Interest Revenue Journal Entry - Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an. To make a journal entry, you enter the details of a transaction into your. Web this journal entry is to recognize $250 of interest expense that charges for the month of april as well as to recognize the $250 of interest liability that the company owes at the. Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Calculate and record accrued interest. Debit your interest expense or accrued interest receivable. The company can make the accrued revenue journal entry by debiting accounts receivable and crediting revenue account. Abc company lent $9,000 at 10% interest on december 1, 2021. Offering flexible return policies can differentiate a business from its competitors, enhancing customer experience. A journal entry in accounting is how you record financial transactions.

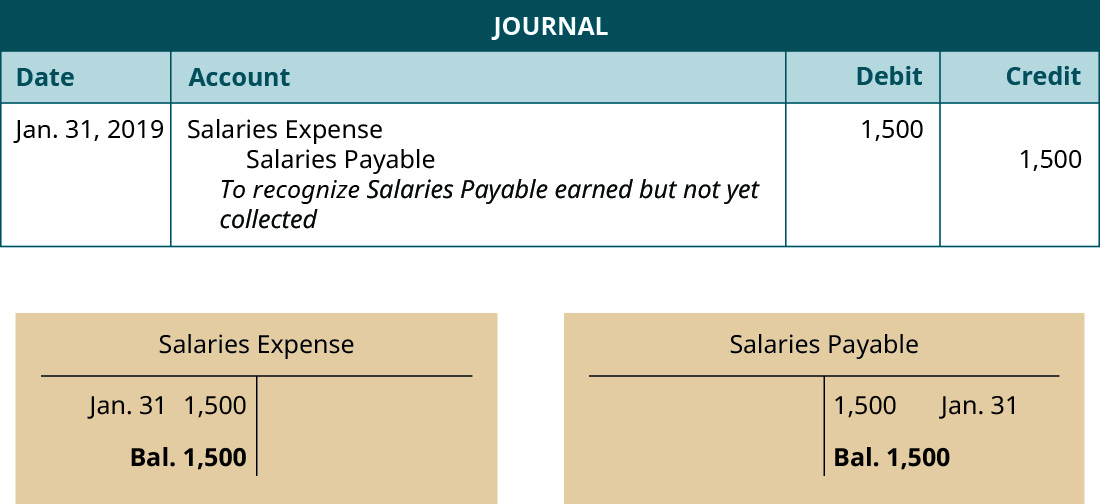

1.10 Adjusting Entry Examples Financial and Managerial Accounting

To make a journal entry, you enter the details of a transaction into your. To the maker of the note, or borrower, interest. Offering flexible.

