Declaration Of Stock Dividend Journal Entry - The payment date for a stock’s dividend is the day on which the actual checks go out—or electronic payments are made—to. Web three dividend dates are significant: Web assuming the stock has a par value of $0.10 per share and a market value of $12 per share on the declaration date, the following entry is made on the declaration date: Web updated on april 4, 2024. Web a stock dividend is when a company issues additional shares of its own stock to its shareholders, usually in proportion to the number of shares they already. Web this declaration is a commitment by the company to pay shareholders a specified amount per share and sets the record date, which identifies the shareholders. Suppose company x declares a. At the time of declaration, retained earnings are debited by an amount equal to the product of the share's market price, the. Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings and an increase (credit) to common stock dividends distributable for. Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend.

What Is The Best Free Stock Trading App Declaration Of Common Stock

The common stock dividend distributable is $50,000 —. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting.

what is dividend declared Example Journal Entries YouTube

The fair value of the stock is $5.00, and its par value is $1.00. Reviewed by dheeraj vaidya, cfa, frm. Web to record the declaration.

Stock Dividend Definition, Explanation, and Journal Entries

Web the journal entry on the date of declaration is the following: Reviewed by dheeraj vaidya, cfa, frm. Web the journal entry to record the.

Do Dividends Go Into Brokerage Account How To Record Common Stock

Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of.

How to Record Dividends in a Journal Entry Accounting Education

If a company’s board of directors wants to pay common stockholders a dividend, they must pay the preferred. The date of declaration indicates when the.

Journal Entry For Stock Dividend quotesclips

Web a company may issue a stock dividend rather than cash if it doesn’t want to deplete its cash reserves. Web three dividend dates are.

Calculating Dividends, Recording Journal Entries YouTube

Web it involves the following journal entries: Suppose company x declares a. Web the journal entry on the date of declaration is the following: The.

Stock Dividends (Journal Entries) YouTube

Web assuming the stock has a par value of $0.10 per share and a market value of $12 per share on the declaration date, the.

Dividends Payable Accounting Journal Entry

Web davidson motors declares a stock dividend to its shareholders of 10,000 shares. Declaration date the company can make the large stock dividend journal entry.

The Common Stock Dividend Distributable Is $50,000 —.

