How To Record Payroll Journal Entry - Create payroll account opening a payroll bank account is typically the first step toward recording accurate journal entries. Also known as an initial recording, this first entry is very important. Accruing payroll liabilities, transferring cash, and making payments. Fred's residential remodeling company has five employees. Company has to withhold some amount such as salary tax $ 5,000 and social security $ 8,000. Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out. There are a few type of payroll journal entries to consider: The initial recording journal entry is done for each pay period. Web generally speaking, there are three types of payroll accounting entries: Web learn how to record payroll journal entry for employee compensation, including wages, taxes, fica, and 401k plan.

What Is The Journal Entry For Payment Of Salaries Info Loans

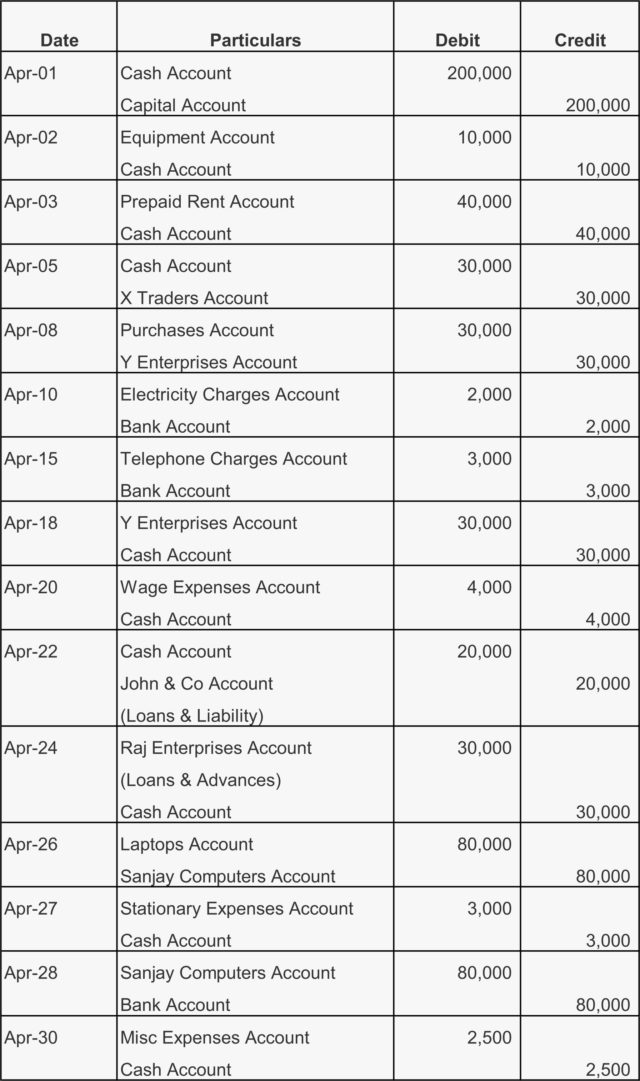

Web learn how to record payroll journal entry for employee compensation, including wages, taxes, fica, and 401k plan. This is the primary journal entry for.

Payroll Journal Entry Example Explanation My Accounting Course

The initial recording journal entry is done for each pay period. One such method is a payroll journal entry, which involves accurately recording pay for.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

This is the primary journal entry for recording gross wages and all of the payroll withholdings for the pay period. One such method is a.

How to Record Journal Entries in Accounting Waytosimple

Accrued payroll is the money that a business owes its employees for work performed during a given pay period but has not yet paid out..

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

The initial recording journal entry is done for each pay period. Web in addition the employer payroll tax liability needs to be recorded with the.

