Journal Entries For Depreciation - Therefore, it is very important to understand that when a depreciation expense journal entry is recognized in the. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. We'll work through a straight l. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. How to keep your journal entries and accounting under control. $0.09 × 30,000 = $2,700. Debit to the income statement account depreciation expense; Web it is recorded through the following journal entry: Selling a depreciable asset, other information. Depreciation in periods after revaluation is based on the revalued amount.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful life or life expectancy. Depreciation is a measure of.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Depreciation in periods after revaluation is based on the revalued amount. Web © 2024 google llc. We simply record the depreciation on debit and credit.

Journal Entry for Depreciation Example Quiz More..

The depreciation expense for 2023 would be: Depreciation is a measure of how much of an asset's value has. A truck costing $40,000 has a.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

A truck costing $40,000 has a useful life of 10 years and a salvage value of $5,000 at the end of its useful life. The.

Depreciation journal Entry Important 2021

Credit to the balance sheet account accumulated depreciation; Web the journal entry of spreading the cost of fixed assets is very simple and straightforward. Web.

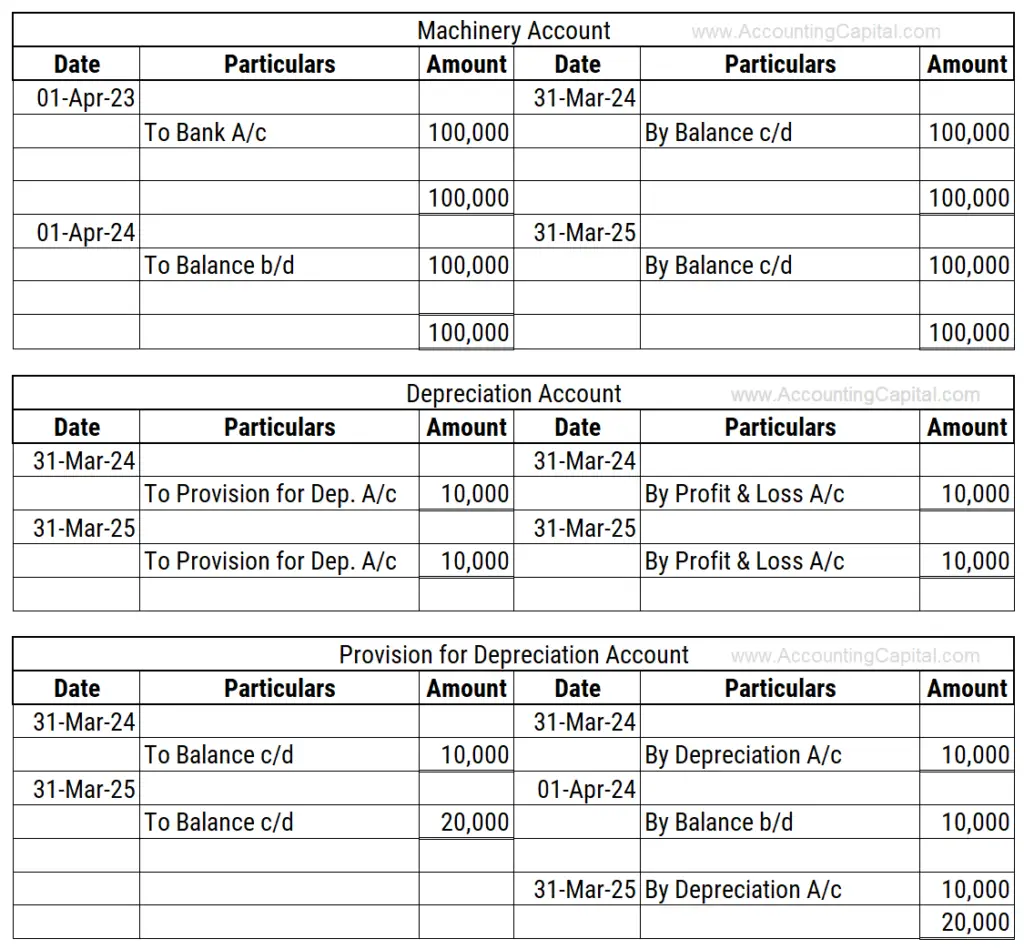

13.4 Journal entries for depreciation

In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as below: The income statement account depreciation.

Depreciation and Disposal of Fixed Assets Finance Strategists

We simply record the depreciation on debit and credit to accumulated depreciation. We'll work through a straight l. Web a quick reference for fixed assets.

