Journal Entry Of Goodwill - Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: We explain how to calculate it, its impairment, example, journal entry, features, amortization & types. Web goodwill is an intangible asset that compensates for the excess acquisition price of another firm based on proprietary or intellectual property, brand awareness, patents, and other intangible assets that are difficult to quantify. (2) calculate the gross goodwill arising on the acquisition of high, ie using the fair value of the nci. The value of goodwill of the firm is rs. Find out impairment loss if any given the following data for two reporting units: X, y, and z are partners in the firm sharing profits in the ratio of 3:2:1. Web assign all goodwill to one or more of its reporting units. Web the following are the journal entries: Goodwill is not amortised but must be tested annually for impairment.

10. Goodwill Impairment Accounting Journal Entries YouTube

Goodwill is not amortised but must be tested annually for impairment. Web the disposal timeline can usually be divided into three discrete accounting events that.

Journal entry for Goodwill for Admission of partners lecture 3 Chapter

(a) goodwill not to appear in books in the future: Web the disposal timeline can usually be divided into three discrete accounting events that require.

Journal Entries for Long lived assets Goodwill (Accounting) Debits

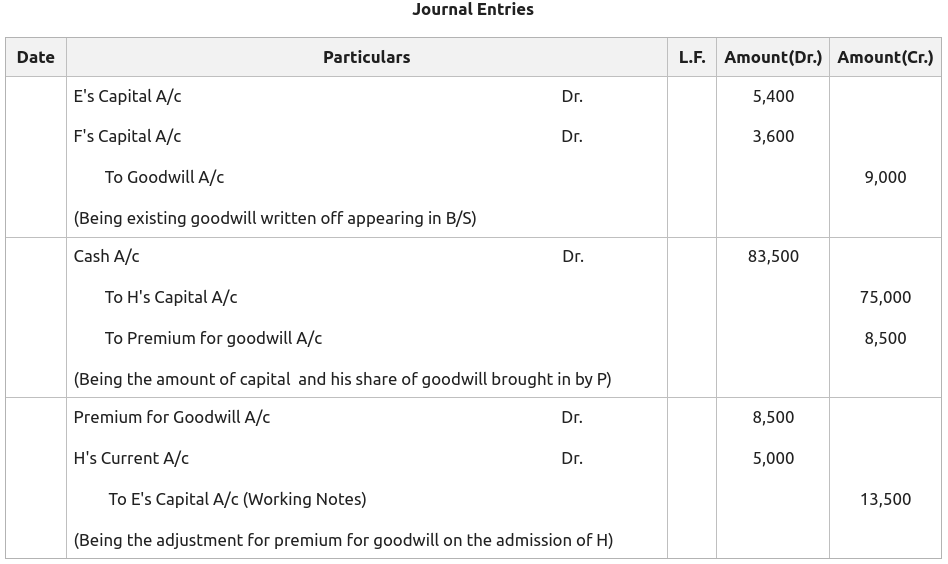

If the goodwill account needs to be impaired, an entry is needed in the general journal. Web (1) calculate the goodwill arising on the acquisition.

Goodwill Written off Journal Entry CArunway

Goodwill is acquired and recorded on the books when an acquirer purchases a target for more than the fair market value of the target’s net.

Admission Journal Entries for Goodwill YouTube

X, y, and z are partners in the firm sharing profits in the ratio of 3:2:1. Per accounting standards, goodwill is recorded as an intangible.

Goodwill Accounting Journal Entries All 7 Method & Examples Class 12 Ch

Web assign all goodwill to one or more of its reporting units. Web in this case, the company needs to make the journal entry for.

12TH ACCOUNTANCY CHAPTER2 JOURNAL ENTRIES OF GOODWILL BY

Web assign all goodwill to one or more of its reporting units. We explain how to calculate it, its impairment, example, journal entry, features, amortization.

PPT Partnership Accounts Goodwill PowerPoint Presentation, free

How amortization reduces the tax liability of an entity? Per accounting standards, goodwill is recorded as an intangible asset and evaluated periodically for any possible.

Comment comptabiliser les écarts d'acquisition ou goodwill

There are many reasons why otis was willing to pay an additional $2m to purchase waverly. Amortization means spreading out the cost of an intangible.

X, Y, And Z Are Partners In The Firm Sharing Profits In The Ratio Of 3:2:1.

Find out impairment loss if any given the following data for two reporting units: Web recognising and measuring goodwill or a gain from a bargain purchase. You are free to use this image on your website, templates, etc, please provide us with an attribution link. Web journal entry for amortization of goodwill.

Web The Following Are The Journal Entries:

For acca candidates studying financial reporting (fr), consolidated financial statements are a key topic. Web what is goodwill impairment? The concept of goodwill comes into play when a company looking to acquire another company is willing to pay a price premium over the fair market value of the company’s net assets. We explain how to calculate it, its impairment, example, journal entry, features, amortization & types.

A Central Part Of This Syllabus Area Is Accounting For The Acquisition Of A Subsidiary Which Will Test The Concept Of.

(b) goodwill continues to appear in the books: Web the disposal timeline can usually be divided into three discrete accounting events that require consideration: Amortization means spreading out the cost of an intangible asset, like a patent or trademark, over the time it is useful. The amount (xxxx) being the goodwill amortized at the end of a respective reporting period.

Goodwill Is Not Amortised But Must Be Tested Annually For Impairment.

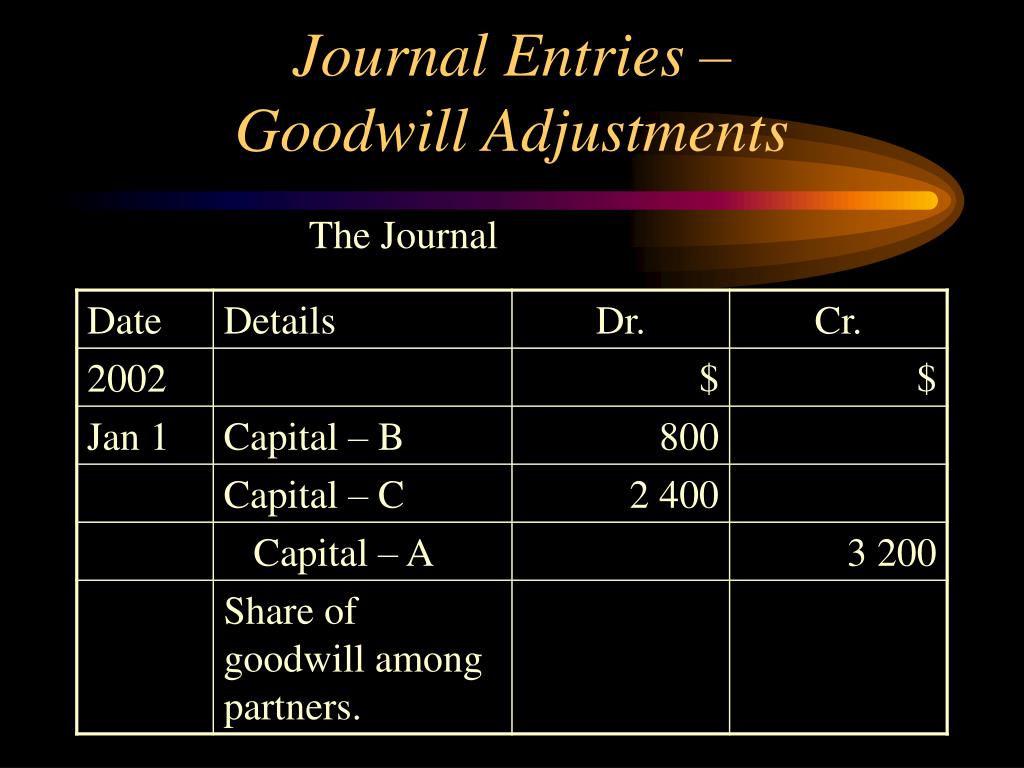

In accounting, goodwill is defined as an excess amount that the company pays for. To record the entry, credit loss on impairment for the impairment amount. How amortization reduces the tax liability of an entity? Web it is adjusted discretely through partner’s capital accounts by recording the following journal entry: