Journal Entry For Payroll Tax Expense - In us and many other countries, employers are required to withhold the income tax from its employees by working out income tax applicable to them based on the. In contrast, a payroll ledger consolidates these entries, providing a detailed account of all payroll activities. Employer portion of social security tax. Web a payroll journal records each payroll transaction through entries like journal entry wages and payroll tax expense journal entries. Employer portion of medicare tax. Web examples of payroll journal entries for wages. Web recording the payroll process with journal entries involves three steps: For example, if the total pay for the period is $50,000, the entry will be: Web there are diverse types of payroll journal entries, including: Web a payroll journal entry is an accounting method to control gross wages and compensation expenses.

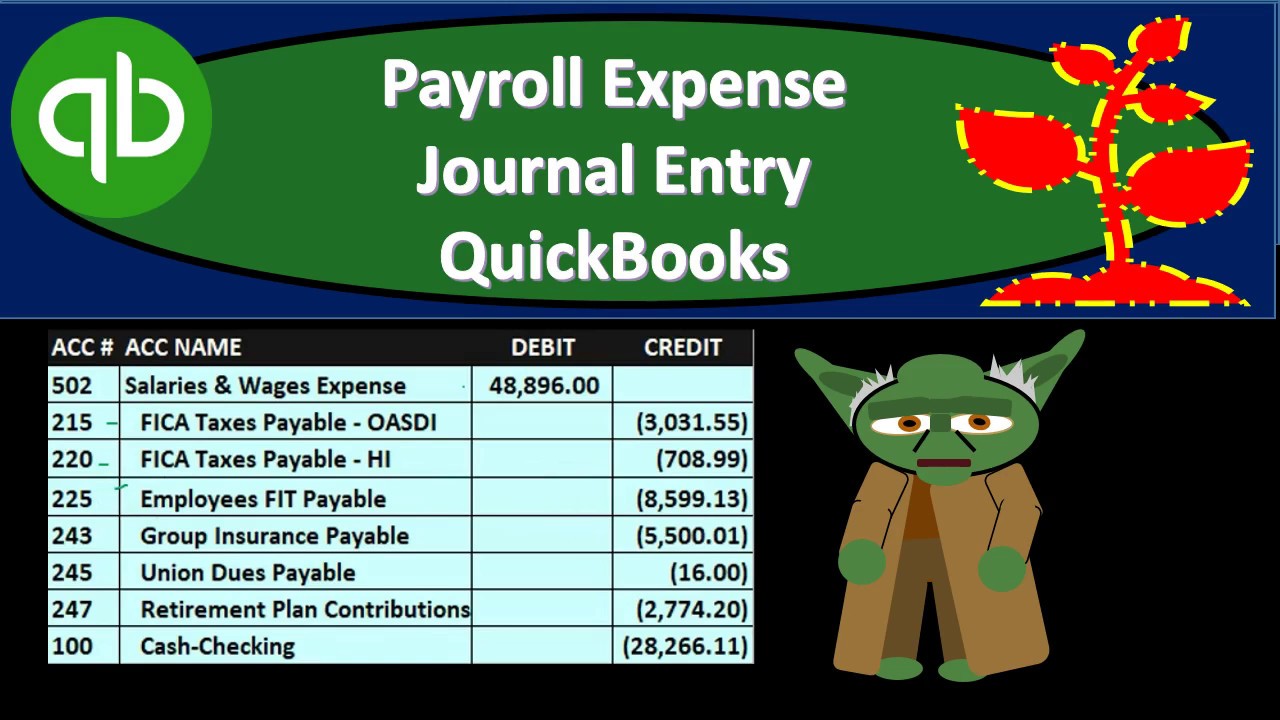

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

Payroll accounting can be pretty complicated. Let’s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day.

