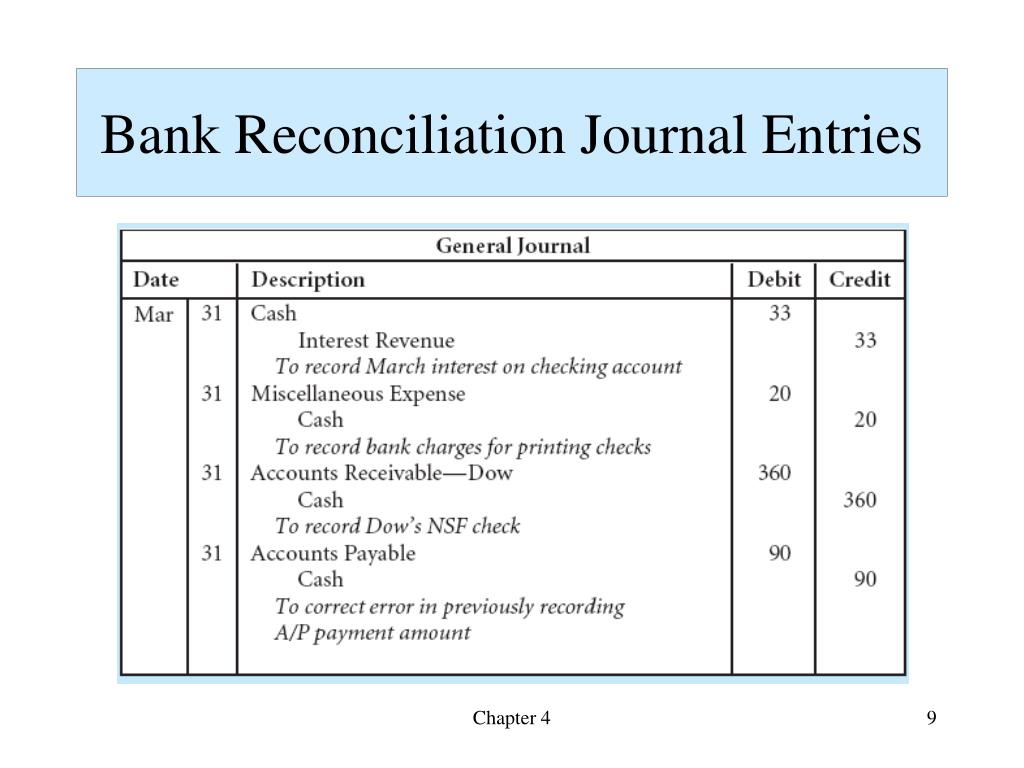

Journal Entries For Bank Reconciliation - Web a bank reconciliation statement is a valuable internal tool that can affect tax and financial reporting and detect errors and intentional fraud. Web journal entries are required in a bank reconciliation when there are adjustments to the balance per books. The good news is every entry will contain cash. See examples of adding and subtracting items, interest, notes. Web bank reconciliation journal entries: Find out how to deal with bank charges, interest, nsf checks, and more. Wilder videos june bank statement shows the following: Web 8.4 define the purpose and use of a petty cash fund, and prepare petty cash journal entries; All your journal entries are gathered. Web learn how to post journal entries for bank reconciliation adjustments with examples and explanations.

