How To Journalize Depreciation - Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation account (which appears in the balance sheet as a contra account that reduces the amount of fixed assets). Depreciation expense will impact the income statement and deduct company profit. The depreciation expense appears on the income statement like any other expense. But what, exactly, is depreciation? Selling a depreciable asset, other information regarding depreciable assets. How to keep your journal entries and accounting under control. Web the journal entry for depreciation is: Whether you maintain the provision for depreciation/accumulated depreciation account determines how to do the journal entry for depreciation. Web the journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal entry to the accumulated depreciation account in the balance sheet. Web create, review, and approve journals, then electronically certify, post them to and store them with all supporting documentation.

What is the journal entry for depreciation? Leia aqui What is

Web the journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal entry.

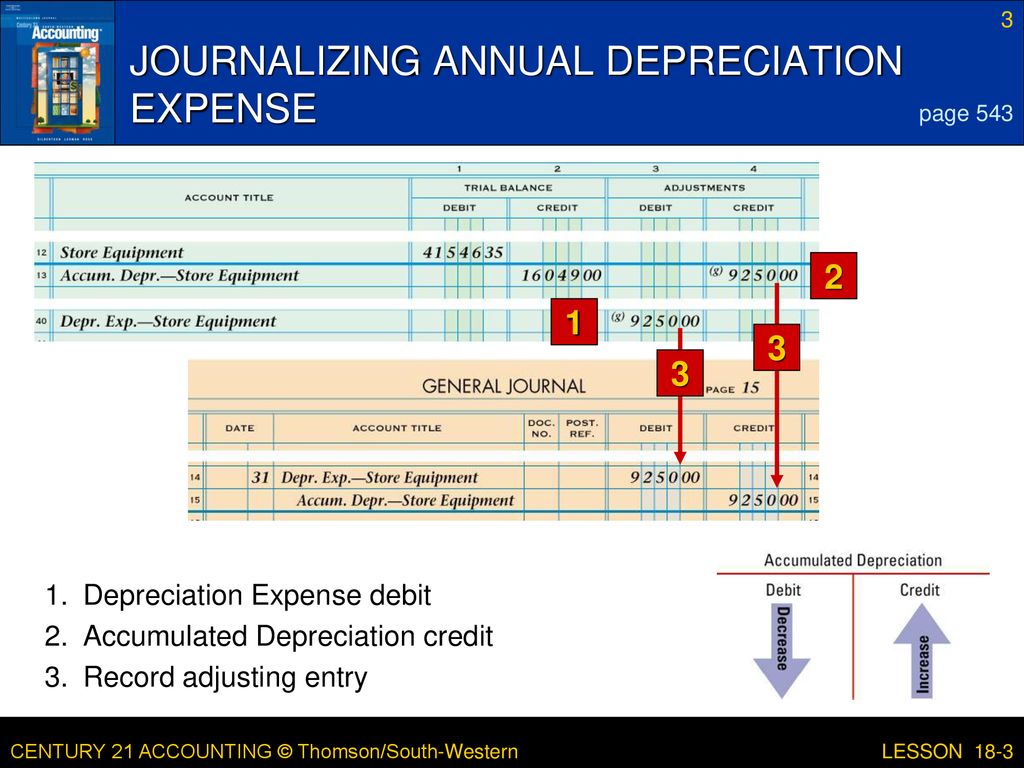

Adjusting Entries Journalizing Depreciation Adjusting Entries

The adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. How to keep your journal entries and accounting under control..

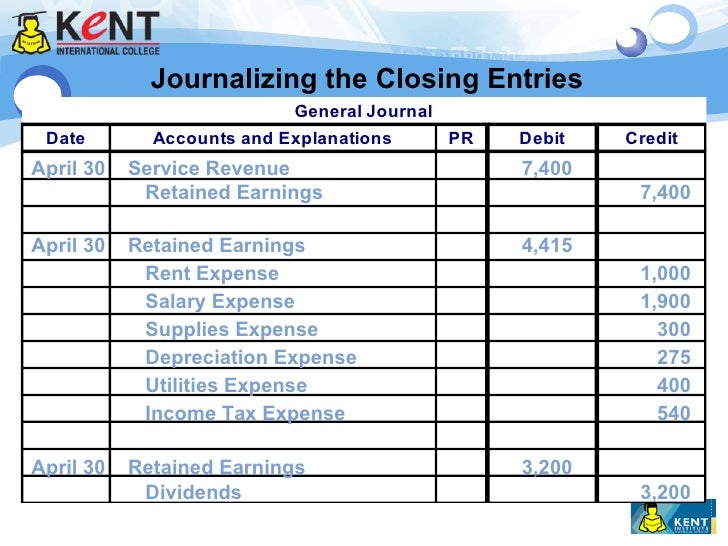

Journalizing Closing Entries / Closing Entries Types Example My

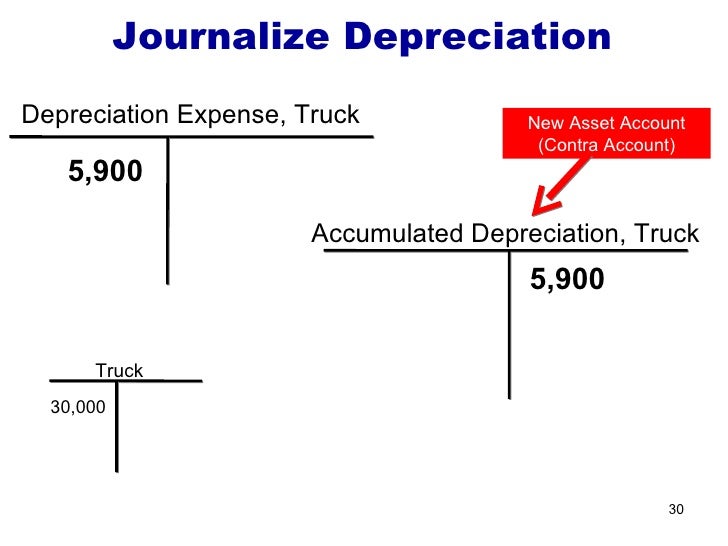

Expenses that have a useful life of multiple years are written off via an accounting method called depreciation. Debit to the income statement account depreciation.

LESSON 183 Journalizing Depreciation Expense ppt download

Web learn how to record a depreciation journal entry using the information on your fixed asset depreciation worksheet. Debit to the income statement account depreciation.

LESSON 8 2 Calculating and Journalizing Depreciation Expense

Web using depreciation allows you to depreciate assets and certain costs over time. Web for natural resources we will use depletion expense and accumulated depletion.

Chapter 3 add depreciation, closing entries, 4 diff timelines accts,

Web © 2024 google llc. Estimated value of the fixed asset at the end of its useful life. The income statement account depreciation expense is.

Recording Depreciation Expense for a Partial Year

Typical fixed assets journal entries. Web using depreciation allows you to depreciate assets and certain costs over time. Credit to the balance sheet account accumulated.

Plant assets and depreciation

Any decrease in the market value of an asset cannot be regarded as depreciation. Credit to the balance sheet account accumulated depreciation. Typical fixed assets.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Debit the accumulated depreciation account for the amount of depreciation claimed over the life of the asset. Web the basic journal entry for depreciation is.

Estimated Value Of The Fixed Asset At The End Of Its Useful Life.

Any decrease in the market value of an asset cannot be regarded as depreciation. Debit the accumulated depreciation account for the amount of depreciation claimed over the life of the asset. How do i record depreciation? Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year.

Web Create, Review, And Approve Journals, Then Electronically Certify, Post Them To And Store Them With All Supporting Documentation.

Purchase price and all incidental cost of the asset. Web the company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation. The journal entry to record depletion would be similar to depreciation: Debit to the income statement account depreciation expense.

How To Keep Your Journal Entries And Accounting Under Control.

Web for natural resources we will use depletion expense and accumulated depletion and the units of production method for calculating depletion. We'll work through a straight l. Recording depreciation to date of sale. Credit the fixed asset account for the original cost of the asset.

Web The Journal Entry For Depreciation Refers To A Debit Entry To The Depreciation Expense Account In The Income Statement And A Credit Journal Entry To The Accumulated Depreciation Account In The Balance Sheet.

Depreciation is a term used in accounting to describe the decrease in the value of an asset over time. Web depreciation journal entry: Web the journal entry for depreciation is: This guide discusses how to calculate the depreciation expense journal entry.