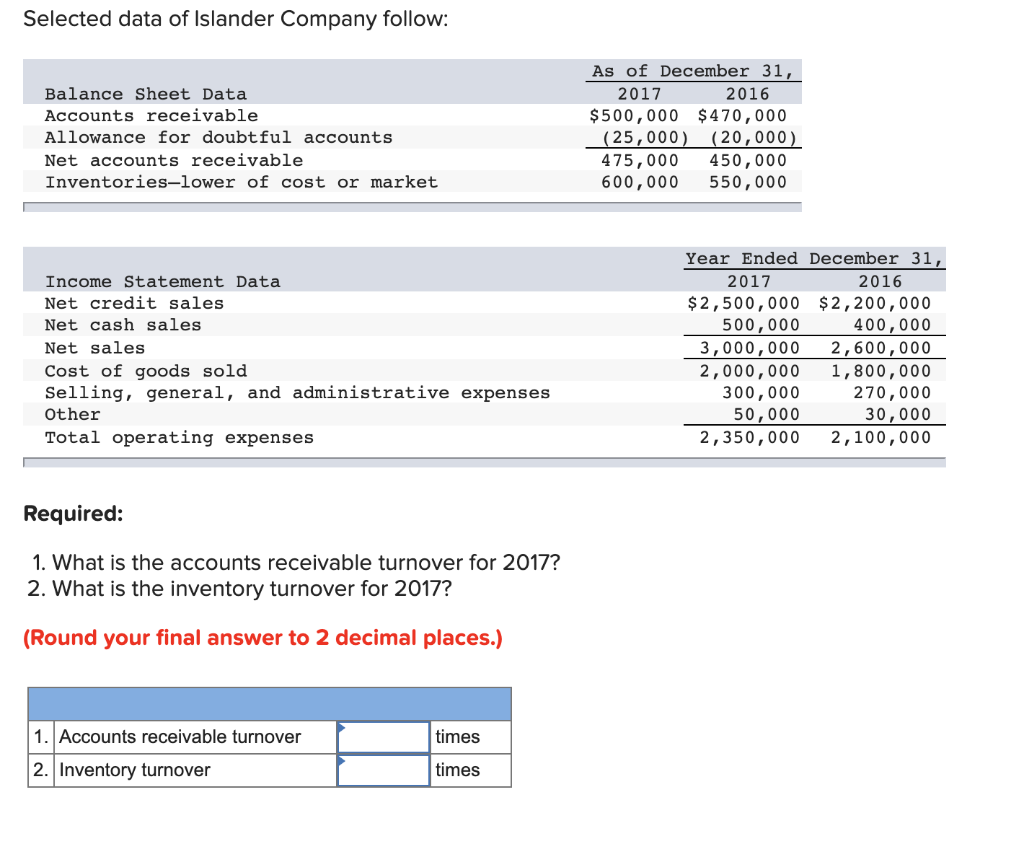

Cost Of Inventory Sold Journal Entry - You should record the cost of goods sold as a business expense on your income statement. This action transfers the goods from inventory to expenses. Identify the cost of inventory sold. To correct the cost of goods sold in the income statement we need to increase the purchases by the. When you sell the $100 product for cash, you. Web additionally, the journal entry for the cost of goods sold with the reduction of the inventory is to reflect the actual balance of the inventory at the time of goods sold under the. Journal entry for a cash sale of inventory the. Web how to record a journal entry for inventory? Perpetual inventory system is a technique of maintaining inventory records that provides a running balance of cost of goods available for sale. This lesson focuses on inventories of merchandise, those inventories held by retailers for.

Cost of Goods Sold Journal Entries Video & Lesson Transcript

Journal entry for a cash sale of inventory the. From the above examples of cost of. Web making a cogs journal entry allows you to.

Recording a Cost of Goods Sold Journal Entry

Various kinds of journal entries are made to. With the information in the example, we can calculate the cost of goods. Web how to record.

LO 6.4a Analyze and Record Transactions for the Sale of Merchandise

Web making a cogs journal entry allows you to track your inventory costs and ensure our financial statements are correct. To correct the cost of.

Recording a Cost of Goods Sold Journal Entry ⋆ Accounting Services

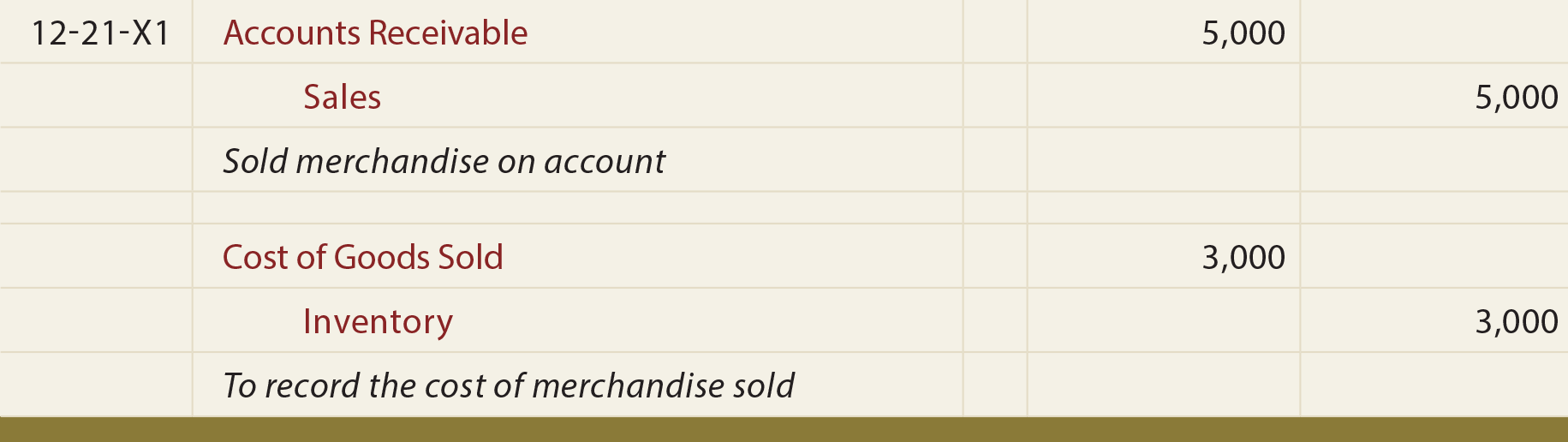

Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. This.

Solved Journal entry worksheet

When you sell the $100 product for cash, you. Identify the cost of inventory sold. Web what is the journal entry to record the cost.

How to Account for Cost of Goods Sold (with Pictures) wikiHow

Collect information ahead of time, such as your beginning inventory balance, purchased. The components of cost of goods sold can be broken down into four.

How to Record a Cost of Goods Sold Journal Entry insurance1health

The inventory cost is $ 60,000 and it sold for $ 80,000 to the customer. The cost of goods sold entry records the total of.

[Solved] Develop journal entries and find out the cost of goods sold

This action transfers the goods from inventory to expenses. Web a sale of goods will result in a journal entry to record the amount of.

Perpetual Inventory System Journal Entry

Abc international has a beginning. Gather information from your books before recording your cogs journal entries. Web additionally, the journal entry for the cost of.

Web You Credit The Finished Goods Inventory, And Debit Cost Of Goods Sold.

Web what is the journal entry to record the cost of goods sold at the end of the accounting period? From the above examples of cost of. Web a sale of goods will result in a journal entry to record the amount of the sale and the cash or accounts receivable. Various kinds of journal entries are made to.

This Action Transfers The Goods From Inventory To Expenses.

Web the journal entry for cost of goods sold is a calculation of beginning inventory, plus purchases, minus ending inventory. You should record the cost of goods sold as a business expense on your income statement. Web how to record a journal entry for inventory? Web additionally, the journal entry for the cost of goods sold with the reduction of the inventory is to reflect the actual balance of the inventory at the time of goods sold under the.

Web Cost Of Goods Sold On An Income Statement.

Identify the cost of inventory sold. When you sell the $100 product for cash, you. Web we calculate cost of goods sold as follows: This entry matches the ending balance in the inventory account to the costed actual ending inventory, while eliminating the $450,000 balance in the purchases account.

Abc International Has A Beginning.

The components of cost of goods sold can be broken down into four key parts: Web suppose for example, the business makes a cash sale for the amount of 300, then the journal entries will be as follows. Collect information ahead of time, such as your beginning inventory balance, purchased. With the information in the example, we can calculate the cost of goods.