Journal Entry Deferred Revenue - Deferred revenue journal entry example 2: Web there are two ways of recording unearned revenue: The journal entries would be as follows: Web deferred revenue refers to the payment received by a company in advance for products or services that have not been delivered to the customer. Rent payments received in advance. Web the deferred revenue journal entry is your tracking mechanism for this type of revenue, within your accounting. This journal entry increases cash for the amount received and records a liability for the goods or. Web journal entries for deferred tax assets and liabilities play a pivotal role in accurately representing a company’s financial health and tax planning strategies. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. To account for this the pest control company needs to make adjusting entries.

What is Unearned Revenue? QuickBooks Canada Blog

Learn why it’s so important for small businesses to properly recognize it. Web 6700 ×.40 = 2680 revenue earned so far. Deferred revenue (also called.

Deferred Revenue Expenditure EXPLAINED By Saheb Academy YouTube

Web 6700 ×.40 = 2680 revenue earned so far. “deferred” means “postponed into the future.” in this case a customer has paid you in advance.

Deferred Revenue Journal Entry with Examples Financial

Under the liability method, a liability account is. Do customers pay for the goods or services purchased. How to record deferred revenue. Web the deferred.

Deferred Revenue Journal Entry Double Entry Bookkeeping

Deferred revenues require adjusting entries. Web the per month revenue of the company is $1000. 6700 ×.60 = 4020 still unearned. Web a deferred revenue.

PPT Profitjets Revenue Journal Entry PowerPoint Presentation, free

Last updated october 24, 2022. Web deferred revenue journal entry example 1: I ncrease in cash (asset): When a customer makes an advance payment, it.

What is Deferred Revenue? The Ultimate Guide (2022)

Learn why it’s so important for small businesses to properly recognize it. The journal entries would be as follows: Web deferred revenue refers to the.

Journal Entry Deferred Revenue Expenditure in Accounting

To account for this the pest control company needs to make adjusting entries. Deferred revenue (also called unearned revenue) is generated when a company receives.

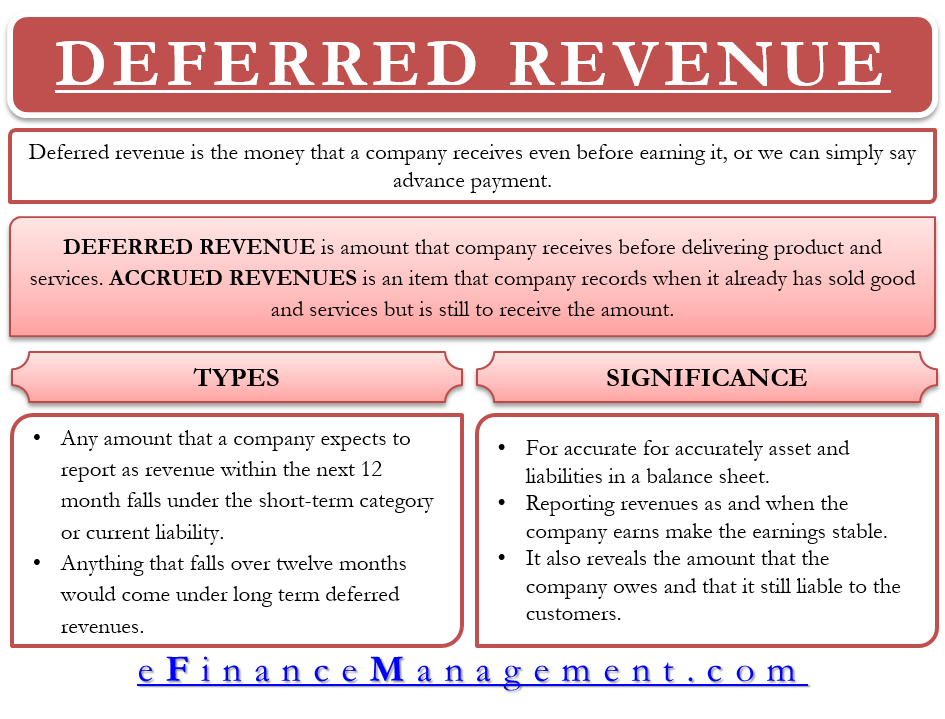

Deferred Revenue Meaning, Importance And More

Web deferred revenue refers to the payment received by a company in advance for products or services that have not been delivered to the customer..

Deferred RevenueMeaning, Examples with Accounting Entry, Liability or

Web deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on.

Web Deferred Revenue Is A Liability Account That Represents The Obligation That The Company Owes To Its Customer When It Receives The Money In Advance.

Web deferred revenue is money that you receive from clients or customers for products or services that you haven’t delivered yet. The journal entries would be as follows: The accounting for deferred revenue involves a debit to the cash or accounts receivable. Do customers pay for the goods or services purchased.

6700 ×.60 = 4020 Still Unearned.

Last updated october 24, 2022. Web 6700 ×.40 = 2680 revenue earned so far. Web there are two ways of recording unearned revenue: I ncrease in cash (asset):

“Deferred” Means “Postponed Into The Future.” In This Case A Customer Has Paid You In Advance For A Service.

Web deferred revenue refers to the payment received by a company in advance for products or services that have not been delivered to the customer. Web journal entries for recording deferred revenue. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. Web deferred revenue, also sometimes called “unearned” revenue or deferred income, is any revenue that you collect from your customers before earning it—a prepayment on a big.

Web Deferred Revenue Journal Entry:

You scratch out what you think the journal entry would look like (you also draw in the original. Web a deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. Web deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed. Web the following deferred revenue journal entry outlines the most common journal entries in accounting.