How to Record Interest Receivable Journal Entry? (Example, Definition

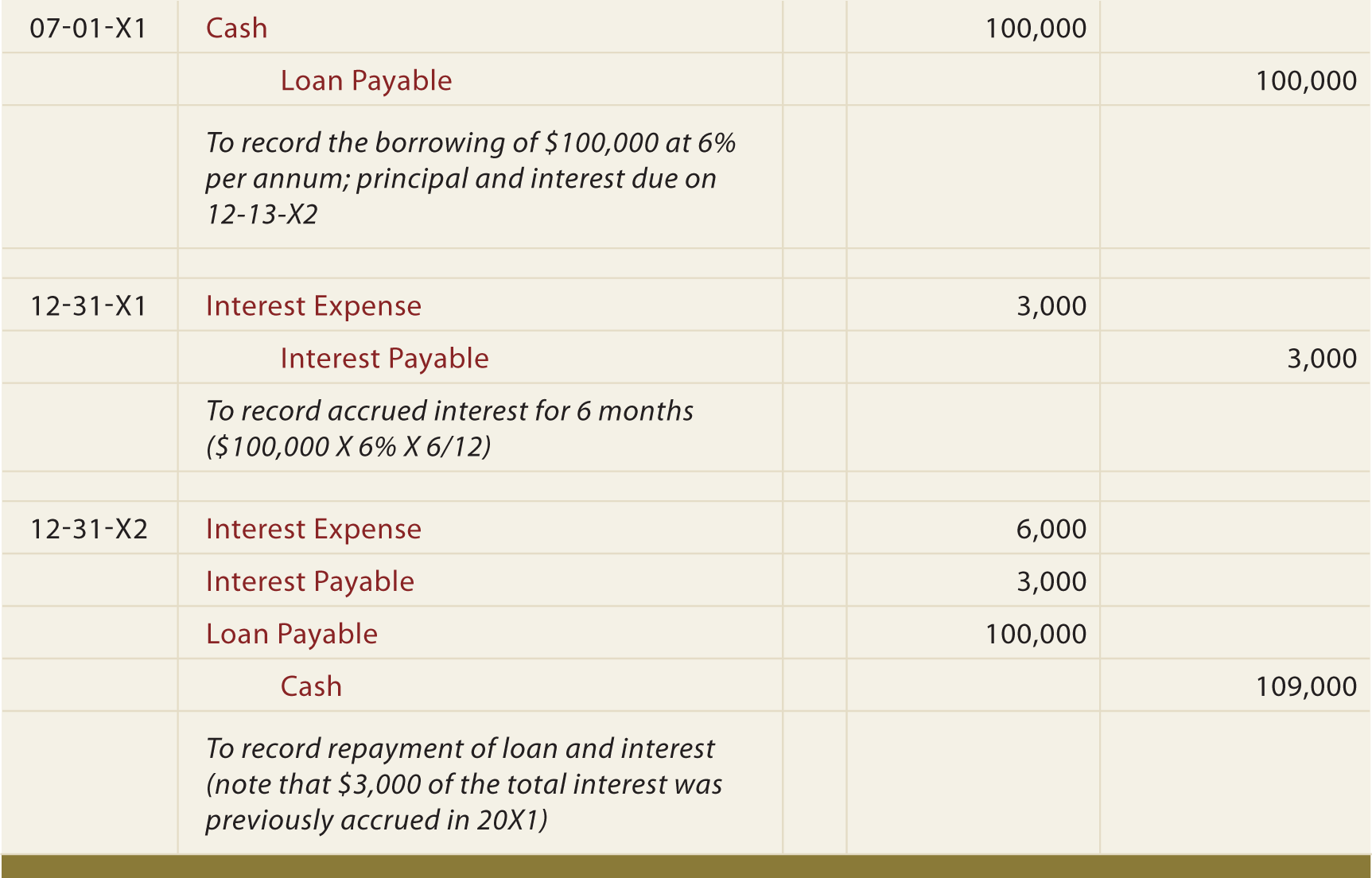

Web the journal entry is debiting interest expense, interest payable and credit cash paid. It will increase the interest receivable amount $ 2,000 and interest.

Accounting Q and A EX 154 Entries for investment in bonds, interest

This transaction will reverse the interest payable to zero and record interest expense from the. Web what is a journal entry? Interest is the.

How to use Excel for accounting and bookkeeping QuickBooks

Interest is the fee charged for use of money over a specific time period. In the years 2024 through 2026, the instafix co. Web .

What is Accrued Interest? Formula + Loan Calculator

Web interest income is the income earned on investment in debt securities such as money market securities, bonds, loans, etc. Offering flexible return policies can.

Interest Earned Double Entry Bookkeeping

Web once the interest income is accrued (becomes receivable), the journal entry should be passed to record when it became due and the date when.

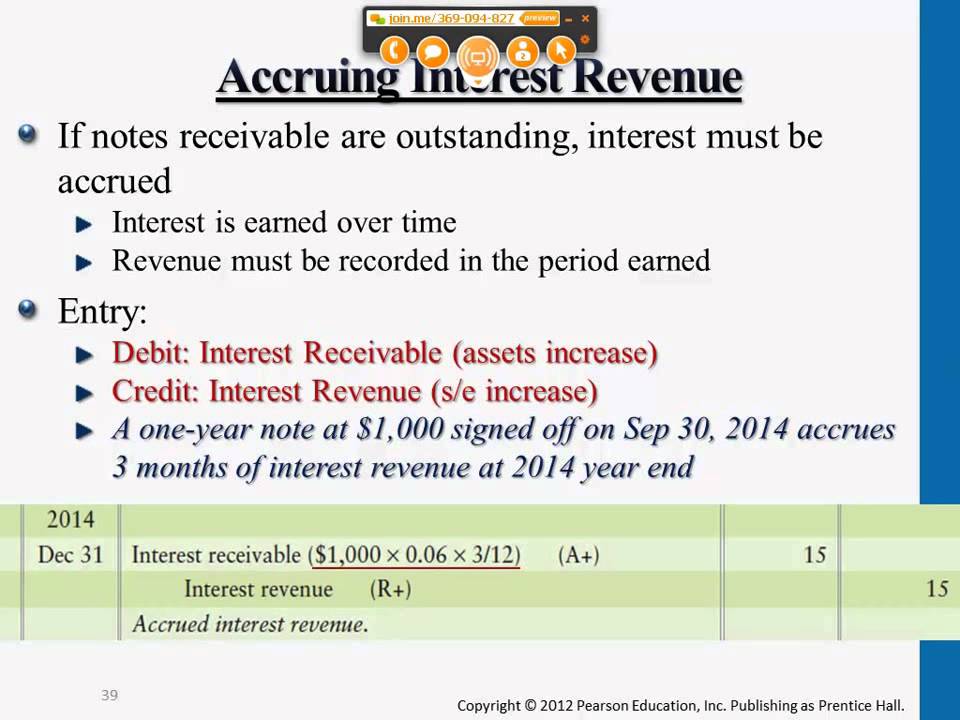

Accruing Interest Revenue Professor Victoria Chiu YouTube

To record the accrued interest over an accounting period, debit your accrued interest receivable. Calculate and record accrued interest. Web the entry consists of interest.

Self Study Notes The Adjusting Process And Related Entries

Web interest income journal entry is crediting the interest income under the income account in the income statement and debiting the interest receivable account in.

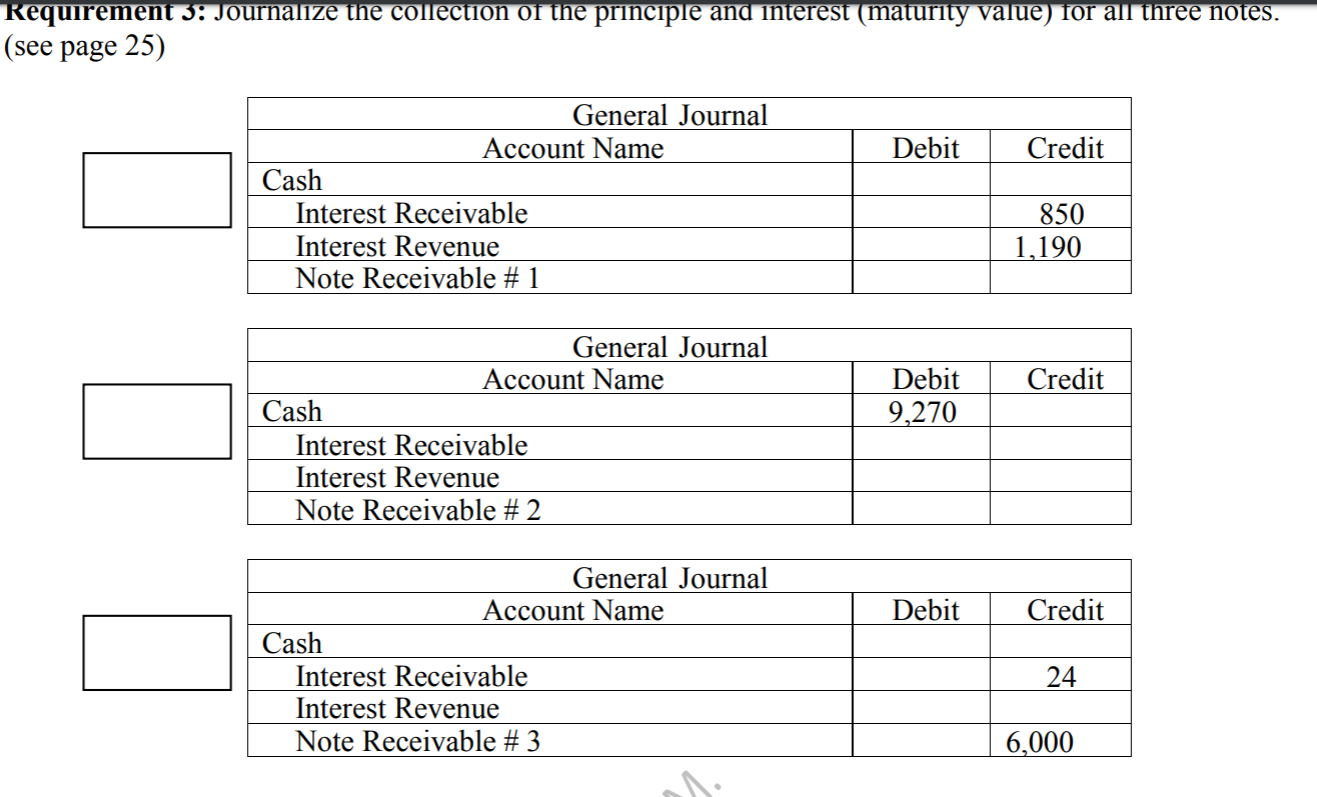

Outline page 28, the journal entry for the collection

Calculate and record accrued interest. Web what are accrued revenue journal entries? Web the journal entry is debiting interest expense, interest payable and credit cash.

Will Record A Total Of $249 Of Interest.

To the maker of the note, or borrower, interest. Accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an. The company can make the interest income journal entry by debiting the interest receivable account and crediting the interest income account. Web once the interest income is accrued (becomes receivable), the journal entry should be passed to record when it became due and the date when the payment against.

Accountant Records On December 31, 2023:

Web accrued revenue journal entry. Since the payment of accrued. Web for example, a company using the accrual basis of accounting purchases a certificate of deposit for $10,000 and earns 6% interest on it, which results in interest. Web you must record the revenue you’re owed in your books.

The Amount Will Be Collected After 1 Year.

Offering flexible return policies can differentiate a business from its competitors, enhancing customer experience. Web the entry consists of interest income or interest expense on the income statement, and a receivable or payable account on the balance sheet. Web the journal entry is debiting interest expense, interest payable and credit cash paid. Web the adjusting journal entry would be:

A Journal Entry In Accounting Is How You Record Financial Transactions.

Interest is the fee charged for use of money over a specific time period. To record the accrued interest over an accounting period, debit your accrued interest receivable. Abc company lent $9,000 at 10% interest on december 1, 2021. Web interest income is the income earned on investment in debt securities such as money market securities, bonds, loans, etc.