Journal Entry Loan From Bank - As a result, when borrowed money is repaid, the firm usually pays some sort of interest on top of the principal. Web what is the journal entry for the loan received from the bank? A company’s accounting system is built on countless journal entries, whether they’re recorded on paper, entered by hand or automatically into a computer program, or created using some combination of multiple methods. In our first journal entry lesson george burnham invested $15,000 of his personal funds into his new business, george's catering. Web here are four steps to record loan and loan repayment in your accounts: Loan is taken from a bank or person: Web bank loan received journal entry bank loans enable a business to get an injection of cash into the business. On july 1,2023 , cullumber ltd. Below is a compound journal entry for loan payment made including both principal and interest component; It increases (or occurs) on the credit side and decreases on the debit side.

Loan Journal Entry Examples for 15 Different Loan Transactions (2023)

Web once the loan is set up, a journal entry will be created on the loan account and bank account. Web journal entry for a.

Bank Loan EMI Entries in Tally ERP9 Loan installment entries Journal

Web once the loan is set up, a journal entry will be created on the loan account and bank account. Below is a compound journal.

Bank Loan Repaid Journal Entry Info Loans

Web to record the loan amount, deposit it for cash loans. In the deposit to field, select the account to deposit the loan into. To.

Receive a Loan Journal Entry Double Entry Bookkeeping

Web a journal entry is a record of a business transaction. A business can take an amount of money as a loan from a bank.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

In return, the business has to pay interest. Early loan repayment should be reflected in the journal entry, including the amount paid off and any.

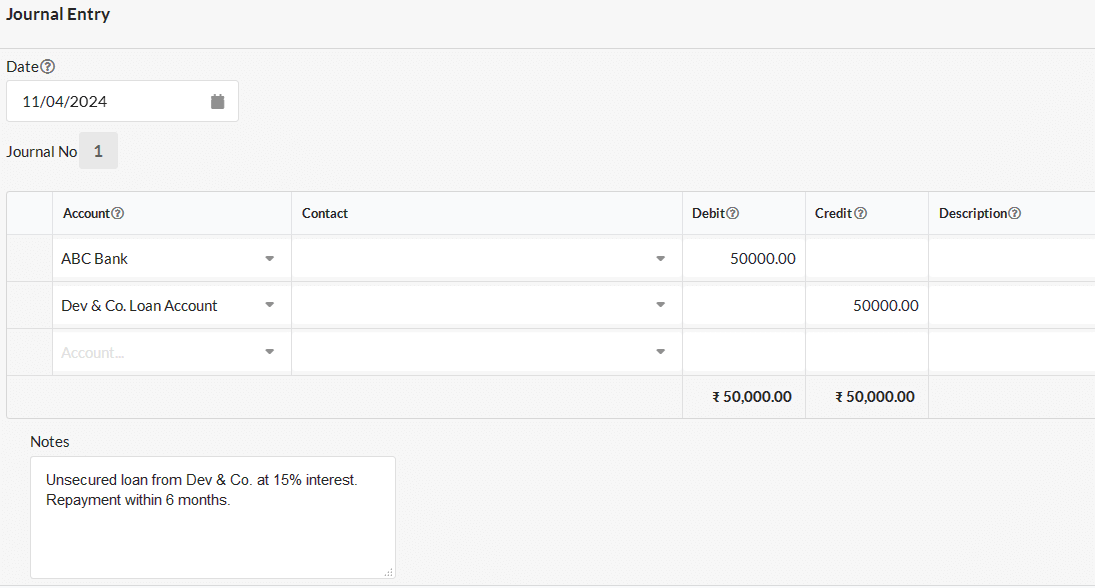

Journal entry for Loan Payable Output Books

It shows that you’ve received the loan, and outlines the loan liability. There will also be a journal entry for each payment for the amount.

What Is The Journal Entry For A Loan Payment

Web what is the journal entry for the loan received from the bank? This is the exact opposite of the first journal entry above. A.

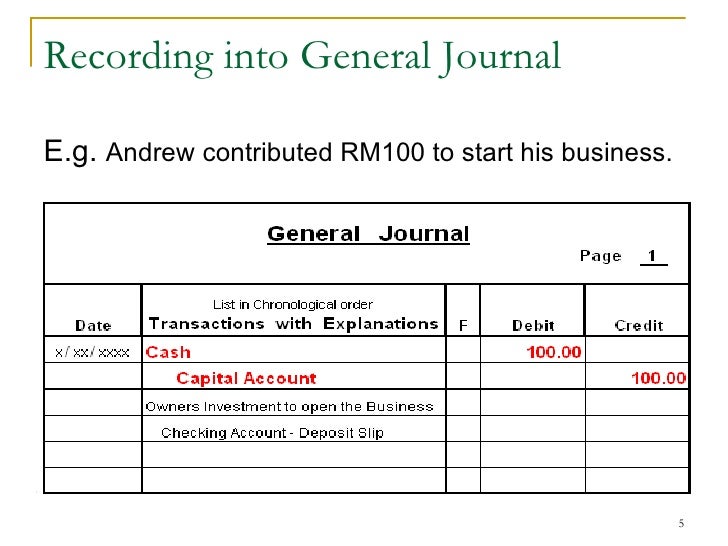

Journal Entries Examples Format How To Use Explanation

*assuming that the money was deposited directly in the firm’s bank. Go to the banking menu, then select make deposits. A company’s accounting system is.

Journal Entries of Loan Accounting Education

Journal entries record the entire spectrum of monetary transactions. Web journal entry for a loan from the bank. Web for the purpose of making the.

Web The Journal Entry Would Involve Debiting The Interest Expense Account For $200, Debiting The Loan Liability Account For $800, And Crediting The Cash Account For The Total Payment Of $1,000.

Obtaining a loan from a bank or other financial institution is a common way for companies to access the financial resources they need to fund their operations and support their growth. As a result, when borrowed money is repaid, the firm usually pays some sort of interest on top of the principal. Loan is taken from a bank or person: If the payments to deposit window open, select cancel.

Journal Entry For A Bank Loan Repaid In Full.

Web we can make the journal entry for loan payment with interest by debiting the loan payable account and the interest payable account and crediting the cash account. Check the date and enter an optional memo. Bank (or cash) is an asset. *usually, the bank will provide the payment schedule as in the table.

Below Is A Compound Journal Entry For Loan Payment Made Including Both Principal And Interest Component;

Web now the journal entry for repaying the loan is as follows: Web they can be obtained from banks, nbfcs, private lenders, etc. The first step is to produce a loan repayment schedule as shown below. Loan/note payable general journal entry.

Early Loan Repayment Should Be Reflected In The Journal Entry, Including The Amount Paid Off And Any Interest Payments.

Web on january 1, 2020. In the make deposits window: Company abc is making a loan to its business partner for $ 70,000. The company records adjusting journal entries annually at yearend on december 31.