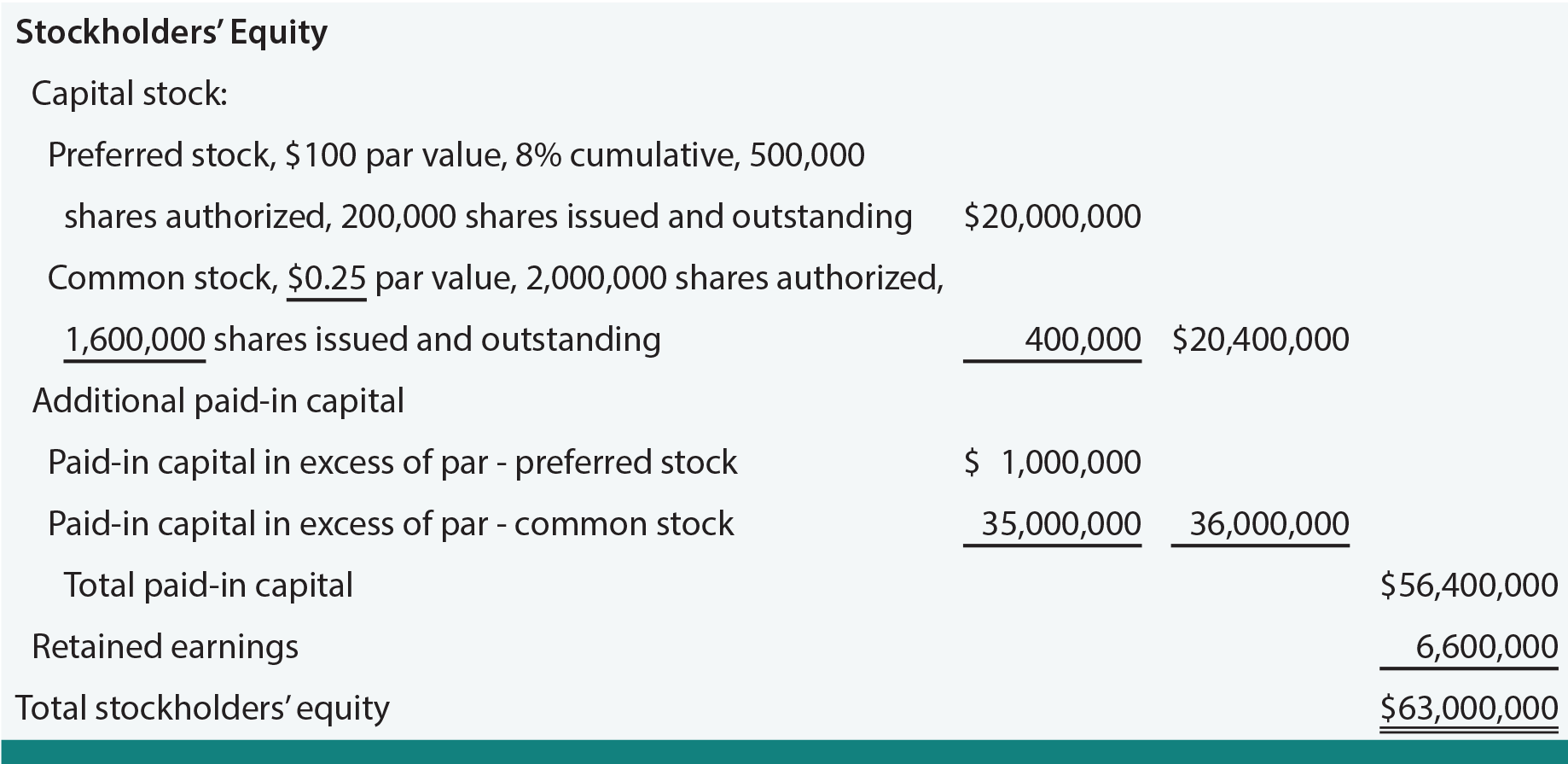

The date of declaration indicates when the board of directors approved a motion declaring that dividends. Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings and an increase (credit) to common stock dividends distributable for. The payment date for a stock’s dividend is the day on which the actual checks go out—or electronic payments are made—to. As shown in the general ledger above, the retained earnings account is debited by $50,000 while the.

The Fair Value Of The Stock Is $5.00, And Its Par Value Is $1.00.

