Issuance Of Bonds Journal Entry - Web the entry to record the issuance of the bonds is: As this entry illustrates, cash is debited for the actual proceeds received, and bonds payable is. Bonds payable → credit by $1 million. Bonds issued at a premium. Web learn how to record cash received and liabilities incurred by issuing bonds, a type of debt financing. Web there are four journal entries related to issuing bonds, as follows: For each month that the bond is. See examples of journal entries for different scenarios and bond. Notice that interest was paid in full through september 30. Web learn how to record bonds issued at face value, discount, or premium, and how to accrue interest payments.

Issuance of Bonds Journal Entry Lesson 2 YouTube

Notice that interest was paid in full through september 30. When performing these calculations, the rate is adjusted for more frequent interest payments. See examples.

Issuance of Bonds Journal Entry Lesson 1 YouTube

For each month that the bond is. Debit bond issue costs for $1 million. See how to calculate the present value, coupon. Web the journal.

Accounting For Bonds Payable

See how to calculate bond price, interest expense, and amortization of. For each month that the bond is. See examples of journal entries for bonds.

Issuance of Bonds Journal Entries YouTube

See examples of journal entries for various types of. Debit bond issue costs for $1 million. Web learn how to account for the issuance of.

Journal Entries for Bond Issuance YouTube

Learn how to record bond issuance, interest payment, and principal repayment in different scenarios. Web learn how to record notes and bonds issued at face.

Bonds Issued Between Interest Dates

Web record the appropriate book entries upon issuing the bond. Note that the total amount received is debited to the cash account and the bond’s.

Issuing Bonds (Journal Entries) YouTube

Web bond accounting means accounting for cash received from the buyer upon issuance of the bond in the balance sheet and its effects on the.

Bond Issuance Journal Entries and Financial Statement Presentation

See how to calculate bond price, interest expense, and amortization of. Web the journal entry to record this bond issue is: Find out the advantages.

Prepare The Journal Entry For The Issuance Of Thes...

Debit bond discount for $0.5 million. Cash account → debit by $1 million. Web bond accounting means accounting for cash received from the buyer upon.

Web What Is The Journal Entry To Record The Issuance Of The Bonds?