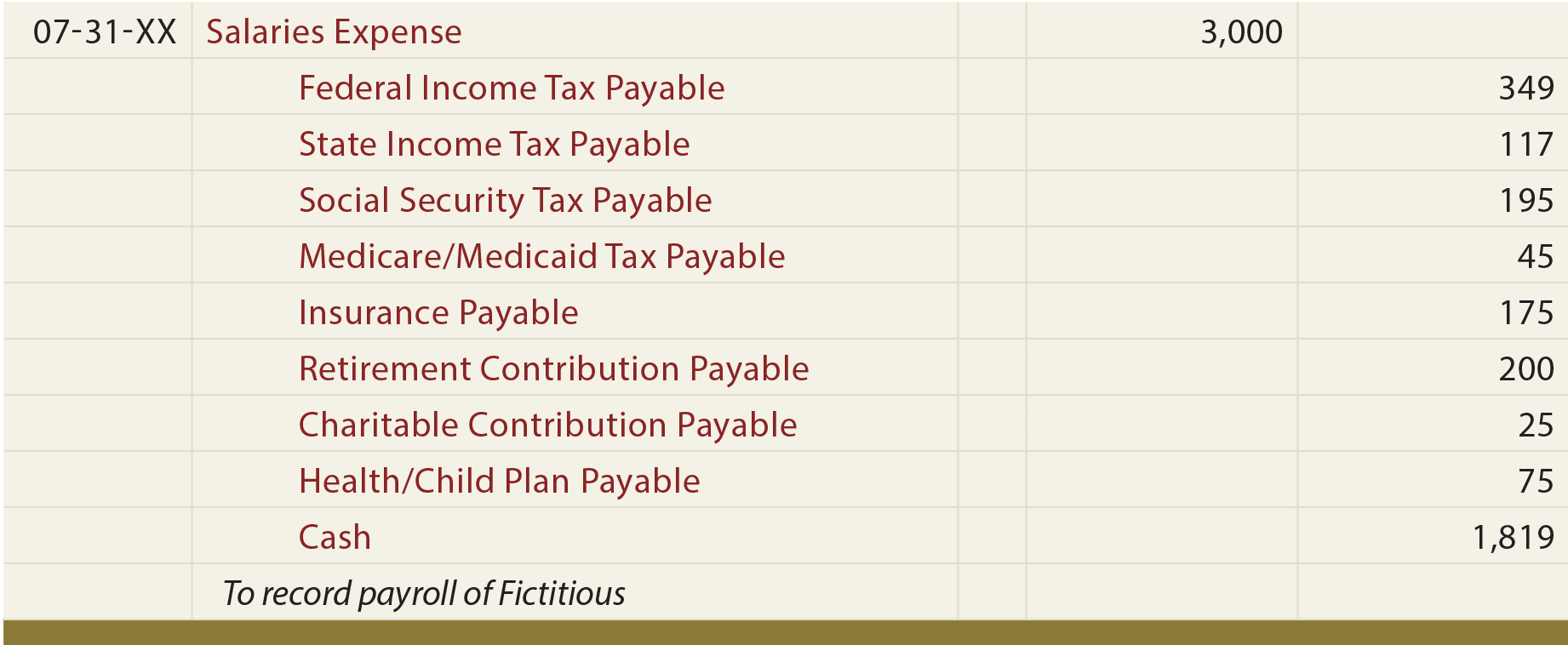

Payroll Journal Entry Example Explanation My Accounting Course

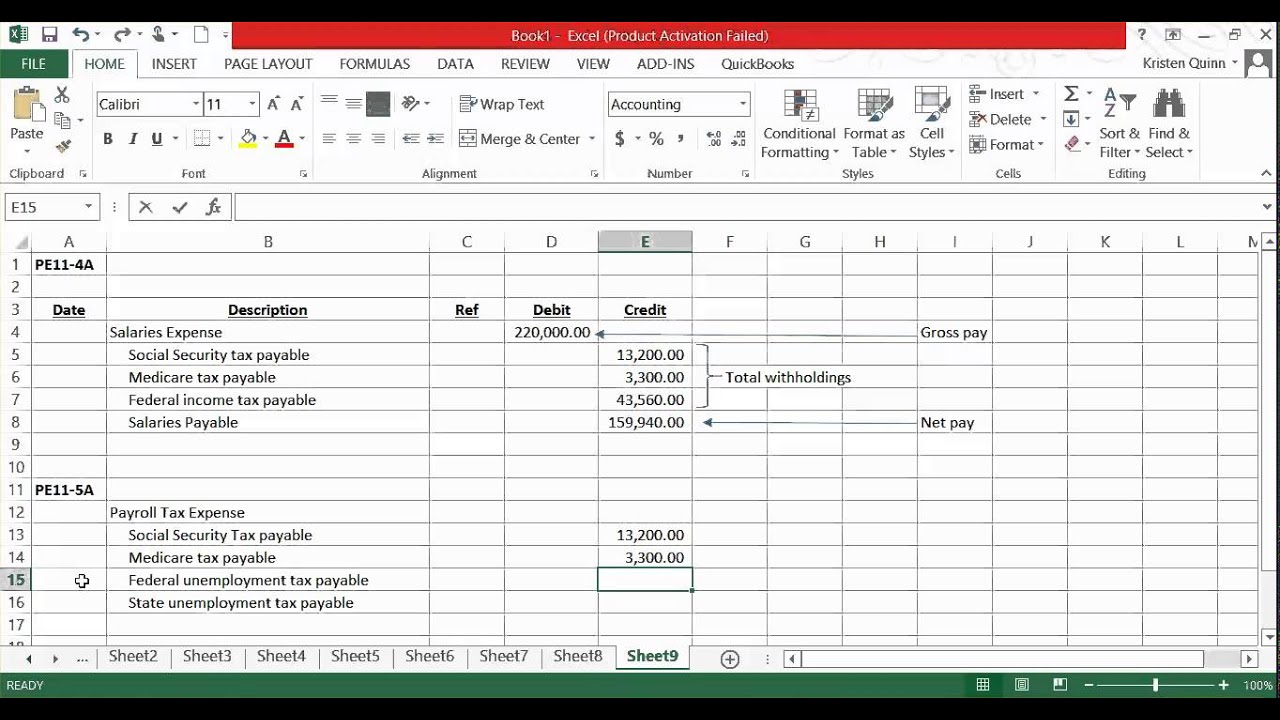

Once you've completed your payroll journal entry, you can post it. For example, if the total pay for the period is $50,000, the entry will.

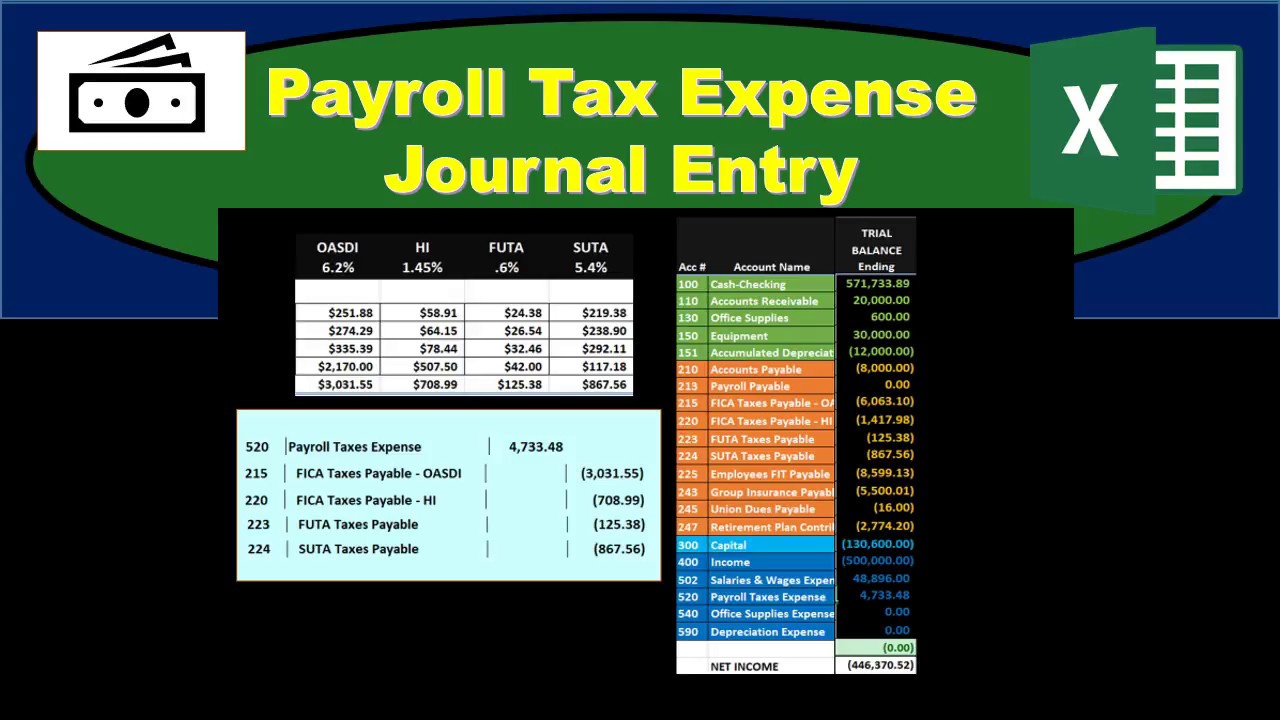

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Web journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. As a.

Payroll Expense Journal EntryHow to record payroll expense and

Web one method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer taxes. Web.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

An accountant records these entries into their general ledger for the company and uses payroll journal entries to document payroll expenses. Web a payroll journal.

Payroll

Employer portion of medicare tax. Record the following expenses in your payroll account: While the process may look different for every company, payroll ledgers can.

80 Payroll Tax Expense Journal Entry u YouTube

Assume a company had a payroll of $35,000 for the month of april. This entry usually includes debits for the direct labor expense, salaries,. While.

10 Payroll Journal Entry Template Template Guru

In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. You’ll.

Journal Entry For Tax Payable

Web the journal entry is debiting payroll expense $ 50,000 and credit salary tax payable $ 5,000, social security payable $ 8,000, cash $ 37,000..

Web Examples Of Payroll Journal Entries For Salaries.

An accountant records these entries into their general ledger for the company and uses payroll journal entries to document payroll expenses. This entry records the gross pay earned by employees during a pay period. Payroll accounting can be pretty complicated. Web one method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer taxes.

Web Recording The Payroll Process With Journal Entries Involves Three Steps:

We break down what payroll entries are and how to make one to process your payroll. You’ll need to collect a few forms from your employees before you can run payroll: Whether you are paying one employee or dozens of employees, you need to make a payroll journal entry. And medical insurance premiums $940.

Discover Best Practices To Manage And Record Your Payroll!

Web payroll journal entries record your workers’ pay alongside overall business expenses. Accruing payroll liabilities, transferring cash, and making payments. Web payroll taxes expense (er) $687.41: Web examples of payroll journal entries for wages.

In Us And Many Other Countries, Employers Are Required To Withhold The Income Tax From Its Employees By Working Out Income Tax Applicable To Them Based On The.

Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. The company withheld the following amounts from the employees’ pay: Web the payroll expense equals the accrued gross salaries plus employer payroll taxes and the amount paid to employees is net of any employee payroll taxes. Web examples of payroll journal entries for salaries.