Journal Entry for Depreciation Example Quiz More..

Credit to the balance sheet account accumulated depreciation; The journal entry to record depreciation is fairly standard. The depreciation expense for 2023 would be: Depreciation.

13.4 Journal entries for depreciation

Web © 2024 google llc. Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful life or life expectancy..

Web Depreciation Journal Entry:

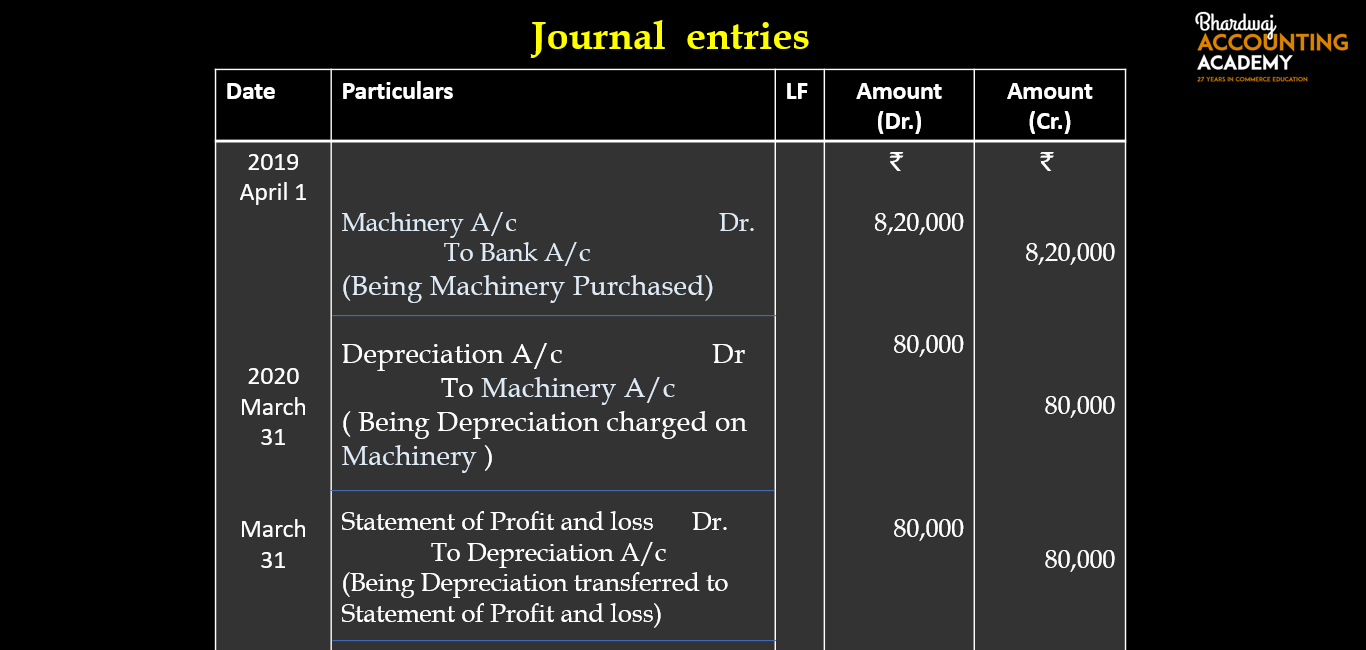

Web here are four easy steps that’ll teach you how to record a depreciation journal entry. Web what is the journal entry for depreciation? Web journal entries for the straight line depreciation. Credit to accumulated depreciation, which is reported on the balance sheet.

Before You Record Depreciation, You Must First Select The Depreciation Method—And The Depreciation Method Must Be Uniform.

Credit to the balance sheet account accumulated depreciation; $0.09 × 20,000 = $1,800. In 2023, the van will be used for 3 months only (january to march) since it has a useful life of 5 years (i.e. $0.09 × 30,000 = $2,700.

Debit To The Income Statement Account Depreciation Expense;

Selling a depreciable asset, other information. Depreciation for 2011 shall be the new carrying amount divided by the. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. In case of axe ltd.

From April 1, 2018 To March 31, 2023).

Depreciation refers to the method of accounting which allocates a tangible asset's cost over its useful life or life expectancy. This journal entry is necessary for the company to present an actual net book value of. Depreciation is a way to account for the reduction of an asset’s value as a result of. Web the journal entry of spreading the cost of fixed assets is very simple and straightforward.