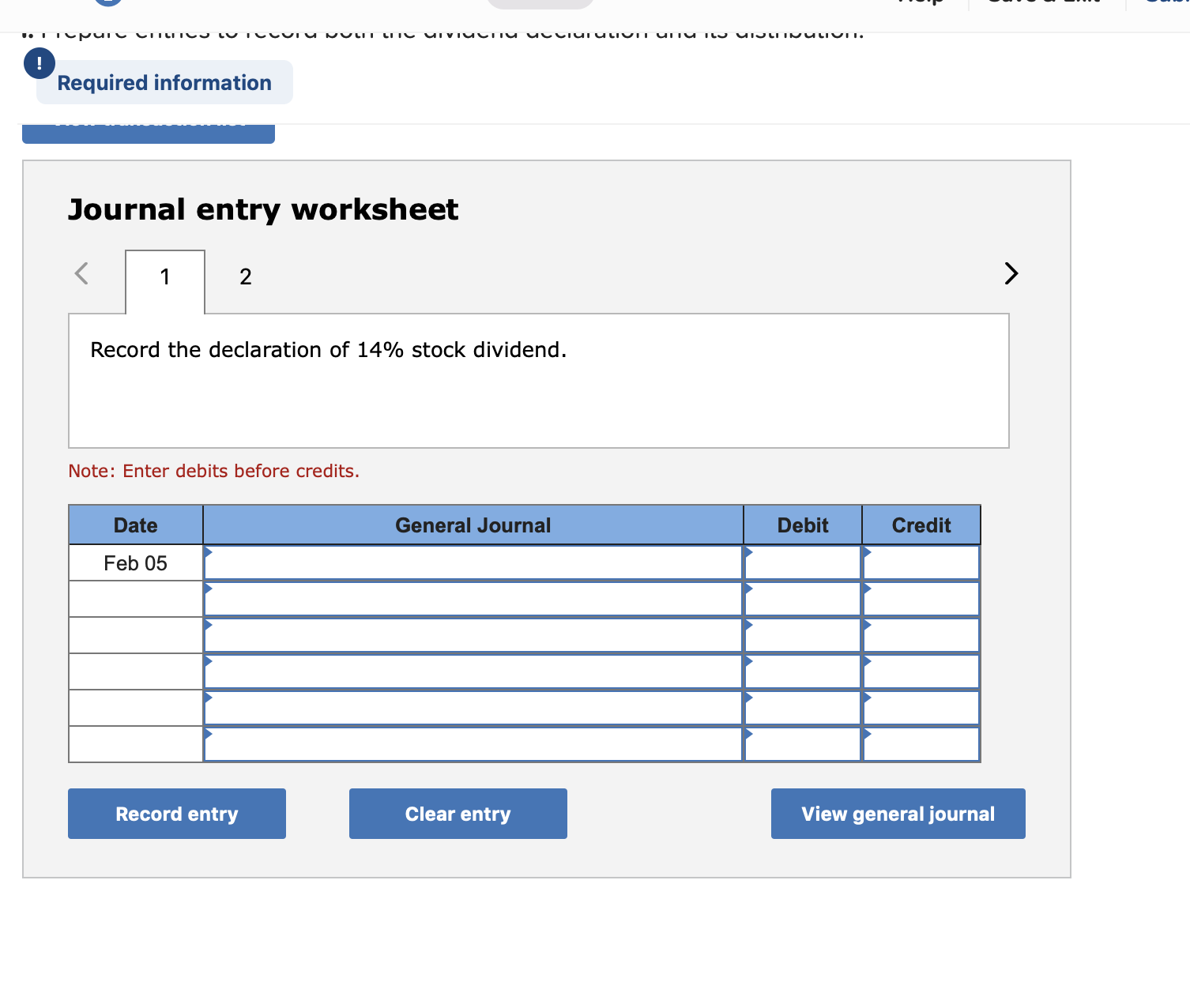

Web this journal entry is to eliminate the dividend liabilities that the company has recorded on december 20, 2019, which is the declaration date of the dividend. Web three dividend dates are significant: Web assuming the stock has a par value of $0.10 per share and a market value of $12 per share on the declaration date, the following entry is made on the declaration date: Declaration date the company can make the large stock dividend journal entry on the declaration date by debiting the stock dividends account and crediting the common stock dividend distributable account.

Web Davidson Motors Declares A Stock Dividend To Its Shareholders Of 10,000 Shares.

If a company’s board of directors wants to pay common stockholders a dividend, they must pay the preferred. Web the journal entry to record the stock dividend declaration requires a decrease (debit) to retained earnings and an increase (credit) to common stock dividends distributable for. Web updated on april 4, 2024. Suppose company x declares a.

Web A Stock Dividend Is When A Company Issues Additional Shares Of Its Own Stock To Its Shareholders, Usually In Proportion To The Number Of Shares They Already.

Web a formal procedure would recognize the dividend at the date of the declaration with the following entry for a large dividend for a par value of $1,000,000:. Reviewed by dheeraj vaidya, cfa, frm. Web the journal entry on the date of declaration is the following: Web a company may issue a stock dividend rather than cash if it doesn’t want to deplete its cash reserves.