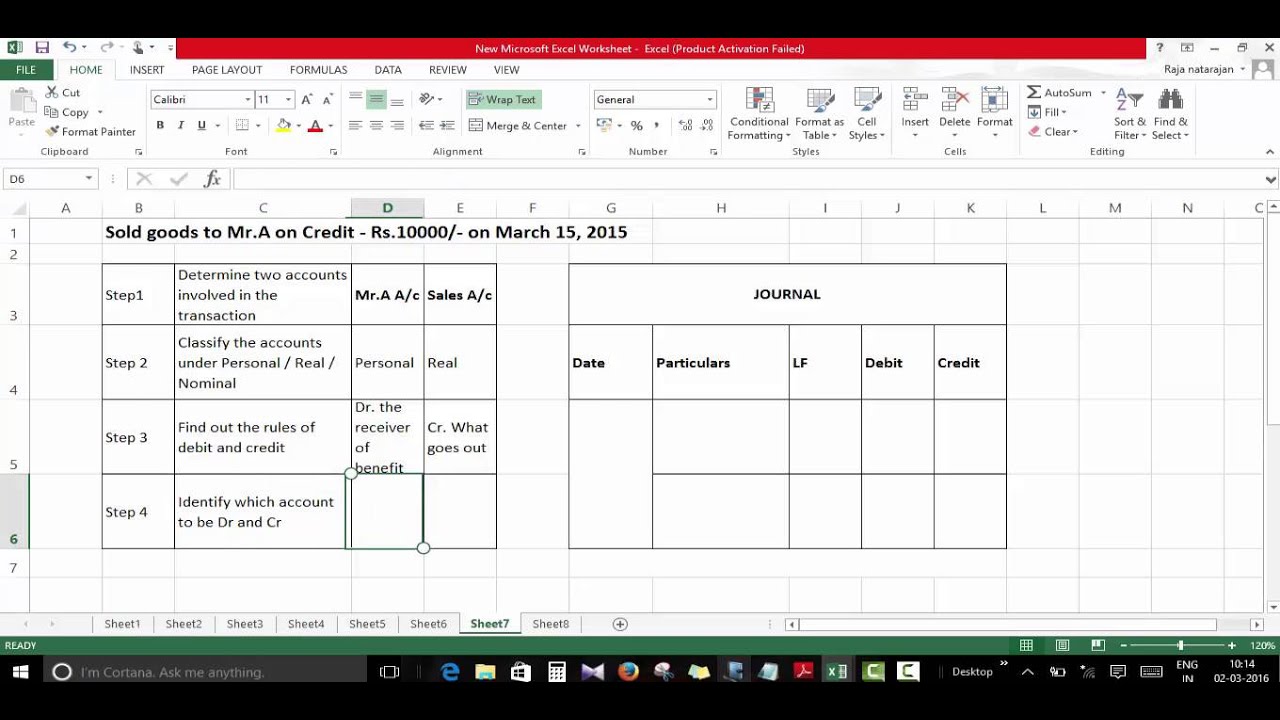

Journal Entry Credit Sales - In case of a journal entry for cash sales, a cash account and sales account are used. This involves creation of account receivable. Web when goods/services are sold in credit, the transactions are known as credit sales, i.e., when the customer promises to pay in future, credit sales occur. Credit sales refer to sales transactions where the payment is deferred to a future date. On august 1, a customer purchases 56 tablet computers on credit. Sales credit journal entry is vital for companies that sell their goods on credit. Web sales are credit journal entries, but they have to be balanced by debit entries to other accounts. Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. The payment terms are 2/10, n/30, and the invoice is dated august 1. How to show credit sales in.

Credit Sales Journal Entry Examples Financial

Example of sales credit journal entry. When you credit the revenue account, it means that your total revenue has increased. Accounting and journal entry for.

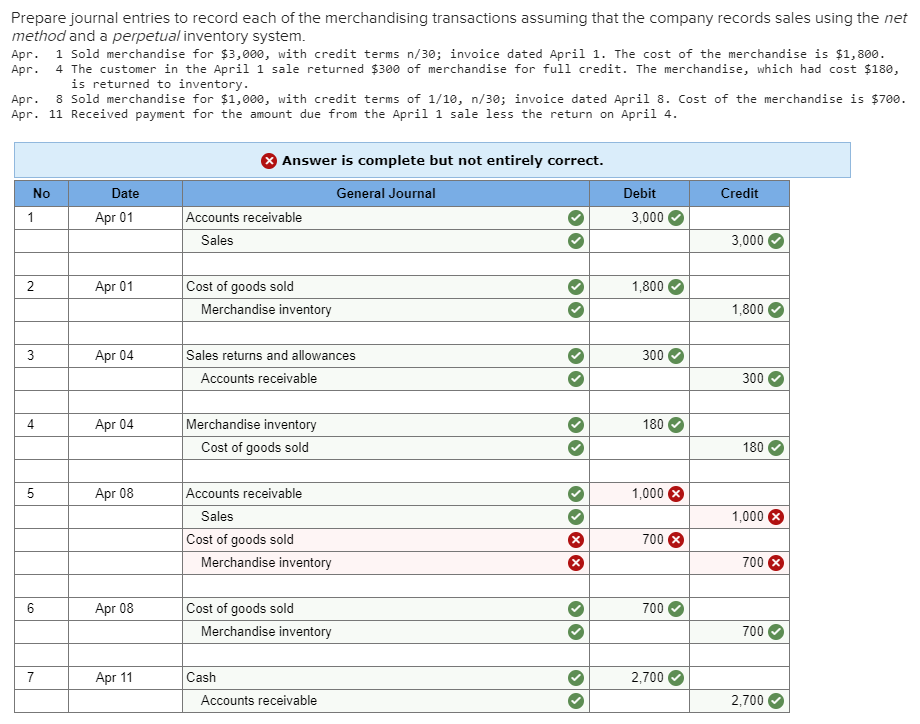

2.4 Sales of Merchandise Perpetual System Financial and Managerial

Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. When you credit.

Accounting for Sales Return Journal Entry Example Accountinguide

Instead of receiving cash immediately, the seller extends credit to the buyer, allowing them to pay for the goods or services at a later date..

Journal Entry for Credit Sales YouTube

Each general journal entry lists the date, the account title (s) to be debited and the corresponding amount (s) followed by the account title (s).

Sales Journal Definition, Explanation, Format and Entry Examples

Web a sales journal is a type of journal used to record credit sale transactions of the company and is used for maintenance and tracking.

Explain the Revenue Recognition Principle and How It Relates to Current

Web accounting and journal entry for credit sales include 2 accounts, debtor and sales. Another way to visualize business transactions is to write a general.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

Credit sales refer to sales transactions where the payment is deferred to a future date. Web sales are credit journal entries, but they have to.

Sales Credit Journal Entry What Is It, Examples, How to Record?

Example of the sales journal entry. However, let us consider the effect of the credit terms 2/10 net 30 on this purchase. This type of.

Credit Sales Journal Entry Solved QS 71 Credit Card Sales LO C1

Web sales discount transaction journal entries. In the first entry, both accounts receivable (debit) and sales (credit) increase by $16,800 ($300 × 56). Web how.

The Sales Revenue Journal Entry Typically Involves At Least Two Accounts:

Sales credit journal entry is vital for companies that sell their goods on credit. Web sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client. Web how to record a credit sale with credit terms. Web when goods/services are sold in credit, the transactions are known as credit sales, i.e., when the customer promises to pay in future, credit sales occur.

When The Buyer Pays The Invoice Within The Discount Period, A Cash Discount Is Recorded.

The debit to the accounts receivable account will indicate that the customer has purchased goods or services on credit. Web components of a sales revenue journal entry. As an example of a sales journal entry, a company completes a sale on credit for $1,000, with an associated 5%. The journal entry includes the name of the customer, the amount of the sale, and the date of.

How To Show Credit Sales In.

This type of journal entry is used to keep track of sales that have not been paid for in cash. Another way to visualize business transactions is to write a general journal entry. How to record entry of sales credit? On august 1, a customer purchases 56 tablet computers on credit.

Web What Is The Correct Journal Entry To Record This Sale?

Sales are recorded as a credit to the revenue account. The sales journal is simply a chronological list of the sales invoices and is used to save time, avoid cluttering the general ledger with too much. In the first entry, both accounts receivable (debit) and sales (credit) increase by $16,800 ($300 × 56). Accounting and journal entry for credit sales;