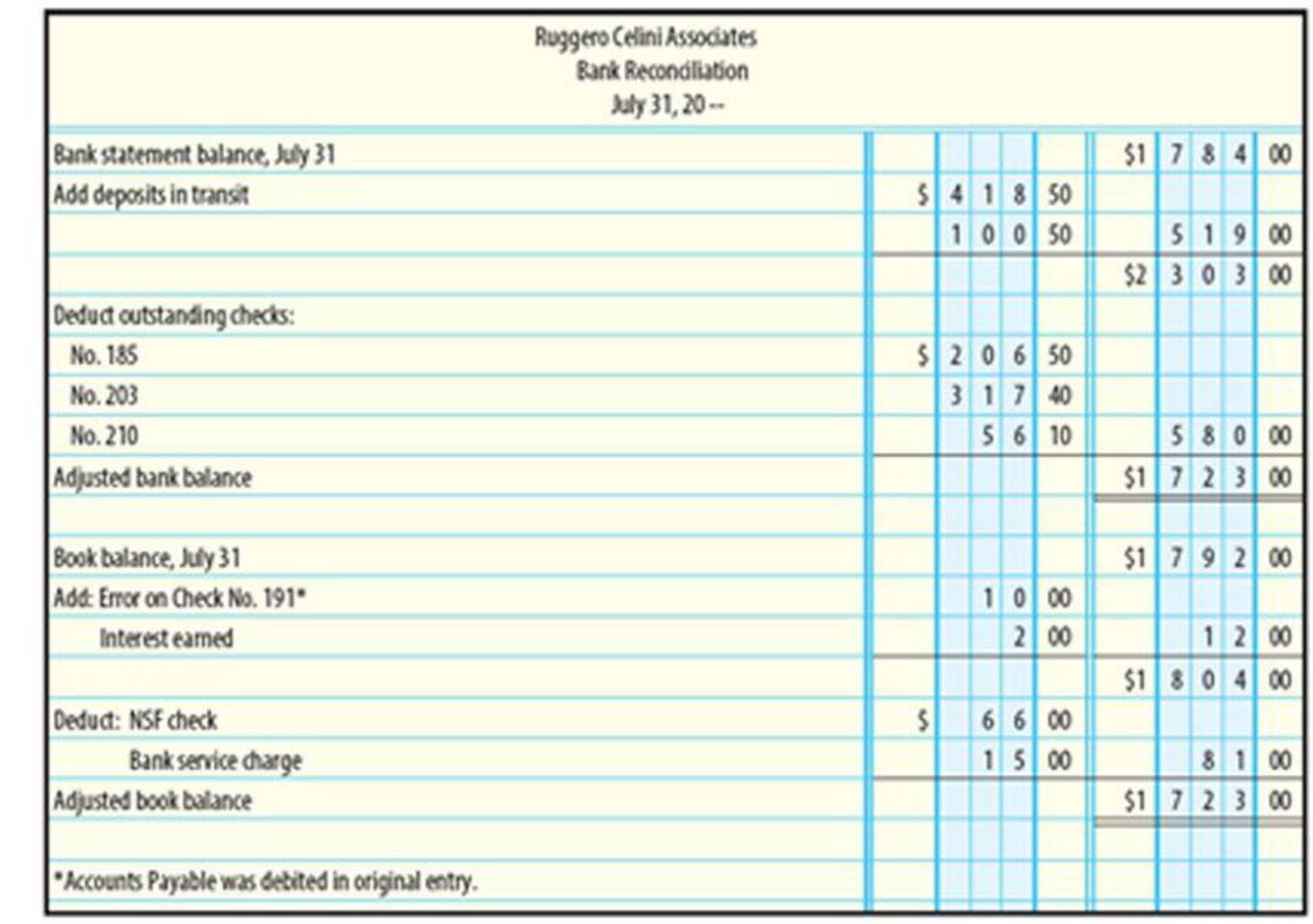

PREPARE JOURNAL ENTRIES FOR BANK RECONCILIATION Based on the following

Web 8.4 define the purpose and use of a petty cash fund, and prepare petty cash journal entries; Example 2 (bank collection of notes receivable).

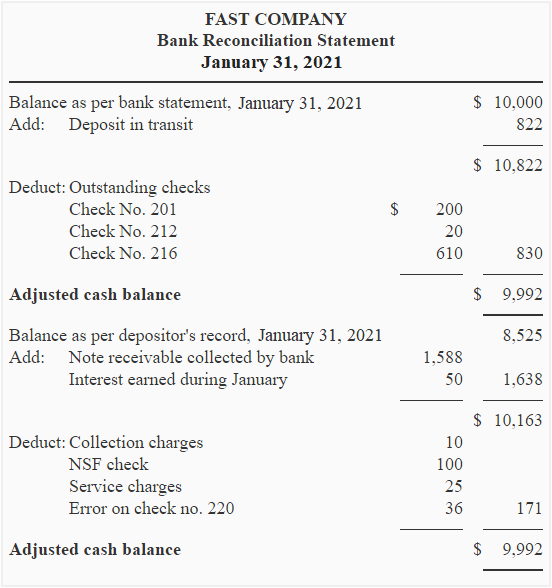

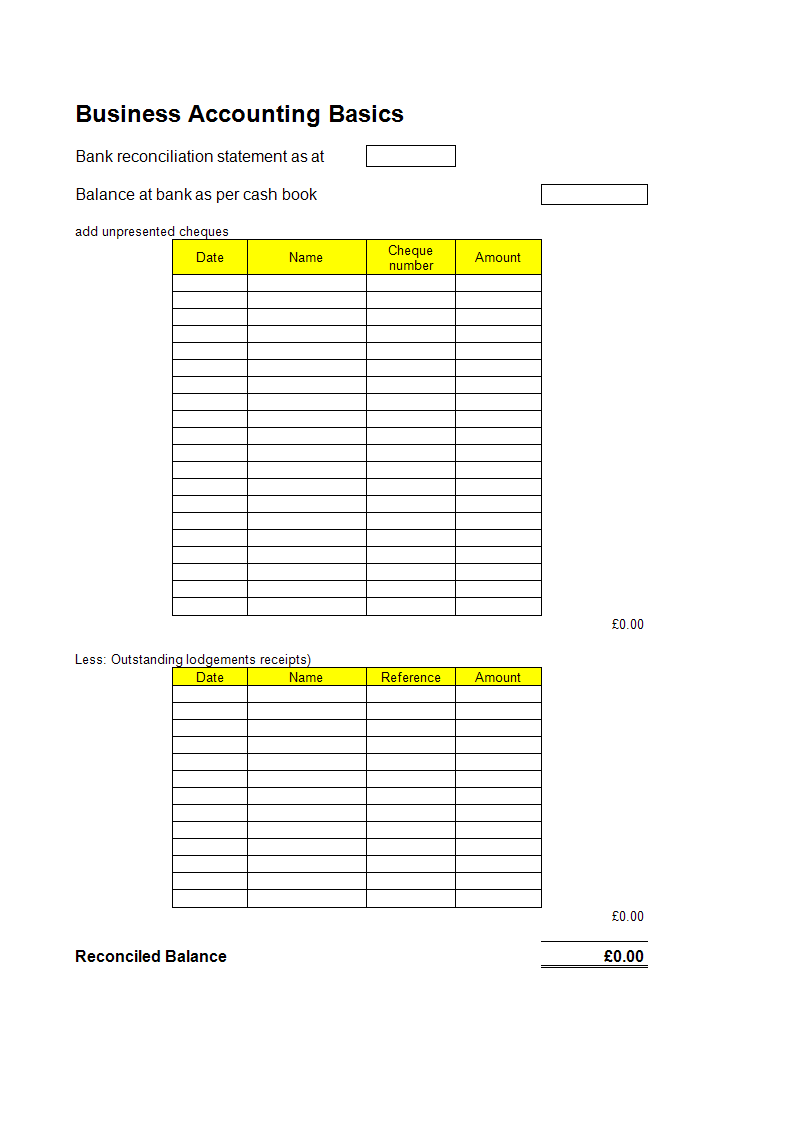

The correct bank reconciliation statement is provided

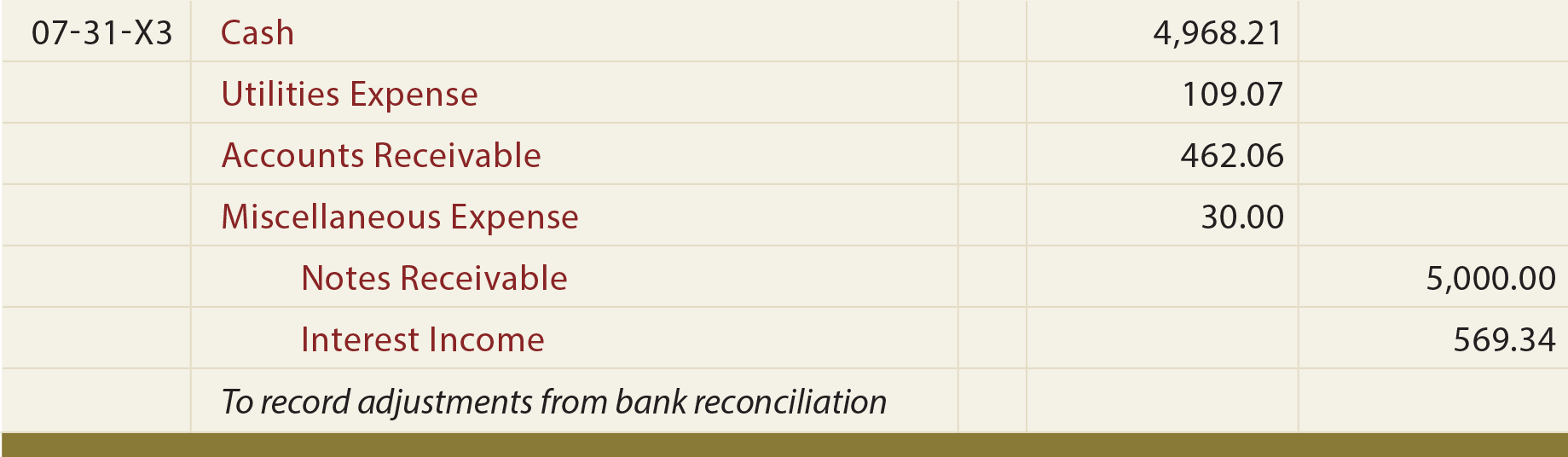

50k views 4 years ago. When an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal..