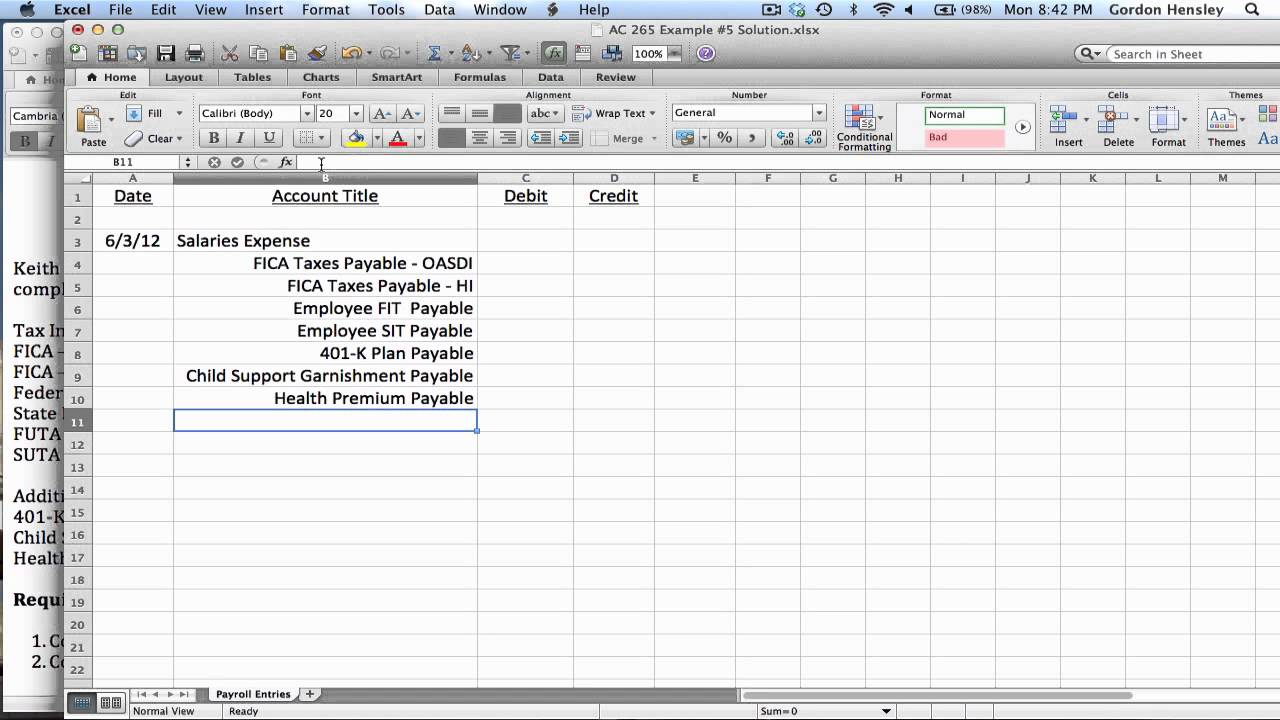

How to use Excel for accounting and bookkeeping QuickBooks

Payroll entries are made via journal entries that record the wages of employees. Accrued payroll is the money that a business owes its employees for.

Payroll Journal Entries Demonstration YouTube

All accounts credited in the entry are current liabilities and will be reported on the balance sheet if not paid prior to the preparation of.

Payroll taxes journal entries YouTube

Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and.

10 Payroll Journal Entry Template Template Guru

The first entry is the expense charged to the income statement, and the second entry is the liability to the tax authorities recorded in the.

When These Liabilities Are Paid, The Employer Debits Each One And Credits Cash.

One such method is a payroll journal entry, which involves accurately recording pay for each team member alongside overall company expenses. Set aside copies of this information in order to include it in the next payroll. Now, you can record the journal entry in your accounting system. Payroll entries are made via journal entries that record the wages of employees.

Web Learn What Payroll Journal Entries Are, Why They Are Important, And How To Record Them In Five Steps.

How to create payroll journal entries. In this example, $4,055.00 is the total amount. Company abc has employed several employees to work for them. Web payroll journal entries fall under the payroll account and are part of your general ledger.

A Separate Account For Payroll Can Improve Visibility On Employee Payments.

Pay the employee the net pay. Web learn how to record payroll journal entry for employee compensation, including wages, taxes, fica, and 401k plan. Web salaried payroll entry #1: Web updated jan 05, 2024.

What Is A Payroll Journal Entry?

See a detailed example of a payroll journal entry for a manufacturing company with different payroll options. Web generally speaking, there are three types of payroll accounting entries: Company has to withhold some amount such as salary tax $ 5,000 and social security $ 8,000. Set up the chart of accounts.