How To Record Depreciation Expense Journal Entry - Credit the fixed asset account for the original cost of the asset. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life. Overview of depreciation calculation methods. The depreciation cost estimate is an expense of the business included in the income statement for each accounting period. When recording depreciation on income tax returns, it’s important to follow the irs guidelines to the letter. Journal entry for year 1. One is where the depreciation account is debited and accumulated depreciation account is credited. Web depreciation journal entry example: Web how to calculate the depreciation expense. Explanation of what depreciation is.

Accounting Journal Entries For Dummies

Residual value or scrap value: Web the journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement.

Journal Entry for Depreciation Example Quiz More..

Explanation of what depreciation is. The need for depreciation for tax purposes. Web the journal entry to record this expense is straightforward. Depreciation is recorded.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Grow your business with quickbooks. When recording depreciation on income tax returns, it’s important to follow the irs guidelines to the letter. Enter the depreciated.

What is the journal entry for depreciation? Leia aqui What is

Journal entry for year 1. On the first line, select the asset account you use to track the loan from the account dropdown. We cannot.

journal entry format accounting accounting journal entry template

We cannot record expenses on the purchasing date as it will provide benefits over a long period. Web jul 7, 2023 bookkeeping by adam hill..

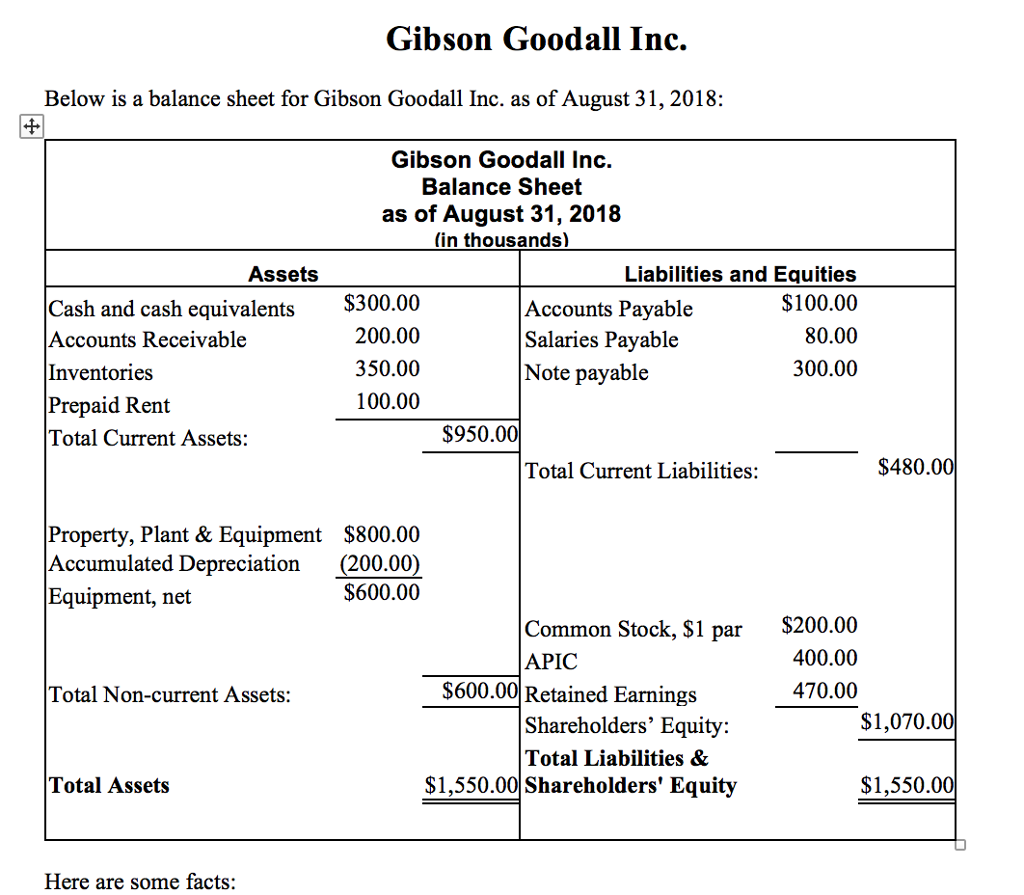

Solved Gibson Goodall Inc. Below is a balance sheet for

Web the journal entry to record depreciation is fairly standard. Credit the fixed asset account for the original cost of the asset. Irs rules for.

