Interest Received Journal Entry - If it is a bank account, the date posted can be. A credit to the interest income account. Web how you create an accrued interest journal entry depends on whether you’re the borrower or lender. Web the process of recording interest receivable in financial accounting involves creating journal entries that reflect the accrued interest income. This journal entry will eliminate the $150 of. Web the journal entry for interest received in advance is: Web interest earned journal entry. Web learn how to create common journal entries for accrued interest, including adjusting entries and delayed bond issues sold at par value. Web on july 15, 2020, when the company receives the interest of $300 (60,000 x 0.5%) from the bank, it can make the journal entry below: Web the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting.

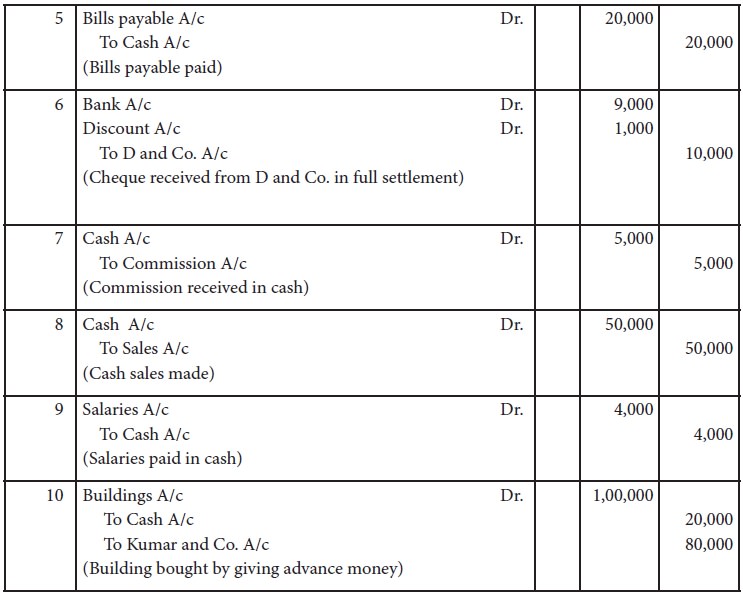

Journal entries Meaning, Format, Steps, Different types, Application

Web the journal entry to record this interest revenue would be: A credit to the interest income account. A debit to the interest receivable account..

Journal entries Meaning, Format, Steps, Different types, Application

Now suppose, a firm star shine receives interest on loan of 5,00,000 @ 7% p.a. Web learn how to create common journal entries for accrued.

Journal Entry Problems and Solutions Format Examples

Web the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double.

Journal Entry of Interest received in Cash Class 11, BookKeeping and

A business earns interest on deposits, but this is not received until after the month end. To illustrate suppose a business has deposited 10,000 with.

Interest received journal entry The debit credit

Web the journal entry to record this interest revenue would be: In this case at the end of the year, the interest is. A credit.

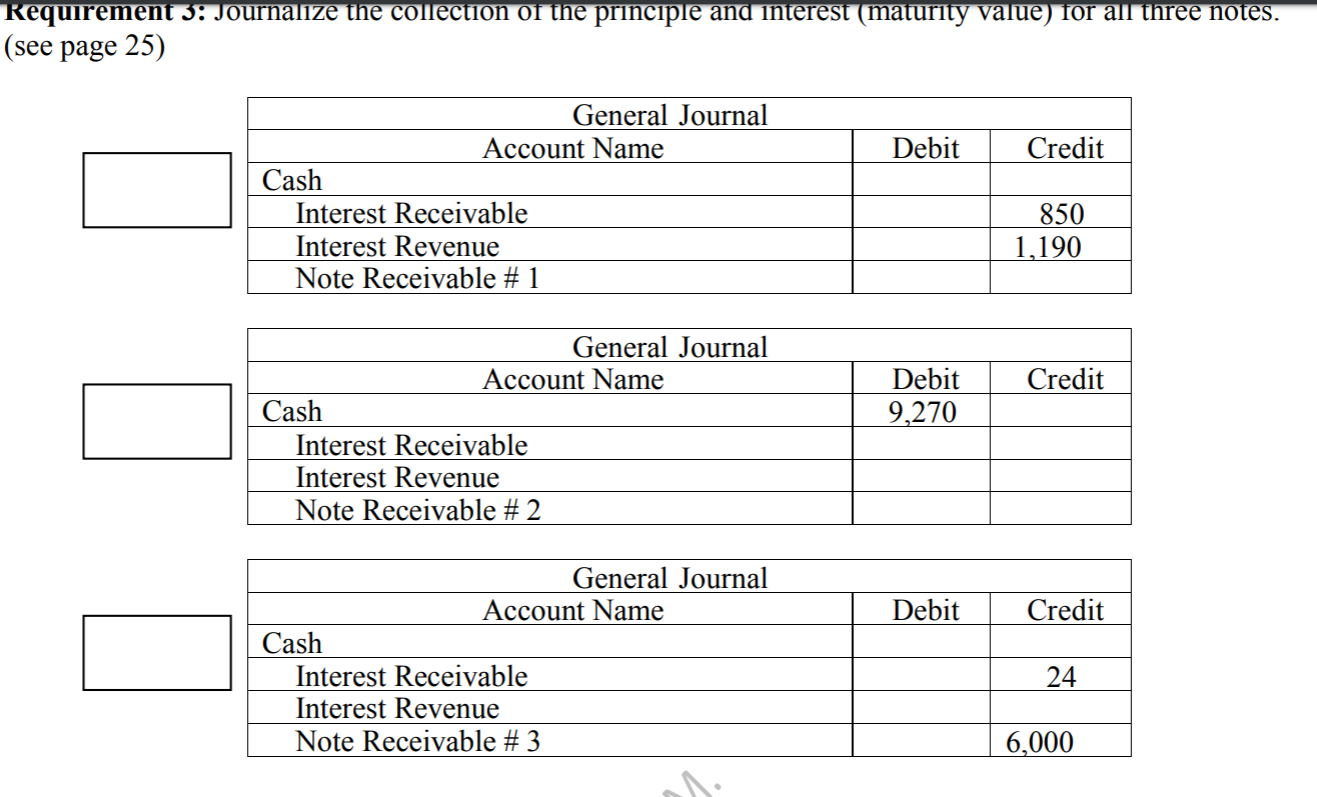

Outline page 28, the journal entry for the collection

This journal entry will eliminate the $150 of. Web how you create an accrued interest journal entry depends on whether you’re the borrower or lender..

What is Accrued Interest? Formula + Loan Calculator

It will increase the interest receivable amount $ 2,000 and interest income for the. Web the journal entry for interest received in advance is: Web.

Interest Earned Double Entry Bookkeeping

Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Now suppose, a firm star shine receives interest on.

When a Job Is Completed the Journal Entry Involves a OlivehasHenderson

A business earns interest on deposits, but this is not received until after the month end. This journal entry will eliminate the $150 of. Interest.

The Following Interest Receivable Journal Entry Example Explains The Most Common Type Of Situations Where The Journal Entry Of.

Web the journal entry is debiting accrued interest receivable $ 2,000 and interest income $ 2,000. Web journal entry for interest received from bank; I'll share with you the complete actions in recording interest in quickbooks online. These entries are crucial for.

However, If The Company Had Been Using The Cash Basis Of Accounting And The Cash Had Not Yet Been Received By The.

It will increase the interest receivable amount $ 2,000 and interest income for the. Web january 08, 2021 04:21 pm. Web the journal entry for recording interest received from the bank is provided below: Web the bank reconciliation journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting.

Web The Journal Entry Is Debiting Interest Receivable And Credit Interest Income.

Date the journal entry for the day interest was posted to the account. To illustrate suppose a business has deposited 10,000 with a bank earning 5% simple interest. If you’re the borrower, you’ll work the following accounts: Web the usual journal entry used to record interest receivable is a debit to the interest receivable account and a credit to the interest income account.

Debit The Receiver And Credit All Incomes And Gains) Example.

Alex has a savings account with abc bank. Interest received ₹24,000 for eight. There are two ways of recording the interest,. Web on july 15, 2020, when the company receives the interest of $300 (60,000 x 0.5%) from the bank, it can make the journal entry below: