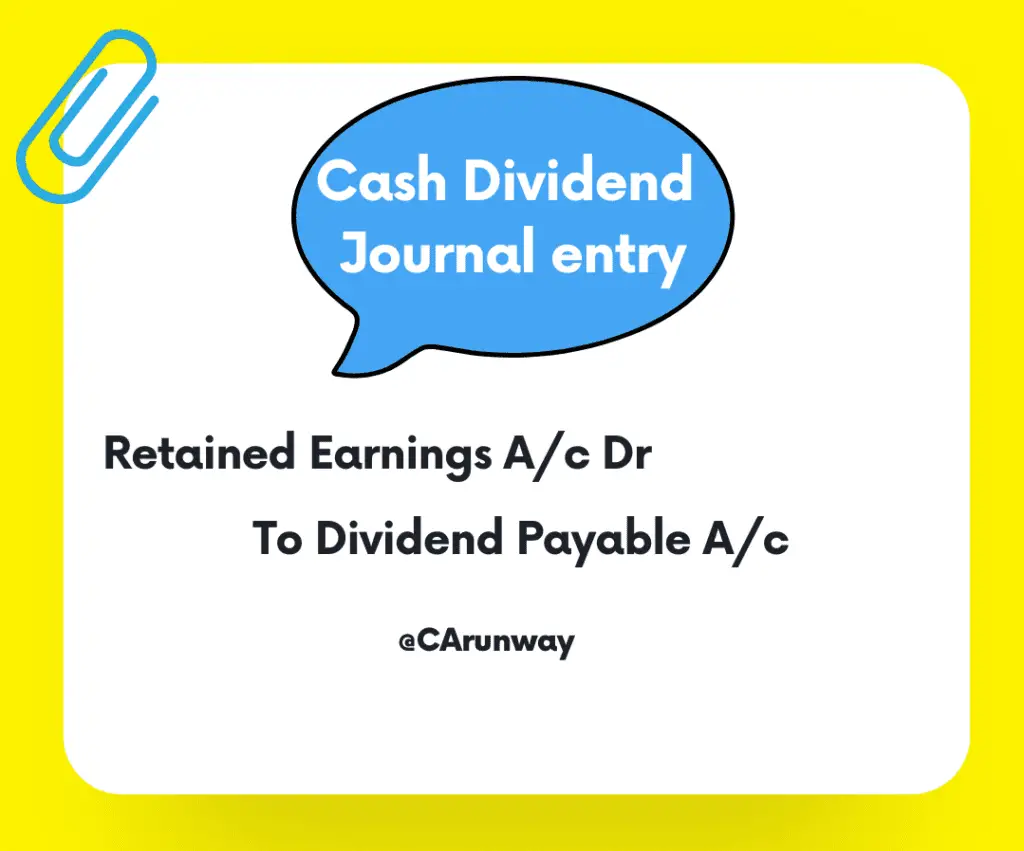

Journal Entry Cash Dividend - Web dividends are paid out of the company’s retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable. Web what are journal entry examples of dividends payable? Web prepare journal entries to record these transactions. The nature and purposes of dividends. To record the payment of a dividend, you would need to debit the dividends payable account and credit the cash account. When the dividend is paid, the company’s obligation is extinguished, and the cash account is decreased by the amount of the dividend. Cash dividend is a distribution of earnings by cash to the shareholders of the company. Web the company pays a cash dividend of $1.50 per share; The journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an increase (credit) to cash dividends payable (a liability account). When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account.

Cash Dividend Journal entry CArunway

Cash dividend decreases retained earnings. Web what is the journal entry for paying out cash dividends? Cash dividends are one of the means through which.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web the dividends declared journal entry impacts the accounting equation by increasing liabilities (dividends payable), and decreasing the owners equity. To record the cash dividend.

How To Record And Report Dividend Payments In Accounting Records And

Web this section explains the three types of dividends—cash dividends, property dividends, and stock dividends—along with stock splits, showing the journal entries involved and the.

Cash Dividend Journal entry CArunway

Cash dividend is a distribution of earnings by cash to the shareholders of the company. Web what are journal entry examples of dividends payable? Suppose.

Cash Dividends How to record a cash dividend Journal entry for cash

When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account. Web journal entry.

Dividends Payable Accounting Journal Entry

To record the cash dividend declared. The journal entry of cash dividends is usually made in two parts. Web you would record the following entry:.

Calculating Dividends, Recording Journal Entries YouTube

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an increase.

Cash Dividends Journal Entry YouTube

Web prepare journal entries to record these transactions. Web dividends are paid out of the company’s retained earnings, so the journal entry would be a.

Journal Entry for Dividends YouTube

Web the cash dividend declared is $1.25 per share to stockholders of record on july 1, (date of record), payable on july 10, (date of.

If The Corporation’s Board Of Directors Declared A Cash Dividend Of $0.50 Per Common Share On The $10 Par Value, The Dividend Amounts To $50,000.

Web prepare journal entries to record these transactions. If the corporation wants to keep a separate general ledger record of the current year dividends, it could use a temporary, contra retained earnings account entitled dividends declared. The $20,000 for preferred and $12,000 for common dividends can be combined into one journal entry. One month later, the company pays the dividend, so record the following entry:

Because Financial Transactions Occur On Both The Date Of Declaration (A Liability Is Incurred) And On The Date Of Payment (Cash Is Paid), Journal Entries Record The Transactions On Both Of These Dates.

Web what is the journal entry for paying out cash dividends? Although, the duration between dividend declared and paid is usually not long, it is still important to make the two separate journal entries. Web this section explains the three types of dividends—cash dividends, property dividends, and stock dividends—along with stock splits, showing the journal entries involved and the reason why companies declare and pay dividends. Web journal entry for payment of a dividend.

Cash Dividends Are One Of The Means Through Which Shareholders Earn Return On Their Investment In A Company, The Other Being Capital Appreciation Of Shares Or Repurchase Of Shares By The Company.

Web the dividends declared journal entry impacts the accounting equation by increasing liabilities (dividends payable), and decreasing the owners equity. It is important to realize that the actual cash outflow doesn’t occur until the payment date. Web the cash dividend declared is $1.25 per share to stockholders of record on july 1, (date of record), payable on july 10, (date of payment). Suppose a corporation currently has 100,000 common shares outstanding with a par value of $10.

Prepare Journal Entries For The Above Transactions And Provide The Balance In The Following Accounts:

Web on the payment date of dividends, the company needs to make the journal entry by debiting dividends payable account and crediting cash account. Cash dividend decreases retained earnings. The nature and purposes of dividends. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a stockholders’ equity account) and an increase (credit) to cash dividends payable (a liability account).