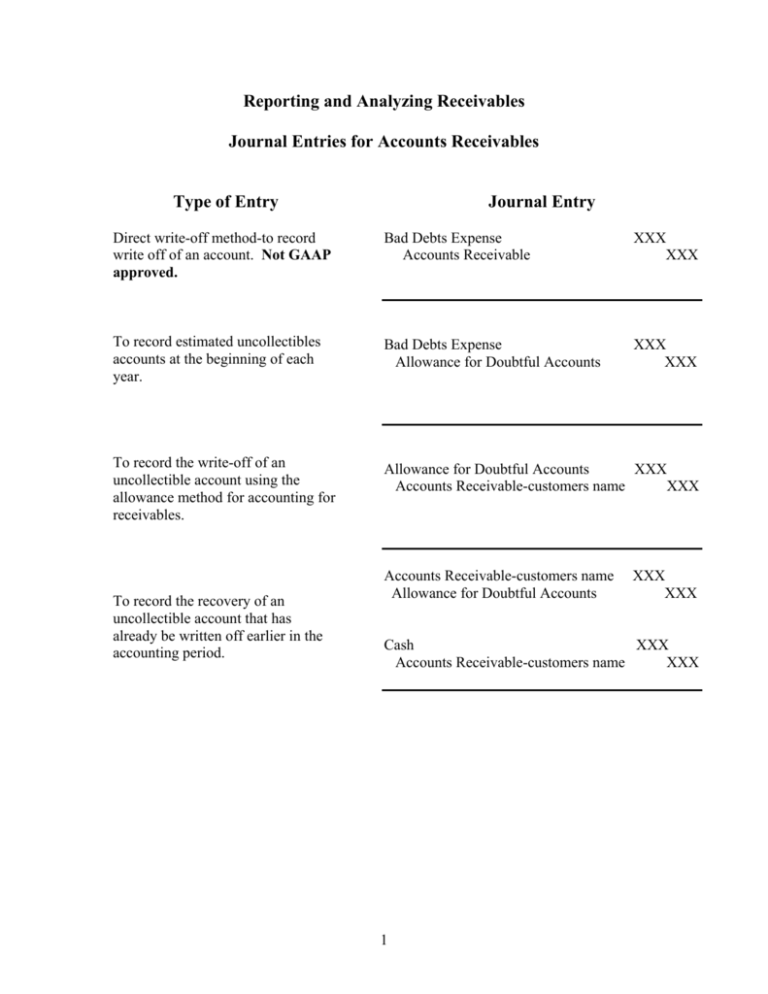

Journal Entries from Bank Reconciliation

Wilder videos checkbook lists the following: In this article, you will learn: Web journal entries in bank reconciliation. Example 2 (bank collection of notes receivable).

Solved Bank Reconciliation? Journal Entries Prepare the

When an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal. 50k views 4 years ago..

Bank reconciliation statement definition, explanation, example and

25 july 2022 32 min read. Begin by reviewing the bank statement and. 8.5 discuss management responsibilities for maintaining internal controls. Web journal entries are.

Journal Entries For Bank Reconciliation PDF Cheque Deposit Account

Web journal entries in bank reconciliation. Wilder videos june bank statement shows the following: Example 1 (interest income) bank reconciliation journal entries: Compare every amount.

Bank Reconciliation Definition & Example of Bank Reconciliation

When an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal. See examples of adding and.

Bank Reconciliation

Find out how to deal with bank charges, interest, nsf checks, and more. In this article, you will learn: Web a bank reconciliation statement is.

Bank Reconciliation Journal Entries Templates at

Journal entries are how you record all your transactions (sometimes called debits and credits). Web a bank reconciliation statement is a valuable internal tool that.

I Did A Manual Journal Entry To Adjust For A 0.10.

Web how do you get journal entries to show up on your bank reconciliation screen in order to reconcile your bank. 50k views 4 years ago. Journal entries are how you record all your transactions (sometimes called debits and credits). Example 2 (bank collection of notes receivable) bank.

A Bank Reconciliation Is A Critical Tool For Managing Your Cash.

Web learn how to prepare journal entries for bank reconciliations based on the bank statement and the general ledger. All your journal entries are gathered. See examples of adding and subtracting items, interest, notes. Web learn how to post journal entries for bank reconciliation adjustments with examples and explanations.

In This Article, You Will Learn:

Wilder videos checkbook lists the following: Web examples of journal entries for bank reconciliation. Find out how to deal with bank charges, interest, nsf checks, and more. Add book transactions to your bank balance.

Web Journal Entries Are Required In A Bank Reconciliation When There Are Adjustments To The Balance Per Books.

Web journal entries in bank reconciliation. To do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the. Click here to see the original bank reconciliation video: Wilder videos june bank statement shows the following: