How To Journalize Adjusting Entries - We will use the following preliminary balance sheet, which reports the account balances prior to any adjusting entries: journal entries track how money moves—how it enters your business, leaves it, and moves between different accounts. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. It typically relates to the balance sheet. Web make adjusting journal entries. This is a systematic way to prepare and post adjusting journal entries that accountants have been using for about 500 years. Fact checked by leila najafi. Web posting adjusted journal entries to the ledger | financial accounting. Emily roberts â©the balance 2019. Web how to make adjusting entries.

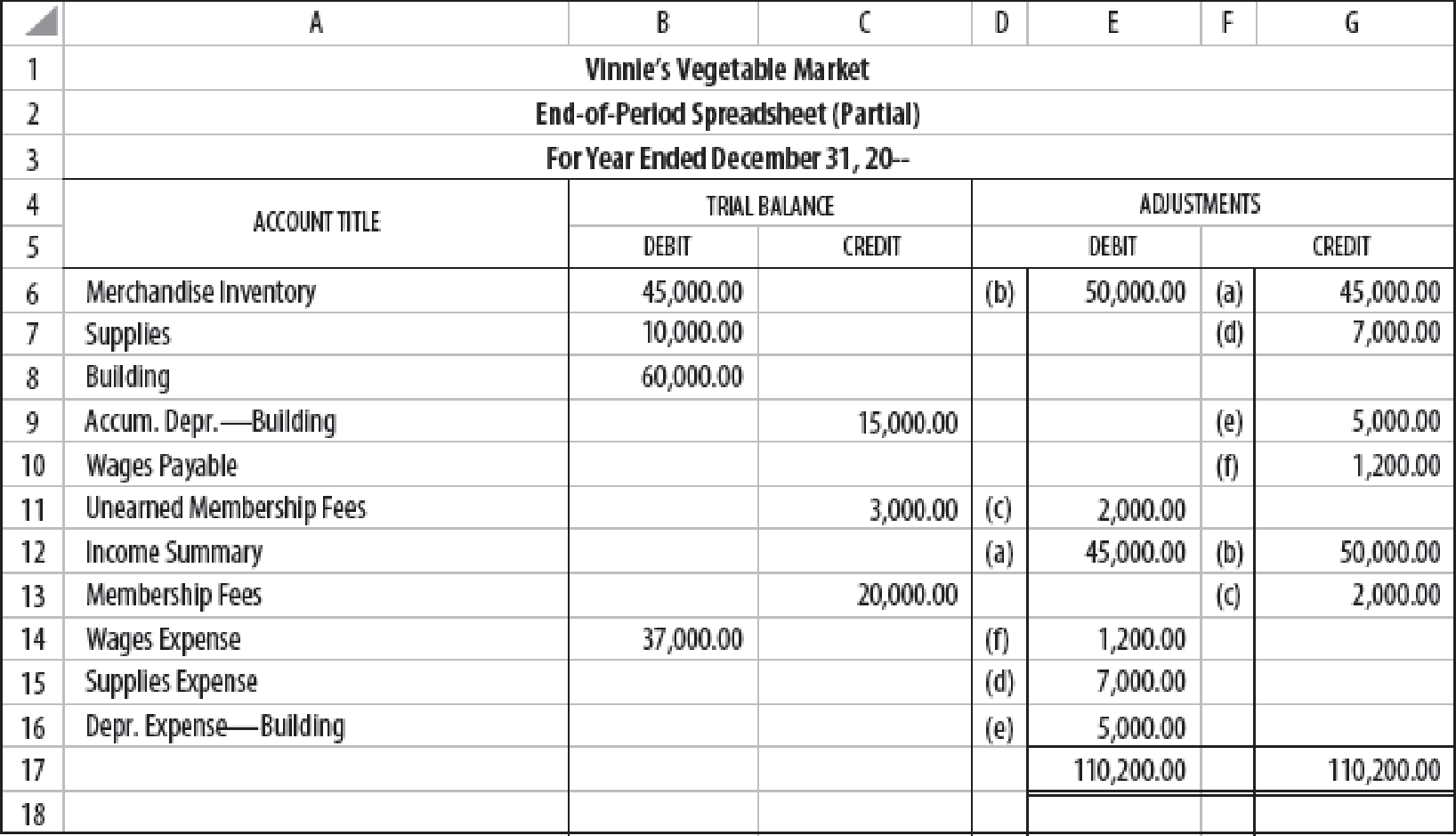

JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING BUSINESS The following

Common types of adjusting entries include accrued expenses, accrued revenues, provisions, and deferred revenues and expense and. Web building your business. Adjusting entries, also known.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

Accrued income refers to income already earned but not yet received. You can use an adjusting journal entry for accrual accounting when accounting periods transition..

Adjusting Journal Entries Defined Accounting Play

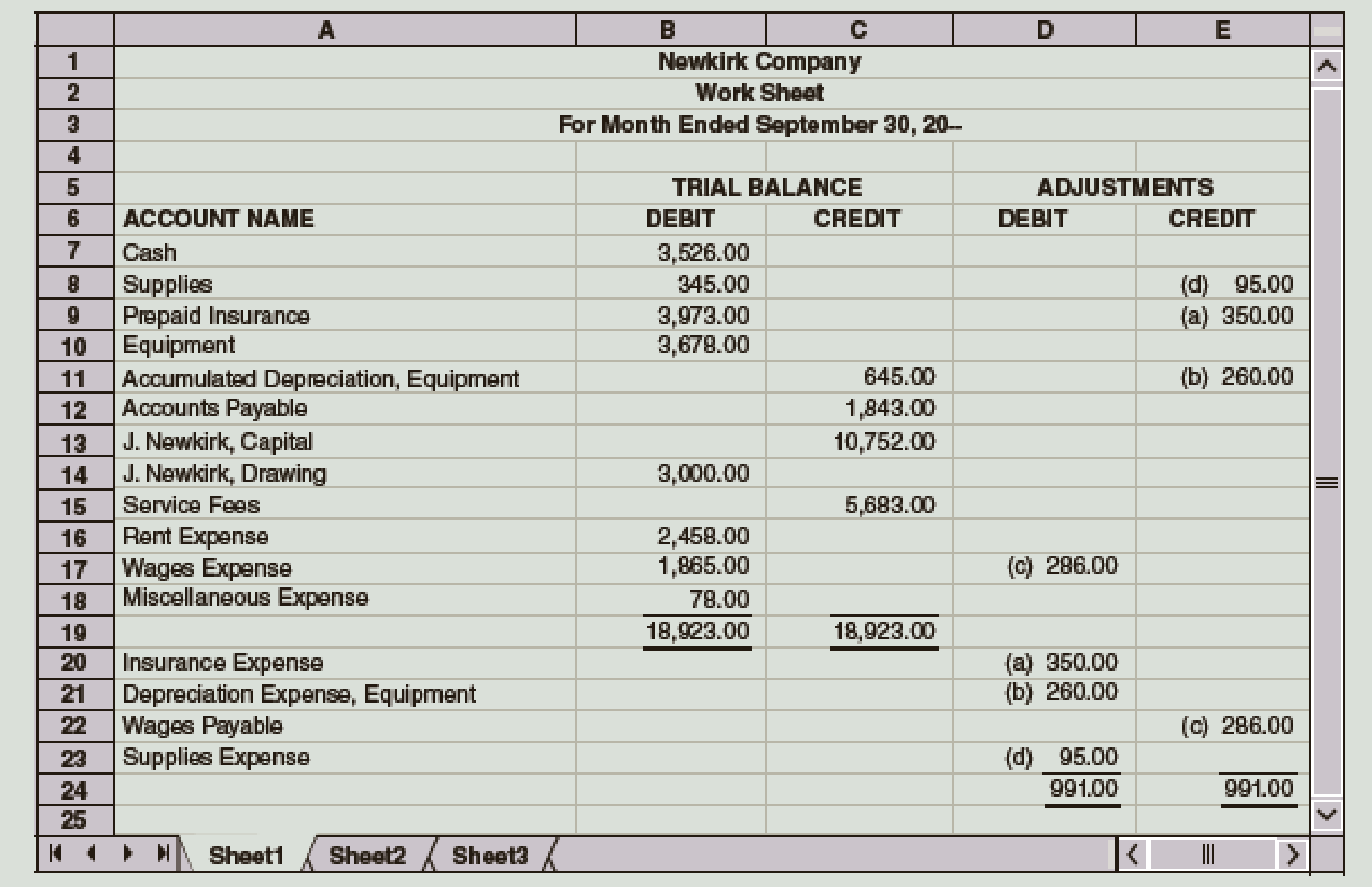

For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. The preparation of adjusting entries is an application of the accrual concept and.

What Are Adjusting Entries

125k views 9 years ago simplifying accounting principles. For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. Specifically, they make sure that.

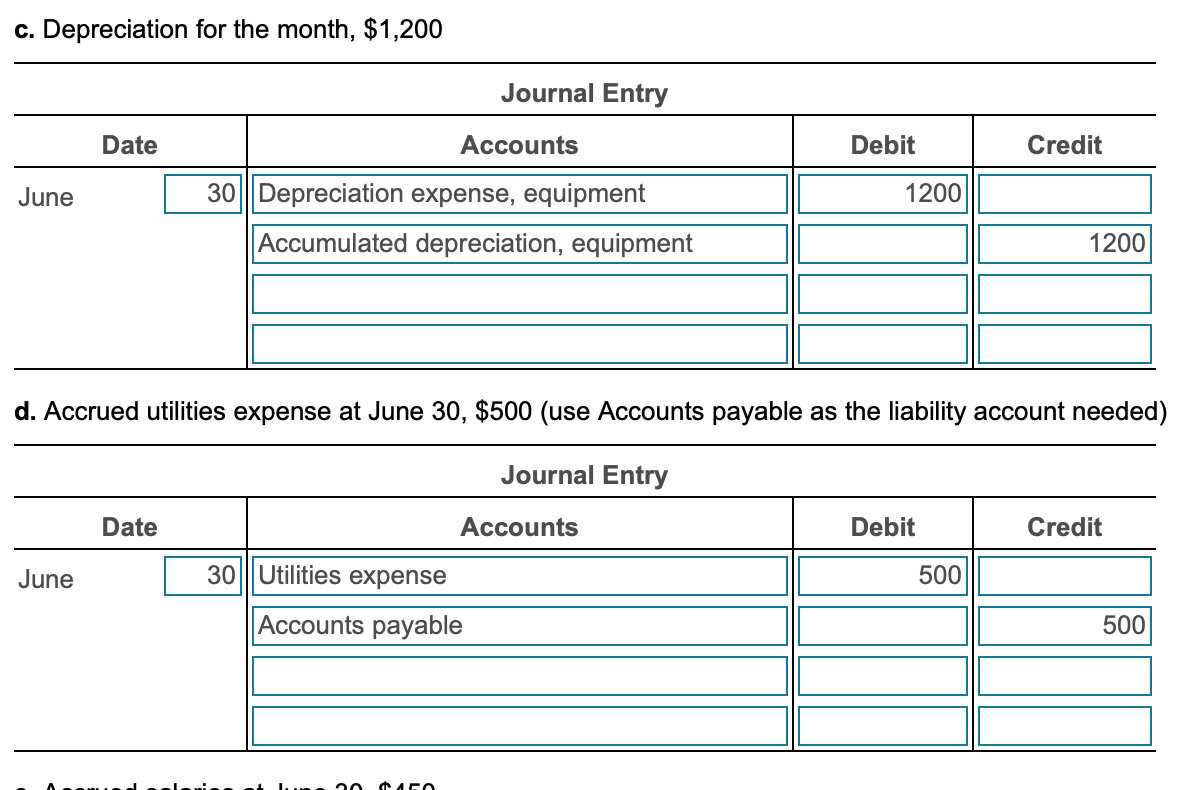

Solved 4. Journalize the adjusting entries using the

Web an adjusting journal entry is typically made just prior to issuing a company’s financial statements. Emily roberts â©the balance 2019. Adjusting entries are step.

Solved Requirement 1. Journalize the adjusting entries.

It typically relates to the balance sheet. For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. Web here are the three main.

How To Journalize Adjusting Entries

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it.

Accounting Chapter 8 1 Journalizing and posting adjusting entries YouTube

For companies with manual accounting systems, accountants log adjusting entries using spreadsheets. Adjusting entries in your accounting journals. Posting adjusting entries is no different than.

Adjusting Entries Examples Accountancy Knowledge

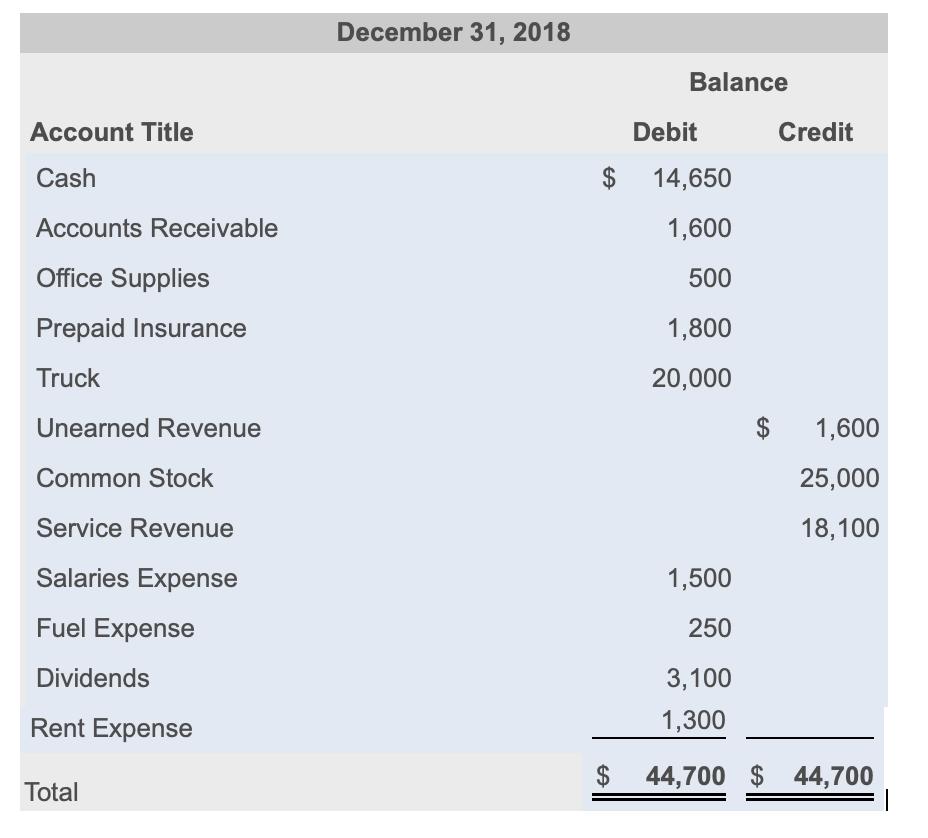

Keeping your balance sheet accurate is critical to running a business. Making adjustments accurately is essential for your records. We will use the following preliminary.

The Unadjusted Trial Balance Comes Right Out Of Your Bookkeeping System.

Once you have journalized all of your adjusting entries, the next step is posting the entries to your ledger. Common types of adjusting entries include accrued expenses, accrued revenues, provisions, and deferred revenues and expense and. Keeping your balance sheet accurate is critical to running a business. The primary objective behind these adjustments is to transition from cash transactions to the accrual.

Introduction To Adjusting Journal Entries.

Web an adjusting journal entry is typically made just prior to issuing a company’s financial statements. Determine what current balance should be. We are committed to sharing unbiased reviews. Let’s dig into each step.

The Preparation Of Adjusting Entries Is An Application Of The Accrual Concept And The Matching Principle.

Adjusting entries in your accounting journals. Fact checked by leila najafi. Let’s start by reviewing neatniks’s trial balance for the month of october: If you use accrual accounting, your accountant must also enter adjusting journal entries to keep your books in compliance.

Accrued Income Refers To Income Already Earned But Not Yet Received.

An adjusting journal entry is a financial record you can use to track unrecorded transactions. Web building your business. Web here are the three main steps to record an adjusting journal entry: A numerical mistake within your accounting journals could lead to a landslide of problems by the end of an accounting period.