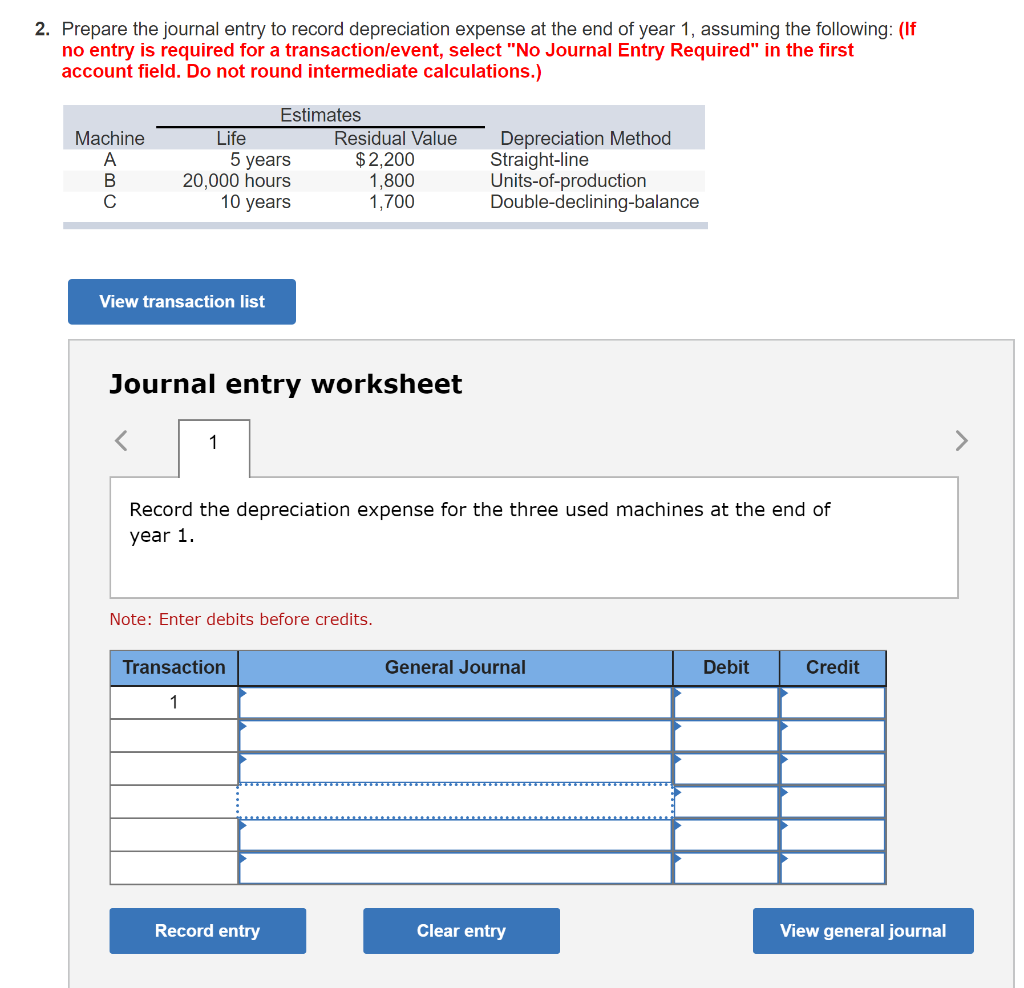

Solved 2. Prepare the journal entry to record depreciation

How do i record depreciation? Residual value or scrap value: By debiting the depreciation expense and crediting accumulated depreciation, the book value of the asset.

Depreciation Explanation Accountingcoach with Bookkeeping Reports

The journal entry for year 2 is as follow: Web here are four easy steps that’ll teach you how to record a depreciation journal entry..

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

For example, manufacturing equipment is a fixed asset class. Web there are two methods that can be used to record the journal entry for depreciation..

Journal Entry For Year 2.

Residual value or scrap value: Accumulated depreciation is a contra account to fixed assets. Debit the accumulated depreciation account for the amount of depreciation claimed over the life of the asset. Explanation of what depreciation is.

Web Jul 7, 2023 Bookkeeping By Adam Hill.

Web at the end of the year after you've talked to your accountant, create a journal entry to record the lost value. Web the journal entry for depreciation is: Web company usually records revenue every month base on the accrual basis, so depreciation expense needs to record in the same period that company consumes its benefit. You credit your cash account to record money leaving the business if you've paid for the expense.

How Do I Record Depreciation?

Provisions involve allocating funds to anticipate future. Web to record depreciation, a journal entry is made at the end of each accounting period, debiting the depreciation expense account and crediting the accumulated depreciation account. The depreciation cost estimate is an expense of the business included in the income statement for each accounting period. When recording depreciation on income tax returns, it’s important to follow the irs guidelines to the letter.

Web The Initial Recording Of An Asset Has Two Steps:

In year 1, the journal entry is as follow: In year 2, the depreciation is the same as in year 1. Before you record depreciation, you must first select the depreciation method—and the depreciation method must be uniform for all classes of assets. We cannot record expenses on the purchasing date as it will provide benefits over a long period.