Sales Tax Paid Journal Entry - Web the journal entry is debiting sale tax payable $ 500 and credit cash $ 500. The transaction will decrease cash $500 and decrease sale tax payable $ 500. At the time of collection of sales taxes. Web us quickbooks community. Next, you’ll credit your “ sales ” account with the amount billed for your food. Enter sales tax in the name and description fields. Write tax expense on the first line of the account column. This account will be increased for. Web january 29, 2022 10:01 am. Credit the amount of the sales price to the sales account in the same.

Purchase Return Double Entry Bookkeeping

Web to create a journal entry in your general ledger or for a sale, take the following steps. General journal entry for sales tax. Debit.

Example Journal Entry with VAT

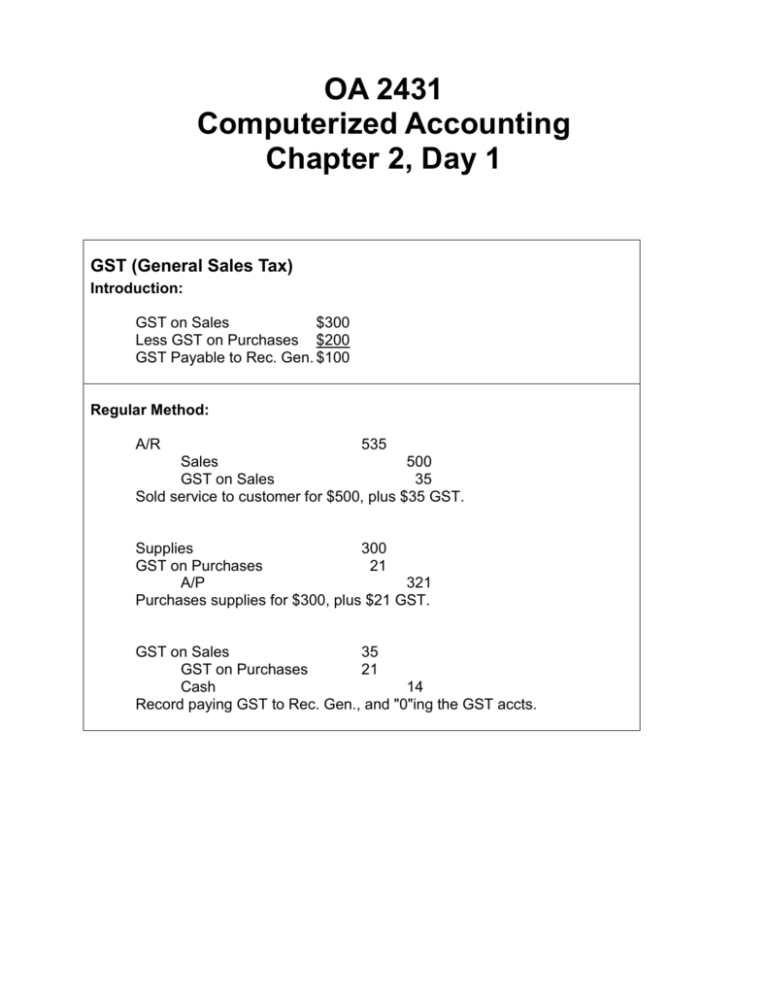

Web since an entity will recover sales tax it pays on purchases, input tax must not be shown as an expense. The sales tax journal.

Enter Journal Entries with VAT

Web on the products and services page, click new. Web the following general journal entry was made to record the return. Web debit $220 to.

Sales Tax Payable Journal Entries YouTube

Web you can record the sales tax by creating journal entries. General journal entry for sales tax. Web the journal entry is debiting sale tax.

Journal Entries Format

This represents the account that has been paid. Web the journal entry is debiting sale tax payable $ 500 and credit cash $ 500. How.

Journal Entry for Tax Paid by Cheque davistakey1939 Davis

Web to create a journal entry in your general ledger or for a sale, take the following steps. At the time of collection of sales.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Web sales tax abc, inc. This account will be increased for. Web debit $220 to the cash account in a new journal entry. The transaction.

Entries for Sales and Purchase in GST Accounting Entries in GST

Web the journal entry for sales tax is a debit to the accounts receivable or cash account for the entire amount of the invoice or.

Journal Entry Examples

Web sales tax abc, inc. For an amount which shall be the sum of. At the time of collection of sales taxes. Web the following.

Subtract The Total Deductions From The Gross Pay To Find The Net Pay—The Amount That Will Actually Be Disbursed To The Employee.

Web sales tax abc, inc. Write the amount of the sales tax payment in the debit column on. Web since an entity will recover sales tax it pays on purchases, input tax must not be shown as an expense. Therefore, purchases are shown net of any sales tax paid.

Then, To Ensure You'll Be Able To Accurately Assign The.

August 29, 2023 09:28 pm. Write tax expense on the first line of the account column. How do i record sales tax paid when i have a sales tax payable liability account? Web sales tax journal entry.

Web To Create A Journal Entry In Your General Ledger Or For A Sale, Take The Following Steps.

Web january 29, 2022 10:01 am. Web first, you’ll debit your “ cash/bank ” account with the total amount received, i.e. Web on the products and services page, click new. Sales tax payable is the tax obligation that the company owes to the government.

Web Us Quickbooks Community.

Last updated november 08, 2018 1:47 pm. The sales tax journal entry you record depends on whether you: Web when a customer is billed for sales taxes, the journal entry is a debit to the accounts receivable asset asset for the entire amount of the invoice, a credit to the. For an amount which shall be the sum of.