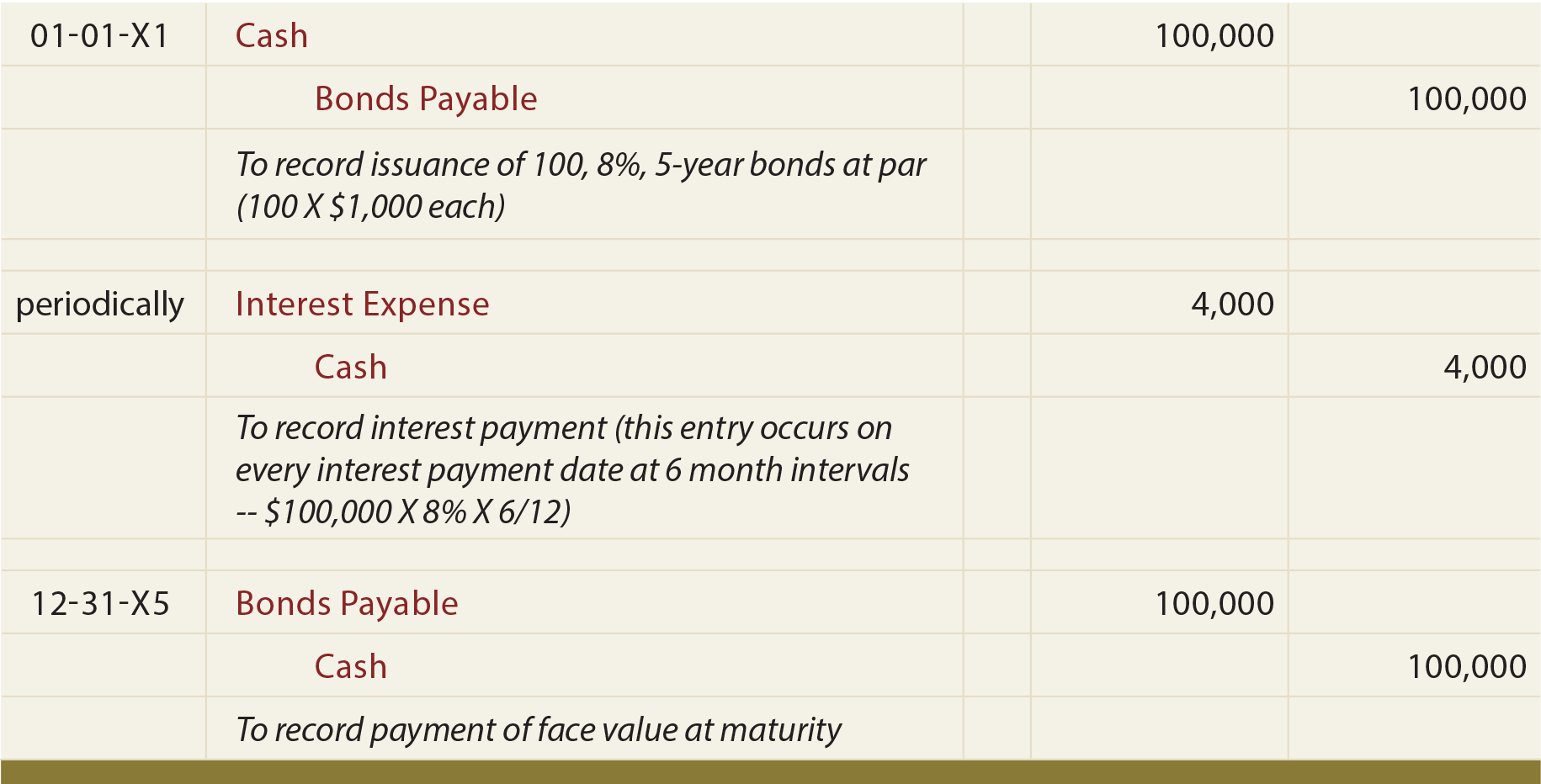

The valenzuela corporation is required to make semiannual interest payments of $6,000 or $100,000 x 6%. The bonds had a stated rate of 8% and pay. Bonds issued at a premium. The first accounting treatment occurs when the bond originates and warrants an entry in the.

Learn How To Record Bond Issuance, Interest Payment, And Principal Repayment In Different Scenarios.

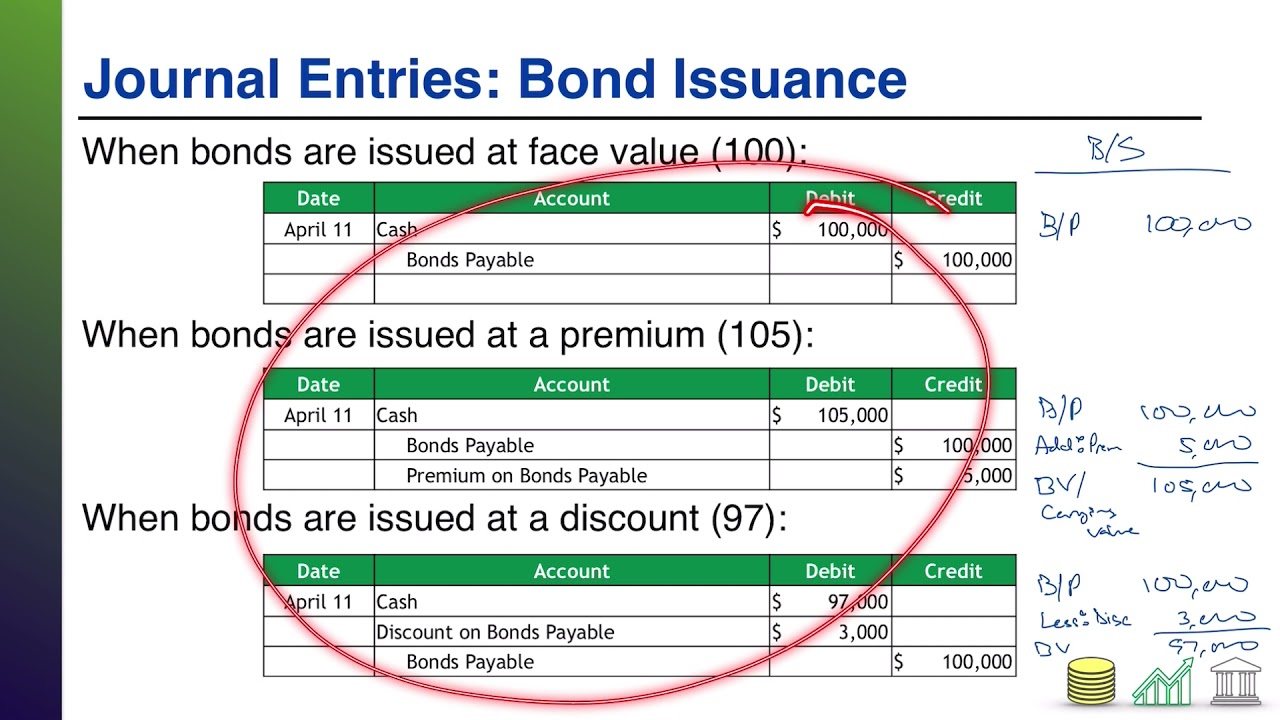

When performing these calculations, the rate is adjusted for more frequent interest payments. (figure) medhurst corporation issued $90,000 in bonds for $87,000. Cash account → debit by $1 million. As this entry illustrates, cash is debited for the actual proceeds received, and bonds payable is.

Notice That Interest Was Paid In Full Through September 30.

Web learn how to record notes and bonds issued at face value or discounted, with different interest rates and payment dates. Web the entry to record the issuance of the bonds is: See examples of journal entries for bonds issued at par, discount, and premium. Debit bond issue costs for $1 million.

Web Learn How To Record Bonds Issued At Face Value, Discount, Or Premium, And How To Accrue Interest Payments.

See how to calculate the present value, coupon. See examples of journal entries for different scenarios and bond. See how to calculate bond price, interest expense, and amortization of. Web record the appropriate book entries upon issuing the bond.